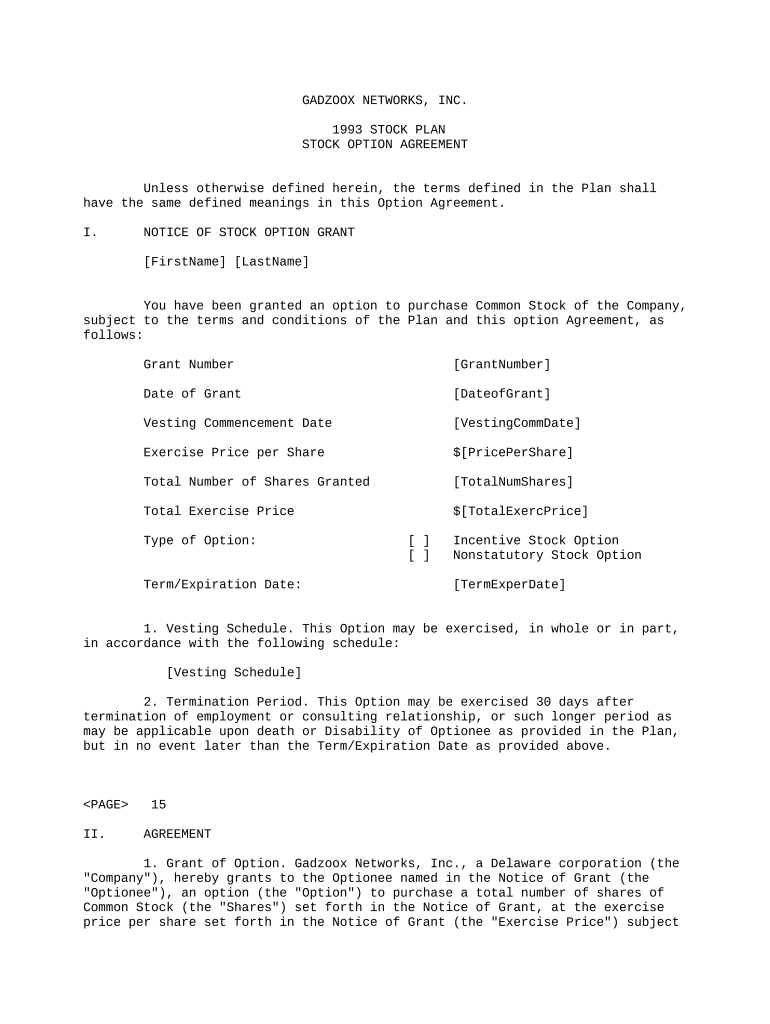

GADZOOX NETWORKS, INC.

1993 STOCK PLAN

STOCK OPTION AGREEMENT

Unless otherwise defined herein, the terms defined in the Plan shall

have the same defined meanings in this Option Agreement.

I. NOTICE OF STOCK OPTION GRANT

[FirstName] [LastName]

You have been granted an option to purchase Common Stock of the Company,

subject to the terms and conditions of the Plan and this option Agreement, as

follows:

Grant Number [GrantNumber]

Date of Grant [DateofGrant]

Vesting Commencement Date [VestingCommDate]

Exercise Price per Share $[PricePerShare]

Total Number of Shares Granted [TotalNumShares]

Total Exercise Price $[TotalExercPrice]

Type of Option: [ ] Incentive Stock Option

[ ] Nonstatutory Stock Option

Term/Expiration Date: [TermExperDate]

1. Vesting Schedule. This Option may be exercised, in whole or in part,

in accordance with the following schedule:

[Vesting Schedule]

2. Termination Period. This Option may be exercised 30 days after

termination of employment or consulting relationship, or such longer period as

may be applicable upon death or Disability of Optionee as provided in the Plan,

but in no event later than the Term/Expiration Date as provided above.

15

II. AGREEMENT

1. Grant of Option. Gadzoox Networks, Inc., a Delaware corporation (the

"Company"), hereby grants to the Optionee named in the Notice of Grant (the

"Optionee"), an option (the "Option") to purchase a total number of shares of

Common Stock (the "Shares") set forth in the Notice of Grant, at the exercise

price per share set forth in the Notice of Grant (the "Exercise Price") subject

to the terms, definitions and provisions of the 1993 Stock Plan (the "Plan")

adopted by the Company, which is incorporated herein by reference. Unless

otherwise defined herein, the terms defined in the Plan shall have the same

defined meanings in this Option.

If designated in the Notice of Grant as an Incentive Stock

Option, this Option is intended to qualify as an Incentive Stock Option as

defined in Section 422 of the Code. However, if this Option is intended to be an

Incentive Stock Option, to the extent that it exceeds the $100,000 rule of Code

Section 422(d) it shall be treated as a Nonstatutory Stock Option.

2. Exercise of Option. This Option shall be exercisable during its term

in accordance with the Exercise Schedule set out in the Notice of Grant and with

the provisions of Section 9 of the Plan as follows:

(i) Right to Exercise.

(a) This Option may not be exercised for a fraction of a

share.

(b) In the event of Optionee's. death, disability or other

termination of employment, the exercisability of the Option is governed by

Sections 6, 7 and 8 below, subject to the limitation contained in subsection

2(i)(c).

(c) In no event may this option be exercised after the date

of expiration of the term of this Option as set forth in the Notice of Grant.

(ii) Method of Exercise. This Option shall be exercisable by

written notice (in the form attached as Exhibit A) which shall state the

election to exercise the Option, the number of Shares in respect of which the

Option is being exercised, and such other representations and agreements as to

the holder's investment intent with respect to such shares of Common Stock as

may be required by the Company pursuant to the provisions of the Plan. Such

written notice shall be signed by the Optionee and shall be delivered in person

or by certified mail to the Secretary of the Company. The written notice shall

be accompanied by payment of the Exercise Price. This Option shall be deemed to

be exercised upon receipt by the Company of such written notice accompanied by

the Exercise Price.

No Shares will be issued pursuant to the exercise of an Option

unless such issuance and such exercise shall comply with all relevant provisions

of law and the requirements of any stock exchange upon which the Shares may then

be listed. Assuming such compliance, for income tax

-2-

16

purposes the Shares shall be considered transferred to the Optionee on the date

on which the option is exercised with respect to such Shares.

3. Optionee's Representations. In the event the Shares purchasable

pursuant to the exercise of this Option have not been registered under the

Securities Act of 1933, as amended, at the time this Option is exercised,

optionee shall, if required by the Company, concurrently with the exercise of

all or any portion of this option, deliver to the Company his Investment

Representation Statement in the form attached hereto as Exhibit B.

4. Lock-Up Period. Optionee hereby agrees that, if so requested by the

Company or any representative of the underwriters (the "Managing Underwriter")

in connection with any registration of the offering of any securities of the

Company under the Securities Act, Optionee shall not sell or otherwise transfer

any Shares or other securities of the Company during the 180-day period (or such

other period as may be requested in writing by the Managing Underwriter and

agreed to in writing by the Company) (the "Market Standoff Period") following

the effective date of a registration statement of the Company filed under the

Securities Act. Such restriction shall apply only to the first registration

statement of the Company to become effective under the Securities Act that

includes securities to be sold on behalf of the Company to the public in an

underwritten public offering under the Securities Act. The Company may impose

stop-transfer instructions with respect to securities subject to the foregoing

resolutions until the end of such Market Standoff Period.

5. Method of Payment. Payment of the Exercise Price shall be by any of

the following, or a combination thereof, at the election of the Optionee:

(i) cash; or

(ii) check; or

(iii) surrender of other shares of Common Stock of the Company

which (A) in the case of Shares acquired pursuant to the exercise of a Company

option, have been owned by the Optionee for more than six (6) months on the date

of surrender, and (B) have a fair market value on the date of surrender equal to

the Exercise Price of the Shares as to which the option is being exercised.

6. Restrictions on Exercise. This Option may not be exercised until such

time as the Plan has been approved by the shareholders of the Company, or if the

issuance of such Shares upon such exercise or the method of payment of

consideration for such shares would constitute a violation of any applicable

federal or, state securities or other law or regulation, including any rule

under Part 207 of Title 12 of the Code of Federal Regulations ("Regulation G")

as promulgated by the Federal Reserve Board. As a condition to the exercise of

this Option, the Company may require Optionee to make any representation and

warranty to the Company as may be required by any applicable law or regulation.

7. Termination of Relationship. In the event of termination of

Optionee's Continuous Status as an Employee or Consultant, Optionee may, to the

extent otherwise so entitled at the date of such

-3-

17

termination (the "Termination Date"), exercise this Option during the

Termination Period set out in the Notice of Grant. To the extent that Optionee

was not entitled to exercise this option at the date of such termination, or if

Optionee does not exercise this option within the time specified herein, the

Option shall terminate.

8. Disability of Optionee. Notwithstanding the provisions of Section 6

above, in the event of termination of Optionee's Continuous Status as an

Employee or Consultant as a result of total and permanent disability (as defined

in Section 22(e)(3) of the Code), Optionee may, but only within twelve (12)

months from the date of termination of employment (but in no event later than

the date of expiration of the term of this Option as set forth in Section 10

below), exercise the Option to the extent otherwise so entitled at the date of

such termination. To the extent that Optionee was not entitled to exercise the

Option at the date of termination, or if optionee does not exercise such Option

(to the extent otherwise so entitled) within the time specified herein, the

Option shall terminate.

9. Death of Optionee. In the event of termination of Optionee's

Continuous Status as an Employee or Consultant as a result of the death of

Optionee, the Option may be exercised at any time within twelve (12) months

following the date of death (but in no event later than the date of expiration

of the term of this Option as set forth in Section 10 below), by Optionee's

estate or by a person who acquired the right to exercise the Option by bequest

or inheritance, but only to the extent the Optionee could exercise the Option at

the date of death.

10. Non-Transferability of Option. This Option may not be transferred in

any manner otherwise than by will or by the laws of descent or distribution and

may be exercised during the lifetime of Optionee only by him. The terms of this

Option shall be binding upon the executors, administrators, heirs, successors

and assigns of the Optionee.

11. Term of Option. This Option may be exercised only within the term

set out in the Notice of Grant, and may be exercised during such term only in

accordance with the Plan and the terms of this Option. The limitations set out

in Section 7 of the Plan regarding Options designated as Incentive Stock Options

and Options granted to more than ten percent (10%) shareholders shall apply to

this Option.

12. Taxation Upon Exercise of Option. Optionee understands that, upon

exercising a nonstatutory Option, he or she will recognize income for tax

purposes in an amount equal to the excess of the then fair market value of the

Shares over the exercise price. However, the timing of this income recognition

may be deferred for up to six months if Optionee is subject to Section 16 of the

Securities Exchange Act of 1934, as amended (the "Exchange Act"). If the

Optionee is an employee, the Company will be required to withhold from

Optionee's compensation, or collect from Optionee and pay to the applicable

taxing authorities, an amount equal to a percentage of this compensation income.

Additionally, the Optionee may at some point be required to satisfy tax

withholding obligations with respect to a disqualifying disposition of an

Incentive Stock Option. The Optionee shall satisfy his or her tax withholding

obligation arising upon the exercise of this Option out of Optionee's

compensation or by payment to the Company.

-4-

18

13. Tax Consequences. Set forth below is a brief summary as of the date

of this option of some of the federal and California tax consequences of

exercise of this Option and disposition of the Shares. THIS SUMMARY IS

NECESSARILY INCOMPLETE, AND THE TAX LAWS AND REGULATIONS ARE SUBJECT TO CHANGE.

OPTIONEE SHOULD CONSULT A TAX ADVISER BEFORE EXERCISING THIS OPTION OR DISPOSING

OF THE SHARES.

(i) Exercise of ISO. If this option qualifies as an ISO, there

will be no regular federal income tax liability or California income tax

liability upon the exercise of the Option, although the excess, if any, of the

fair market value of the Shares on the date of exercise over the Exercise Price

will be treated as an adjustment to the alternative minimum tax for federal tax

purposes and may subject the optionee to the alternative minimum tax in the year

of exercise.

(ii) Exercise of Nonstatutory Stock Option. If this Option does

not qualify as an ISO, there may be a regular federal income tax liability and

California income tax liability upon the exercise of the Option. The Optionee

will be treated as having received compensation income (taxable at ordinary

income tax rates) equal to the excess, if any, of the fair market value of the

Shares on the date of exercise over the Exercise Price. If Optionee is an

employee, the Company will be required to withhold from Optionee's compensation

or collect from Optionee and pay to the applicable taxing authorities an amount

equal to a percentage of this' compensation income at the time of exercise.

(iii) Disposition of Shares. In the case of an NSO, if Shares are

held for at least one year, any gain realized on disposition of the Shares will

be treated as long-term capital gain for federal and California income tax

purposes. In the case of an ISO, if Shares transferred pursuant to the Option

are held for at least one year after exercise and are disposed of at least two

years after the Date of Grant, any gain realized on disposition of the Shares

will also be treated as long-term capital gain for federal and California income

tax purposes. If Shares purchased under an ISO are disposed of within such

one-year period or within two years after the Date of Grant, any gain realized

on such disposition will be treated as compensation income (taxable at ordinary

income rates) to the extent of the difference between the Exercise Price and the

lesser of (1) the fair market value of the Shares on the date of exercise, or

(2) the sale price of the Shares.

(iv) Notice of Disqualifying Disposition of ISO Shares. If the

Option granted to Optionee herein is an ISO, and if Optionee sells or otherwise

disposes of any of the Shares acquired pursuant to the ISO on or before the

later of (1) the date two years after the Date of Grant, or (2) the date one

year after the date of exercise, the Optionee shall immediately notify the

Company in writing of such disposition. Optionee agrees that optionee may be

subject to income tax withholding by the Company on the compensation income

recognized by the Optionee.

-5-

19

Gadzoox Networks, Inc.,

a Delaware corporation

By:___________________________

OPTIONEE ACKNOWLEDGES AND AGREES THAT THE VESTING OF SHARES PURSUANT TO

THE OPTION HEREOF IS EARNED ONLY BY CONTINUING CONSULTANCY OR EMPLOYMENT AT THE

WILL OF THE COMPANY (NOT THROUGH THE ACT OF BEING HIRED, BEING GRANTED THIS

OPTION OR ACQUIRING SHARES HEREUNDER). OPTIONEE FURTHER ACKNOWLEDGES AND AGREES

THAT NOTHING IN THIS AGREEMENT, NOR IN THE COMPANY'S STOCK OPTION PLAN WHICH IS

INCORPORATED HEREIN BY REFERENCE, SHALL CONFER UPON OPTIONEE ANY RIGHT WITH

RESPECT TO CONTINUATION OF EMPLOYMENT OR CONSULTANCY BY THE COMPANY, NOR SHALL

IT INTERFERE IN ANY WAY WITH HIS RIGHT OR THE COMPANY'S RIGHT TO TERMINATE HIS

EMPLOYMENT OR CONSULTANCY AT ANY TIME, WITH OR WITHOUT CAUSE.

Optionee acknowledges receipt of a copy of the Plan and represents that

they are familiar with the terms and provisions thereof, and hereby accepts this

Option subject to all of the terms and provisions thereof. Optionee has reviewed

the Plan and this Option in their entirety, has had an opportunity to obtain the

advice of counsel prior to executing this Option and fully understands all

provisions of the Option. Optionee hereby agrees to accept as binding,

conclusive and final all decisions or interpretations of the Administrator upon

any questions arising under the Plan or this Option.

Dated:__________________ _________________________________

Optionee

Useful tips for finalizing your ‘Stock Option Agreement Document’ online

Are you fed up with the complications of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can smoothly finalize and authorize documents online. Utilize the extensive features integrated into this user-friendly and budget-friendly platform and transform your method of document management. Whether you need to validate forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Stock Option Agreement Document’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don't worry if you need to collaborate with your colleagues on your Stock Option Agreement Document or send it for notarization—our solution offers everything you need to fulfill such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!