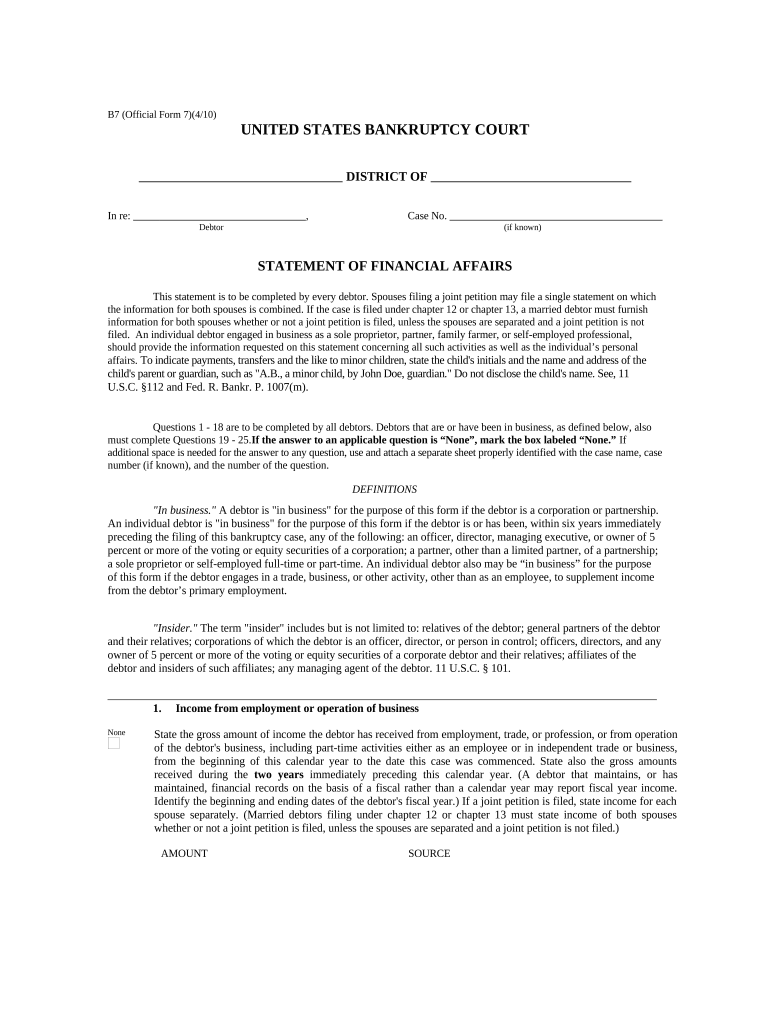

B7 (Official Form 7)(4/10)

UNITED STATES BANKRUPTCY COURT

DISTRICT OF

In re: , Case No.

Debtor (if known)

STATEMENT OF FINANCIAL AFFAIRS

This statement is to be completed by every debtor. Spouses filing a joint petition may file a single statement on which

the information for both spouses is combined. If the case is filed under chapter 12 or chapter 13, a married debtor must furnish

information for both spouses whether or not a joint petition is filed, unless the spouses are separated and a joint petition is not

filed. An individual debtor engaged in business as a sole proprietor, partner, family farmer, or self-employed professional,

should provide the information requested on this statement concerning all such activities as well as the individual’s personal

affairs. To indicate payments, transfers and the like to minor children, state the child's initials and the name and address of the

child's parent or guardian, such as "A.B., a minor child, by John Doe, guardian." Do not disclose the child's name. See, 11

U.S.C. §112 and Fed. R. Bankr. P. 1007(m).

Questions 1 - 18 are to be completed by all debtors. Debtors that are or have been in business, as defined below, also

must complete Questions 19 - 25. If the answer to an applicable question is “None”, mark the box labeled “None.” If

additional space is needed for the answer to any question, use and attach a separate sheet properly identified with the case name, case

number (if known), and the number of the question.

DEFINITIONS

"In business." A debtor is "in business" for the purpose of this form if the debtor is a corporation or partnership.

An individual debtor is "in business" for the purpose of this form if the debtor is or has been, within six years immediately

preceding the filing of this bankruptcy case, any of the following: an officer, director, managing executive, or owner of 5

percent or more of the voting or equity securities of a corporation; a partner, other than a limited partner, of a partnership;

a sole proprietor or self-employed full-time or part-time. An individual debtor also may be “in business” for the purpose

of this form if the debtor engages in a trade, business, or other activity, other than as an employee, to supplement income

from the debtor’s primary employment.

"Insider." The term "insider" includes but is not limited to: relatives of the debtor; general partners of the debtor

and their relatives; corporations of which the debtor is an officer, director, or person in control; officers, directors, and any

owner of 5 percent or more of the voting or equity securities of a corporate debtor and their relatives; affiliates of the

debtor and insiders of such affiliates; any managing agent of the debtor. 11 U.S.C. § 101.

_________________________________________________________________________________________________

1. Income from employment or operation of business

None

State the gross amount of income the debtor has received from employment, trade, or profession, or from operation

of the debtor's business, including part-time activities either as an employee or in independent trade or business,

from the beginning of this calendar year to the date this case was commenced. State also the gross amounts

received during the two years immediately preceding this calendar year. (A debtor that maintains, or has

maintained, financial records on the basis of a fiscal rather than a calendar year may report fiscal year income.

Identify the beginning and ending dates of the debtor's fiscal year.) If a joint petition is filed, state income for each

spouse separately. (Married debtors filing under chapter 12 or chapter 13 must state income of both spouses

whether or not a joint petition is filed, unless the spouses are separated and a joint petition is not filed.)

AMOUNT SOURCE

2. Income other than from employment or operation of business

None

State the amount of income received by the debtor other than from employment, trade, profession, operation of the

debtor's business during the two years immediately preceding the commencement of this case. Give particulars. If

a joint petition is filed, state income for each spouse separately. (Married debtors filing under chapter 12 or chapter

13 must state income for each spouse whether or not a joint petition is filed, unless the spouses are separated and a

joint petition is not filed.)

AMOUNT SOURCE

_______________________________________________________________________________________________________

3. Payments to creditors

Complete a. or b., as appropriate, and c.

None a. Individual or joint debtor(s) with primarily consumer debts: List all payments on loans, installment purchases

of goods or services, and other debts to any creditor made within 90 days immediately preceding the

commencement of this case unless the aggregate value of all property that constitutes or is affected by such

transfer is less than $600. Indicate with an asterisk (*) any payments that were made to a creditor on account of a

domestic support obligation or as part of an alternative repayment schedule under a plan by an approved nonprofit

budgeting and credit counseling agency. (Married debtors filing under chapter 12 or chapter 13 must include

payments by either or both spouses whether or not a joint petition is filed, unless the spouses are separated and a

joint petition is not filed.)

NAME AND ADDRESS OF CREDITOR DATES OF

PAYMENTS AMOUNT

PAID AMOUNT

STILL OWING

None

b. Debtor whose debts are not primarily consumer debts: List each payment or other transfer to any creditor

made within 90 days immediately preceding the commencement of the case unless the aggregate value of all

property that constitutes or is affected by such transfer is less than $5,850 * . If the debtor is an individual, indicate

with an asterisk (*) any payments that were made to a creditor on account of a domestic support obligation or as

part of an alternative repayment schedule under a plan by an approved nonprofit budgeting and credit counseling

agency. (Married debtors filing under chapter 12 or chapter 13 must include payments and other transfers by

either or both spouses whether or not a joint petition is filed, unless the spouses are separated and a joint petition

is not filed.)

NAME AND ADDRESS OF CREDITOR DATES OF AMOUNT AMOUNT

PAYMENTS/ PAID OR STILL

TRANSFERS VALUE OF OWING

TRANSFERS

_________________________________ 2

* Amount subject to adjustment on 4/01/13, and every three years thereafter with respect to cases commenced on or

after the date of adjustment. 3

None

c. All debtors: List all payments made within one year immediately preceding the commencement of this

case to or for the benefit of creditors who are or were insiders. (Married debtors filing under chapter 12 or

chapter 13 must include payments by either or both spouses whether or not a joint petition is filed, unless

spouses are separated and a joint petition is not filed.)

NAME AND ADDRESS OF CREDITOR DATE OF AMOUNT AMOUNT

AND RELATIONSHIP TO DEBTOR PAYMENT PAID STILL OWING

______________________________________________________________________________________________________

4 . Suits and administrative proceedings, executions, garnishments and attachmen ts

None

a. List all suits and administrative proceedings to which the debtor is or was a party within one year immediately

preceding the filing of this bankruptcy case. (Married debtors filing under chapter 12 or chapter 13 must include

information concerning either or both spouses whether or not a joint petition is filed, unless the spouses are

separated and a joint petition is not filed.)

CAPTION OF SUIT COURT OR AGENCY STATUS OR

AND CASE NUMBER NATURE OF PROCEEDING AND LOCATION DISPOSTION

None

b. Describe all property that has been attached, garnished or seized under any legal or equitable process within

one year immediately preceding the commencement of this case. (Married debtors filing under chapter 12 or

chapter 13 must include information concerning property of either or both spouses whether or not a joint petition

is filed, unless the spouses are separated and a joint petition is not filed.)

NAME AND ADDRESS

OF PERSON FOR WHOOSE

BENEFIT PROPERTY WAS SEIZED DATE OF

SEIZURE DESCRIPTION

AND VALUE OF

PROPERTY

_______________________________________________________________________________________________________

5. Repossessions, foreclosures and returns

None

List all property that has been repossessed by a creditor, sold at a foreclosure sale, transferred through a deed in

lieu of foreclosure or returned to the seller, within one year immediately preceding the commencement of this

case. (Married debtors filing under chapter 12 or chapter 13 must include information concerning property of

either or both spouses whether or not a joint petition is filed, unless the spouses are separated and a joint petition

is not filed.)

NAME AND ADDRESS

OF CREDITOR OR SELLER DATE OF REPOSSESSION

FORECLOSURE SALE,

TRANSFER OR RETURN DESCRIPTION

AND VALUE

OF PROPERTY

_______________________________________________________________________________________________________ 4

6. Assignments and receiverships

None

a. Describe any assignment of property for the benefit of creditors made within 120 days immediately preceding

the commencement of this case. (Married debtors filing under chapter 12 or chapter 13 must include any

assignment by either or both spouses whether or not a joint petition is filed, unless the spouses are separated and a

joint petition is not filed.)

TERMS OF

NAME AND ADDRESS DATE OF ASSIGNMENT

OF ASSIGNEE ASSIGNMENT OR SETTLEMENT

None

b. List all property which has been in the hands of a custodian, receiver, or court-appointed official within one year

immediately preceding the commencement of this case. (Married debtors filing under chapter 12 or chapter 13

must include information concerning property of either or both spouses whether or not a joint petition is filed,

unless the spouses are separated and a joint petition is not filed.)

NAME AND ADDRESS

OF CUSTODIAN NAME AND LOCATION

OF COURT

CASE TITLE & NUMBER DATE OF

ORDER DESCRIPTION

AND VALUE OF

PROPERTY

_______________________________________________________________________________________________________

7. Gifts

None

List all gifts or charitable contributions made within one year immediately preceding the commencement of this

case except ordinary and usual gifts to family members aggregating less than $200 in value per individual family

member and charitable contributions aggregating less than $100 per recipient. (Married debtors filing under

chapter 12 or chapter 13 must include gifts or contributions by either or both spouses whether or not a joint

petition is filed, unless the spouses are separated and a joint petition is not filed.)

NAME AND ADDRESS RELATIONSHIP DESCRIPTION

OF PERSON TO DEBTOR, DATE AND VALUE

OR ORGANIZATION IF ANY OF GIFT OF GIFT

_______________________________________________________________________________________________________

8. Losses

None

List all losses from fire, theft, other casualty or gambling within one year immediately preceding the

commencement of this case or since the commencement of this case . (Married debtors filing under chapter 12

or chapter 13 must include losses by either or both spouses whether or not a joint petition is filed, unless the

spouses are separated and a joint petition is not filed.)

DESCRIPTION

AND VALUE OF

PROPERTY DESCRIPTION OF CIRCUMSTANCES AND, IF

LOSS WAS COVERED IN WHOLE OR IN PART

BY INSURANCE, GIVE PARTICULARS DATE OF

LOSS

_______________________________________________________________________________________________________ 5

9. Payments related to debt counseling or bankruptcy

None

List all payments made or property transferred by or on behalf of the debtor to any persons, including attorneys, for

consultation concerning debt consolidation, relief under the bankruptcy law or preparation of a petition in

bankruptcy within one year immediately preceding the commencement of this case.

NAME AND ADDRESS

OF PAYEE DATE OF PAYMENT,

NAME OF PAYOR IF

OTHER THAN DEBTOR AMOUNT OF MONEY OR

DESCRIPTION AND VALUE

OF PROPERTY

______________________________________________________________________________________________________

10. Other transfers

None

a. List all other property, other than property transferred in the ordinary course of the business or financial affairs

of the debtor, transferred either absolutely or as security within two years immediately preceding the

commencement of this case. (Married debtors filing under chapter 12 or chapter 13 must include transfers by either

or both spouses whether or not a joint petition is filed, unless the spouses are separated and a joint petition is not

filed.)

NAME AND ADDRESS OF TRANSFEREE,

RELATIONSHIP TO DEBTOR DATE DESCRIBE PROPERTY

TRANSFERRED

AND VALUE RECEIVED

None

b. List all property transferred by the debtor within ten years immediately proceeding the commencement of this

case to a self-settled trust or similar device of which the debtor is a beneficiary.

NAME OF TRUST OR OTHER DATE(S) OF AMOUNT OF MONEY OR DESCRIPTION

DEVICE TRANSFER(S) AND VALUE OF PROPERTY OR DEBTOR’S

INTEREST IN PROPERTY

_________________________________________________________________________

11. Closed financial accounts

None

List all financial accounts and instruments held in the name of the debtor or for the benefit of the debtor which

were closed, sold, or otherwise transferred within one year immediately preceding the commencement of this case.

Include checking, savings, or other financial accounts, certificates of deposit, or other instruments; shares and share

accounts held in banks, credit unions, pension funds, cooperatives, associations, brokerage houses and other

financial institutions. (Married debtors filing under chapter 12 or chapter 13 must include information concerning

accounts or instruments held by or for either or both spouses whether or not a joint petition is filed, unless the

spouses are separated and a joint petition is not filed.)

TYPE OF ACCOUNT, LAST FOUR AMOUNT AND

NAME AND ADDRESS DIGITS OF ACCOUNT NUMBER, DATE OF SALE

OF INSTITUTION AND AMOUNT OF FINAL BALANCE OR CLOSING

_______________________________________________________________________________________________________ 6

12. Safe deposit boxes

None

List each safe deposit or other box or depository in which the debtor has or had securities, cash, or other valuables

within one year immediately preceding the commencement of this case. (Married debtors filing under chapter 12 or

chapter 13 must include boxes or depositories of either or both spouses whether or not a joint petition is filed, unless

the spouses are separated and a joint petition is not filed.)

NAME AND ADDRESS

OF BANK OR

OTHER DEPOSITORY NAMES AND ADDRESSES

OF THOSE WITH ACCESS

TO BOX OR DEPOSITORY DESCRIPTION

OF

CONTENTS DATE OF TRANSFER

OR SURRENDER,

IF ANY

_______________________________________________________________________________________________________

13. Setoffs

None

List all setoffs made by any creditor, including a bank, against a debt or deposit of the debtor within 90 days preceding

the commencement of this case. (Married debtors filing under chapter 12 or chapter 13 must include information

concerning either or both spouses whether or not a joint petition is filed, unless the spouses are separated and a joint

petition is not filed.)

NAME AND ADDRESS OF CREDITOR DATE OF

SETOFF AMOUNT OF

SETOFF

_______________________________________________________________________________________________________

14. Property held for another person

None

List all property owned by another person that the debtor holds or controls

NAME AND ADDRESS

OF OWNER DESCRIPTION AND

VALUE

OF PROPERTY LOCATION OF PROPERTY

_______________________________________________________________________________________________________

15. Prior address of debtor

None

If the debtor has moved within the three years immediately preceding the commencement of this case, list all premises

which the debtor occupied during that period and vacated prior to the commencement of this case. If a joint petition is

filed, report also any separate address of either spouse.

ADDRESS NAME USED DATES OF OCCUPANCY

_______________________________________________________________________________________________________ 7

16. Spouses and Former Spouses

None

If the debtor resides or resided in a community property state, commonwealth or territory (including Alaska, Arizona,

California, Idaho, Louisiana, Nevada, New Mexico, Puerto Rico, Texas, Washington or Wisconsin) within eight years

immediately preceding the commencement of the case, identify the name of the debtor’s spouse and of any former spouse

who resides or resided with the debtor in the community property state.

NAME

_______________________________________________________________________________________________________

17. Environmental Information

For the purpose of this question, the following definitions apply:

“Environmental Law” means any federal, state or local statute or regulation regulating pollution, contamination,

releases of hazardous or toxic substances, wastes or material into the air, land, soil, surface water, groundwater, or

other medium, including, but not limited to, statutes or regulations regulating the cleanup of these substances, wastes,

or material.

“Site” means any location, facility, or property as defined under any Environmental Law, whether or not presently or

formerly owned or operated by the debtor, including, but not limited to, disposal sites.

“Hazardous Material” means anything defined as a hazardous waste, hazardous substance, toxic substance, hazardous

material, pollutant, or contaminant or similar term under an Environmental Law.

None

a. List the name and address of every site for which the debtor has received notice in writing by a governmental unit

that it may be liable or potentially liable under or in violation of an Environmental Law. Indicate the governmental

unit, the date of the notice, and, if known, the Environmental Law:

SITE NAME

AND ADDRESS NAME AND ADDRESS

OF GOVERNMENTAL UNIT DATE OF

NOTICE ENVIRONMENTAL

LAW

None

b. List the name and address of every site for which the debtor provided notice to a governmental unit of a release of

Hazardous Material. Indicate the governmental unit to which the notice was sent and the date of the notice.

SITE NAME NAME AND ADDRESS

OF GOVERNMENTAL UNIT DATE OF

NOTICE ENVIRONMENTAL

LAW

None

c. List all judicial or administrative proceedings, including settlements or orders, under any Environmental Law with

respect to which the debtor is or was a party. Indicate the name and address of the governmental unit that is or was a

party to the proceeding, and the docket number.

NAME AND ADDRESS

OF GOVERNMENTAL UNIT DOCKET NUMBER STATUS OR

DISPOSITION

_____________________________________________________________________________________________________

18. Nature, location and nature of business

None

a. If the debtor is an individual , list the names, addresses, taxpayer-identification numbers, nature of the businesses,

and beginning and ending dates of all businesses in which the debtor was an officer, director, partner, or managing 8

executive of a corporation, partner in a partnership, sole proprietorship, or was a self-employed in a trade, profession or

activity either full- or part- time within six years immediately preceding the commencement of this case, or in which

the debtor owned 5 percent or more of the voting or equity securities within the six years immediately preceding the

commencement of this case.

If the debtor is a partnership , list the names, addresses, taxpayer-identification numbers, nature of the businesses,

and beginning and ending dates of all businesses in which the debtor was a partner or owned 5 percent or more of

the voting or equity securities, within the six years immediately preceding the commencement of this case.

If the debtor is a corporation , list the names, addresses, taxpayer-identification numbers, nature of the businesses,

and beginning and ending dates of all businesses in which the debtor was a partner or owned 5 percent or more of

the voting or equity securities, within the six years immediately preceding the commencement of this case

LAST FOUR DIGITS

OF SOCIAL SECURITY BEGINNING AND

NAME OR OTHER INDIVIDUAL ADDRESS NATURE OF BUSINESS ENDING DATES

TAXPAYER-I.D. NO.

(ITIN)/ COMPLETE EIN

None

b. Identify any business listed in response to subdivision a., above, that is “single asset real estate” as

Defined in 11 U.S.C. § 101.

NAME ADDRESS

_______________________________________________________________________________________________________

The following questions are to be completed by every debtor that is a corporation or partnership and by any individual

debtor who is or has been, within the six years immediately preceding the commencement of this case, any of the following: an

officer, director, managing executive, or owner of more than 5 percent of the voting or equity securities of a corporation; a

partner, other than a limited partner, of a partnership; a sole proprietorship or self-employed in a trade, profession, or other

activity, either full-time or part-time.

(An individual or joint debtor should complete this portion of the statement only if the debtor is or has been in

business, as defined above, within the six years immediately preceding the commencement of this case. A debtor who has

not been in business within those six years should go directly to the signature page.)

_________________________________________________________________________________________________

19. Books, records and financial statements

None

a.Listallbookkeepersandaccountantswhowithinthe twoyears immediatelyprecedingthe

filingofthisbankruptcycasekeptorsupervisedthekeepingofbooksofaccountand

recordsofthedebtor.

NAME AND ADDRESS DATE SERVICES RENDERED

_______________________________________________________________________________________________________

None

b. List all firms or individuals who within the two years immediately preceding the filing of this bankruptcy case

have audited the books of account and records, or prepared a financial statement of the debtor.

NAME ADDRESS DATES SERVICES RENDERED

9

None

c. List all firms or individuals who at the time of the commencement of this case were in possession of the books

of account and records of the debtor. If any of the books of account and records are not available, explain.

NAME ADDRESS

_______________________________________________________________________________________________________

None

d. List all financial institutions, creditors and other parties, including mercantile and trade agencies, to whom a financial

statement was issued within the two years immediately preceding the commencement of this case.

NAME AND ADDRESS DATE ISSUED

_______________________________________________________________________________________________________

20. Inventories

None

a. List the dates of the last two inventories taken of your property, the name of the person who supervised the taking of

each inventory, and the dollar amount and basis of each inventory.

DATE OF INVENTORY INVENTORY SUPERVISOR DOLLAR AMOUNT OF INVENTORY

(Specify cost, market or other basis)

None

b. List the name and address of the person having possession of the records of each of the inventories reported

in a., above.

DATE OF INVENTORY NAME AND ADDRESS OF CUSTODIAN OF

INVENTORY RECORDS

_______________________________________________________________________________________________________

21. Current Partners, Officers, Directors and Shareholders

None

a. If the debtor is a partnership, list the nature and percentage of partnership interest of each member of the

partnership.

NAME AND ADDRESS NATURE OF INTEREST PERCENTAGE OF

INTEREST

_______________________________________________________________________________________________________

None

b. If the debtor is a corporation, list all officers and directors of the corporation, and each stockholder who directly or

indirectly owns, controls, or holds 5 percent or more of the voting or equity securities of the corporation.

NAME AND ADDRESS TITLE NATURE AND PERCENTAGE OF

STOCK OWNERSHIP

_____________________________________________________________________________________________________ 10

22. Former partners, officers, directors and shareholders

None

a. If the debtor is a partnership, list each member who withdrew from the partnership within one year immediately

preceding the commencement of this case

NAME ADDRESS DATE OF WITHDRAWAL

____________________________________________________________________________________________________

None

b. If the debtor is a corporation, list all officers or directors whose relationship with the corporation terminated

within one year immediately preceding the commencement of this case.

NAME AND ADDRESS TITLE DATE OF TERMINATION

_____________________________________________________________________________________________________

23. Withdrawals from a partnership or distributions by a corporation

None

If the debtor is a partnership or corporation, list all withdrawals or distributions credited or given to an insider,

including compensation in any form, bonuses, loans, stock redemptions, options exercised and any other perquisite

during one year immediately preceding the commencement of this case.

NAME AND ADDRESS

OF RECIPIENT,

RELATIONSHIP TO DEBTOR DATE AND PURPOSE

OF WITHDRAWAL AMOUNT OF MONEY

OR DESCRIPTION

AND VALUE OF PROPERTY

_______________________________________________________________________________________________________

24. Tax Consolidation Group.

None

If the debtor is a corporation, list the name and federal taxpayer-identification number of the parent corporation of any

consolidated group for tax purposes of which the debtor has been a member at any time within six years immediately

preceding the commencement of the case.

NAME OF PARENT CORPORATION TAXPAYER-IDENTIFICATION NUMBER (EIN)

_______________________________________________________________________________________________________

25. Pension Funds.

None

If the debtor is not an individual, list the name and federal taxpayer-identification number of any pension fund to

which the debtor, as an employer, has been responsible for contributing at any time within six years immediately

preceding the commencement of the case.

NAME TAXPAYER-IDENTIFICATION NUMBER (EIN)

* * * * * * 11

[ If completed by an individual or individual and spouse]

I declare under penalty of perjury that I have read the answers contained in the foregoing statement of financial affairs and any

attachments thereto and that they are true and correct.

Date Signature_______________________________________

Of Debtor

Date Signature_______________________________________

Of Joint Debtor

(if any)

____________________________________________________________________________________________________

[If completed on behalf of a partnership or corporation]

I declare under penalty of perjury that I have read the answers contained in the foregoing statement of financial affairs and

any attachments thereto and that they are true and correct to the best of my knowledge, information and belief.

Date Signature

Print Name and Title

[An individual signing on behalf of a partnership or corporation must indicate position or relationship to debtor.]

continuation sheets attached

Penalty for making a false statement. Fine of up to $500,000 or imprisonment for up to 5 years, or both. 18 U.S.C. § 152 and 3571

______________________________________________________________________________________________________

DECLARATION AND SIGNATURE OF NON-ATTORNEY BANKRUPTCY PETITION PREPARER (See 11 U.S.C. § 110)

I declare under penalty of perjury that: (1) I am a bankruptcy petition preparer as defined in 11 U.S.C. § 110; (2) I prepared this document for

compensation, and have provided the debtor with a copy of this document and the notices and information required under 11 U.S.C. §§ 110(b), 110(h), and

342 (b); and (3) if rules or guidelines have been promulgated pursuant to 11 U.S.C. § 110 (h) setting a maximum fee for services chargeable by bankruptcy

petition preparers, I have given the debtor notice of the maximum amount before preparing any document for filing for a debtor or accepting any fee from

the debtor, as required by that section.

Printed or Typed Name and Title, if any, of Bankruptcy Petition Preparer Social-Security No. (Required by 11 U.S.C. § 110(c).)

If the bankruptcy petition preparer is not an individual, state the name, title(if any), address, and social security number of the officer, principal,

responsible person, or partner who signs this document.

Address

Signature of Bankruptcy Petition Preparer Date

Names and Social-Security numbers of all other individuals who prepared or assisted in preparing this document unless the bankruptcy petition

preparer is not an individual:

If more than one person prepared this document, attach additional signed sheets conforming to the appropriate Official Form for each person.

A bankruptcy petition preparer’s failure to comply with the provisions of title II and the Federal Rules of Bankruptcy Procedure may result

in fines or imprisonment or both. 18 U.S.C. § 156. 12