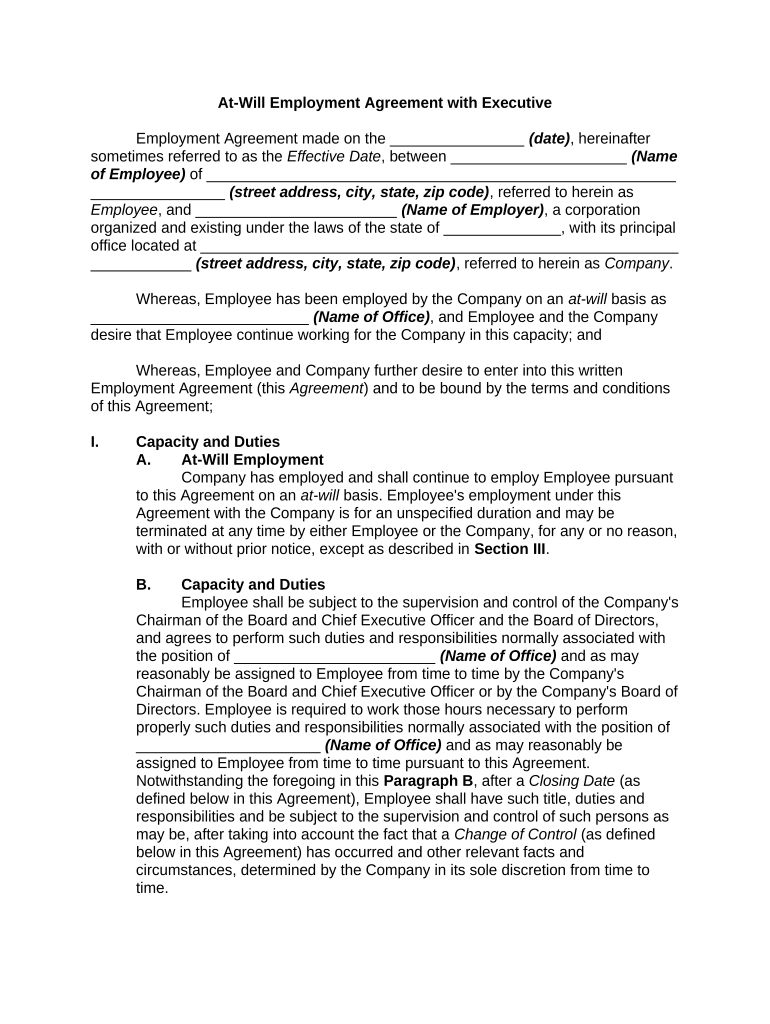

At-Will Employment Agreement with Executive

Employment Agreement made on the ________________ (date) , hereinafter

sometimes referred to as the Effective Date , between _____________________ (Name

of Employee) of ________________________________________________________

________________ (street address, city, state, zip code) , referred to herein as

Employee , and ________________________ (Name of Employer) , a corporation

organized and existing under the laws of the state of ______________, with its principal

office located at _________________________________________________________

____________ (street address, city, state, zip code) , referred to herein as Company .

Whereas, Employee has been employed by the Company on an at-will basis as

__________________________ (Name of Office) , and Employee and the Company

desire that Employee continue working for the Company in this capacity; and

Whereas, Employee and Company further desire to enter into this written

Employment Agreement (this Agreement ) and to be bound by the terms and conditions

of this Agreement;

I. Capacity and Duties

A. At-Will Employment

Company has employed and shall continue to employ Employee pursuant

to this Agreement on an at-will basis. Employee's employment under this

Agreement with the Company is for an unspecified duration and may be

terminated at any time by either Employee or the Company, for any or no reason,

with or without prior notice, except as described in Section III .

B. Capacity and Duties

Employee shall be subject to the supervision and control of the Company's

Chairman of the Board and Chief Executive Officer and the Board of Directors,

and agrees to perform such duties and responsibilities normally associated with

the position of ________________________ (Name of Office) and as may

reasonably be assigned to Employee from time to time by the Company's

Chairman of the Board and Chief Executive Officer or by the Company's Board of

Directors. Employee is required to work those hours necessary to perform

properly such duties and responsibilities normally associated with the position of

______________________ (Name of Office) and as may reasonably be

assigned to Employee from time to time pursuant to this Agreement.

Notwithstanding the foregoing in this Paragraph B , after a Closing Date (as

defined below in this Agreement), Employee shall have such title, duties and

responsibilities and be subject to the supervision and control of such persons as

may be, after taking into account the fact that a Change of Control (as defined

below in this Agreement) has occurred and other relevant facts and

circumstances, determined by the Company in its sole discretion from time to

time.

2. Compensation and Fringe Benefits

A. Compensation

1. Base Salary

As base compensation for Employee's services under this

Agreement, the Company shall pay to Employee an initial salary at an

annual rate of $___________ (the Base Salary ). Employee's Base Salary

will be payable in accordance with the Company's regular payroll practices

in effect from time to time during Employee's employment, but not less

than monthly. Employee's Base Salary shall be reviewed by the Company

no less often than annually and shall be adjusted (upward, and with the

consent of Employee, downward) upon review as determined by the

Company.

2. Bonus

a. Incentive Bonus

Employee shall be eligible to receive an annual incentive

bonus pursuant to and in accordance with the _________________

_____________ (Name of Company) Incentive Compensation

Plan (the Plan ) and subject to the Plan's eligibility requirements and

other terms, conditions and restrictions (the Incentive Bonus );

provided, however, that the Plan and its terms are subject to

change and the Plan may be modified or eliminated in accordance

with the terms of the Plan.

b. Additional Bonuses

Employee shall not be entitled to receive any other bonuses

from the Company; provided, however, that the Company may

award Employee additional bonuses as it determines are

appropriate in its sole discretion (the Additional Bonuses ).

B. Fringe Benefits

1. Insurance and Retirement Benefits

Employee (and his eligible dependents, where applicable) shall be

eligible to participate in the Company's insurance and health benefit plans

to the extent and upon the terms offered to the Company's other senior

executive officers, including but not limited to any 401(k) plans,

supplemental executive retirement plans (“SERP”), savings plans,

incentive plans, stock purchase plans, stock incentive plans, retirement

plans or deferred compensation plans, subject to the plans' respective

eligibility requirements and other terms, conditions, restrictions and

exclusions. To the extent applicable, Employee shall be entitled to

participate in such plans as a Tier ________ (number) employee. Nothing

in this Agreement shall preclude or otherwise restrict the Company's right

to modify or terminate any insurance or other benefit plan, policy or

program as it deems appropriate in its sole discretion.

2. Vacation

Employee shall be entitled to _____ (number of weeks) weeks of

paid vacation during each full calendar year of his employment in

accordance with the terms and provisions of the Company's policies and

practices in effect from time to time.

3. Expense Reimbursement

Company shall reimburse Employee for all reasonable expenses

incurred by him in connection with the performance of his duties under this

Agreement in accordance with the Company's regular reimbursement

policies as in effect from time to time and upon receipt of itemized

vouchers and such other supporting information as the Company may

reasonably require. The reimbursement of any such eligible expense shall

be made on or before the last day of the calendar year next following the

calendar year in which the expense was incurred.

4. Transportation Allowance

Employee shall receive a monthly transportation allowance in the

amount of $_____________ (the Transportation Allowance ). The

Transportation Allowance shall be payable in accordance with the

Company's regular payroll practices in effect from time to time.

5. Additional Benefits

Employee shall be eligible to participate in such other fringe

benefits upon the terms offered to the Company's other senior executive

officers and subject to the terms, conditions, restrictions and exclusions of

any such fringe benefit plans or programs.

6. Indemnification

a. The Company shall maintain a directors’ and officers’ liability

insurance policy while Employee is employed by the Company

pursuant to this Agreement to the extent such a policy is available

at commercially reasonable rates as determined by the Board of

Directors. Employee shall be entitled to coverage under such policy

as an officer of the Company, subject to the policy's terms,

conditions, restrictions and exclusions.

b. In addition to the Company's obligation to maintain such

insurance, the Company shall, to the fullest extent permitted by and

in accordance with applicable law as it may be amended from time

to time, indemnify Employee in connection with any claim, action,

suit, investigation or proceeding arising out of or relating to

performance by Employee of services for, or any action of

Employee as a director, officer, member, manager or employee of,

the Company, or of any other person or enterprise for whom

Employee is serving at the request of the Company as a director,

officer, member, manager or employee. Expenses reasonably

incurred by Employee in defending such a claim, action, suit,

investigation or proceeding shall, to the extent permitted by

applicable law, be paid by the Company in advance of the final

disposition of such a claim, action, suit, investigation or proceeding

upon receipt of a written undertaking by or on behalf of Employee

to repay such amounts if it shall ultimately be determined that

Employee is not entitled to indemnification by the Company as

provided in this Paragraph 6 . Notwithstanding anything in the

foregoing to the contrary, in no event will Employee be entitled to

any indemnification (including but not limited to any advancement

of fees or expenses) pursuant to this ________________________

(Name of Office) Paragraph 6 with respect to any action, suit or

proceeding brought or made by Employee against the Company or

any of its affiliates or officers, directors, employees or agents. The

provisions of this Paragraph 6 shall be in addition to any

indemnification rights Employee may have by law, contract, charter,

by-law, policy of insurance or otherwise.

C. Payments After Termination of Employment

1. Termination for Any Reason

Regardless of the reason for the termination of Employee's

employment, whether by Employee or the Company, whether or not due

to Employee's death or Disability (as that term is defined in Section III , and

whether or not for Cause (as that term is defined in Section III , or for

Good Reason (as that term is defined in Section III ), Employee (or his )

estate) will receive unpaid Base Salary for any days actually worked by

Employee prior to the termination of his employment, expense

reimbursement for all reasonable expenses incurred by him in connection

with the performance of his duties prior to the termination of his

employment, and payment for accrued but unused vacation pay to the

extent Employee may be eligible for such payment under the Company's

policies.

2. Termination by the Company Without Cause or Due to

Employee's Death, Disability or by Employee for Good Reason

(i) Subject to the terms and conditions set forth in Subparagraph 4

of this Paragraph C , (i) if Employee is terminated by the Company without

Cause (as that term is defined in Section III ) or due to his Disability (as

that term is defined in Section III) , (ii) if Employee terminates his

employment with the Company for Good Reason (as that term is defined

in Section III) , or (iii) ________ (his/her) employment with the Company

terminates due to his death, then in addition to the payments described in

Subparagraph 1 above:

a. The Company shall pay Employee any accrued but unpaid

Incentive Bonus with respect to any completed Plan Year (as that

term is defined in the Plan) ending prior to the date on which

Employee's employment terminates, to be paid in accordance with

the terms of the Plan. Payment of any such amount shall be made

at the same time these amounts would have been paid if

Employee's employment had not terminated.

b. The Company shall pay Employee a prorated bonus

calculated by multiplying the higher of (x) the sum of the Incentive

Bonus and any Additional Bonuses Employee received with respect

to the last full Company fiscal year during which Employee was

employed by the Company (and for which bonus determinations

have been made), or (y) the average of the Incentive Bonuses and

any Additional Bonuses Employee received during each of the last

two full fiscal years during which Employee was employed by the

Company, by a fraction, the numerator of which is the number of

days in the current fiscal year through Employee's termination date,

and the denominator of which is 365; provided, however, that the

sum of any Incentive Bonuses and any Additional Bonuses

Employee received in respect of Fiscal __________ (identification

of year) shall be deemed to be $__________ (dollar amount of

deemed total of annual incentive bonuses and additional

bonuses) regardless of the actual amount of such bonuses. This

amount will be paid in a single lump sum as soon as practicable

following Employee's termination of employment; provided,

however, that if any portion of such payment constitutes a payment

of nonqualified deferred compensation for purposes of Section

409A of the Internal Revenue Code, and the payment of any

portion of such payments would be in violation of Section 409A(a)

(2)(B)(i) of the Internal Revenue Code, then, to the extent required

to avoid a violation of Section 409A(a)(2)(B)(i) of the Internal

Revenue Code, such payment shall be deferred until the six-month

anniversary date of Employee's termination. Deferred benefits will

be paid with interest at the lesser of the prime rate (as published

from time to time in the Money Rates section of the Wall Street

Journal) and _______ (interest rate) %.

c. Company shall pay Employee a severance equal to the sum

of (A) the higher of (x) Employee's annual Base Salary (at the rate

in effect on the date of termination), or (y) the average of the annual

Base Salary Employee received during each of the last ______

(number of years) full fiscal years during which Employee was

employed by the Company, and (B) the higher of (x) the sum of the

Incentive Bonus and any Additional Bonuses Employee received

with respect to the last full Company fiscal year during which

Employee was employed by the Company, or (y) the average of the

Incentive Bonuses and any Additional Bonuses Employee received

during each of the last _____ (number of years) full fiscal years

during which Employee was employed by the Company; provided,

however, that the sum of any Incentive Bonuses and any Additional

Bonuses Employee received in respect of Fiscal __________

(identification of year) shall be deemed to be $_________ (dollar

amount of deemed total of annual incentive bonuses and

additional bonuses) regardless of the actual amount of such

bonuses, and provided further that any amounts payable to

Employee or his estate, surviving spouse, eligible dependents or

other beneficiaries as a death or disability benefit under the

Company's SERP (the SERP Payment ) shall be deducted from the

amounts otherwise payable pursuant to this subparagraph c . This

amount will be paid in a single lump sum as soon as practicable

following Employee's termination of employment; provided,

however, that if any portion of such payment constitutes a payment

of nonqualified deferred compensation for purposes of Section

409A of the Internal Revenue Code, and the payment of any

portion of such payments would be in violation of Section 409A(a)

(2)(B)(i) of the Internal Revenue Code, then, to the extent required

to avoid a violation of Section 409A(a)(2)(B)(i) of the Internal

Revenue Code, such payment shall be deferred until the six-month

anniversary date of Employee's termination. Deferred benefits will

be paid with interest at the lesser of the prime rate (as published

from time to time in the “Money Rates” section of the Wall Street

Journal) and _______ (interest rate) %. If the full amount of the

SERP Payment is not actually paid to Employee or his estate,

surviving spouse, eligible dependents or other beneficiaries within

_______ (number) days after the termination of Employee's

employment giving rise to the right to receive payment under this

subparagraph c , then within ______ (number) days after such

termination, the Company shall pay to Employee or his estate,

surviving spouse, eligible dependents or other beneficiaries an

amount equal to the difference between the full amount of the

SERP Payment and any portion of the SERP Payment previously

paid. If, subsequent to the payment of any such difference,

Employee or his estate, surviving spouse, eligible dependents or

other beneficiaries receive any payment on account of any unpaid

portion of the SERP Payment, then within ______ (number) days

after receipt of any such payment, the recipient shall pay such

amount to the Company.

d. The Company shall reimburse Employee (or his surviving

spouse or eligible dependents, in the event of Employee's death)

for the full cost of continuation coverage under the Company's

group health plan pursuant to the Consolidated Omnibus Budget

Reconciliation Act ( COBRA ) at the same level of coverage

Employee (and his ) eligible dependents, where applicable) had as

of Employee's termination date (collectively, COBRA Payments ) for

up to ______ (number) months, so long as Employee (or

Employee's eligible dependents) remain eligible for continuation

coverage under COBRA and provided that Employee is eligible for

and timely elects continuation coverage under COBRA and

continues to make COBRA payments on a timely basis. If

Employee provides to the Company within _______ (number) days

after his termination written notice that he elects to receive the

COBRA Payments in a lump sum, then as soon as practicable after

such notice the Company shall pay to Employee a lump sum equal

to the aggregate amount of COBRA Payments Employee would

have received as reimbursement of COBRA payments for the full

initial _____ (number) -month period of COBRA continuation

coverage (less any COBRA payments made by the Company for

which Employee is required to reimburse the Company). Employee

acknowledges that this benefit (whether paid in a lump sum or in

installments) may be taxable to Employee. Payment of

reimbursements pursuant to this subparagraph d shall in all cases

be made in a time and manner consistent with the requirements of

Treasury Regulations regarding payment of reimbursements under

Internal Revenue Code Section 409A. If Employee (or his ) surviving

spouse or eligible dependents, in the event of Employee's death) is

eligible for COBRA continuation coverage beyond the initial

_____ (number) -month period of COBRA continuation coverage

( Extended COBRA Coverage ), so long as Employee (or

Employee's eligible dependents) timely elects continuation of

coverage under COBRA and makes the COBRA payments on a

timely basis, Employee (and his eligible dependents, where

applicable) may continue the Extended COBRA Coverage at

Employee's sole cost and expense, which cost and expense will not

be reimbursed by the Company.

e. At such time as Employee or Employee's eligible

dependents become ineligible for continuation coverage under the

Company's group health plan pursuant to COBRA, the Company

shall take reasonable steps to assist Employee and Employee's

eligible dependents in securing alternative health coverage on a

fully insured basis (which may be in the form of conversion

coverage, if such coverage is available from any insurance carrier

which is at that time providing coverage or services in connection

with a Company group health plan) or, if a determination is made

by the Company in its sole discretion that coverage can be made

available to Employee and Employee's eligible dependents after

Employee or Employee's eligible dependents cease to be eligible

for continuation coverage under COBRA without resulting in the

health benefits becoming taxable to Employee, then the Company

will permit Employee and Employee's eligible dependents to

continue to participate in the Company's group health plan with

payment of premiums comparable to those required under either

the Company's plan, or COBRA, at the option of the Company.

Payment of premiums under any such arrangement will be made by

Employee from Employee's own funds and will not be subject to

reimbursement by the Company.

f. Unless otherwise specifically provided to the contrary in the

applicable grant or award document (as such grant or award

document may be modified by the Company), all of Employee's

unvested options to acquire Company stock and unvested

restricted Company stock shall immediately vest, with such

accelerated vesting to be otherwise in accordance with the terms

and conditions of the applicable grant or award document and plan.

(The provisions of this subparagraph f shall be considered to be an

amendment to any applicable grant or award document to the

extent necessary to implement the terms of this subparagraph f .)

3. Termination in Connection with a Change of Control.

Subject to the terms and conditions set forth in the following

Subparagraph 4 and subject to the occurrence of the Closing Date with

respect to the subject Change of Control, if (x) the Company terminates

Employee's employment for any reason (including, but not limited to,

Disability) or Employee's employment terminates due to Employee's death

during the period beginning _____ (number) days prior to a Change of

Control (as defined in Section III ) and ending on the applicable Closing

Date, (y) the Company terminates Employee's employment with the

Company for any reason (including, but not limited to, Disability) or

Employee's employment terminates due to Employee's death within one

year following the applicable Closing Date, provided that Employee was

employed by the Company on the applicable Closing Date, or (z)

Employee terminates Employee's employment with the Company for: (1)

Good Reason (provided, however, that solely for purposes of this

Subparagraph 3 , Good Reason shall not include the facts or

circumstances described in clause (ii) of the definition of Good Reason set

forth in Section III ) within one year following the Closing Date, provided

that Employee was employed by the Company on the applicable Closing

Date, or (2) for any reason within ______ (number) days immediately

preceding the one-year anniversary of the Closing Date, provided that

Employee was employed by the Company on the applicable Closing Date,

then in addition to the payments describe in Subparagraph 2 of this

Paragraph C : the Company shall pay Employee (or his estate, surviving

spouse, eligible dependents or other beneficiaries, in the event of

Employee's death) severance in an amount that is equal to ______

(number) Employee's average total compensation (including Base Salary,

Incentive Bonus and Additional Bonuses), calculated by determining the

average (mean) total cash compensation Employee earned for the most

recent _______ (number of years) full fiscal years worked prior to

Employee's termination to exceed $___________ of total compensation

for any one year, in order that such calculation is made on a basis

consistent with the definition of recognized compensation under the

Company's SERP as it exists on the effective date of this Agreement. If

severance is payable pursuant to this Subparagraph 3 as a result of

Employee's death or Disability, any amount payable as described in this

Subparagraph 3 will be reduced by any amount that is payable to

Employee or his estate, surviving spouse, eligible dependents as a death

or disability benefit under the Company's SERP (the COC SERP

Payment ). The amount payable under this Subparagraph 3 will be paid

in a single lump sum as soon as practicable following Employee's

termination of employment or the applicable Closing Date, if later;

provided, however, that if any portion of such payment constitutes a

payment of nonqualified deferred compensation for purposes of Section

409A of the Internal Revenue Code, and the payment of any portion of

such payments would be in violation of Section 409A(a)(2)(B)(i) of the

Internal Revenue Code, then, to the extent required to avoid a violation of

Section 409A(a)(2)(B)(i) of the Internal Revenue Code, such payment

shall be deferred until the six-month anniversary date of Employee's

termination. Deferred benefits will be paid with interest at the lesser of the

prime rate (as published from time to time in the “Money Rates” section of

the Wall Street Journal) and ________ (interest rate) %. If the full amount

of the COC SERP Payment is not actually paid to Employee or his estate,

surviving spouse, eligible dependents or other beneficiaries within _____

(number) days after the termination of Employee's employment giving rise

to the right to receive payment under this Subparagraph 3 or the

applicable Closing Date, if later, then within ______ (number) days after

such termination the Company shall pay to Employee or his estate,

surviving spouse, eligible dependents or other beneficiaries an amount

equal to the difference between the full amount of the COC SERP

Payment and any portion of the COC SERP Payment previously paid. If,

subsequent to the payment of any such difference, Employee or his

estate, surviving spouse, eligible dependents receives any payment on

account of any unpaid portion of the COC SERP Payment, then within

_____ (number) days after receipt of any such payment, the recipient

shall pay such amount to the Company. Notwithstanding anything in the

foregoing to the contrary, any amounts paid pursuant to Subparagraph

2(c) of this Paragraph C shall be deducted from amounts payable

pursuant to this Subparagraph 3 .

4. Termination Agreement

Employee shall receive the benefits set forth in Subparagraph 2 or

3 of this Paragraph C if and only if (x) Employee (or his ) estate, if

Employee's employment terminates due to his death) duly executes and

returns to the Company (and does not revoke if a revocation period is

included in the sole discretion of the Company) a termination agreement

(the Termination Agreement) substantially in the form attached to this

Agreement as Exhibit A , as such form may be modified by the Company

in its reasonable discretion solely to address developments in the law

including legal claims that came into existence after the date of this

Agreement; and (y) Employee complies in all material respects with his

obligations under this Agreement and the Termination Agreement.

5. No Mitigation

In no event shall Employee be obligated to seek other employment

or take any other action by way of mitigation of the amounts payable to

Employee under any of the provisions of this Agreement, and such

amounts shall not be reduced whether or not Employee obtains other

employment.

III. Termination of Employment

A. Death of Employee

Employee's employment under this Agreement shall immediately

terminate upon his death.

B. Employee's Disability

Employee's employment under this Agreement may be terminated by the

Company in the event of Employee's Disability, which shall mean Employee's

inability, for a total of ______ (number) weeks or more in any rolling ______

(number) -month period to perform the essential duties of Employee's position,

with any reasonable accommodation required by law, due to a mental or physical

impairment which substantially limits one or more major life activities. The

determination as to whether Employee has a Disability shall be made by a

physician selected by the Company, and Employee agrees to submit to

reasonable medical examinations upon the request and at the expense of the

Company.

C. Termination for Cause

Company may terminate Employee's employment at any time for Cause ,

which for purposes of this Agreement shall mean any of the following: (i) self-

dealing, willful misconduct, fraud, misappropriation, embezzlement, dishonesty,

or misrepresentation (other than a good faith dispute over an expense account

charge that is of an immaterial and insignificant amount); (ii) being charged by

governmental authorities with or convicted of a felony; (iii) material failure of

Employee to perform his known duties and responsibilities to the Company which

persists for more than ______ (number) days after written notice or which recurs

(i.e., the same or substantially similar matter which has been cured after written

notice from the Company occurs again within the succeeding ______ (number) -

month period); (iv) gross negligence which persists for more than _______

(number) days after written notice from the Company or which recurs; (v) any

violation of the Company's Code of Business Conduct and Ethics (as it may be

amended, restated, or replaced from time to time) which causes, or is likely to

cause, a material or significant injury to the Company or which recurs; (vi)

violation in any material respect by Employee of any policy, rule, or reasonable

direction or regulation of the Company which persists for more than _______

(number) days after written notice or which recurs; (vii) any violation by

Employee of the provisions of the Non-Competition and Confidentiality

Agreement described in Section IV below; or (viii) any violation by Employee of

any material provision of this Agreement (other than the Non-Competition and

Confidentiality Agreement) which persists for more than ______ (number) days

after written notice or which recurs.

D. Termination without Cause

Company may terminate Employee's employment at any time and for any

or no reason (i.e., without Cause) by providing Employee with ______ (number)

days prior written notice, which notice the Company can waive, in whole or in

part, in its sole discretion, by paying Employee for such time; provided, however,

the Company may terminate Employee's employment immediately if there is

Cause (as defined in Paragraph C of this Section III) , in the event of

Employee's Disability (as defined in Paragraph B ) and in the event of

Employee's death.

E. Termination for Good Reason

Employee may terminate Employee's employment at any time for “Good

Reason,” which for purposes of this Agreement shall mean: (i) reduction of

Employee's Base Salary, except as agreed to by Employee in accordance with

Section 2 , Subparagraph A(1) ; (ii) the assignment to Employee by the Chief

Executive Officer or the Board of Directors of duties which represent a material

decrease in responsibility and are materially inconsistent with the duties

associated with Employee's position, or any material reduction in Employee's job

title, or a material negative change in the level of employee to whom Employee

reports; (iii) the Company's requiring Employee to be based at any office or

location other than in _______________ (name of city) , _______________

(name of state) , or within _________ (number of miles) miles of the

_______________ (name of city) metropolitan area; or (iv) any material breach

of this Agreement by the Company; provided, however, that Good Reason shall

not exist under (i) through (iv) above unless and until Employee provides the

Company with written notice of the condition that Employee believes to constitute

Good Reason and the Company fails to cure the condition within ______

(number) days after receiving such written notice or such condition recurs.

F. Termination for Other Than Good Reason

Employee may terminate Employee's employment at any time and for

other than Good Reason by providing the Company with _____ (number) days'

prior written notice, which notice period the Company may waive, in whole or in

part, in its sole discretion, by paying Employee for such time.

G. Change of Control and Closing Date

A Change of Control shall be deemed to have occurred upon the earliest

to occur of the following dates:

1. The date the stockholders of the Company (or the Board of

Directors, if stockholder action is not required) approve a plan or other

arrangement pursuant to which the Company will be dissolved or

liquidated;

2. The date the stockholders of the Company (or the Board of

Directors, if stockholder action is not required) approve a definitive

agreement to sell or otherwise dispose of substantially all of the assets of

the Company;

3. The date the stockholders of the Company (or the Board of

Directors, if stockholder action is not required) and the stockholders of the

other constituent corporation (or its board of directors if stockholder action

is not required) have approved a definitive agreement to merge or

consolidate the Company with or into such other corporation, other than,

in either case, a merger or consolidation of the Company in which holders

of shares of the Company's Common Stock immediately prior to the

merger or consolidation will have at least a majority of the voting power of

the surviving corporation's voting securities immediately after the merger

or consolidation, which voting securities are to be held in the same

proportion as such holders' ownership of Common Stock of the Company

immediately before the merger or consolidation; or

4. The date any entity, person or group, within the meaning of Section

13(d)(3) or Section 14(d)(2) of the Exchange Act (other than: (A) the

Company or any of its subsidiaries or any employee benefit plan (or

related trust) sponsored or maintained by the Company or any of its

subsidiaries, (B) ___________________ (name of primary shareholder)

or family members of ___________________ (name of primary

shareholder) (all such persons being referred to as “_________________

(name of primary shareholder) Family Members”), (C) any entity a

majority of the equity in which is owned by ___________________ (name

of primary shareholder) Family Members, or (D) any trust as to which a

majority of the beneficiaries are _____________________ (name of

primary shareholder) Family Members), shall have become the

beneficial owner of, or shall have obtained voting control over, more than

50% of the outstanding shares of the Company's common stock. As used

in this Agreement, the term Closing Date means the date, if any, on which

a transaction that is treated as a Change of Control is consummated.

H. Non-Competition and Confidentiality Agreement

Termination of Employee's employment either by Employee or the

Company, whether with or without Cause, and whether or not due to Employee's

death or Disability, shall not release Employee from Employee's obligations and

restrictions under the Non-Competition and Confidentiality Agreement referred to

in Section Four below except to the extent specifically provided in that

agreement.

IV. Non-Competition and Confidentiality

The terms of this Agreement are contingent upon Employee's execution of a

Non-Competition and Confidentiality Agreement in the form attached to this Agreement

as Exhibit B . Employee's failure to execute the Non-Competition and Confidentiality

Agreement on or before this Agreement's Effective Date will invalidate this Agreement.

V. Miscellaneous

A. Special Tax Provision; Section 280G

1. Anything in this Agreement to the contrary notwithstanding and

except as set forth below, if it shall be determined that any payment or

distribution by the Company to or for the benefit of Employee (whether

paid or payable or distributed or distributable pursuant to the terms of this

Agreement or otherwise, but determined without regard to any additional

payments required under this Paragraph A ) (a Payment) would be subject

to the excise tax imposed by Section 4999 of the Internal Revenue Code

or any Interest or Penalties (as defined below) are incurred by Employee

with respect to such excise tax (such excise tax, together with any such

Interest or Penalties, are collectively referred to as the Excise Tax ), then

Employee shall be entitled to receive an additional payment (a Gross-Up

Payment ) in an amount such that after payment by Employee of all taxes

(including any Interest or Penalties imposed with respect to such taxes),

including, but not limited to, any income taxes (and any Interest or

Penalties imposed with respect to such taxes) and Excise Tax imposed

upon the Gross-Up Payment, Employee retains an amount of the Gross-

Up Payment equal to the Excise Tax imposed upon the Payments.

Notwithstanding the foregoing provisions of this Subparagraph 1, if it

shall be determined that Employee is entitled to a Gross-Up Payment, but

that the Payments do not exceed 110% of the greatest amount (the

Reduced Amount) that could be paid to Employee such that the receipt of

Payments would not give rise to any Excise Tax, then no Gross-Up

Payment shall be made to Employee and the Payments, in the aggregate,

shall be reduced to the Reduced Amount. For purposes of this Agreement,

the term Interest or Penalties refers only to amounts of interest or

penalties imposed under applicable provisions of the Internal Revenue

Code with respect to excise taxes imposed on Employee pursuant to

Section 4999 of the Code, and only to the extent such amounts of interest

or penalties are attributable to errors in calculation of amounts considered

to be, or potentially considered to be excess parachute payments (as that

term is used for purposes of Section 280G of the Internal Revenue Code)

or are attributable to the Company's determination to contest claims or

assessments of such excise taxes by the Internal Revenue Service.

2. All determinations required to be made under this Paragraph A,

including whether and when a Gross-Up Payment is required and the

amount of such Gross-Up Payment and the assumptions to be use in

arriving at such determination, shall be made by such certified public

accounting firm as may be designated by the Company (the Accounting

Firm ) which shall provide detailed supporting calculations both to the

Company and Employee within ________ (number) business days of the

receipt of notice from Employee that there has been a Payment requiring

a Gross-Up Payment, or such earlier time as is requested by the

Company. If the Accounting Firm is serving as accountant or auditor for

the individual, entity or group effecting the Change of Control or the

Accounting Firm refuses to make the required determinations, the

Company shall appoint another nationally recognized accounting firm to

make the determinations required under this Agreement (which

accounting firm shall then be referred to as the Accounting Firm under this

Agreement). All fees and expenses of the Accounting Firm shall be borne

solely by the Company. Any Gross-Up Payment, as determined pursuant

to this Paragraph G , shall be paid by the Company to Employee within

______ (number) days of the receipt of the Accounting Firm's

determination. Any determination by the Accounting Firm shall be binding

upon the Company and Employee, absent manifest error. As a result of

the uncertainty in the application of Section 4999 of the Internal Revenue

Code at the time of the initial determination by the Accounting Firm under

this Agreement, it is possible that Gross-Up Payments which will not have

been made by the Company should have been made ( Underpayment ),

consistent with the calculations required to be made under this

Agreement. If the Company exhausts its remedies pursuant to

Subparagraph 3 below and Employee subsequently is required to make a

payment of any Excise Tax, the Accounting Firm shall determine the

amount of the Underpayment that has occurred and any such

Underpayment shall be promptly paid by the Company to or for the benefit

of Employee.

3. Employee shall notify the Company in writing of any claim by the

Internal Revenue Service that, if successful, would require the payment by

the Company of the Gross-Up Payment. Such notification shall be given

as soon as practicable but no later than _______ (number) business days

after Employee is informed in writing of such claim and shall apprise the

Company of the nature of such claim and the date on which such claim is

requested to be paid. Employee shall not pay such claim prior to the

expiration of the _____ (number) -day period following the date on which it

gives such notice to the Company (or such shorter period ending on the

date that any payment of taxes with respect to such claim is due). If the

Company notifies Employee in writing prior to the expiration of such period

that it desires to contest such claim, Employee shall:

a. Give the Company any information reasonably requested by

the Company relating to such claim;

b. Take such action in connection with contesting such claim as

the Company shall reasonably request in writing from time to time,

including but not limited to accepting legal representation with

respect to such claim by an attorney reasonably selected by the

Company;

c. Cooperate with the Company in good faith in order

effectively to contest such claim; and

d. Permit the Company to participate in any proceedings

relating to such claim; provided, however, that the Company shall

bear and pay directly all costs and expenses (including additional

Interest or Penalties) incurred in connection with such contest and

shall indemnify and hold Employee harmless, on an after-tax basis,

for any Excise Tax or additional income tax (including Interest or

Penalties with respect to such tax) imposed as a result of such

representation and payment of costs and expenses. Without

limitation on the foregoing provisions of this Paragraph A , the

Company shall control all proceedings taken in connection with

such contest and, at its sole option, may pursue or forgo any and all

administrative appeals, proceedings, hearings and conferences

with the taxing authority in respect of such claim and may, at its

sole option, either direct Employee to pay the tax claimed and sue

for a refund or contest the claim in any permissible manner, and

Employee agrees to prosecute such contest to a determination

before any administrative tribunal, in a court of initial jurisdiction

and in one or more appellate courts, as the Company shall

determine; provided, however, that if the Company directs

Employee to pay such claim and sue for a refund, the Company

shall, to the extent permitted by law, advance the amount of such

payment to Employee, on an interest-free basis and shall indemnify

and hold Employee harmless, on an after-tax basis, from any

Excise Tax or income tax (including Interest or Penalties with

respect to such tax) imposed with respect to such advance or with

respect to any imputed income with respect to such advance; and

further provided that any extension of the statute of limitations

relating to payment of taxes for the taxable year of Employee with

respect to which such contested amount is claimed to be due is

limited solely to such contested amount. Furthermore, the

Company's control of the contest shall be limited to issues with

respect to which a Gross-Up Payment would be payable under this

Agreement and Employee shall be entitled to settle or contest, as

the case may be, any other issue raised by the Internal Revenue

Service or any other taxing authority.

4. If, after the receipt by Employee of an amount advanced by the

Company pursuant to Subparagraph 3 above, Employee becomes

entitled to receive any refund with respect to such claim, Employee shall

(subject to the Company's complying with the requirements of

Subparagraph 3 ) promptly pay to the Company the amount of such

refund (together with any interest paid or credited on such refund after

taxes applicable to the same). If, after the receipt by Employee of an

amount advanced by the Company pursuant to Subparagraph 3 , a

determination is made that Employee shall not be entitled to any refund

with respect to such claim and the Company does not notify Employee in

writing of its intent to contest such denial of refund prior to the expiration of

______ (number) days after such determination, then such advance shall

be forgiven and shall not be required to be repaid and the amount of such

advance shall offset, to the extent of such advance, the amount of Gross-

Up Payment required to be paid.

5. Notwithstanding anything in this Paragraph G to the contrary, all

amounts payable to Employee as a Payment shall be paid as soon as

practicable following the determination of the amount required to be paid

to Employee, and in no event later than the end of the calendar year

following the calendar year in which Employee pays the taxes subject to

the “gross-up” provision. This Subparagraph 5 is intended to require a

time and manner of payment for Payments that is consistent with the

requirements for treatment of such payments as payable at a specified

time for purposes of Code Section 409A, as such requirements are set

forth in Treasury Regulation Section 1.409A-3(i)(1)(v) and shall in all

cases be interpreted consistent with such requirements, or any successor

provisions or guidance regarding compliance with Section 409A of the

Internal Revenue Code.

B. Special Provisions if Covered Employee Status Remains Effective

After Termination of Employment .

Notwithstanding anything to the contrary contained in this Agreement, if

Employee is treated as a “covered employee” (as that term is used for

purposes of Section 162(m) of the Internal Revenue Code) after his

termination of employment with the Company, then severance and other

payments otherwise payable under this Agreement for any taxable year of

the Company shall be limited to the extent that such payments would not

be deductible by the Company by reason of Section 162(m) of the Internal

Revenue Code, and, to the extent so limited, shall be paid in succeeding

taxable years (up to the maximum permitted to be deducted under Section

162(m) of the Internal Revenue Code) until all amounts required to be paid

under this Agreement have been paid; except that no amounts shall be

deferred longer than the end of the third taxable year following the taxable

year in which Employee's termination occurred so that the Company shall

pay out any unpaid balance in the third taxable year following Employee's

termination even if the third taxable year's payment exceeds the maximum

amount permitted to be deducted under Section 162(m) of the Internal

Revenue Code. If payments are deferred on this basis, payments shall

continue over a period of equal monthly installments (except that any

additional payments required to be made in the third taxable year following

Employee's termination shall be added to and paid out along with the

twelfth and final equal monthly installment for such third taxable year) and

are intended to constitute a fixed time and manner of payment consistent

with the requirements of Section 409A of the Internal Revenue Code.

Payments made on a deferred basis by reason of Paragraph D of this

Section V shall be increased, in the aggregate, so that later payment of

amounts due include amounts that represent (simple) interest or earnings,

determined by reference to the lesser of the prime rate (as published from

time to time in the Money Rates section of the Wall Street Journal) or

_______ (interest rate) %.

C. Special Rules Regarding Section 409A of the Internal Revenue Code.

Notwithstanding anything in this Agreement to the contrary, if any

payments or benefits required to be provided under this Agreement are deemed

to constitute payments of nonqualified deferred compensation that is subject to

the requirements of Section 409A of the Internal Revenue Code, then the time

and manner in which such payment or benefit is provided shall be adjusted, to

the extent reasonably possible, so that payment or distribution is made at a time

and in a manner that is consistent with the requirements of such Section 409A

(and applicable proposed or final Treasury regulations or other guidance issued

or to be issued by the Internal Revenue Service). This Paragraph C may, for

example, require that certain payments to Employee following his termination of

employment be delayed until the date that is six months after the date of his

separation from service with the Company if at the time of such termination of

employment Employee was a specified employee (as that term is used for

purposes of Section 409A(2)(B)(i)). All other payments and taxable benefits shall

be made available or distributed to Employee at such times as provided by the

applicable provisions of this Agreement. If any payments are delayed as required

by this Paragraph C , those payments shall be made in a single lump sum with

interest, at the lesser of the prime rate (as published from time to time in the

Money Rates section of the Wall Street Journal) or _______ (interest rate) %. In

addition, to the extent any payments made by reason of Employee's termination

of employment are considered payable under a nonqualified deferred

compensation plan that is subject to Internal Revenue Code Section 409A, any

reference to termination of employment shall be interpreted to mean a separation

from service as defined in Treasury Regulations applicable under Internal

Revenue Code Section 409A. To the extent any reimbursements or in-kind

benefits due to Employee under this Agreement constitute deferred

compensation under Internal Revenue Code Section 409A, any such

reimbursements or in-kind benefits shall be paid to Employee in a manner

consistent with Treas. Reg. Section 1.409A-3(i)(1)(iv). Each payment made

under this Agreement shall be designated as a “separate payment” within the

meaning of Internal Revenue Code Section 409A. The Company shall consult

with Employee in good faith regarding the implementation of the provisions of this

Paragraph C .

D. Payment Dates and Payments

Company shall be deemed to have complied with the payment dates

referenced in this Agreement if the Company pays Employee on the payroll pay

date that corresponds to the pay period during which the relevant payment date

falls. All payments under this Agreement shall be subject to applicable

withholdings and taxes.

E. Recognized Bonus; Outstanding Options and Restricted Stock.

Company confirms that all bonus income, whether received before, on or

after, the date of this Agreement, and regardless of whether such bonus income

is Incentive Bonus, Additional Bonus or any other bonus amounts and whether

deferred or not or elected to be in a non-cash form shall be considered

Recognized Bonus for purposes of the Company's SERP.

F. Severability

The invalidity of any portion of this Agreement will not and shall not be

deemed to affect the validity of any other provision. If any provision of this

Agreement is held to be invalid, the parties agree that the remaining provisions

shall be deemed to be in full force and effect as if they had been executed by

both parties subsequent to the expungement of the invalid provision.

G. No Waiver

The failure of either party to this Agreement to insist upon the performance of any

of the terms and conditions of this Agreement, or the waiver of any breach of any

of the terms and conditions of this Agreement, shall not be construed as

subsequently waiving any such terms and conditions, but the same shall

continue and remain in full force and effect as if no such forbearance or waiver

had occurred.

H. Governing Law

This Agreement shall be governed by, construed, and enforced in

accordance with the laws of the State of __________.

I. Notices

Any notice provided for or concerning this Agreement shall be in writing and shall

be deemed sufficiently given when sent by certified or registered mail if sent to

the respective address of each party as set forth at the beginning of this

Agreement.

J . Mandatory Arbitration

Any dispute under this Agreement shall be required to be resolved by

binding arbitration of the parties hereto. If the parties cannot agree on an

arbitrator, each party shall select one arbitrator and both arbitrators shall then

select a third. The third arbitrator so selected shall arbitrate said dispute. The

arbitration shall be governed by the rules of the American Arbitration Association

then in force and effect.

K. Entire Agreement

This Agreement shall constitute the entire agreement between the parties

and any prior understanding or representation of any kind preceding the date of

this Agreement shall not be binding upon either party except to the extent

incorporated in this Agreement.

L. Modification of Agreement

Any modification of this Agreement or additional obligation assumed by

either party in connection with this Agreement shall be binding only if placed in

writing and signed by each party or an authorized representative of each party.

M. Assignment of Rights

The rights of each party under this Agreement are personal to that party

and may not be assigned or transferred to any other person, firm, corporation, or

other entity without the prior, express, and written consent of the other party.

N. Counterparts

This Agreement may be executed in any number of counterparts, each of

which shall be deemed to be an original, but all of which together shall constitute

but one and the same instrument.

O. In this Agreement, any reference to a party includes that party's heirs,

executors, administrators, successors and assigns, singular includes plural and

masculine includes feminine.

WITNESS our signatures as of the day and date first above stated.

_________________________

(Name of Company)

________________________ By:_________________________

(P rinted Name of Employee) _______________________

____________________ (P rinted name & Office in Corporation)

(Signature of Employee) _____________________

(Signature of Officer)