Fill and Sign the Bankruptcy Intake Form Fillable

Effective Suggestions for Finalizing Your ‘Bankruptcy Intake Form Fillable’ Online

Are you weary of the inconvenience of managing documents? Look no further than airSlate SignNow, the ultimate eSignature solution for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features embedded within this user-friendly and economical platform and transform your method of document management. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all effortlessly, with merely a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Select +Create to upload a file from your device, cloud, or our template archive.

- Open your ‘Bankruptcy Intake Form Fillable’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you wish to collaborate with your team on your Bankruptcy Intake Form Fillable or send it for notarization—our platform has everything you need to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

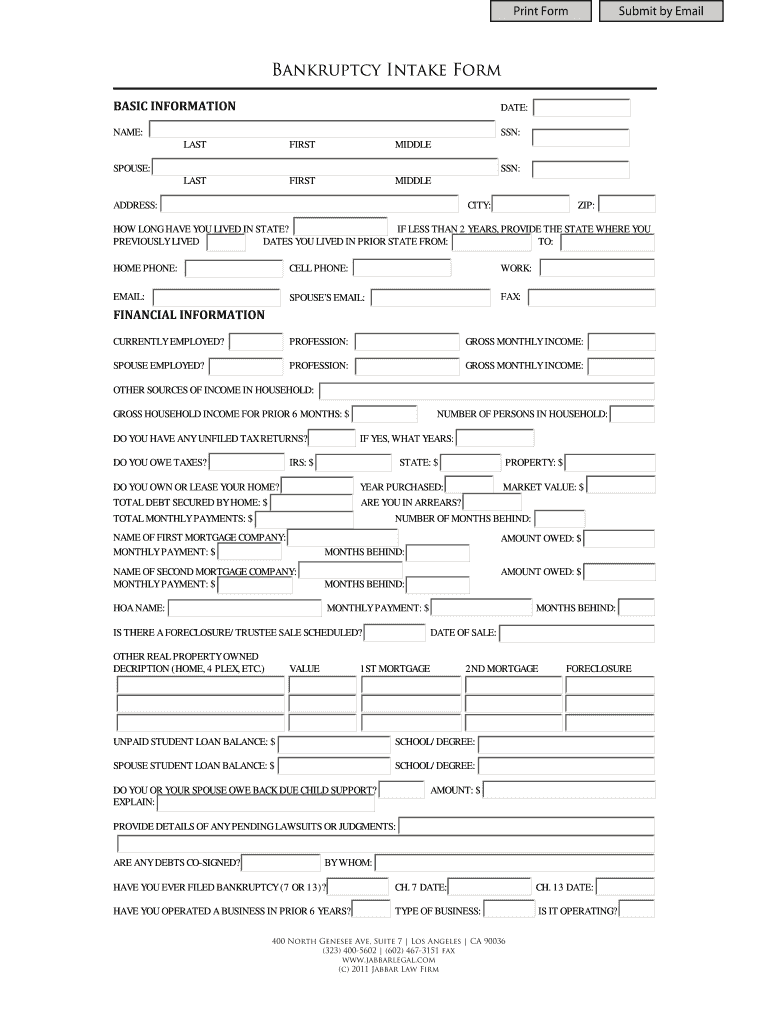

What is a Bankruptcy Intake Form and how does it work?

A Bankruptcy Intake Form is a crucial document used to collect necessary information from clients seeking bankruptcy services. With airSlate SignNow, you can easily create and customize your Bankruptcy Intake Form to ensure you gather all necessary details efficiently. This streamlines the client onboarding process and helps in preparing for bankruptcy filings.

-

How can I create a Bankruptcy Intake Form using airSlate SignNow?

Creating a Bankruptcy Intake Form with airSlate SignNow is straightforward and user-friendly. You can start by selecting a template or designing your form from scratch, adding fields for essential client information, and incorporating eSignature options. Our platform enables you to customize the form to fit your specific needs and branding.

-

Is airSlate SignNow secure for handling Bankruptcy Intake Forms?

Yes, airSlate SignNow offers top-notch security features to protect your Bankruptcy Intake Forms and sensitive client information. We utilize bank-level encryption, secure data storage, and compliance with industry standards to ensure that your documents remain safe and confidential during the entire signing process.

-

What are the pricing options for using airSlate SignNow for Bankruptcy Intake Forms?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which include features for creating and managing Bankruptcy Intake Forms. Our pricing is designed to be cost-effective while offering comprehensive functionality, so you can get the most value.

-

Can I integrate airSlate SignNow with other software for my Bankruptcy Intake Forms?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to enhance your workflow and manage your Bankruptcy Intake Forms more efficiently. Whether you're using CRM systems, cloud storage, or accounting software, our integrations will help you streamline processes and data management.

-

What features does airSlate SignNow offer for Bankruptcy Intake Forms?

airSlate SignNow includes a range of features specifically designed for effective management of Bankruptcy Intake Forms. These features include customizable templates, eSignature capabilities, document tracking, and automated reminders, making it easier for you to collect information and keep your clients informed throughout the process.

-

How can a Bankruptcy Intake Form benefit my legal practice?

Using a Bankruptcy Intake Form can signNowly enhance your legal practice by streamlining the client intake process. With airSlate SignNow, you can reduce paperwork, minimize errors, and improve client communication, ultimately leading to a more efficient workflow and better client satisfaction.

Find out other bankruptcy intake form fillable

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles