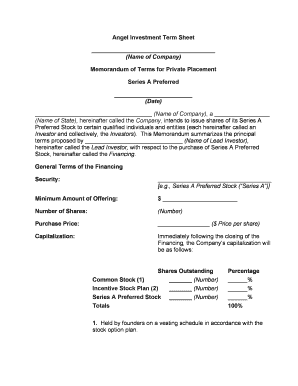

Angel Investment Term Sheet ______________________________________

(Name of Company)

Memorandum of Terms for Private Placement Series A Preferred ________________________

(Date)

____________________________________ (Name of Company), a _________________

(Name of State), hereinafter called the Company, intends to issue shares of its Series A

Preferred Stock to certain qualified individuals and entities (each hereinafter called an

Investor and collectively, the Investors). This Memorandum summarizes the principal

terms proposed by ______________________________ (Name of Lead Investor),

hereinafter called the Lead Investor, with respect to the purchase of Series A Preferred

Stock, hereinafter called the Financing.

General Terms of the FinancingSecurity: ___________________________________

[e.g., Series A Preferred Stock (“Series A”)]

Minimum Amount of Offering: $ _______________________Number of Shares: (Number)Purchase Price: ________________ ($ Price per share)Capitalization: Immediately following the closing of the

Financing, the Company’s capitalization will

be as follows: Shares Outstanding Percentage Common Stock (1) _______ (Number) ______%Incentive Stock Plan (2) _______ (Number) ______%Series A Preferred Stock_______ (Number) ______%Totals 100%1. Held by founders on a vesting schedule in accordance with the

stock option plan.

2. The Company's Board of Directors has adopted a stock option

plan to be administered by the Board authorizing the Company to

grant options and stock purchase rights to employees and

consultants. There are ________ (Number) shares under the Stock

Option Plan that are subject to outstanding options and _______

(Number) shares remain available for future issuance.

Rights, Preferences, and PrivilegesDividends: The holders of Series A Preferred Stock

(“Series A”) shall be entitled to receive in

preference to the Common Stock

(Common), noncumulative dividends of

$ ______ per share per annum

(____%/____%/____%), respectively, when

and if declared by the Board of directors.Liquidation Preference: In the event of any liquidation or winding up

of the Company, the holders of Series A

shall be entitled to receive, in preference to

the holders of Common, an amount equal

to the price paid per Series A share, plus all

declared but unpaid dividends on such

shares. Thereafter, the assets available for

distribution shall be distributed ratably

among the holders of [Common Series A /

Common and Series A will be capped at

______ (e.g., 3x) the Investor’s Initial

Investment / Common]. A merger or sale of

all or substantially all of the assets of the

Company shall be treated as a liquidation

or winding up for purposes of the liquidation

preference.Conversion: Optional Conversion: The holders of

Preferred shall have the right to convert

their shares of Preferred, at the option of

the holder, at any time into shares of

Common, at the rate of one share of

Preferred for one share of Common,

subject to adjustment as described below.Automatic Conversion: The Preferred shall be automatically

converted into Common, at the then

applicable conversion rate, (i) in the event

of the closing of an underwritten public

offering of the Company’s securities in

which the aggregate gross proceeds to the

Company equals or exceeds

_______________ [e.g., $20,000,000 /

$10,000,000], or (ii) upon the election of the

holders of a ___________________ [e.g.,

66% / majority] of the shares of Preferred

then outstanding.

Anti-dilution Provisions: In the event that the Company issues

additional securities without consideration

or for a consideration per share less than

the price paid for Series A Stock, as

adjusted for capital reorganization, stock

splits, reclassification, etc., (other than

(i) the issuance of options or shares of

Common Stock to employees, directors,

and consultants, (ii) the sale of shares in

connection with a firm commitment

underwritten public offering, (iii) the

issuance of Common Stock upon

conversion of the Preferred Stock or other

already outstanding convertible securities,

(iv) dividends or distributions on Preferred

Stock, (v) the issuance of warrants to banks

or equipment lessors, or (vi) the issuance

of shares in connection with business

combinations or corporate partnering

agreements approved by the Board of

Directors), then, and in such event, the

Conversion Price for the Series A Preferred

Stock shall be adjusted using a _________

_____________________ [e.g., ratchet /

narrow based / broad based weighted

average] anti-dilution formula.

Redemption. Commencing on the date that there is

__________________________________ ___________________________________________________________ [e.g., three

years after Closing and for three years

thereafter, the holders of a majority of

Series A (provided that the Lead Investor

consents) may require the Company to

redeem their respective shares of Preferred

at a price equal to cost plus dividends

declared but not paid. Any redemption

payment not made when due shall

thereafter bear interest at the ___________

____________ (e.g., Prime Rate plus 5%).

Voting Rights: Generally. The holder of each share of

Preferred shall have the right to that

number of votes equal to the number of

shares of Common issuable upon

conversion of such share of Preferred. The

Preferred votes together with the Common

on all matters except as described below.

Election of Directors: The Company’s Board of directors will have

___________ [five (5)] directors. The

holders of Common, voting as a separate

class, shall be entitled to elect ________

(e.g., two) members of the Company’s

Board of directors. The holders of Preferred

Stock, voting as a separate class, shall be

entitled to elect _______ (e.g., two)

members of the Company’s Board of

directors. The Lead Investor will be entitled

to elect the ________ [e.g, one] member of

the Company’s Board of directors. Board Composition: Upon the closing of the sale and issuance

of the Series A, the Company’s Board shall

be comprised of _____________________

(Name) and __________________ (Name),

who will be deemed elected by the holders

of Common, and _____________ and

_____________, who will be deemed

elected by Series A, and _____________,

who will be deemed elected by the Lead

Investor.Protective Provisions: Consent of both (i) the holders of at least a

majority of the outstanding Series A voting

together as a single class and (ii) at least a

majority of the Board of Directors that

includes the Lead Investor director shall be

required for any action which would allow

(a) the repurchase or redemption of

Common (except from an employee or

consultant upon termination), (b) any

increase in the number of authorized

shares of Series A, (c) any offer, sale, or

issuance of any security senior to or

ranking equally with Series A Preferred,

(d) any amendment to the Bylaws or

Articles of Incorporation of the Company,

(e) the payment by the Company of any

dividends to the holders of Common, (f) any

merger, reorganization or sale of all or

substantially all of the assets of the

Company, (g) any liquidation or dissolution

of the Company, (h) the issuance of

securities of any subsidiary of the

Company, (i) increase to the Board size,

(j) increase in compensation for any

executive officer during any one year in

excess of ____________ (e.g., 15%) or (k)

any change to the Company’s stock option

plan.

Consent by at least a majority vote of the

Board of Directors that includes the Lead

Investor director shall be required for the

Company to: (a) mortgage or pledge, or

create a security interest in, permit any

subsidiary to mortgage, pledge or create a

security interest in, all or substantially all of

the property of the Company or such

subsidiary Company, (b) make any loans or

advances to employees, except in the

ordinary course of business as part of travel

advances or salary (promissory notes for

purchase of shares permitted); (c) make

guarantees except in ordinary course; (d)

grant or issue any equity, options or

warrants representing in the aggregate over

__________ (e.g., 0.5%) of the fully diluted

capitalization of the Company or (e) allow

acceleration of either the vesting of options

or expiration of the Company’s right of

repurchase as to the equity interest of any

service provider. Terms of Investors Rights AgreementInformation Rights: So long as a holder of Preferred continues

to hold at least _____________________

[e.g., 50,000 / 100,000] shares of Preferred

or Common issuable upon conversion of

Preferred (the “Conversion Stock”) (each a

“Major Investor”), the Company shall deliver

to such holder audited annual and

unaudited ______________________ [e.g.,

monthly / quarterly] financial statements.

These information rights provisions shall

terminate upon the initial public offering of

the Common Stock. Information rights may

be transferred to a transferee who, after

such transfer, will hold at least __________

[e.g., 50,000 / 100,000] shares of Preferred

or Conversion Stock, provided that the

Company is given prior written notice of

such transfer.

Right of Participation: Each Major Investor shall have a right to

purchase its pro rata portion of New

Securities in the event of any sale of New

Securities by the Company, excluding

shares sold to employees, consultants,

officers or directors in connection with

services pursuant to arrangements

authorized by the Board of directors, and

other customary exclusions. Each Major

Investor shall have the right of re-allotment

in the event any Major Investor chooses not

to exercise his right of participation.Registration Rights: Demand Rights: If, at any time after the

earlier of ___________ [e.g., three / four]

years from the date of Closing of the

Series A or the date that is six months

following the Company’s initial public

offering, holders of a majority of the

Preferred or Conversion Stock requests

that the Company file a registration

statement for an aggregate offering price of

at least ______________ [e.g., $5,000,000

/ $10,000,000], the Company will use its

best efforts to cause such shares of

Conversion Stock to be registered. The

Company shall not be obligated to effect

more than __________ [e.g., two / one]

registrations under these demand right

provisions.“Piggyback” Registration: If at any time the Company determines to

register its securities, the holders of

Preferred shall be entitled to have their

shares of Conversion Stock included in

such registration. The Company and its

underwriters shall have the right to

terminate or withdraw any registration

initiated by the Company and, in the case of

the Company’s initial public offering, to

reduce or eliminate the number of shares

proposed to be registered on behalf of the

holders in view of market conditions. For

registrations following the initial public

offering, the holders of registration rights

may not be cut back to less than ________

[e.g., 30% / 15%] of the offering.

S-3 Demand Rights: If available for use by the Company, the

holders of Conversion Stock will be entitled

to _________________ (e.g., unlimited /

three) S-3 registrations provided that the

anticipated aggregate offering price, net of

discounts and commissions, would exceed

$1,000,000. The Company shall not be

obligated to file more than one S -3

registration statement in any twelve-month

period.Expenses: All registration expenses (including

expenses of one attorney for the holders of

Registrable Securities but excluding

underwriting discounts and commissions)

shall be borne by the Company, subject to

customary exclusions and exceptions. Other Provisions: Registration rights terminate __________

[e.g., five / three] years after consummation

of the Company’s first underwritten public

offering or earlier as to a particular holder if

such holder can sell all of its shares in a

90 day period pursuant to Rule 144. The

registration rights may be transferred to a

transferee who acquires a minimum

number of shares of Preferred or

Conversion Stock provided the Company is

given written notice thereof. The holders of

Preferred agree not to sell any shares of

the Preferred or Conversion Stock for

180 days following the closing of the

Company’s initial public offering.

Registration rights provisions may be

amended or waived solely with the consent

of: (i) the Company (ii) holders of over 50%

of the Registrable Securities and (iii) the

Lead Investor.

Other Issues

Co-Sale Right and Right of First Refusal: Right of First Refusal. The Company will

have the right to repurchase shares offered

for sale by a Founder, subject to customary

exceptions for transfers in connection with

estate planning, bona fide loan transactions

and sales up to _______ [e.g., 5% / 10%] of

the total number of shares of capital stock

held by a Founder. To the extent not

exercised by the Company, the right of first

refusal will be transferred to the holders of

Series A on a pro rata basis with a right of

re-allotment. Co-Sale Right. In the event that a Founder

proposes to sell any shares of the

Company’s Common Stock (subject to

customary exclusions), the holders of

Series A shall be given the right to sell on a

pro rata basis a portion of their shares to

the proposed purchaser in lieu of the

purchase being made from the Founder.

Such right shall include a right of re-

allotment to the extent that the right is not

exercised by holders of Series A. Termination. These rights shall terminate

upon the closing of the Company’s initial

public offering or upon the merger of the

Company into another entity. Small Business Stock: So long as it does not require the Company

to operate its business in a manner which

would limit its prospects, the Company’s

shall seek to have Series A Preferred Stock

qualify as a small business stock within the

meaning of Section 1202(c) of the Internal

Revenue Code and the Company shall

perform all acts reasonably necessary to so

qualify its stock and shall make all filings

required under Section 1202(d)(1)(c) of the

IRC and related Treasury regulations.Purchase Agreement: The investment shall be made subject to

the negotiation of a Stock Purchase

Agreement for Series A reasonably

acceptable to the Company and the Lead

Investor, which agreement shall contain,

among other things, customary and

appropriate representations and warranties

of the Company, covenants of the

Company reflecting the provisions set forth

herein, and appropriate conditions of

closing. The Stock Purchase Agreement

shall provide that it may only be amended

and any waivers thereunder shall only be

made with the consent of (i) the Company

(ii) holders of over 50% of the Series A sold

thereunder and (iii) the Lead Investor.

The Closing: The closing is subject to the Company

raising at least the Minimum Amount of

Offering in the Financing and completion of

legal and financial due diligence by the

Lead Investor.Indemnification Agreements: The officers and directors will have

standard indemnification agreements

acceptable to the Investors.Expenses: The Company will bear its legal expenses;

in addition, the Company will pay the

reasonable legal fees and expenses of one

counsel to the Investors up to a maximum

of _______________ [e.g., $15,000 /

$7,500]. No Commitment: Nothing in this Memorandum of Terms, or

any notes, or any actions occurring after

there is an agreement on this Memorandum

of Terms, will be construed as a

commitment by Lead Investor or any other

Investor to proceed with any stage of the

financing contemplated hereby. However,

once closing occurs, Investors’ obligations

as set forth in the closing documents will be

binding upon all parties.