Fill and Sign the This Evidence of Insurance Documentation is Provided for Our Business Partners Including Customers and Propertyequipment Les Form

Useful tips for finalizing your ‘This Evidence Of Insurance Documentation Is Provided For Our Business Partners Including Customers And Propertyequipment Les’ digitally

Are you fed up with the complications of dealing with paperwork? Look no further than airSlate SignNow, the top eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy routines of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the robust features included in this intuitive and budget-friendly platform to transform your document management approach. Whether you need to authorize documents or collect electronic signatures, airSlate SignNow simplifies the process significantly, requiring just a few clicks.

Adhere to this detailed guide:

- Access your account or register for a complimentary trial of our service.

- Hit +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘This Evidence Of Insurance Documentation Is Provided For Our Business Partners Including Customers And Propertyequipment Les’ within the editor.

- Select Me (Fill Out Now) to complete the form on your end.

- Add and assign fillable fields for others (if needed).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save your document, print a hard copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your team on your This Evidence Of Insurance Documentation Is Provided For Our Business Partners Including Customers And Propertyequipment Les or send it for notarization—our platform provides everything necessary to complete those tasks. Sign up for airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the importance of This Evidence Of Insurance Documentation for businesses?

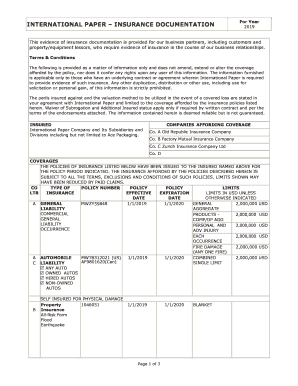

This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les, ensuring that all involved parties have the necessary proof of coverage. It protects businesses from liability and builds trust with partners. Having this documentation readily available can streamline processes and enhance your credibility.

-

How can I access This Evidence Of Insurance Documentation through airSlate SignNow?

With airSlate SignNow, you can easily create and manage This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les. Our platform allows you to upload documents, fill out necessary fields, and eSign them within minutes. All your documents are securely stored and easily accessible whenever you need them.

-

Is There a cost associated with obtaining This Evidence Of Insurance Documentation?

The cost of obtaining This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les varies based on the subscription plan you choose with airSlate SignNow. We offer flexible pricing options to suit different business needs. Reviewing our pricing page can help you find the right plan that includes all essential features.

-

What features does airSlate SignNow offer for managing insurance documentation?

airSlate SignNow provides a range of features that streamline the management of This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les. Some key features include customizable templates, easy document sharing, and electronic signature capabilities. These tools simplify the process and enhance efficiency for businesses.

-

Can airSlate SignNow integrate with other software for insurance documentation?

Yes, airSlate SignNow can integrate with various software applications to enhance your workflow for This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les. This includes CRM systems, cloud storage services, and project management tools, allowing for seamless data transfer and improved efficiency.

-

How does airSlate SignNow ensure the security of my insurance documentation?

At airSlate SignNow, the security of your documents is a top priority. We implement industry-standard security measures, including encryption and secure access controls, to protect This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les. You can trust that your sensitive information is safe with us.

-

What are the benefits of using airSlate SignNow for insurance documentation?

Using airSlate SignNow for managing This Evidence Of Insurance Documentation Is Provided For Our Business Partners, Including Customers And Propertyequipment Les offers numerous benefits. It simplifies document workflow, enhances collaboration, and reduces turnaround times. Additionally, our platform is user-friendly and cost-effective, making it ideal for businesses of all sizes.

Find out other this evidence of insurance documentation is provided for our business partners including customers and propertyequipment les form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles