Fill and Sign the 10 Commoffice Form

Valuable advice on preparing your ‘10 Commoffice’ online

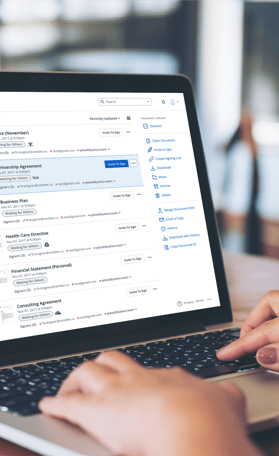

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the laborious task of printing and scanning documents. With airSlate SignNow, you can seamlessly fill out and sign paperwork online. Take advantage of the comprehensive tools integrated into this user-friendly and affordable platform and transform your method of paperwork organization. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

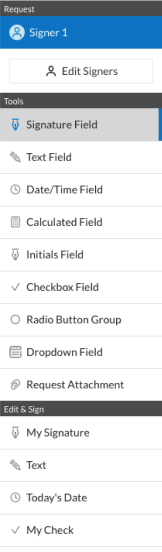

Follow this detailed guide:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘10 Commoffice’ in the editor.

- Click Me (Fill Out Now) to get the document ready on your end.

- Add and assign fillable fields for additional parties (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a multi-use template.

No need to worry if you have to collaborate with your teammates on your 10 Commoffice or send it for notarization—our platform provides you with everything necessary to accomplish those tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the Standard Tax Deduction and how much is it for 2023?

The Standard Tax Deduction is a fixed dollar amount that reduces the income you're taxed on. For the tax year 2023, the Standard Tax Deduction is $13,850 for single filers and $27,700 for married couples filing jointly. Understanding the Standard Tax Deduction, how much it is and when to take it, can signNowly impact your tax savings.

-

When should I take the Standard Tax Deduction instead of itemizing?

You should take the Standard Tax Deduction when it exceeds your total itemized deductions. For many taxpayers, especially those with fewer eligible deductions, the Standard Tax Deduction is the more beneficial option. Knowing when to take the Standard Tax Deduction, how much it is, and the specifics can help simplify your tax filing process.

-

How does the Standard Tax Deduction affect my overall tax liability?

The Standard Tax Deduction directly lowers your taxable income, which in turn reduces your overall tax liability. By understanding the Standard Tax Deduction, how much it is and when to take it, you can better calculate how much tax you owe and potentially increase your refund.

-

Are there any changes to the Standard Tax Deduction for 2024?

While specific changes for 2024 have not been announced yet, tax deductions typically adjust for inflation. It's crucial to stay informed about the Standard Tax Deduction, how much it is and when to take it, to optimize your tax strategy in the coming year.

-

Can I use the Standard Tax Deduction if I have self-employment income?

Yes, you can still take the Standard Tax Deduction if you have self-employment income, as long as you meet the eligibility requirements. However, you must report your self-employment income separately. Understanding the Standard Tax Deduction, how much it is and when to take it, is essential for self-employed individuals to maximize their tax benefits.

-

What documents do I need to claim the Standard Tax Deduction?

To claim the Standard Tax Deduction, you typically don't need extensive documentation, as it's a fixed amount. However, keep records of your filing status and any relevant income information. Knowing the Standard Tax Deduction, how much it is and when to take it, can help you prepare your tax return efficiently.

-

How does airSlate SignNow help with tax-related document management?

airSlate SignNow streamlines the management of tax-related documents, making it easy to eSign and send important forms securely. By using airSlate SignNow, you can ensure your tax submissions, including deductions like the Standard Tax Deduction, are handled efficiently. Understand the Standard Tax Deduction, how much it is and when to take it, while benefiting from our easy-to-use solution.

Related searches to 10 commoffice form

Find out other 10 commoffice form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles