Fill and Sign the Tempe Az Sales Tax 2014 Form

Valuable tips on finishing your ‘Tempe Az Sales Tax 2014 Form’ online

Are you weary of the trouble of handling paperwork? Look no further than airSlate SignNow, the top eSignature platform for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features embedded in this intuitive and budget-friendly platform and transform your method of document management. Whether you need to approve forms or gather digital signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Access your account or sign up for a complimentary trial with our service.

- Hit +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Tempe Az Sales Tax 2014 Form’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Insert and assign fillable fields for other individuals (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Save, print your version, or transform it into a multi-usable template.

No need to worry if you have to collaborate with others on your Tempe Az Sales Tax 2014 Form or send it for notarization—our solution provides you with everything necessary to accomplish such tasks. Register with airSlate SignNow today and take your document management to a new level!

FAQs

-

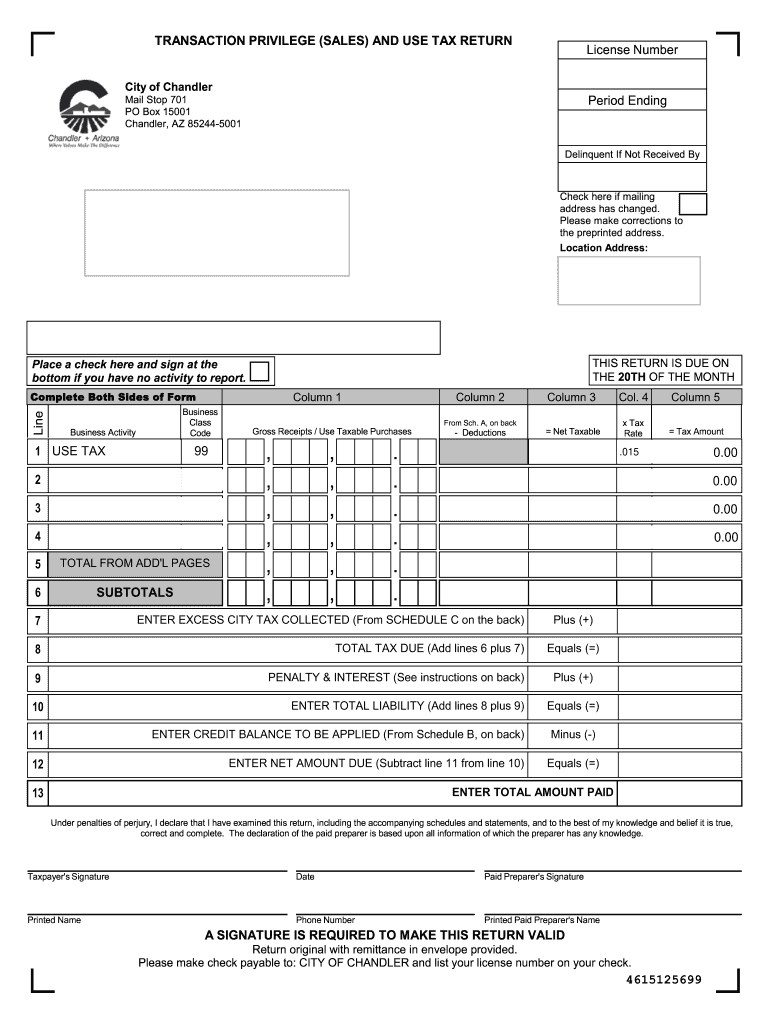

What is the Trnsaction Privilege Use And Severance Tax Return Form?

The Trnsaction Privilege Use And Severance Tax Return Form is a tax form used by businesses to report and pay transaction privilege taxes. This form is essential for compliance with state tax regulations, ensuring that businesses correctly declare their taxable transactions. Understanding how to fill out this form accurately can help avoid penalties and ensure timely payments.

-

How can airSlate SignNow help me with the Trnsaction Privilege Use And Severance Tax Return Form?

airSlate SignNow streamlines the process of managing your Trnsaction Privilege Use And Severance Tax Return Form by allowing you to easily send, sign, and store documents securely. Our platform simplifies the workflow, making it easy to collaborate with accountants or tax professionals. You can ensure that your tax documents are always completed on time and stored securely.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers a variety of features that enhance your experience with tax documents like the Trnsaction Privilege Use And Severance Tax Return Form. These features include eSignature capabilities, document templates, and real-time tracking for signatures. This means you can manage your tax forms efficiently and keep all parties informed of the signing status.

-

Is there a cost associated with using airSlate SignNow for the Trnsaction Privilege Use And Severance Tax Return Form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. We offer various pricing plans that cater to different needs, ensuring you have access to the tools necessary for managing your Trnsaction Privilege Use And Severance Tax Return Form without breaking the bank. Explore our plans to find the best fit for your business.

-

Can I integrate airSlate SignNow with other software I use for taxes?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and tax software, allowing you to manage your Trnsaction Privilege Use And Severance Tax Return Form alongside your other financial documents. This integration ensures that all your data is synchronized, which minimizes errors and streamlines your workflow. Check our integrations page for a list of compatible software.

-

What benefits does eSigning the Trnsaction Privilege Use And Severance Tax Return Form provide?

eSigning your Trnsaction Privilege Use And Severance Tax Return Form with airSlate SignNow offers several benefits, including speed and security. You can sign documents from anywhere, eliminating the need for physical meetings or mail delays. Additionally, eSigning provides a secure, verifiable trail that can protect your business in case of audits.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, including the Trnsaction Privilege Use And Severance Tax Return Form. Our platform utilizes advanced encryption and complies with industry standards to keep your data safe. You can have peace of mind knowing that your sensitive tax information is protected while using our services.

Find out other tempe az sales tax 2014 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles