SECURE ESTATE

SERVICES, LLC

A Guide to Living Trusts

How to avoid probate costs and protect your family’s future with

smart estate planning.

•

•

•

•

•

•

•

Why it Pays to Avoid Probate Court

How Does a Living Trust Work

Who’s Who in a Living Trust

Types of Living Trusts

What Goes in a Living Trust

Changing a Living Trust

Planning For the Future

By David J. Sears, CLDP

Founder of SECURE ESTATE SERVICES, LLC

Questions? Call us toll free at (888) 885-6767 or visit us at www.sfsgroup.net

�TABLE OF CONTENTS

Introduction

1

At-a Glance Estate Planning Comparison Chart

2

A Time Honored Estate Planning Tool

3

Why it Pays to Avoid Probate Court

3

How Does a Living Trust Work?

4

What is a Living Trust. . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

A Declaration of Trust . . . . . . . . . . . . . . . . . . . . . . . . . . 4

How Property is Transferred . . . . . . . . . . . . . . . . . . 4

The Benefits of Flexibility . . . . . . . . . . . . . . . . . . . . . . . . 5

Potential Tax Savings . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Protecting Your Beneficiaries . . . . . . . . . . . . . . . . . . . 5

Who’s Who in a Living Trust

6

Types of Living Trusts

7

Revocable & Irrevocable Trusts . . . . . . . . . . . . . . . . . . 7

Individual & Shared Trusts . . . . . . . . . . . . . . . . . . . . . . . 7

8

What Goes into a Living Trust

Protecting Your Most Valuable Assets . . . . . . . . . . . . 8

Minor Children as Beneficiaries . . . . . . . . . . . . . . . . . . 8

Handling Debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.

Leaving Assets Out of Your Trust

_______

_9

Protecting Other Assets . . . . . . . . . . . . . . . . . . . . . . . . . 9

Why You Need a Pour – Over Will . . . . . . . . . . . . . . . . 9

10

Changing a Living Trust

Amendments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Revoking a Living Trust . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Planning For the Future

A GUIDE TO LIVING TRUSTS

ii

�Introduction

The popularity of the living trust has soared in recent years as more and more people

discover its significant estate planning benefits. Like a last will and testament, a living

trust allows you to designate beneficiaries for your assets, as well as designate

someone responsible to manage your assets. But unlike a last will & testament, a living

trust is not subject to probate, a complex legal process that can tie up your property

for years and consume a large portion of your estate’s value in court fees. As an

added benefit, a living trust keeps the details of your estate private. In many cases, it

can even reduce certain estate taxes. And here’s the best part – creating a SECURE

ESTATE SERVICES, LLC living trust is just as easy as making a Will – and very affordable.

Key Benefits of a SECURE ESTATE SERVICES, LLC Living Trust

Immediately transfers property to loved ones

Avoids time – consuming court procedures and legal fees

Ensures privacy (probate is a matter of public record)

May help you avoid or reduce certain estate taxes

Can be revised or revoked at any time

Transfers management of your property if you become physically or

mentally incapacitated

Keeps the assets of your minor beneficiaries safe until they reach a

responsible age or achieve certain goals

A GUIDE TO LIVING TRUSTS

1

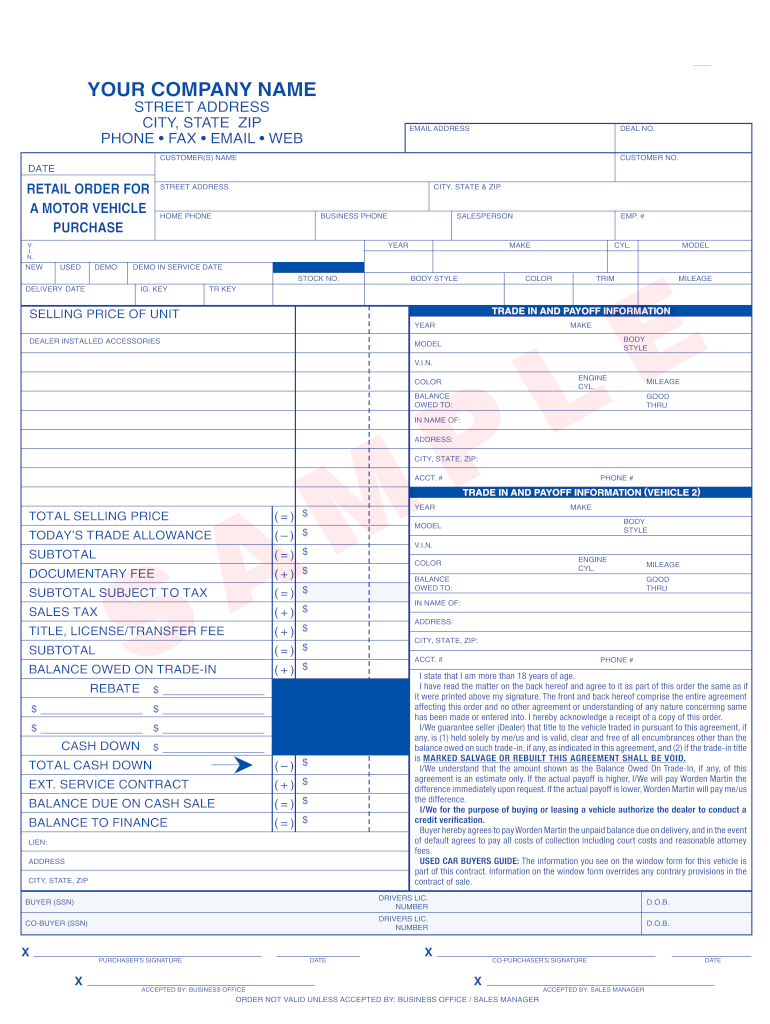

�At – a – Glance Estate Planning Comparison Chart

A Last Will and Testament

A SECURE ESTATE SERVICES, LLC

Living Trust

Can take months or even years for your loved

ones to receive inheritance.

Quickly transfers property to loved ones upon your

death.

Can eat up to 20% of your estate’s value in court

administration costs.

Avoids Probate Court, saving your loved ones

significant legal and court fees.

Is a matter of public record.

Is a private matter between you and your

beneficiaries.

Establishes guardianship for minor children and

specifies last wishes.

Comes with a complimentary pour-over will that

allows you to establish guardianship for minor

children and specify last wishes.

Does not transfer management of your property

if you become physically or mentally

incapacitated.

Transfers management of your property if you

become physically or mentally incapacitated.

Can be revised or revoke at any time.

Can be revised or revoke at any time.

A GUIDE TO LIVING TRUSTS

2

�A Time Honored Estate Planning Tool

It may seem like a modern idea, but the “trust” originated centuries ago. A Roman

citizen and his wife had planned to leave their property to their children. The only

problem was the man’s wife was not a Roman, and under Roman law, their children

would be barred from their inheritance. To get around this problem, the man willed his

property to a friend who promised he would use it to provide for the children. When

the citizen died, his friend went back on his word and used the property for himself.

When Caesar Augustus learned of the betrayal, he took the matter to the courts to be

resolved. As a result, the trust was established as a centerpiece of Roman law.

Today, the living trust endures as a valuable estate planning tool. It offers many

benefits, but perhaps the most important one is the ability to circumvent probate

court.

Why it Pays to Avoid Probate Court

What is Probate?

“In many cases, probate can

Probate is the legal process through which

take up to 3 years to complete

your property is distributed to your

and take as much as 20% of your

beneficiaries. During probate, the court

estates total value”

system must determine the validity of your

will, appraise and inventory all of the assets

in your estate (money, real estate or other

items of value), pay any outstanding debts, and then distribute whatever is left

according to the instructions in your last will & testament. If there is no last will &

testament, the state distributes your assets according to state succession laws.

Probate is often expensive, complicated and time – consuming. In many cases,

probate can take up to 3 years to complete and take as much as 20% of your

estate’s total value. But by planning ahead with a SECURE ESTATE SERVICES, LLC Living

Trust, you can leave property to your loved ones without subjecting them to delays,

expense, and hassle of probate court.

A GUIDE TO LIVING TRUSTS

3

�How Does a Living Trust Work?

What is a Living Trust?

When you create a Living Trust, you are establishing a separate legal entity to

hold whatever property or valuables you choose to place inside it. In fact, one of the

benefits of a Living Trust is that it allows you to gather all of your significant property

(bank accounts, stock certificates, real estates, etc.) into one convenient “container”

or imaginary “safe”. It’s an easy way to track all of your assets and manage them as a

single unit.

As the creator or “grantor” of the trust, you retain complete control over your assets

by appointing yourself as the trust’s initial trustee. You can do whatever you wish with

the property in the trust – this includes transferring into or out of the trust.

But the main benefit of creating a living

trust a living trust is that the property you

place inside is not subject to probate

court. By avoiding probate court, you

help speed the transfer of your assets to

your beneficiaries. Compared to gifting

property through a last will & testament,

transferring property through a living trust

is fast, easy and private.

“Compared to gifting property

through a Last Will &

Testament, transferring property

through a Living Trust is fast,

easy and private.”

A Declaration of Trust

A Living Trust is created with a document known as a Declaration of Trust. This is the

legal document that names your beneficiaries, describes your trust property and

provides for the terms of its transfer. The living trust is managed by a trustee. In most

cases, you will want to designate yourself as the initial trustee. You will also need to

designate an individual or institution to succeed you as a “successor trustee”. You can

always change the named individual or institution whenever you’d like. The trustee is

responsible for managing the property transferred into the trust.

How Property is Transferred

Upon your death, the person you assigned to succeed you as trustee (the successor

trustee) takes over management of the trust and sees that all of your gifts are

distributed to your beneficiaries. Your successor trustee may not change the trust,

which becomes irrevocable at the time of your death. In other words, you can revise

your trust while you’re alive, but it cannot be changed after you’re gone.

A GUIDE TO LIVING TRUSTS

4

�The Benefits of Flexibility

The flexibility of a revocable living trust is one of its many advantages. You can

change your mind, make amendments or end the trust anytime you wish. You can

add property to your trust, transfer ownership of trust assets back to yourself, add or

remove beneficiaries, name a new successor trustee, and sell, give, or mortgage

property owned by the trust.

When the time comes, the transfer of

your property will take place between

the members of your family and the

successor trustee that you name. There’s

no need for lawyers or the court to

distribute your property. The transfer of

assets is kept confidential because a

living trust does not become matter of

public record.

“There’s no need for lawyers or

the court to distribute your

property. The transfer of assets

is kept confidential because a

living trust does not become

matter of public record.”

Potential Tax Savings

While most living trusts are created for the purpose of avoiding probate, you may also

benefit from savings in certain kinds of estate taxes. An AB living trust (described under

Types of Living Trusts) can mean significant tax savings for a married couple with a

combined estate value greater then the applicable federal estate tax exemption

amount.

Protecting Your Beneficiaries

An additional benefit of a living trust is that it allows you to control when your

beneficiaries will receive their inheritance. For example, if your beneficiaries are minor

children at the time of your death, the trust can hold their assets until they reach a

certain age or achieve certain goals.

A GUIDE TO LIVING TRUSTS

5

�Who’s Who in a Living Trust

Parties to the Trust

Grantor: the person who sets up the trust. The grantor is also someone

referred to as the “donor” or “settlor”.

Trustee: the person designated to manage the trust assets. In a

revocable trust, the grantor and the trustee are usually the same person.

Successor Trustee: the person who will manage the trust assets if the

grantor dies (or becomes incapacitated). The Successor Trustee is in

charge of managing the assets in your trust for the benefit of the trust

beneficiaries as well as transferring the assets as directed by the trust.

Beneficiaries: the people or entities that will receive the property in your

trust. The grantor (you) is the original beneficiary, and those who receive

benefits after your passing are known as “remainder beneficiaries”.

A GUIDE TO LIVING TRUSTS

6

�Types of Living Trusts

Revocable & Irrevocable Trusts

A living trust is often called a “revocable living trust” because it allows you to revoke

or change the terms of the trust however you wish, anytime you like, as long as you

live. Think of it as a living document, open

to continual revision. An irrevocable trust,

“A SECURE ESTATE

on the other hand, can’t be changed by

SERVICES, LLC Living Trust

the grantor. A SECURE ESTATE SERVICES, LLC

Living Trust can be either a Revocable or

can be a revocable living trust,

an irrevocable trust depending upon your

which means you can change it

needs.

whenever you like.”

Individual & Shared Trusts

As the name suggests, an individual living trust is used by one person. A shared trust,

on the other hand, is created to manage shared property. If you and your spouse, for

example, create a trust together, you would be required to state in the trust

document that you both want your shared property transferred into the trust. If you

don’t share property equally, you’ll need to specify the percentage of ownership you

share. Two of the most common shared trusts are the joint living trust and AB living

trusts. SECURE ESTATE SERVICES, LLC offers both Joint and AB living trusts.

A Joint Living Trust is used by more than one person. Although it is often used by

married couples, non-married couples may also create a joint living trust.

Alternatively, married couples have the option of creating their own individual living

trusts.

An AB Living Trust is a special tax-savings trust that is typically used by married couples

who together own assets that are greater than the current federal estate tax

exemption. Also known as an exemption trust, an AB trust is sometimes preferred over

a traditional joint trust because of its flexibility and particular tax benefits.

A GUIDE TO LIVING TRUSTS

7

�What Goes into a Living Trust

Protecting Your Most Valuable Assets

Generally speaking, a trust is created to hold your most valuable property: your home,

investment real estate, business interests (including stocks, bonds and mutual funds),

money market accounts, brokerage accounts, royalty contracts, patents and

copyrights, jewelry and antiques, precious metals, works of art, and other valuable

collections.

The following assets are commonly included in a Living Trust:

Real Estate

Savings accounts

Brokerage, mutual fund and other financial accounts

Royalty, commission, and other non-real estate contracts

Proceeds from life insurance policies and annuity contracts

Stocks or bonds held directly in certificate or book form

Ownership interests in private or closely-held corporations

Partnership interests, such as real estate partnerships, investment clubs and

regular business partnerships

Sole proprietorships and other business interests

Other significant property or assets

Minor Children as Beneficiaries

If you plan on naming minor children as beneficiaries in your living trust, you may want

to consider designating a trusted adult to manage your beneficiaries’ property until

they are old enough to manage it themselves. This includes any beneficiary under the

age of eighteen, or any beneficiary you feel is not yet sufficiently mature to handle his

or her inheritance responsibly.

There are two ways to designate an adult to manage your beneficiary’s property: (1)

through a Childs Trust or (2) through a Custodianship. Both are a type of sub-trust

within your living trust, and both are effective ways to ensure that an adult is put in

charge of the inheritance until your child reaches the age of majority set forth by law

– generally 18 or 21 but up to 25 years of age in some states. A SECURE ESTATE

SERVICES, LLC Living Trust can include a sub-trust option to protect the financial future

of your minor children.

Handling Debt

Often, items are put into a living trust that are not yet owned free and clear. A good

example is a home carrying a mortgage. If your beneficiaries receive a home with

money still owed on it, they would be responsible for paying the mortgage.

A GUIDE TO LIVING TRUSTS

8

�Leaving Assets Out of Your Trust

Protecting Other Assets

Certain types of property may be exempt from probate or subject to a streamlined

probate process. These include the following:

Personal checking accounts

Property you buy or sell frequently

Automobiles (unless they are particularly valuable, such as vintage and/or

rare automobiles)

IRAs, 401(k)s, Keogh, and other tax-deferred retirement plans

Pension accounts, life insurance policies and annuities (beneficiaries are

customarily named in the policy contract and will receive any monies outside

of probate)

Income or principal from another trust

Property held in joint tenancy

Why you need a Pour-Over Will

Many living trusts include what is known

as a pour-over will. A pour-over will

transfers or “pours” into your trust any

assets not already owned by your trust

at the time of death. This includes property

such as checking accounts, cars and

other property.

“A pour-over will transfers or

“pours” into your trust any

assets not already owned by

your trust at the time of your

death.”

As long as your property is not held in joint tenancy, or subject to other contractual

arrangements, a pour-over will ensures that your assets are distributed to your heirs

according to the terms of your trust. More importantly, a pour-over will allows you to

name a guardian for minor children and specify any last wishes. A SECURE ESTATE

SERVICES, LLC Living Trust comes complete with a complimentary pour-over will.

A GUIDE TO LIVING TRUSTS

9

�Changing a Living Trust

Amendments

Change in life is inevitable. And there are many life changes that will require

amending your living trust. A revocable living trust may be amended (changed) or

revoked (ended) anytime as long as you live. This flexibility is one of the reasons that

living trusts are so popular.

Most of the time, you’ll only want to amend your trust when a major change is

necessary. Common scenarios that would require amending your trust include adding

property to your trust, moving to another

state, marrying, having a child, the death

“Although you can choose to

of a spouse or major beneficiary, or selling

end the trust at any time, it’s

or giving away property designated to a

trust beneficiary.

generally easier to amend an

existing living trust than to

Although you can choose to end the

create a new one.”

trust at any time, it’s generally easier

to amend an existing living trust than to

create a new one. Changing your living trust is a simple procedure. Included in your

SECURE ESTATE SERVICES, LLC Living Trust is several Amendment to Living Trust

documents that allow you to amend your trust at any time.

If you make subsequent amendments, you’ll need to refer to both the original trust

document and all amendments that you have made. With a SECURE ESTATE

SERVICES, LLC Living Trust, you can quickly and easily make amendments yourself or if

you would like assistance, you can contact one of our specialists at our toll-free

number (888) 885-6767.

Revoking a Living Trust

A living trust can be revoked at any time. In some cases, you may need to make so

many amendments that it’s simply more practical to start fresh. For example, you

should revoke a shared living trust if you get divorced. You and your former spouse

can then make new, individual living trusts for yourselves.

Depending on the type of living trust, there are certain restrictions on who can make

changes or amend the trust. If you have an individual living trust and have named

yourself as the original trustee, you can revoke it yourself. A shared Living Trust and an

AB Trust can be revoked by one of the Trustees. However, it takes both parties to

amend it.

A GUIDE TO LIVING TRUSTS

10

�Planning For the Future

One of the goals of good estate planning is to ensure the financial security of your

loved ones. While nothing can replace your presence in their lives, with the right

estate planning tools, you can continue to care for them even after you’re gone. A

SECURE ESTATE SERVICES, LLC Living Trust can help you by ensuring that your gifts go

directly to the people you love – quickly, privately, and without the delays and

expense of probate.

Creating a SECURE ESTATE SERVICES, LLC Living Trust is fast, easy and affordable. And

you can do it from the comfort of your home, office or feel free to visit our corporate

office.

To get started call us at (888) 885-6767, we will

arrange for a free consultation to meet with you and

review your personal estate planning requirements.

You will need to answer a series of straight forward

questions, and we take care of the rest. We prepare

your living trust, review for accuracy and personally

deliver, execute and fund your living trust, to be sure

that your estate plan is in properly in place. In addition

we offer free annual reviews of your estate plan to

ensure that your estate plan is up to date.

Questions?

Call us toll free at (888) 885-6767 or visit us on-line at www.sfsgroup.net

Take control of the long-term future of you estate with a SECURE ESTATE SERVICES, LLC

Living Trust. We can help you do it quickly and affordably from the comfort of your

home or office. To get start call us today!

SESCURE ESTATE SERVICES, LLC

14301 N. 87th Street

Suite 116

Scottsdale, AZ 85260

A GUIDE TO LIVING TRUSTS

11

�