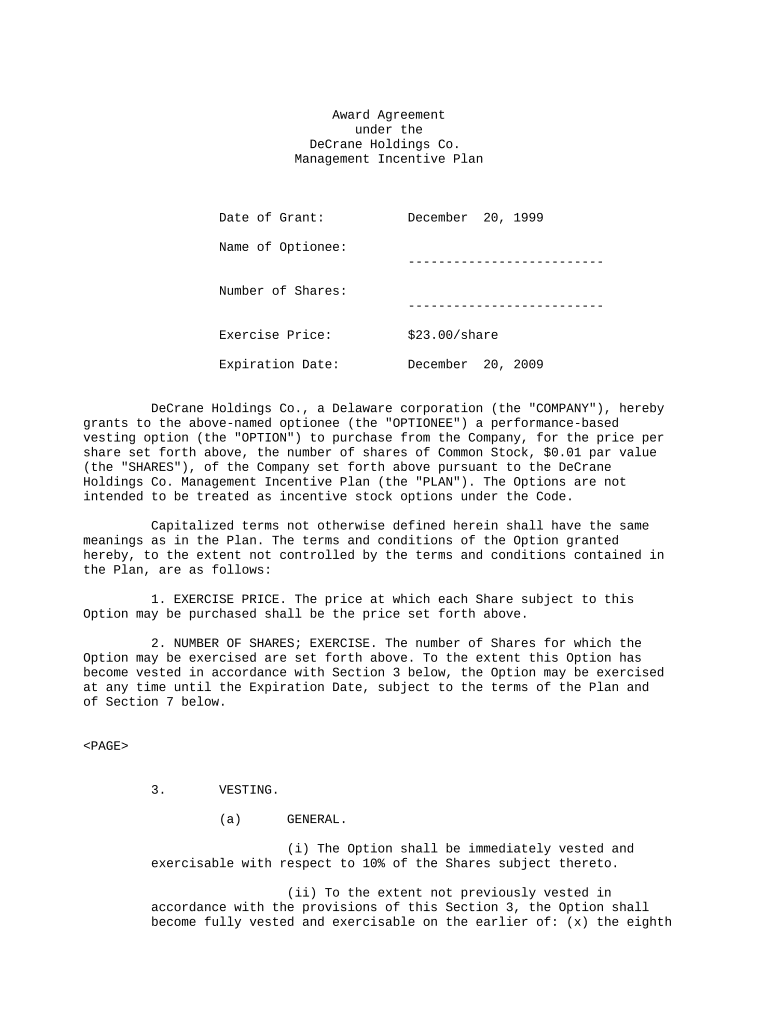

Award Agreement

under the

DeCrane Holdings Co.

Management Incentive Plan

Date of Grant: December 20, 1999

Name of Optionee:

--------------------------

Number of Shares:

--------------------------

Exercise Price: $23.00/share

Expiration Date: December 20, 2009

DeCrane Holdings Co., a Delaware corporation (the "COMPANY"), hereby

grants to the above-named optionee (the "OPTIONEE") a performance-based

vesting option (the "OPTION") to purchase from the Company, for the price per

share set forth above, the number of shares of Common Stock, $0.01 par value

(the "SHARES"), of the Company set forth above pursuant to the DeCrane

Holdings Co. Management Incentive Plan (the "PLAN"). The Options are not

intended to be treated as incentive stock options under the Code.

Capitalized terms not otherwise defined herein shall have the same

meanings as in the Plan. The terms and conditions of the Option granted

hereby, to the extent not controlled by the terms and conditions contained in

the Plan, are as follows:

1. EXERCISE PRICE. The price at which each Share subject to this

Option may be purchased shall be the price set forth above.

2. NUMBER OF SHARES; EXERCISE. The number of Shares for which the

Option may be exercised are set forth above. To the extent this Option has

become vested in accordance with Section 3 below, the Option may be exercised

at any time until the Expiration Date, subject to the terms of the Plan and

of Section 7 below.

3. VESTING.

(a) GENERAL.

(i) The Option shall be immediately vested and

exercisable with respect to 10% of the Shares subject thereto.

(ii) To the extent not previously vested in

accordance with the provisions of this Section 3, the Option shall

become fully vested and exercisable on the earlier of: (x) the eighth

anniversary of the Date of Grant, provided the Optionee is then in the

employ of the Company or a Subsidiary; or (y) upon a Change in Control

provided that the internal rate of return realized by the DLJ Entities

in respect of such Change in Control exceeds the targets set forth on

Schedule 1 to the Plan.

(b) PERFORMANCE CONDITIONS.

(i) The Option shall be considered to be a

"GROWTH-BASED OPTION" to the extent of 90% of the Shares subject

thereto. A portion of this Growth-Based Option shall become vested and

exercisable on the thirtieth day following the availability of audited

financial statements of the Company for each of the four fiscal years

of the Company commencing with the fiscal year ending December 31, 1999

(each such day, a "VESTING DATE"), provided, in the case of Operating

Company Participants, the operating company to which such Optionee's

employment primarily relates (the "OPERATING COMPANY") has achieved

such Operating Company's Target EBITDA for such fiscal year as set

forth in Schedule 2 or Schedule 3 to the Plan, as applicable, or, in

the case of Corporate Participants, provided that the Total

Consolidated EBITDA achieved for such year equals the Total Target

Consolidated EBITDA for such year as set forth in Schedule 3 to the

Plan. Schedule 2 and Schedule 3 set forth the total portion of the

Growth-Based Option that will be treated as vested and exercisable as

of each Vesting Date based on achievement of the specified percentages

of the relevant Target EBITDA and Schedule 3 sets forth the Total

Target Consolidated EBITDA, as the case may be, in each case for each

fiscal year.

(ii) If the Target EBITDA value referred to in clause

(b)(i) for any Operating Company is exceeded in any fiscal year, an

amount equal to all or a portion of the excess of actual EBITDA over

such target EBITDA shall be taken into account in respect of the

immediately preceding fiscal year solely for purposes of determining

whether such Operating Company's Target EBITDA for such preceding

fiscal year has

A-2

been attained; provided, however, that any such excess EBITDA in any

fiscal year that is taken into account as provided herein shall not be

taken into account, directly or indirectly, for any purpose in respect

of any other preceding fiscal year or any fiscal year commencing after

such immediately preceding fiscal year.

(iii) If the Target EBITDA value referred to in

clause (b)(i) for any Operating Company is exceeded in any fiscal year,

an amount equal to all or a portion of the excess of actual EBITDA over

such target EBITDA, provided that such excess has not been taken into

account in respect of the immediately preceding fiscal year pursuant to

Clause (b)(ii), shall be taken into account in the immediately

succeeding fiscal year solely for purposes of determining whether such

Operating Company's Target EBITDA for such succeeding fiscal year has

been attained; provided, however, that any such excess EBITDA in any

fiscal year shall not be taken into account, directly or indirectly,

for any purpose in respect of any fiscal year commencing after such

immediately succeeding fiscal year.

(iv) The Target EBITDA for the Operating Companies

may be reallocated among such Companies provided that: (x) the Board

and management of the Company agree on such reallocation and (y) the

Target Total Divisional EBITDA (Rev.) set forth on Schedule 3 remains

unchanged. In the event that the Company acquires any business during

such period, the Target Total Consolidated EBITDA (Rev.) on Schedule 3

shall be increased by the EBITDA projected for such business for the

year of acquisition and for each subsequent year, as projected for each

such year at the time of its acquisition. The Committee shall have the

discretion to adjust the corporate elimination in Schedule 3 to reflect

such acquisition.

4. MANNER OF EXERCISE. The Optionee (or his representative, devisee or

heir, as applicable) may exercise any portion of this Option which has become

exercisable in accordance with the terms hereof as to all or any of the Shares

then available for purchase by delivering to the Company written notice

specifying:

(i) the number of whole Shares to be purchased together with

payment in full of the aggregate Exercise Price of such shares;

(ii) the address to which dividends, notices, reports, etc.

are to be sent; and

(iii) the Optionee's social security number.

A-3

Payment shall be in cash, by certified or bank cashier's check payable to the

order of the Company, free from all collection charges, or in unencumbered

Shares (provided such shares shall have been held by the Optionee for at least

six months unless the Committee determines in its sole discretion that such

six-month holding period is not necessary to comply with any accounting, legal

or regulatory requirement) having a Fair Market Value equal to the full amount

of the Exercise Price therefor, or such other form as may be permitted by the

Committee. Only one stock certificate will be issued unless the Optionee

otherwise requests in writing. Shares purchased upon exercise of the Option will

be issued in the name of the Optionee or the Optionee's Permitted Transferee. No

Shares shall be issued hereunder unless and until the Optionee (or his

representative, devisee or heir, as applicable) executes and agrees to be bound

by the Investors' Agreement. The Optionee shall not be entitled to any rights as

a stockholder of the Company in respect of any Shares covered by this Option

until such Shares shall have been paid for in full and issued to the Optionee.

5. CERTIFICATES. Certificates issued in respect of Shares acquired upon

exercise of the Option shall, unless the Committee otherwise determines, be

registered in the name of the Optionee or its Permitted Transferee. When the

Optionee ceases to be bound by the provisions of the Investors' Agreement, the

Company shall deliver such certificates to the Optionee or its Permitted

Transferee upon request. Such stock certificate shall carry such appropriate

legends, and such written instructions shall be given to the Company's transfer

agent, as may be deemed necessary or advisable by counsel to the Company in

order to comply with the requirements of the Securities Act of 1933, any state

securities laws or any other applicable laws or the Investors' Agreement.

6. NONTRANSFERABILITY. This Option is personal to the Optionee and may

be exercised only by the Optionee or his or her representative in the event of

the Optionee's Disability or death. This Option shall not be transferable other

than by will or the laws of descent and distribution. Notwithstanding the

foregoing, this Option may be transferred to a trust solely for the benefit of

the Optionee or the Optionee's immediate family (which shall be deemed to

include the Optionee's spouse, parents, siblings, children, stepchildren and

grandchildren).

7. FORFEITURE OF OPTION; RIGHT OF REPURCHASE.

(a) If the Optionee's employment with the Company and its Subsidiaries

shall terminate for any reason other than by the Company or its Subsidiary for

Cause, then (i) to the extent not yet vested as of the date of termination of

employment, the Option shall immediately be forfeited; and (ii) to the extent

vested as of the date of termination of employment, the Option may be

A-4

retained and exercised, in accordance with the terms of the Plan and this

Award Agreement, during the six month period following such termination.

(b) If the Optionee's employment with the Company and its Subsidiaries

shall be terminated by the Company or its Subsidiary for Cause, then the entire

Option shall immediately be forfeited, and all Shares previously acquired upon

exercise of the Option shall be subject to a right of repurchase by the Company

from the Participant or his or her Permitted Transferee at a price equal to the

Exercise Price.

8. SALE OF UNDERLYING SHARES. The Optionee's right and obligation to

sell any Shares acquired upon exercise of the Option (in the case of Optionees

who are party thereto) shall be subject to the terms of the Investors'

Agreement.

9. EMPLOYMENT RIGHTS. This Option does not confer on the Optionee any

right to continue in the employ of the Company or any Subsidiary or interfere in

any way with the right of the Company or any Subsidiary to determine the terms

of the Optionee's employment.

10. TERMS OF PLAN; INTERPRETATIONS. This Option and the terms and

conditions herein set forth are subject in all respects to the terms and

conditions of the Plan, which shall be controlling. All interpretations or

determinations of the Committee and/or the Board shall be binding and conclusive

upon the Optionee and his legal representatives on any question arising

hereunder. The Optionee acknowledges that he has received and reviewed a copy of

the Plan.

11. DELEGATION. Optionee acknowledges that any powers, rights or

responsibilities of the Board and/or the Committee set forth herein may be

delegated to and exercised by any subcommittee thereof as permitted under the

Plan.

12. NOTICES. All notices hereunder to the party shall be delivered or

mailed to the following addresses:

If to the Company:

DeCrane Holdings Co.

c/o DLJ Merchant Banking Partners II, L.P.

277 Park Avenue

New York, New York 10172

Attention: Thompson Dean

Fax: (212) 892-7272

A-5

and

DeCrane Holdings Co.

2361 Rosecrans Avenue

Suite 180

El Segundo, CA 90245

Attention: R. Jack DeCrane

Fax: (310) 643-0746

with a copy to:

Davis Polk & Wardwell

450 Lexington Avenue

New York, New York 10017

Attention: George R. Bason, Jr., Esq.

Fax: (212) 450-4800

If to the Optionee:

To the person and at the address specified on the signature

page.

Such addresses for the service of notices may be changed at any time provided

notice of such change is furnished in advance to the other party.

13. ENTIRE AGREEMENT. This Agreement, together with the Plan and (in

the case of Optionees who are party thereto) the Investors Agreement, contains

the entire understanding of the parties hereto in respect of the subject matter

contained herein. This Agreement, the Plan and the Investors' Agreement

supersede all prior agreements and understandings between the parties hereto

with respect to the subject matter hereof.

14. GOVERNING LAW. This Award Agreement shall be governed by and

construed in accordance with the laws of the State of Delaware, without

application of the conflict of laws principles thereof.

15. COUNTERPARTS. This Award Agreement may be signed in any number of

counterparts, each of which shall be an original, with the same effect as if the

signatures thereto and hereto were upon the same instrument.

A-6

IN WITNESS WHEREOF, the undersigned have caused this Award Agreement to

be duly executed as of the date first above written.

DeCRANE HOLDINGS CO.

By:

---------------------------

Name:

Title:

OPTIONEE:

------------------------------

Name:

Address: c/o DeCrane Holdings Co.

2361 Rosecrans Avenue

Suite 180

El Segundo, CA 90245

Practical tips for preparing your ‘Award Agreement’ online

Are you fed up with the stress of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your document management approach. Whether you need to sign forms or collect signatures, airSlate SignNow manages it all with ease, requiring just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Award Agreement’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for other users (if necessary).

- Proceed with the Send Invite settings to request electronic signatures from others.

- Save, print your copy, or transform it into a reusable template.

Don’t be concerned if you need to collaborate with your teammates on your Award Agreement or send it for notarization—our platform provides everything you require to complete such tasks. Create an account with airSlate SignNow today and take your document management to new levels!