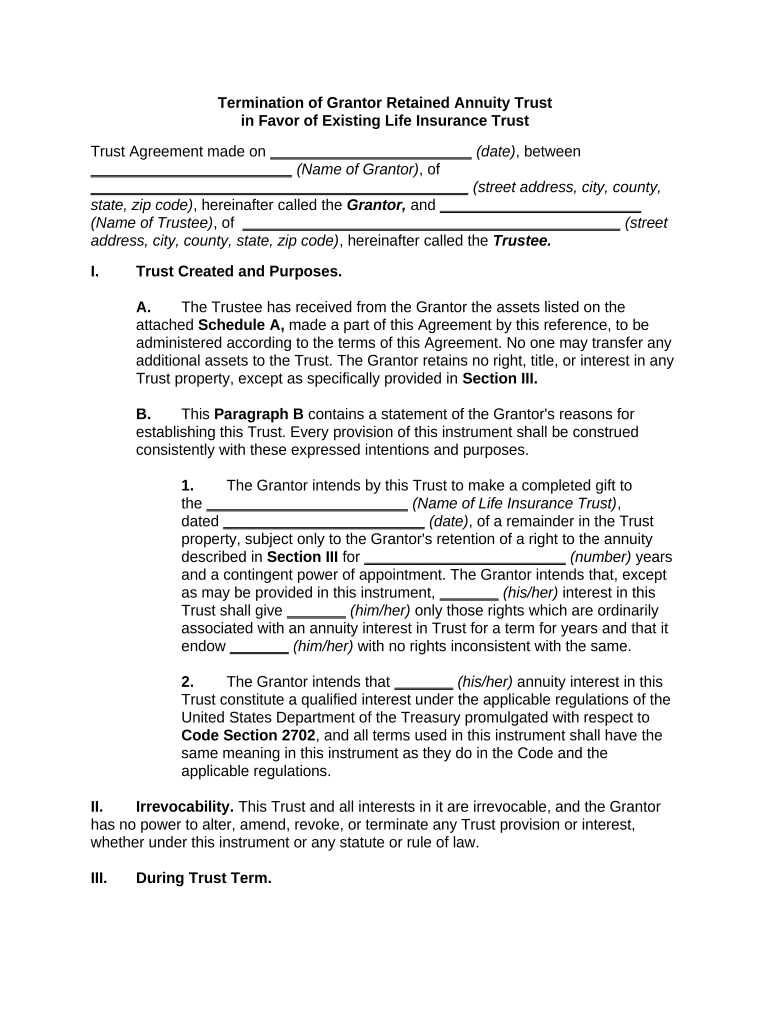

Fill and Sign the Annuity Trust Form

Useful advice on preparing your ‘Annuity Trust’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your methods of managing paperwork. Whether you need to approve documents or collect eSignatures, airSlate SignNow handles everything effortlessly, requiring just a few clicks.

Follow these step-by-step guidelines:

- Log in to your account or sign up for a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Annuity Trust’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if necessary).

- Complete the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Annuity Trust or send it for notarization—our platform offers everything required to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is an Annuity Trust and how does it work?

An Annuity Trust is a financial arrangement that allows you to receive fixed payments over a specified period, typically for the rest of your life. By establishing an Annuity Trust, you can ensure a steady income stream while also benefiting from tax advantages. This type of trust can be an essential tool for estate planning and wealth management.

-

How can an Annuity Trust benefit my estate planning?

An Annuity Trust can signNowly enhance your estate planning by providing a reliable income stream to your beneficiaries while potentially reducing estate taxes. This allows you to maintain financial support for loved ones without compromising your estate's overall value. By incorporating an Annuity Trust, you can ensure that your financial legacy is secure.

-

What are the costs associated with setting up an Annuity Trust?

Setting up an Annuity Trust typically involves legal fees, administrative costs, and possibly initial funding requirements. While the costs can vary depending on the complexity of your trust, it is essential to view these expenses as an investment in your financial future. Consulting with a financial advisor can help you understand the overall costs and benefits of an Annuity Trust.

-

Can I integrate airSlate SignNow with my Annuity Trust documentation process?

Absolutely! airSlate SignNow seamlessly integrates with various platforms to streamline your Annuity Trust documentation process. Our electronic signature solution allows you to send, sign, and manage all necessary documents quickly and securely, ensuring that your Annuity Trust setup is efficient and hassle-free.

-

What features does airSlate SignNow offer for managing Annuity Trust documents?

airSlate SignNow provides a range of features ideal for managing Annuity Trust documents, including customizable templates, secure electronic signatures, and real-time tracking. These tools help you maintain organization and ensure that all parties involved in the Annuity Trust can easily access and sign necessary paperwork. Plus, our platform is user-friendly, making it accessible for everyone.

-

Is airSlate SignNow compliant with legal requirements for Annuity Trusts?

Yes, airSlate SignNow is compliant with all legal requirements for electronic signatures and document management, making it a reliable choice for your Annuity Trust needs. Our platform adheres to the ESIGN Act and UETA, ensuring that your Annuity Trust documents are legally binding and secure. You can trust our service for all your important documentation.

-

What are the tax implications of an Annuity Trust?

The tax implications of an Annuity Trust can vary depending on how it is structured. Generally, the income generated by the trust may be subject to taxation, but the contributions to the trust can often be tax-deductible. Consulting with a tax professional can provide you with the necessary insights to maximize the benefits of your Annuity Trust.

The best way to complete and sign your annuity trust form

Find out other annuity trust form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles