Signed (Assistant Clerk of said court)

Execution

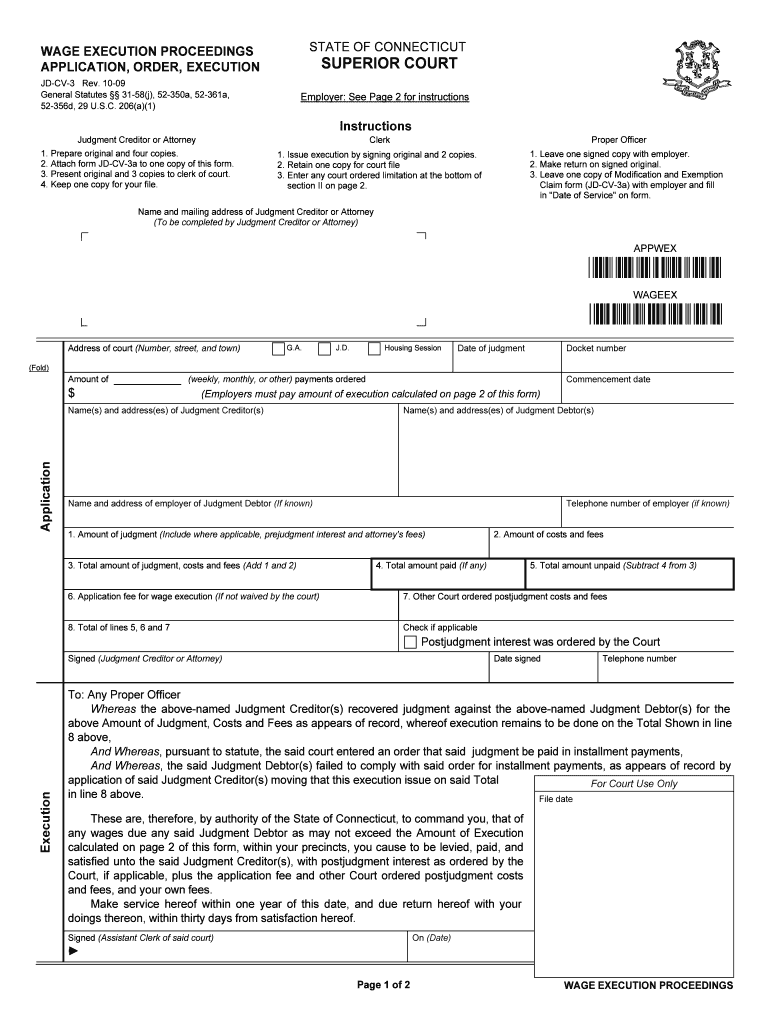

To: Any Proper Officer

Whereas the above-named Judgment Creditor(s) recovered judgment against the above-named Judgment Debtor(s) for the

above Amount of Judgment, Costs and Fees as appears of record, whereof execution remains to be done on the Total Shown in line 8 above,

And Whereas , pursuant to statute, the said court entered an order that said judgment be paid in installment payments,

And Whereas , the said Judgment Debtor(s) failed to comply with said order for installment payments, as appears of record by

application of said Judgment Creditor(s) moving that this execution issue on said Totalin line 8 above.

WAGE EXECUTION PROCEEDINGS APPLICATION, ORDER,

EXECUTION

JD-CV-3 Rev. 10-09

General Statutes §§ 31-58(j), 52-350a, 52-361a,52-356d, 29 U.S.C. 206(a)(1) STATE OF CONNECTICUT

SUPERIOR COURT

Instructions

1. Prepare original and four copies.

2. Attach form JD-CV-3a to one copy of this form.

3. Present original and 3 copies to clerk of court.

4. Keep one copy for your file.

Address of court (Number, street, and town) Date of judgment

1. Issue execution by signing original and 2 copies.

2. Retain one copy for court file

3. Enter any court ordered limitation at the bottom of

section II on page 2.

1. Leave one signed copy with employer.2. Make return on signed original.

3. Leave one copy of Modification and Exemption

Claim form (JD-CV-3a) with employer and fill

in "Date of Service" on form.

$ Docket number

(Fold)

Name and mailing address of Judgment Creditor or Attorney (To be completed by Judgment Creditor or Attorney)

Judgment Creditor or Attorney

ClerkProper Officer

Commencement date

(Employers must pay amount of execution calculated on page 2 of this form)

Name and address of employer of Judgment Debtor (If known) Telephone number of employer (if known)

Signed (Judgment Creditor or Attorney) Telephone number

Application

Page 1 of 2

G.A. J.D.

Amount of

(weekly, monthly, or other) payments ordered

Date signed APPWEX

WAGEEX

Name(s) and address(es) of Judgment Debtor(s)

Name(s) and address(es) of Judgment Creditor(s)

5. Total amount unpaid (Subtract 4 from 3)

1. Amount of judgment (Include where applicable, prejudgment interest and attorney's fees) 2. Amount of costs and fees

3. Total amount of judgment, costs and fees (Add 1 and 2) 4. Total amount paid (If any)

6. Application fee for wage execution (If not waived by the court)

8. Total of lines 5, 6 and 7

On (Date)

For Court Use Only

File date

WAGE EXECUTION PROCEEDINGS

Housing Session

These are, therefore, by authority of the State of Connecticut, to command you, that of

any wages due any said Judgment Debtor as may not exceed the Amount of Execution

calculated on page 2 of this form, within your precincts, you cause to be levied, paid, and

satisfied unto the said Judgment Creditor(s), with postjudgment interest as ordered by the

Court, if applicable, plus the application fee and other Court ordered postjudgment costs

and fees, and your own fees. Make service hereof within one year of this date, and due return hereof with your

doings thereon, within thirty days from satisfaction hereof.

Employer: See Page 2 for instructions

7. Other Court ordered postjudgment costs and fees

Check if applicable

Postjudgment interest was ordered by the Court

Computation Of Employee's Disposable Earnings

Important Notice To Employer

You are being served with a wage execution, a court order requiring you to withhold non-exempt wages from a person employed by

you. This execution is being served on you

because your employee, the Judgment Debtor (on page 1), has had a judgment entered against him/her by the Superior Court requir ing him/her to pay judgment, costs and fees to

the Judgment Creditor (on page 1) and has not made payment of the total amount of the judgment plus any costs and fees as shown on page 1. This notice is to inform you of the

actions you must take in order to comply with the law regarding wage executions. Please read each section carefully.

I. You must notify the employee — Your employee has certain legal rights which

may allow him/her to request the court to change or stop this execution upon his/her

wages. A notice of his/her rights and how to get a hearing in court is attached to the

second copy of the wage execution given to you by the officer. You must complete

your portion of the wage execution and your portion of the exemption and modification

claim form and deliver or mail, postage prepaid, a copy of these papers to your

employee immediately so that your employee can make any claims allowed by law.

Court ordered limitation (If any, to be entered by clerk)

II. Execution not effective for 20 days —

This execution is not effective until after 20

days from the day the officer served these papers on you. No money should be

deducted from your employee's wages until the first wages you pay to your employee

after the 20-day period ends.

If your employee elects within the 20-day period to make a claim to the court that

his/her wages are partially or totally exempt from execution to pay this judgment or

he/she seeks to have the amount of this execution changed, wages are not to be

withheld from the employee until the court decides the claims or determines the rights

of your employee in this case.

If you are not notified that your employee has filed papers with the court, the execution

is to be enforced after 20 days from the date of service on you.

III. Stay of execution — No earnings claimed to be exempt or subject to a claim for

modification may be withheld from any employee until determination of the claim by the court.

IV. Only one execution issued under section 52-361a of the General Statutes is

to be satisfied at a time — You must make deductions from your employee's wages

and pay over the withheld money against only one execution issued under General

Statutes section 52-361a at a time. If you are served with more than one execution

issued under General Statutes section 52-361a against this employee's wages, the executions are to be satisfied in the order in which you are served with them.

(Income

withholdings and voluntary wage deductions for support of a family, if there are any,

must be paid before this execution. Family support income withholdings and voluntary

wage deductions are issued on Form JD-FM-1.)

"Disposable Earnings" means that part of the earnings of an individual remaining after the deduction from those earnings of amo unts to be

withheld for payment of federal income and employment taxes, normal retirement contributions, union dues and initiation fees, g roup life

insurance premiums, health insurance premiums, and federal tax levies.

Section I.

1. Employee's gross compensation per week....................................................................................

.....

2. Federal income tax withheld..................................................................

3. Federal employment tax........................................................................

4. Normal retirement contribution..............................................................

5. Union dues and initiation fees...............................................................

6. Group life insurance premium................................................................

7. Health insurance premium.....................................................................

8. Other federal tax levies..........................................................................

9. Total allowable deductions (Add lines 2-8)............................................

10. Weekly Disposable Earnings (Subtract line 9 from line 1).....................................................

To be calculated by employer Column 1 Column 2

A-1. Weekly disposable earnings (from line 10 above) $

Computation Of Employee's Disposable Earnings

$

$

$

$

$

A-2. 25% of disposable earnings for week

Amount of Execution

(Lesser of the two amounts in column 2 subject to any court

ordered limitation set forth in the box below if a lesser amount.)

B-1. Weekly disposable earnings (from line 10 above)

Forty times the HIGHER of the current federal min-

imum hourly wage OR state full minimum fair wage.

Amount by which line B-1 exceeds B-2

B-2. V. Maximum amount deducted

— The maximum amount which can be legally

withheld from your employee's wages is 25% of his/her disposable earnings for each

week. The amount to be withheld to pay this execution may be less than 25%, but it

can never be more. The computations you complete below will allow you to calculate

the exact amount which should be withheld from this employee's wages.

Unless the court orders that this execution is to be for a smaller amount, you must

withhold and pay over the maximum amount which you figure out using the

computations below. Your employee has a right to request the court to reduce the

amount withheld, but until you receive notice that the court has agreed to allow the

amount to be reduced, you must withhold the maximum amount.

VI. Your duty to comply with this execution — You have a legal duty to make

deductions from your employee's wages and pay any amounts deducted as required

by this execution. If you do not, legal action may be taken against you. If you are

found to be in contempt of a court order, you may be held liable to the Judgment

Creditor for the amounts of wages which you did not withhold from your employee.

VII. Discipline against your employee — You may not discipline, suspend or

discharge your employee because this wage execution has been served upon you. If

you do unlawfully take action against your employee, you may be liable to pay him all

of his lost earnings and employment benefits from the time of your action to the time

that the employee is reinstated.

The law allows you to take disciplinary measures against the employee if you are

served with more than 7 wage executions against his/her wages in any calendar year.

Page 2 of 2

Section II.

JD-CV-3 Rev. 10-09

Useful advice for finalizing your ‘Wage Execution Proceedings’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for both individuals and enterprises. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can efficiently complete and sign paperwork online. Utilize the robust features integrated into this intuitive and affordable platform and transform your method of document management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Wage Execution Proceedings’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other participants (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Wage Execution Proceedings or send it for notarization—our platform provides you with everything necessary to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!