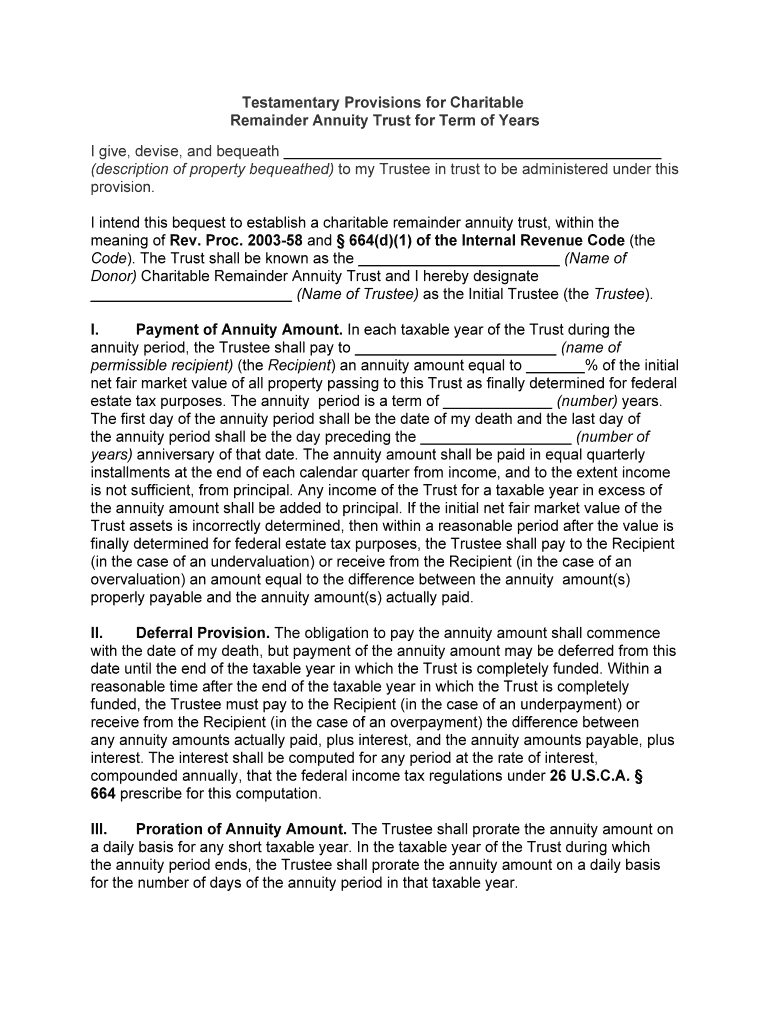

Fill and Sign the Testamentary Provisions for Charitable Form

Helpful tips on getting your ‘Testamentary Provisions For Charitable’ online

Are you fed up with the burden of handling paperwork? Your search ends with airSlate SignNow, the premier eSignature solution for both individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can conveniently complete and sign documents online. Utilize the extensive features embedded in this user-friendly and cost-effective platform to transform your method of document management. Whether you require to sign forms or gather eSignatures, airSlate SignNow effortlessly manages it all with just a few clicks.

Follow this detailed guide:

- Sign in to your account or create a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Testamentary Provisions For Charitable’ in the editor.

- Click Me (Fill Out Now) to get the form ready on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you want to collaborate with your peers on your Testamentary Provisions For Charitable or send it for notarization—our platform provides you with all the tools necessary to accomplish such tasks. Register for an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What are testamentary provisions for charitable donations?

Testamentary provisions for charitable donations refer to the clauses included in a will that designate a portion of an estate to a charitable organization. By incorporating these provisions, individuals can ensure their legacy supports causes they care about, providing both personal satisfaction and potential tax benefits.

-

How can airSlate SignNow assist with testamentary provisions for charitable contributions?

airSlate SignNow offers a streamlined way to create, send, and eSign documents related to testamentary provisions for charitable contributions. Our platform simplifies the process of drafting wills and charitable agreements, ensuring that your intentions are clearly documented and legally binding.

-

What features does airSlate SignNow offer for managing testamentary provisions for charitable?

With airSlate SignNow, you can easily create templates for testamentary provisions for charitable donations, customize them to fit your needs, and securely send them for signatures. The platform also includes tracking capabilities, ensuring all parties are informed during the signing process.

-

Are there any costs associated with using airSlate SignNow for testamentary provisions for charitable?

Yes, airSlate SignNow offers various pricing plans to fit different needs, including features tailored for managing testamentary provisions for charitable donations. These plans are designed to be cost-effective while providing robust tools for document management and eSigning.

-

Can I integrate airSlate SignNow with other tools for managing testamentary provisions for charitable?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage your testamentary provisions for charitable donations alongside your existing workflows. This flexibility enhances efficiency and streamlines your document management process.

-

What benefits do testamentary provisions for charitable donations provide?

Incorporating testamentary provisions for charitable donations in your will allows you to make a meaningful impact after your passing while potentially reducing your estate taxes. This not only supports causes you value but also sets a precedent for philanthropic giving within your family.

-

Is airSlate SignNow legally compliant for creating testamentary provisions for charitable?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management. When creating testamentary provisions for charitable donations, you can trust that our platform adheres to the necessary regulations to ensure your documents are valid and enforceable.

The best way to complete and sign your testamentary provisions for charitable form

Find out other testamentary provisions for charitable form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles