Fill and Sign the 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr Form

Useful tips for preparing your ‘2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Utilize the powerful features embedded in this user-friendly and cost-effective platform and transform your document management strategy. Whether you require signing forms or collecting electronic signatures, airSlate SignNow simplifies the entire process, needing just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and allocate fillable fields for other participants (if required).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr or send it for notarization—our platform has everything necessary to facilitate these tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

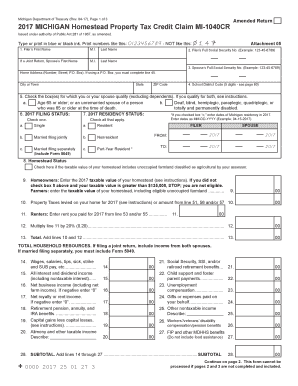

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR?

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a tax credit available to eligible homeowners in Michigan that helps reduce the amount of property taxes owed. This credit aims to provide financial relief to residents, making housing more affordable. To qualify, homeowners must meet specific income and property value criteria as outlined by the Michigan Department of Treasury.

-

How can I apply for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

To apply for the Michigan Homestead Property Tax Credit Claim MI 1040CR, you need to complete the MI 1040CR form and submit it to the Michigan Department of Treasury. This form requires detailed information about your income, property, and tax payments. It's essential to ensure that you meet the eligibility requirements before filing to maximize your potential credit.

-

What documents do I need to file the Michigan Homestead Property Tax Credit Claim MI 1040CR?

When filing the Michigan Homestead Property Tax Credit Claim MI 1040CR, you'll need various documents, including your property tax statements, proof of income, and any supporting documentation that verifies your eligibility. Having these documents ready will help ensure a smooth application process. Remember to keep copies for your records as well.

-

What are the benefits of using airSlate SignNow for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

Using airSlate SignNow for the Michigan Homestead Property Tax Credit Claim MI 1040CR allows you to streamline the signing and submission process of your tax documents. Our platform offers an easy-to-use interface that ensures your forms are completed accurately and securely. Additionally, you can track the status of your documents in real time, giving you peace of mind.

-

Is there a cost associated with using airSlate SignNow for my Michigan Homestead Property Tax Credit Claim MI 1040CR?

Yes, airSlate SignNow offers a subscription model with various pricing plans to fit different needs, making it a cost-effective solution for managing your Michigan Homestead Property Tax Credit Claim MI 1040CR. We provide transparent pricing with no hidden fees, ensuring you know exactly what you're paying for. You can choose the plan that best suits your volume of document management.

-

Can I integrate airSlate SignNow with other software for managing my Michigan Homestead Property Tax Credit Claim MI 1040CR?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Michigan Homestead Property Tax Credit Claim MI 1040CR alongside your existing tools. This integration helps streamline workflows, making it easier to access and process your tax documents efficiently. Check our integrations page for a full list of compatible applications.

-

How secure is my information when using airSlate SignNow for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

Security is a top priority at airSlate SignNow. When you use our platform for the Michigan Homestead Property Tax Credit Claim MI 1040CR, your information is protected with industry-standard encryption and secure data storage. We comply with all relevant regulations to ensure that your sensitive information remains confidential and secure throughout the signing process.

Find out other 2017 michigan homestead property tax credit claim mi 1040cr form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles