Fill and Sign the 1040 Individual Tax Return Engagement Letter Lawrence Tax Form

Useful tips on setting up your ‘1040 Individual Tax Return Engagement Letter Lawrence Tax ’ online

Are you fed up with the inconvenience of managing paperwork? Search no further than airSlate SignNow, the premier electronic signature platform for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the abundant features integrated into this user-friendly and economical platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow takes care of everything with ease, requiring just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a free trial of our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘1040 Individual Tax Return Engagement Letter Lawrence Tax ’ in the editor.

- Select Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or transform it into a reusable template.

No need to worry if you want to collaborate with your team on your 1040 Individual Tax Return Engagement Letter Lawrence Tax or send it for notarization—our solution provides everything necessary to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

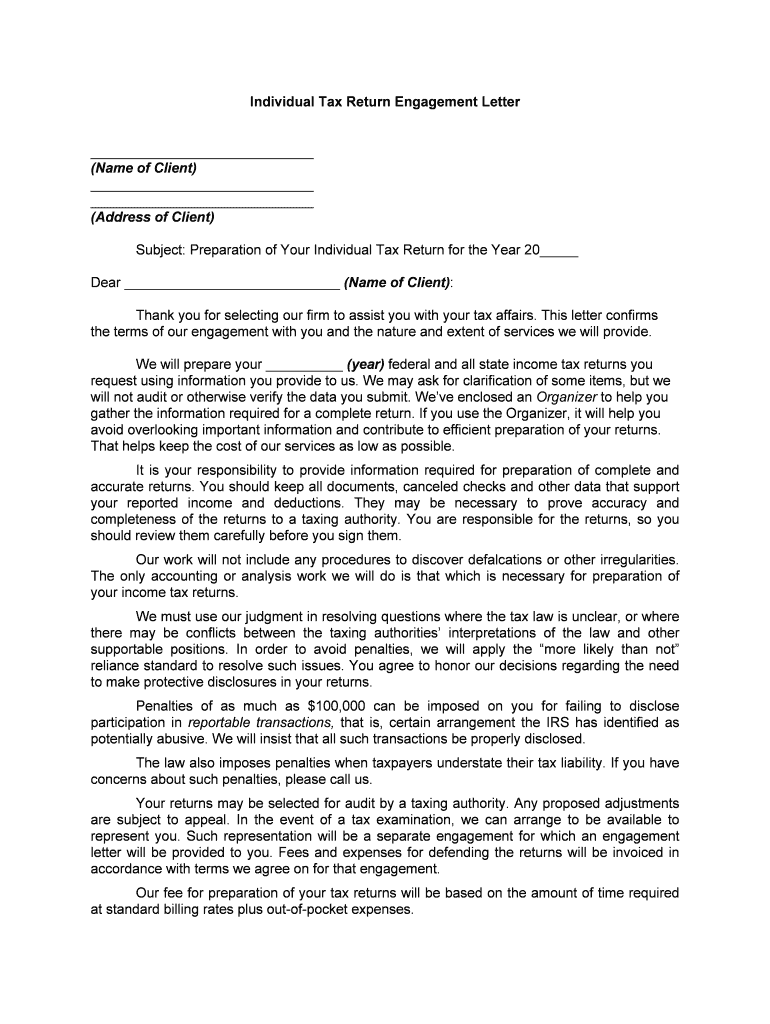

What is an 1040 Individual Tax Return Engagement Letter Lawrence Tax?

The 1040 Individual Tax Return Engagement Letter Lawrence Tax is a formal document that outlines the terms of engagement between a tax preparer and the client for preparing their individual tax return. This letter ensures clarity on the services provided and establishes mutual understanding regarding fees and responsibilities.

-

How does the 1040 Individual Tax Return Engagement Letter Lawrence Tax benefit me?

Using the 1040 Individual Tax Return Engagement Letter Lawrence Tax helps protect both the taxpayer and the tax preparer by clearly defining the scope of work and expectations. This transparency can lead to a smoother tax preparation process and reduce misunderstandings, ensuring compliance and satisfaction.

-

What features does airSlate SignNow offer for the 1040 Individual Tax Return Engagement Letter Lawrence Tax?

airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign the 1040 Individual Tax Return Engagement Letter Lawrence Tax with ease. Features include customizable templates, secure storage, and real-time tracking, making document management efficient and professional.

-

Is there a cost associated with using the 1040 Individual Tax Return Engagement Letter Lawrence Tax template on airSlate SignNow?

Yes, while airSlate SignNow offers various pricing plans, the cost for using the 1040 Individual Tax Return Engagement Letter Lawrence Tax template will depend on the plan you choose. However, the platform is designed to be cost-effective, providing great value for businesses looking to streamline their tax document processes.

-

Can I integrate airSlate SignNow with other software for handling the 1040 Individual Tax Return Engagement Letter Lawrence Tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to efficiently manage your 1040 Individual Tax Return Engagement Letter Lawrence Tax alongside your other business tools. This integration helps maintain workflow continuity and enhances overall productivity.

-

How secure is the 1040 Individual Tax Return Engagement Letter Lawrence Tax when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure storage solutions to protect your 1040 Individual Tax Return Engagement Letter Lawrence Tax and any other sensitive documents, ensuring that your data is safe from unauthorized access.

-

What types of businesses should use the 1040 Individual Tax Return Engagement Letter Lawrence Tax?

The 1040 Individual Tax Return Engagement Letter Lawrence Tax is ideal for tax preparers, accountants, and financial advisors who provide services to individual clients. Any business involved in tax preparation can benefit from using this engagement letter to formalize client agreements and enhance professional credibility.

The best way to complete and sign your 1040 individual tax return engagement letter lawrence tax form

Find out other 1040 individual tax return engagement letter lawrence tax form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles