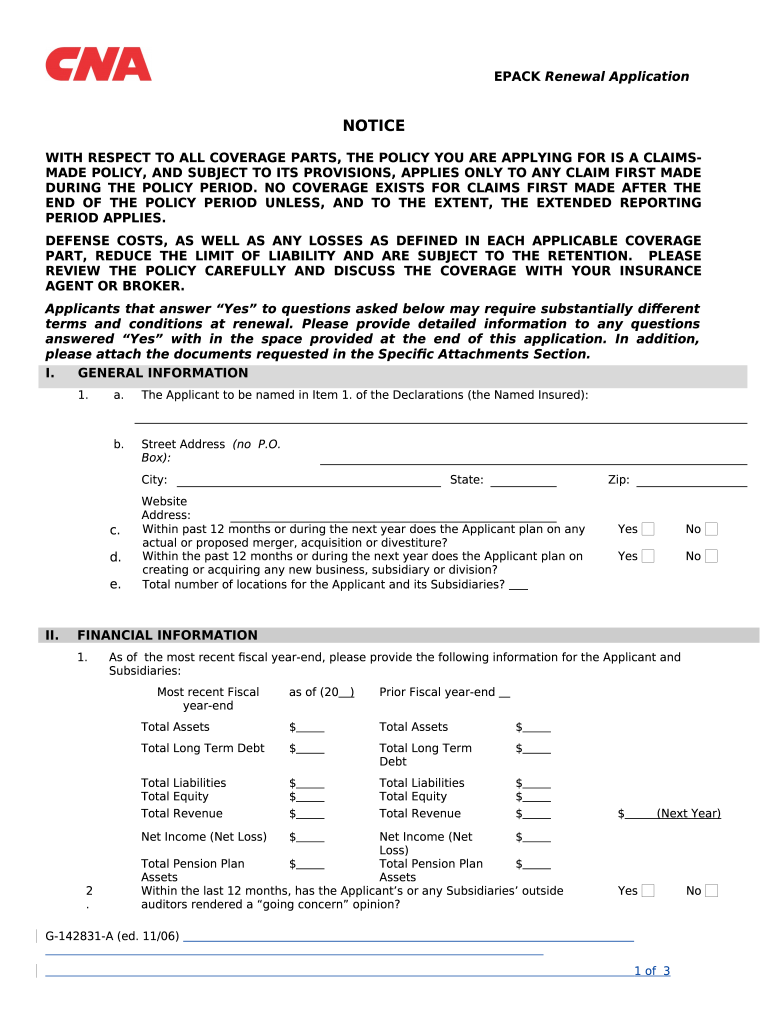

Fill and Sign the With Respect to All Coverage Parts the Policy You Are Applying for is a Claims Made Policy and Subject to Its Provisions Form

Valuable advice on finalizing your ‘With Respect To All Coverage Parts The Policy You Are Applying For Is A Claims Made Policy And Subject To Its Provisions’ online

Are you weary of the complications of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and authorize paperwork online. Utilize the robust features packaged within this user-friendly and cost-effective platform to transform your approach to document management. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Adhere to this step-by-step guide:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘With Respect To All Coverage Parts The Policy You Are Applying For Is A Claims Made Policy And Subject To Its Provisions’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and assign fillable fields for other individuals (if required).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your teammates on your With Respect To All Coverage Parts The Policy You Are Applying For Is A Claims Made Policy And Subject To Its Provisions or send it for notarization—our platform provides you with everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What does it mean when you say, 'WITH RESPECT TO ALL COVERAGE PARTS, THE POLICY YOU ARE APPLYING FOR IS A CLAIMS MADE POLICY, AND SUBJECT TO ITS PROVISIONS, APPL.'?

This statement indicates that the insurance policy in question is a claims-made policy, which means it only covers claims made during the policy period. Therefore, it’s essential to understand its provisions and ensure that you have adequate coverage throughout the duration of your policy.

-

How does airSlate SignNow handle document security?

With respect to all coverage parts, the policy you are applying for is a claims made policy, and subject to its provisions, airSlate SignNow prioritizes document security using advanced encryption and secure cloud storage. This ensures that your documents are protected from unauthorized access while maintaining compliance with industry regulations.

-

Are there any additional fees associated with using airSlate SignNow?

While airSlate SignNow offers transparent pricing, it's important to review all terms carefully. With respect to all coverage parts, the policy you are applying for is a claims made policy, and subject to its provisions, additional fees may apply for premium features or integrations.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers seamless integrations with various software tools and platforms. With respect to all coverage parts, the policy you are applying for is a claims made policy, and subject to its provisions, these integrations can enhance your workflow and improve overall efficiency.

-

What are the key benefits of using airSlate SignNow?

AirSlate SignNow provides numerous benefits, including ease of use, cost-effectiveness, and enhanced document management. With respect to all coverage parts, the policy you are applying for is a claims made policy, and subject to its provisions, these advantages help streamline your e-signature processes and increase productivity.

-

Is there a trial period available for airSlate SignNow?

Yes, airSlate SignNow offers a trial period for new users to explore its features. With respect to all coverage parts, the policy you are applying for is a claims made policy, and subject to its provisions, this trial allows you to assess whether the solution meets your business needs before making a commitment.

-

How does airSlate SignNow support compliance with legal standards?

AirSlate SignNow is designed to comply with various legal standards, ensuring your documents are legally binding. With respect to all coverage parts, the policy you are applying for is a claims made policy, and subject to its provisions, this commitment to compliance is crucial for businesses operating in regulated industries.

Find out other with respect to all coverage parts the policy you are applying for is a claims made policy and subject to its provisions form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles