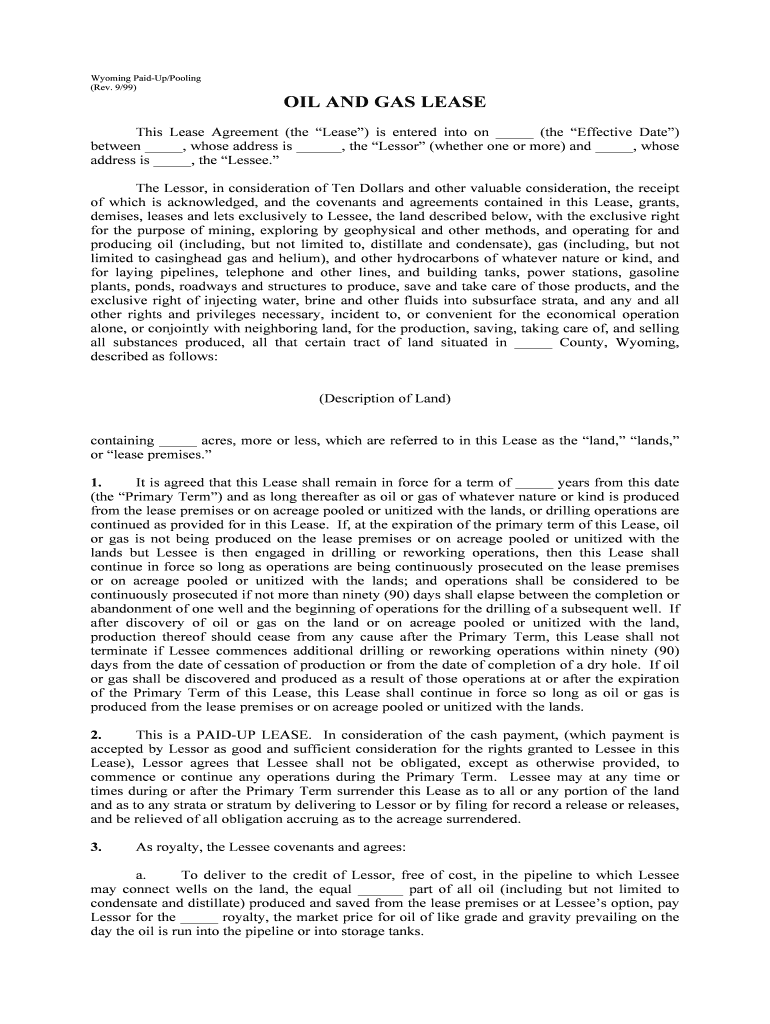

Wyoming Paid-Up/Pooling(Rev. 9/99) OIL AND GAS LEASE This Lease Agreement (the “Lease”) is entered into on _____ (the “Effective Date”)

between _____, whose address is ______, the “Lessor” (whether one or more) and _____, whose

address is _____, the “Lessee.”The Lessor, in consideration of Ten Dollars and other valuable consideration, the receipt

of which is acknowledged, and the covenants and agreements contained in this Lease, grants,

demises, leases and lets exclusively to Lessee, the land described below, with the exclusive right

for the purpose of mining, exploring by geophysical and other methods, and operating for and

producing oil (including, but not limited to, distillate and condensate), gas (including, but not

limited to casinghead gas and helium), and other hydrocarbons of whatever nature or kind, and

for laying pipelines, telephone and other lines, and building tanks, power stations, gasoline

plants, ponds, roadways and structures to produce, save and take care of those products, and the

exclusive right of injecting water, brine and other fluids into subsurface strata, and any and all

other rights and privileges necessary, incident to, or convenient for the economical operation

alone, or conjointly with neighboring land, for the production, saving, taking care of, and selling

all substances produced, all that certain tract of land situated in _____ County, Wyoming,

described as follows: (Description of Land) containing _____ acres, more or less, which are referred to in this Lease as the “land,” “lands,”

or “lease premises.”1.It is agreed that this Lease shall remain in force for a term of _____ years from this date

(the “Primary Term”) and as long thereafter as oil or gas of whatever nature or kind is produced

from the lease premises or on acreage pooled or unitized with the lands, or drilling operations are

continued as provided for in this Lease. If, at the expiration of the primary term of this Lease, oil

or gas is not being produced on the lease premises or on acreage pooled or unitized with the

lands but Lessee is then engaged in drilling or reworking operations, then this Lease shall

continue in force so long as operations are being continuously prosecuted on the lease premises

or on acreage pooled or unitized with the lands; and operations shall be considered to be

continuously prosecuted if not more than ninety (90) days shall elapse between the completion or

abandonment of one well and the beginning of operations for the drilling of a subsequent well. If

after discovery of oil or gas on the land or on acreage pooled or unitized with the land,

production thereof should cease from any cause after the Primary Term, this Lease shall not

terminate if Lessee commences additional drilling or reworking operations within ninety (90)

days from the date of cessation of production or from the date of completion of a dry hole. If oil

or gas shall be discovered and produced as a result of those operations at or after the expiration

of the Primary Term of this Lease, this Lease shall continue in force so long as oil or gas is

produced from the lease premises or on acreage pooled or unitized with the lands.2. This is a PAID-UP LEASE. In consideration of the cash payment, (which payment is

accepted by Lessor as good and sufficient consideration for the rights granted to Lessee in this

Lease), Lessor agrees that Lessee shall not be obligated, except as otherwise provided, to

commence or continue any operations during the Primary Term. Lessee may at any time or

times during or after the Primary Term surrender this Lease as to all or any portion of the land

and as to any strata or stratum by delivering to Lessor or by filing for record a release or releases,

and be relieved of all obligation accruing as to the acreage surrendered.3. As royalty, the Lessee covenants and agrees: a. To deliver to the credit of Lessor, free of cost, in the pipeline to which Lessee

may connect wells on the land, the equal ______ part of all oil (including but not limited to

condensate and distillate) produced and saved from the lease premises or at Lessee’s option, pay

Lessor for the _____ royalty, the market price for oil of like grade and gravity prevailing on the

day the oil is run into the pipeline or into storage tanks.

b.To pay Lessor for gas of whatever nature or kind (with all of its constituents)

produced and sold or used off the lease premises, or used in the manufacture of products, _____

of the net proceeds realized by Lessee for the gas sold, used off the premises, or used in the

manufacture of products, the net proceeds to be less a proportionate part of the production,

severance, and other exercise taxes and costs incurred by Lessee in delivering, processing,

compressing, or otherwise making the gas merchantable. Gas of any kind or nature unavoidably

lost, or which may be used by Lessee in any process in recovering oil or other liquid

hydrocarbons from the lease premises, or returned to the ground, whether through wells located

on the lease premises or elsewhere, shall not be deemed to have been sold or used off the lease

premises within the meaning, express or implied, of this Lease. 4. Where gas from a well capable of producing gas is not sold or used, Lessee may pay or

tender as royalty to the royalty owners One Dollar per year per net royalty acre retained by this

Lease, this payment or tender to be made on or before the anniversary date of this Lease next

ensuing after the expiration of 90 days from the date such well is shut in and thereafter on or

before the anniversary date of this Lease during the period such well is shut in. If the payment or

tender is made, it will be considered that gas is being produced within the meaning of this Lease.5.If Lessor owns a lesser interest in the land than the entire and undivided fee simple estate,

then the royalties (including any shut-in gas royalty) provided for in this Lease shall be paid to

the Lessor only in the proportion which Lessor’s interest bears to the whole and undivided fee.6.Lessee shall have the right to use, free of cost, gas, oil and water produced on the land or

on lands pooled or unitized with the land for Lessee’s operations, except water from the wells of

Lessor.7. When requested by Lessor, Lessee shall bury Lessee’s pipeline below plow depth, on

cultivated lands.8. No well shall be drilled nearer than 200 feet to the house or barn now on the land without

written consent of Lessor.9. Lessee shall pay for damages caused by Lessee’s operations to growing crops on the

land.10. Lessee shall have the right at any time to remove all machinery and fixtures placed on the

land, including the right to draw and remove casing.11. The rights of Lessor and Lessee may be assigned in whole or part. No change in

ownership of Lessor’s interest (by assignment or otherwise) shall be binding on Lessee until

Lessee has been furnished with notice, consisting of certified copies of all recorded instruments

or documents and other information necessary to establish a complete chain of record title from

Lessor, and then only with respect to payments later made. No other kind of notice, whether

actual or constructive, shall be binding on Lessee. No present or future division of Lessor’s

ownership as to different portions or parcels of the land shall operate to enlarge the obligations or

diminish the rights of Lessee, and all Lessee’s operations may be conducted without regard to

any division. If all or any part of this Lease is assigned, no leasehold owner shall be liable for

any act or omission of any other leasehold owner.12. Lessee, at its option, is given the right and power at any time and from time to time as a

recurring right, either before or after production, as to all or any part of the land and as to any

one or more formations, to pool or unitize the leasehold estate and the mineral estate covered by

this Lease with other land, lease, or leases in the immediate vicinity for the production of oil and

gas, or separately for the production of either, when in Lessee’s judgment it is necessary or

advisable to do so, and irrespective of whether authority similar to this exists with respect to such

other land, lease or leases. Likewise, units previously formed to include formations not

producing oil or gas, may be reformed to exclude such non-producing formations. The forming

or reforming of any unit shall be accomplished by Lessee executing and filing of record a

declaration of such unitization or reformation, which declaration shall describe the unit. Any

unit may include land on which a well has been completed or on which operations for drilling

have been commenced. Production, drilling, or reworking operations or a well shut-in for want

of a market anywhere on a unit which includes all or a part of this Lease shall be treated as if it

were production, drilling, or reworking operations or a well shut-in for want of a market under

this Lease. In lieu of the royalties specified in this Lease, including shut-in gas royalties. Lessor

shall receive on production from the unit so pooled royalties only on the portion of production

allocated to this Lease; such allocation shall be that proportion of the unit production that the

total number of surface acres covered by this Lease and included in the unit bears to the total

number of surface acres in the unit. In addition to the foregoing, Lessee shall have the right to

unitize, pool, or combine all or any part of the lands as to one or more of formations with other

lands in the same general area by entering into a cooperative or unit plan of development or

operation approved by any governmental authority and, from time to time, with like approval, to

modify, change or terminate any plan or agreement and, in such event, the terms, conditions, and

provisions of this Lease shall be deemed modified to conform to the terms, conditions, and

provisions of the approved cooperative or unit plan of development or operation and,

particularly, all drilling and development requirements of this Lease, express or implied, shall be

satisfied by compliance with the drilling and development requirements of the plan or agreement,

and this Lease shall not terminate or expire during the life of the plan or agreement. In the event

that all or any part of the lands shall be operated under any cooperative or unit plan of

development or operation by which the production from it is allocated to different portions of the

land covered by the plan, then the production allocated to any particular tract of land shall, for

the purpose of computing the royalties to be paid to Lessor, be regarded as having been produced

from the particular tract of land to which it is allocated and not to any other tract of land, and the

royalty payments to be made to Lessor shall be based on production only as so allocated. Lessor,

if requested by Lessee, shall have the obligation to formally express Lessor’s consent to any

cooperative or unit plan of development or operation adopted by Lessee and approved by any

governmental agency and shall execute the same on request of Lessee.13. All express or implied covenants of this Lease shall be subject to all Federal and State

Laws, Executive Orders, Rules or Regulations, and this Lease shall not be terminated, in whole

or in part, nor Lessee held liable in damages, for failure to comply with them, if compliance is

prevented by, or if the failure is the result of, any Law, Order, Rule or Regulation.14. Lessor warrants and agrees to defend the title to the lands, and agrees that the Lessee

shall have the right at any time to redeem for Lessor, by payment, any mortgages, taxes, or other

liens on the lands, in the event of default of payment by Lessor and be subrogated to the rights of

the holder, and Lessor agrees that any payment made by Lessee for Lessor may be deducted

from any amounts of money which may become due to the Lessor under the terms of this Lease.

The undersigned Lessors, for themselves and their heirs, successors and assigns, surrender and

release all right of dower and homestead in the lease premises, insofar as the right of dower and

homestead may in any way affect the purposes for which this Lease is made, as recited in this

Lease.15. Should any one or more of the parties named as Lessor fail to execute this Lease, it shall

nevertheless be binding on all parties who do execute it as Lessor. The word “Lessor,” as used

in this Lease, shall mean any one or more or all of the parties who execute this Lease as Lessor.

All the provisions of this Lease shall be binding on the heirs, successors and assigns of Lessor

and Lessee.16. This Lease shall not be terminated, forfeited, or canceled for failure by Lessee to perform

in whole or in part any of its implied covenants, conditions, or stipulations until it shall have

been first finally and judicially determined that the failure or default exists, and then Lessee shall

be given a reasonable time to correct any default so determined, or at Lessee’s election it may

surrender the Lease with the option of reserving under the terms of this Lease each producing

well and forty (40) acres surrounding it as selected by Lessee, together with the right of ingress

and egress. Lessee shall not be liable in damages for breach of any implied covenant or

obligation.17. No part of the surface of the lease premises shall, without the written consent of the

Lessee, be let, granted, or licensed by the Lessor to any other party for the erection, construction,

location or maintenance of structures, tanks, pits, reservoirs, equipment, or machinery to be used

for the purpose of exploring, developing or operating adjacent lands for oil or gas.

18.Any and all payments permitted or required to be made under the terms of this Lease

shall be made or tendered to the Lessor or to Lessor’s credit in the ______ Bank (the depository

bank) at _____ or its successor or successors, or any bank with which it may be merged, or

consolidated, or which succeeds to its business or assets or any part of them, by purchase or

otherwise, which shall continue as the depository bank regardless of changes in the ownership of

the land. This Lease is executed as of the date of the acknowledgments below, but shall be deemed

effective for all purposes as of the Effective Date stated above. Lessor Acknowledgment for all InstrumentsSTATE OF ______________________COUNTY OF ____________________ The foregoing instrument was acknowledged before me by (Name), this __________ day

of __________, __________.

Witness my hand official seal. Notary Public in and for the State of Printed Name: (Seal)Commission Expires: