Fill and Sign the Transfer Amp Conveyance Standard Hamilton County Ohio Hamiltoncountyohio Form

Useful advice for preparing your ‘Transfer Amp Conveyance Standard Hamilton County Ohio Hamiltoncountyohio’ online

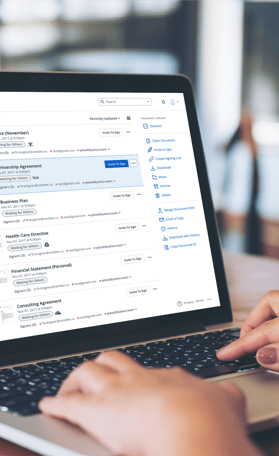

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier digital signature platform for individuals and businesses. Wave goodbye to the tedious process of printing and scanning files. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the powerful features included in this user-friendly and cost-effective platform and transform your document management approach. Whether you need to sign forms or collect signatures, airSlate SignNow takes care of it all conveniently, with just a few clicks.

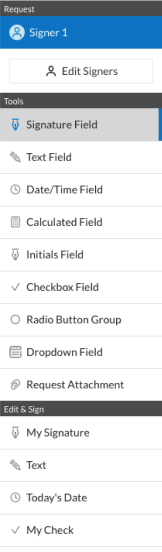

Follow this detailed guide:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Transfer Amp Conveyance Standard Hamilton County Ohio Hamiltoncountyohio’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Transfer Amp Conveyance Standard Hamilton County Ohio Hamiltoncountyohio or send it for notarization—our platform equips you with everything required to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the Transfer & Conveyance Standard for Hamilton County, Ohio?

The Transfer & Conveyance Standard for Hamilton County, Ohio, Hamiltoncountyohio, outlines the requirements for transferring property ownership in the county. This standard ensures that all legal documents are properly formatted and executed, facilitating a smooth transaction process. Understanding these standards is crucial for buyers, sellers, and real estate professionals.

-

How can airSlate SignNow help with the Transfer & Conveyance Standard in Hamilton County, Ohio?

airSlate SignNow streamlines the process of preparing and signing documents required by the Transfer & Conveyance Standard in Hamilton County, Ohio, Hamiltoncountyohio. With our easy-to-use eSignature platform, you can create, send, and sign documents quickly, ensuring compliance with local regulations. This efficiency saves time and reduces the hassle traditionally associated with property transfers.

-

What are the pricing options for using airSlate SignNow for Hamilton County documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective solution for handling the Transfer & Conveyance Standard in Hamilton County, Ohio, Hamiltoncountyohio. Our plans include features like unlimited eSignatures and document templates, allowing you to choose the best option based on your transaction volume and requirements.

-

Are there any features specific to the Transfer & Conveyance Standard in Hamilton County, Ohio?

Yes, airSlate SignNow includes features tailored to meet the Transfer & Conveyance Standard's requirements in Hamilton County, Ohio, Hamiltoncountyohio. These features include customizable templates, secure cloud storage, and automated workflows to ensure that all necessary documents comply with local regulations, simplifying the transfer process.

-

Can I integrate airSlate SignNow with other tools for managing property documents in Hamilton County?

Absolutely! airSlate SignNow offers seamless integrations with popular real estate platforms and document management systems. This capability allows you to efficiently manage the Transfer & Conveyance Standard documents for Hamilton County, Ohio, Hamiltoncountyohio, alongside your existing tools, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for property transfers in Hamilton County, Ohio?

Using airSlate SignNow for property transfers in Hamilton County, Ohio, Hamiltoncountyohio, provides numerous benefits including increased efficiency, reduced paperwork, and enhanced security. Our platform's user-friendly interface and robust features enable quick document preparation and signing, ensuring that transactions comply with the Transfer & Conveyance Standard without unnecessary delays.

-

Is airSlate SignNow compliant with legal requirements for the Transfer & Conveyance Standard in Hamilton County, Ohio?

Yes, airSlate SignNow is designed to comply with the legal requirements of the Transfer & Conveyance Standard in Hamilton County, Ohio, Hamiltoncountyohio. Our eSignature solutions meet the necessary legal standards, ensuring that all electronically signed documents are valid and enforceable under state law.

Related searches to transfer amp conveyance standard hamilton county ohio hamiltoncountyohio form

Find out other transfer amp conveyance standard hamilton county ohio hamiltoncountyohio form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles