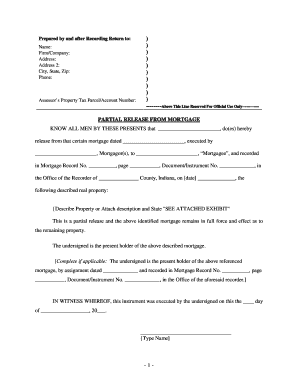

Fill and Sign the Mortgagors to Mortgagee and Recorded Form

Valuable advice on preparing your ‘ Mortgagors To Mortgagee And Recorded’ online

Are you fed up with the difficulties of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and small businesses. Wave farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features integrated into this user-friendly and affordable platform and transform your approach to document administration. Whether you need to approve documents or collect electronic signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Access your account or sign up for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template repository.

- Edit your ‘ Mortgagors To Mortgagee And Recorded’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your teammates on your Mortgagors To Mortgagee And Recorded or send it for notarization—our solution offers everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

What is the role of Mortgagors, To, Mortgagee, And Recorded in the eSigning process?

In the eSigning process, Mortgagors, To, Mortgagee, And Recorded are crucial for ensuring that all parties involved in a mortgage transaction are properly documented and acknowledged. airSlate SignNow allows for seamless integration of these roles, ensuring that signatures are collected efficiently and legally binding. This helps streamline the mortgage process and reduces the risk of errors.

-

How does airSlate SignNow ensure compliance for Mortgagors, To, Mortgagee, And Recorded?

airSlate SignNow is designed to comply with all legal requirements for electronic signatures, including those relevant to Mortgagors, To, Mortgagee, And Recorded. Our platform uses advanced encryption and authentication methods to ensure that all signed documents are secure and legally valid. This compliance helps protect all parties involved in the mortgage process.

-

What features does airSlate SignNow offer for managing documents related to Mortgagors, To, Mortgagee, And Recorded?

airSlate SignNow offers a variety of features tailored for managing documents related to Mortgagors, To, Mortgagee, And Recorded. Users can easily create, send, and track documents, ensuring that all signatures are collected in a timely manner. Additionally, our platform provides templates specifically designed for mortgage agreements, making the process even more efficient.

-

Is airSlate SignNow cost-effective for businesses dealing with Mortgagors, To, Mortgagee, And Recorded?

Yes, airSlate SignNow is a cost-effective solution for businesses that frequently deal with Mortgagors, To, Mortgagee, And Recorded. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to choose a plan that fits your needs without breaking the bank. This affordability makes it easier for businesses to manage their document signing processes efficiently.

-

Can airSlate SignNow integrate with other tools for managing Mortgagors, To, Mortgagee, And Recorded?

Absolutely! airSlate SignNow offers integrations with various CRM and document management systems, enhancing your ability to manage Mortgagors, To, Mortgagee, And Recorded. This connectivity allows for a more streamlined workflow, enabling you to access all necessary documents and information in one place. Integrating with your existing tools can signNowly improve efficiency.

-

What benefits does airSlate SignNow provide for handling Mortgagors, To, Mortgagee, And Recorded?

Using airSlate SignNow for handling Mortgagors, To, Mortgagee, And Recorded provides numerous benefits, including faster turnaround times and reduced paperwork. The platform simplifies the signing process, allowing all parties to sign documents from anywhere, at any time. This convenience not only enhances customer satisfaction but also accelerates the overall mortgage process.

-

How secure is airSlate SignNow for documents involving Mortgagors, To, Mortgagee, And Recorded?

Security is a top priority for airSlate SignNow, especially for documents involving Mortgagors, To, Mortgagee, And Recorded. Our platform employs industry-standard encryption and secure access controls to protect sensitive information. This commitment to security ensures that all documents remain confidential and are only accessible to authorized parties.

The best way to complete and sign your mortgagors to mortgagee and recorded form

Find out other mortgagors to mortgagee and recorded form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles