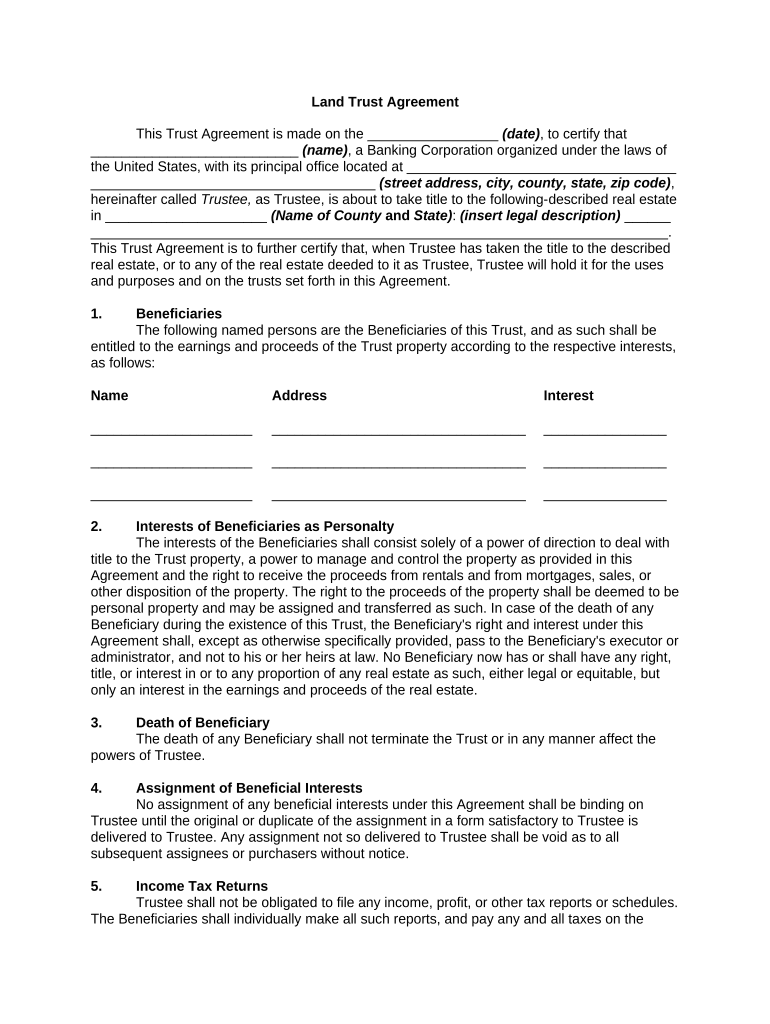

Land Trust Agreement

This Trust Agreement is made on the _________________ (date) , to certify that

___________________________ (name) , a Banking Corporation organized under the laws of

the United States , with its principal office located at ___________________________________

_____________________________________ (street address, city, county, state, zip code) ,

hereinafter called Trustee , as Trustee, is about to take title to the following-described real estate

in _____________________ (Name of County and State) : (insert legal description) ______

___________________________________________________________________________.

This Trust Agreement is to further certify that, when Trustee has taken the title to the described

real estate, or to any of the real estate deeded to it as Trustee, Trustee will hold it for the uses

and purposes and on the trusts set forth in this Agreement.

1. Beneficiaries

The following named persons are the Beneficiaries of this Trust, and as such shall be

entitled to the earnings and proceeds of the Trust property according to the respective interests,

as follows:

Name Address Interest

_____________________ _________________________________ ________________

_____________________ _________________________________ ________________

_____________________ _________________________________ ________________

2. Interests of Beneficiaries as Personalty

The interests of the Beneficiaries shall consist solely of a power of direction to deal with

title to the Trust property, a power to manage and control the property as provided in this

Agreement and the right to receive the proceeds from rentals and from mortgages, sales, or

other disposition of the property. The right to the proceeds of the property shall be deemed to be

personal property and may be assigned and transferred as such. In case of the death of any

Beneficiary during the existence of this Trust, the Beneficiary's right and interest under this

Agreement shall, except as otherwise specifically provided, pass to the Beneficiary's executor or

administrator, and not to his or her heirs at law. No Beneficiary now has or shall have any right,

title, or interest in or to any proportion of any real estate as such, either legal or equitable, but

only an interest in the earnings and proceeds of the real estate.

3. Death of Beneficiary

The death of any Beneficiary shall not terminate the Trust or in any manner affect the

powers of Trustee.

4. Assignment of Beneficial Interests

No assignment of any beneficial interests under this Agreement shall be binding on

Trustee until the original or duplicate of the assignment in a form satisfactory to Trustee is

delivered to Trustee. Any assignment not so delivered to Trustee shall be void as to all

subsequent assignees or purchasers without notice.

5. Income Tax Returns

Trustee shall not be obligated to file any income, profit, or other tax reports or schedules.

The Beneficiaries shall individually make all such reports, and pay any and all taxes on the

earnings and proceeds of the trust property or growing out of their interest under this

Agreement.

6. Reimbursement and Indemnification of Trustee

If Trustee makes any advances of money on account of this Trust, is made a party to

any litigation on account of holding title to the real estate or in connection with this Trust, or if

Trustee is compelled to pay any sum of money on account of this Trust, whether on account of

a breach of contract, injury to personal property, fines or penalties under any law, or otherwise,

the Beneficiaries will on demand pay to Trustee, with interest at the rate of _____% per year, all

such disbursements or advances or payments made by Trustee, together with Trustee's

expenses, including reasonable attorney fees. Trustee shall not be called on to convey or

otherwise deal with the trust property at any time held under this Agreement until all of the

disbursements, payments, advances, and expenses made or incurred by Trustee have been

fully paid, together with interest. Trustee shall not be required to advance or to pay out any

money on account of this trust or to prosecute or defend any legal proceedings involving this

trust or any property or interest under this Agreement unless Trustee is furnished with funds

sufficient for the same or is satisfactorily indemnified.

7. Protection of Third Parties

No party dealing with Trustee in relation to the Trust property in any manner whatsoever,

and no party to whom the property or any part of or interest in it is conveyed, contracted to be

sold, leased, or mortgaged by Trustee, shall be obliged to see to the application of the purchase

money paid or to inquire into the necessity or expediency of any act of Trustee or the provisions

of this instrument.

8. Recordation

This Agreement shall not be placed on record in the recorder's office of the county in

which the Trust property is situated, or elsewhere. Any such recording shall not be considered

as notice of the rights of any person under this Agreement derogatory to the title or powers of

Trustee.

9. Disclosure of Beneficiaries’ Names

In the event of service of process on Trustee at any time, Trustee may in its discretion

disclose to the other parties to any such proceeding the names and addresses of the

Beneficiary or Beneficiaries.

10. Resignation of Trustee

Trustee may resign at any time by sending a notice of its intention to do so by registered

mail to each of the Beneficiaries at his or her address last known to Trustee. Such resignation

shall become effective (e.g. 10) _____ days after the mailing of the notices. In the event of the

Trustee's resignation, a successor or successors may be appointed by the person or persons

then entitled to direct Trustee in the disposition of the Trust property. Trustee shall then convey

the Trust property to such successor or successors in trust. If no successor in trust is named

within (e.g. 10) _____ days after the mailing of the notices, Trustee may convey the Trust

property to the Beneficiaries in accordance with their respective interests under this Agreement,

or Trustee may, at its option, file a bill for appropriate relief in any court of competent

jurisdiction. Notwithstanding the resignation of Trustee, Trustee shall continue to have a first lien

on the Trust property for its costs, expenses, and attorney fees, and for its reasonable

compensation. Every successor or successors in trust shall become fully vested with all the

estate, properties, rights, powers, trusts, duties, and obligations of its, his, her or their

predecessor.

11. Duties of Trustee

Trustee assumes and agrees to perform the following active and affirmative duties under

this Agreement:

A. When and as directed to do so in writing by the following named person or

persons: ______________________________________ (name or names) , Trustee

shall execute such instruments as shall be necessary:

1. To protect and conserve the Trust property;

2. To sell, contract to sell, and grant options to purchase the property and

any right, title or interest in the property on any terms;

3. To exchange the property or any part of it for any other real or personal

property on any terms;

4. To convey the property by deed or other conveyance to any grantee, with

or without consideration;

5. To mortgage, execute principal and interest notes, pledge or otherwise

encumber the property or any part of it;

6. To lease, contract to lease, grant options to lease and renew, extend,

amend, and otherwise modify leases on the property or any part of it, for any

period of time, for any rental, and on any other terms and conditions; and

7. To release, convey, or assign any other right, title, or interest whatsoever

in the property or any part of the property.

B. Any and all trust deeds, mortgages, and notes executed by Trustee shall contain

provisions exempting and exonerating the Beneficiaries under this Trust from all

personal obligation and liability whatsoever by reason of the execution of the same and

from any and all personal obligation or liability for the repayment of the borrowed money

evidenced and secured by the same.

C. Trustee shall not be required to inquire into the authenticity, necessity, or

propriety of any written direction delivered to it pursuant to this section or otherwise

under this Agreement. Any Beneficiary who is not vested with the foregoing power of

direction may, by a written notice delivered to Trustee, prevent Trustee from dealing with

title to the Trust property except on the written collective direction of all the Beneficiaries

under this Agreement.

D. If any property remains in trust (e.g. 20) years from the date of this Agreement,

Trustee shall promptly sell the same at public sale after a reasonable public

advertisement and reasonable notice of the sale to the Beneficiaries. After deducting its

reasonable fees and expenses, Trustee shall divide the proceeds of the sale among the

Beneficiaries as their interests may then appear without any direction or consent

whatsoever, or shall transfer, set over, convey, and deliver to all the then Beneficiaries of

this trust their respective undivided interest in any nondivisible assets, or shall transfer,

settle, and deliver all of the assets of the Trust to the Beneficiaries in their respective

proportionate interests at any time that the assets of the Trust consist solely of cash.

12. Management and Operation of Trust Property

The Beneficiaries shall, in their own right, have full and exclusive control over the

management and operation of the Trust property and control of the sale, rental, or other

disposition of it. Each Beneficiary, or his or her agent, shall collect and otherwise handle his or

her share of the rents and proceeds and the proceeds of any sale or other disposition. Trustee

shall have no duty respecting the payment of taxes, insurance premiums, or other costs or

charges against or concerning the Trust property.

13. Compensation of Trustee

The Beneficiaries shall pay Trustee as its compensation the following:

A. $_________ for accepting this Trust, taking title to the Trust property, and the

first annual fee.

B. $_________ per year, or any portion of a year, for holding title to the trust

property, as long as any property remains in Trust, commencing on _____________

(date) .

C. Trustee's regular schedule of fees for causing such deeds, mortgages, leases,

and other instruments to be executed as may be required under this Agreement.

D. Reasonable compensation for any special services that may be rendered by

Trustee under this Agreement, and for taking and holding title to any other property that

may later be conveyed to Trustee.

14. Binding on Successors

The terms and conditions of this Agreement shall inure to the benefit of and be binding

on any successor Trustee and on all successors in interest of the Beneficiaries.

15. Governing Law

This Agreement shall be construed and regulated, and its validity and effect shall be

determined, by the laws of _______________ (state) , as such laws may from time to time exist.

Witness our signatures _________________ (date) .

___________________________

(Name of Trustee)

By: _________________________ _____________________________

____________________________ ____________________________

(P rinted name & Office in Corporation) (Name & Signature of Beneficiary)

__________________________

(Signature of Officer)

____________________________ ____________________________

_____________________________ ____________________________

(Name & Signature of Beneficiary) (Name & Signature of Beneficiary)

_____________________________ _____________________________

_____________________________ _____________________________

(Name & Signature of Beneficiary) (Name & Signature of Beneficiary)

(Acknowledgments)