Fill and Sign the Texas Commercial Lease Agreement Formdocx

Valuable advice on preparing your ‘Texas Commercial Lease Agreement Formdocx’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and endorse documents online. Utilize the robust features embedded in this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to sign forms or collect electronic signatures, airSlate SignNow takes care of everything seamlessly, with just a few simple actions.

Adhere to this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Hit +Create to upload a document from your device, cloud storage, or our template repository.

- Open your ‘Texas Commercial Lease Agreement Formdocx’ in the editor.

- Click Me (Fill Out Now) to fill in the form on your side.

- Add and allocate fillable fields for others (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Texas Commercial Lease Agreement Formdocx or send it for notarization—our platform provides everything you require to achieve such objectives. Sign up with airSlate SignNow today and take your document management to the next level!

FAQs

-

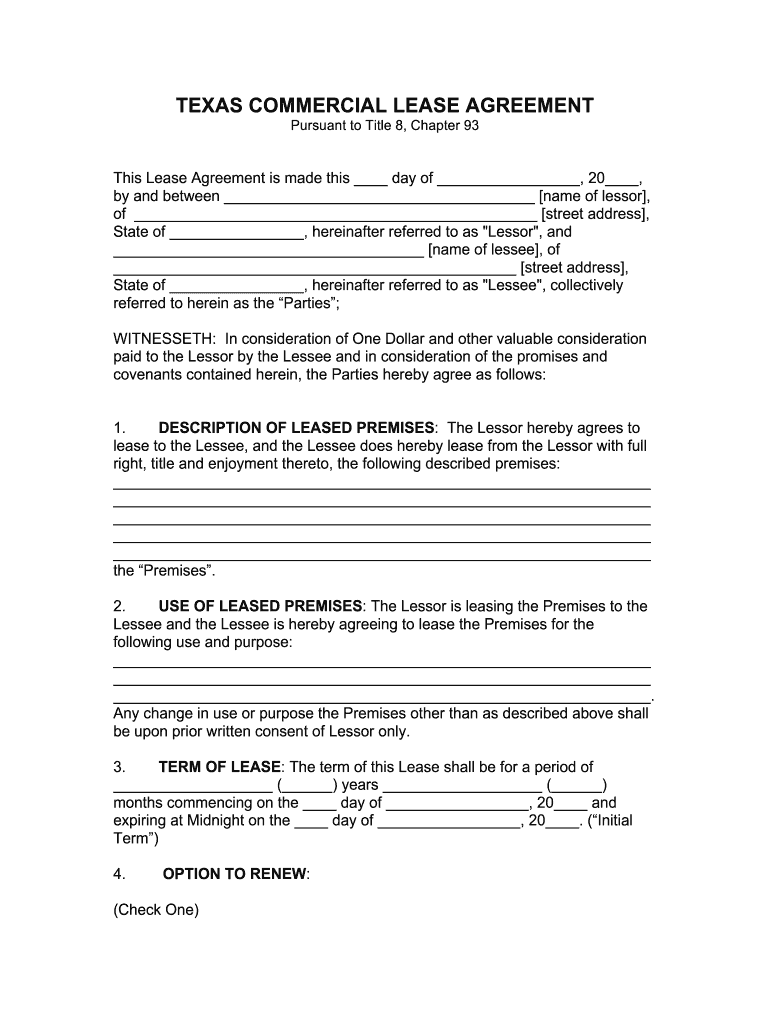

What is a Texas commercial lease agreement form docx?

A Texas commercial lease agreement form docx is a legal document used to outline the terms of leasing commercial property in Texas. This form specifies the rights and responsibilities of both landlords and tenants, ensuring clarity and protection for both parties. Using an easily editable docx format, businesses can customize the agreement to fit their specific needs.

-

How can airSlate SignNow help me with a Texas commercial lease agreement form docx?

airSlate SignNow allows you to easily create, edit, and eSign a Texas commercial lease agreement form docx. Our platform streamlines the document management process, enabling you to send and receive signed agreements quickly and securely. With our user-friendly interface, you can customize your lease agreement to meet your business requirements.

-

What are the benefits of using a Texas commercial lease agreement form docx?

Using a Texas commercial lease agreement form docx provides several benefits, including legal protection and clearly defined terms. This document helps prevent disputes between landlords and tenants by ensuring all details are agreed upon. Additionally, having a standardized form saves time and reduces the complexity of drafting a lease from scratch.

-

Is there a cost associated with using airSlate SignNow for my Texas commercial lease agreement form docx?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. With our cost-effective solutions, you can access features for creating, sending, and signing your Texas commercial lease agreement form docx. We also offer a free trial, so you can explore our platform before committing to a subscription.

-

Can I integrate airSlate SignNow with other software for my Texas commercial lease agreement form docx?

Absolutely! airSlate SignNow offers seamless integrations with popular software and applications, enhancing your workflow for managing your Texas commercial lease agreement form docx. You can connect with CRM systems, cloud storage services, and more to ensure your documents are organized and accessible.

-

What features does airSlate SignNow offer for managing a Texas commercial lease agreement form docx?

airSlate SignNow provides a range of features for managing your Texas commercial lease agreement form docx, including customizable templates, real-time tracking, and secure eSignature capabilities. Our platform ensures that your documents are legally binding and easily accessible from anywhere. Additionally, you can collaborate with team members for a more efficient leasing process.

-

How secure is my Texas commercial lease agreement form docx when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to ensure your Texas commercial lease agreement form docx is safe and secure. You can trust that your sensitive information is protected at all times, giving you peace of mind while managing your lease agreements.

Find out other texas commercial lease agreement formdocx

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles