RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 1 of 16

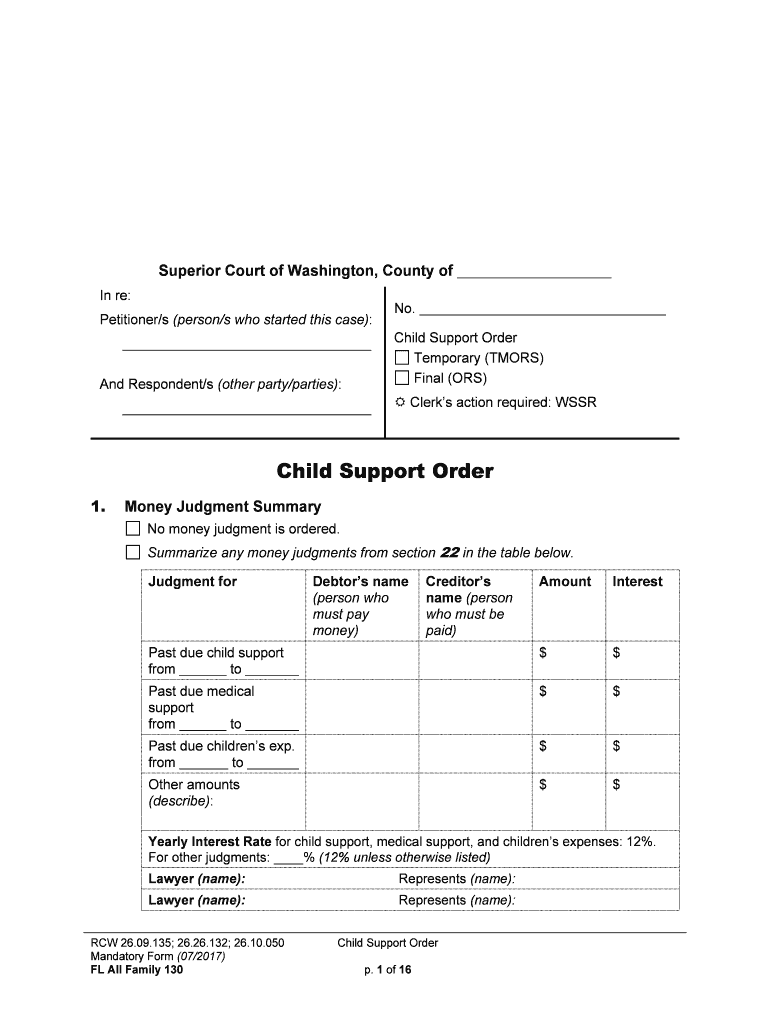

Superior Court of Washington, County of

In re:Petitioner/s (person/s who started this case):And Respondent/s (other party/parties) :No. Child Support Order Temporary (TMORS) Final (ORS) � Clerk’s action required: WSSR

Child Support Order 1.Money Judgment Summary No money judgment is ordered. Summarize any money judgments from section 22 in the table below. Judgment forDebtor’s name

(person who

must pay

money) Creditor’s name (person

who must be

paid)AmountInterestPast due ch ild s u pport

fr o m t o $$Past due medical

sup port

fr o m t o $$Past due children’s exp.

fro m t o $$Other amounts

(describe): $$Yearly Interest Rate for child support, medical support, and children’s expenses: 12%.

For other judgments: ____% (12% unless otherwise listed)Lawyer (name): Represents (name): Lawyer (name): Represents (name):

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 2 of 16 � Findings and Orders2. The court orders child support as part of this family law case. This is a (check one): temporary order. final order. 3. The Child Support Schedule Worksheets attached or filed separately are approved by the

court and made part of this Order. 4. Parents’ contact and employment information Each parent must fill out and file with the court a Confid entia l I n fo rm atio n f o rm ( F L A ll

Fa m ily 0 01) in clu din g p ers o n al id entif y in g in fo rm atio n, m ailin g a ddre ss, h om e a ddre ss, a nd

em plo ye r c o n ta ct in fo rm atio n. Important! If you move or get a new job any time while support is still owed, you must: � Notif y t h e S upport R egis tr y , a nd � Fill o ut a nd f ile a n u pdate d C onfid entia l I n fo rm atio n f o rm w it h t h e c o urt. W arn in g! A ny notice of a child support action delivered to the last address you provided

on the Confidential Information form will be considered adequate notice, if the party trying

to serve you has shown diligent efforts to locate you.5.Parents’ Income Pare n t ( n am e): P are n t ( n am e): Net monthly income $ .(line 3 of the Worksheets) This income is (check one): imputed to this parent. (Skip to 6.) this parent’s actual income (after any

exclusions approved below). Net monthly income $ .(line 3 of the Worksheets) This income is (check one): imputed to this parent. (Skip to 6.) this parent’s actual income (after any

exclusions approved below). Does this parent have income from

overtime or a 2nd

job? No. (Skip to 6.)Yes. (Fill out below.) Should this income be excluded? (check

one): No. T he c o urt h as i n clu ded t h is

in co m e in this parent’ s g ro ss m onth ly

in co m e o n lin e 1 o f t h e W ork sh eets . Yes. This income sh ould b e e xclu ded

beca use : � This p are nt w ork e d o ve r 4 0 h ours

pe r w eek a ve ra ged o ve r 1 2 m onth s,

an d � Tha t in co m e w as e arn ed t o p ay f o r

c u rre nt f a m ily n eeds d ebts Does this parent have income from

overtime or a 2nd

job? No. (Skip to 6.)Yes. (Fill out below.) Should this income be excluded? (check

one): No. T he c o urt h as i n clu ded t h is

in co m e in this parent’ s g ro ss m onth ly

in co m e o n lin e 1 o f t h e W ork sh eets . Yes. This income sh ould b e e xclu ded

beca use : � This p are nt w ork e d o ve r 4 0 h ours

pe r w eek a ve ra ged o ve r 1 2 m onth s,

an d � Tha t in co m e w as e arn ed t o p ay f o r

c u rre nt f a m ily n eeds d ebts

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 3 of 16 Pare n t ( n am e): P are n t ( n am e): fr o m a p ast r e la tio nsh ip c h ild

su p port d ebt, a nd� This p are nt w ill s to p e arn in g t h is

extr a in co m e a fte r p ayin g t h ese

de bts .T he c o urt h as e xclu ded $

fr o m this parent’ s g ro ss m on th ly

in co m e o n lin e 1 o f t h e W ork sh eets .

Other Findings: fr o m a p ast r e la tio nsh ip c h ild

su p port d ebt, a nd� This p are nt w ill s to p e arn in g t h is

extr a in co m e a fte r p ayin g t h ese

de bts .T he c o urt h as e xclu ded $

fr o m this parent’ s g ro ss m on th ly

in co m e o n lin e 1 o f t h e W ork sh eets .

Other Findings: 6.Imputed Income To calculate child support, the court may impute income to a parent: � whose income is unknown, or �who the court finds is unemployed or under-employed by choice. Imputed income is not actual income. It is an assigned amount the court finds a parent

could or should be earning. (RCW 26.19.071(6)) Pare n t ( n am e): P are n t ( n am e): Does not apply. This parent’s actual

income is used. (Skip to 7 .) Does not apply. This parent’s actual

income is used. (Skip to 7 .)This parent’s monthly net income is

imputed because (check one): th is p are nt’s income is unknown. th is p are nt is voluntarily

unemployed. th is p are nt is voluntarily under-

employed. this parent works full-time but is

purposely under-employed to

reduce child support. The imputed amount is based on the

information below: (Options are listed in

order of required priority. The Court

used the first option possible based on

the information it had.) Full-time pay at current pay rate.Full-time pay based on reliable

information about past earnings.Full-time pay based on incomplete

or irregular information about past

earnings. F ull- tim e p ay a t minimum wage in This parent’s monthly net income is

imputed because (check one): th is p are nt’s income is unknown. th is p are nt is voluntarily

unemployed. th is p are nt is voluntarily under-

employed. this parent works full-time but is

purposely under-employed to

reduce child support. The imputed amount is based on the

information below: (Options are listed in

order of required priority. The Court

used the first option possible based on

the information it had.) Full-time pay at current pay rate.Full-time pay based on reliable

information about past earnings.Full-time pay based on incomplete

or irregular information about past

earnings. F ull- tim e p ay a t minimum wage in

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 4 of 16 Pare n t ( n am e): P are n t ( n am e): the area where the parent lives

because this parent (check all that

apply): is a high school student.re ce ntly w orked at minimum

wage jobs.re ce ntly s topped receiving public

assistance, supplemental

security income (SSI), or

disability.was r e ce ntly in ca rc e ra te d.Table of Median Net Monthly

Income.Other (specify): the area where the parent lives

because this parent (check all that

apply): is a high school student.re ce ntly w orked at minimum

wage jobs.re ce ntly s topped receiving public

assistance, supplemental

security income (SSI), or

disability.was r e ce ntly in ca rc e ra te d.Table of Median Net Monthly

Income.Other (specify): 7.Limits affecting the monthly child support amount Does not apply. The monthly amount was not affected by the upper or lower limits in

RCW 26.19.065. The monthly amount has been affected by (check all that apply):low-income limits. The self-support reserve and presumptive minimum payment

have been calculated in the Worksheets, lines 8.a. - c. the 45% net income limit. The court finds that the paying parent’s child support

obligations for his/her biological and legal children are more than 45% of his/her

net income (Worksheets, line 18). Based on the children’s best interests and the

parents’ circumstances, it is (check one): fair. not fair to apply the 45%

limit. (Describe both parents’ situations):

Com bin ed M onth ly N et I n co m e o ver $ 12,0 00. T ogeth er t h e p are nts e arn m ore

tha n $ 12,0 0 0 p er m onth ( W ork sh eets lin e 4 ). T he c h ild s u pport a m ount ( c h eck o ne): is the presumptive amount from the economic table. is m ore t h an t h e p re su m ptiv e a m ount f r o m t h e e co nom ic t a ble b eca use ( s p ecif y ): 8. Standard Calculation Parent NameStandard calculation

Worksheets line 17$

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 5 of 16 $ Check here if there is a Residential Split– (each parent has at least one of the

children from this relationship living with him/her most of the time.) These children (names and ages): These children (names and ages): Live with (parent’s name): Live with (parent’s name):The standard calculation for the parent paying support is $ . This is from

(check one):

The Attachment for Residential Split Adjustment (Arvey calculation), line G (form

WSCSS–Attachment for RSA). This Attachment to the Child Support Schedule

Worksheets is approved by the court and made part of this order. Other calculation (specify method and attach Worksheet/s): 9. Deviation from standard calculation Should the monthly child support amount be different from the standard calculation? No – The monthly child support amount ordered in section 10 is the same as the

standard calculation listed in section 8 because (check one): Neither parent asked for a deviation from the standard calculation. (Skip to 10 .) There is no good reason to approve the deviation requested by (name/s):

The facts supporting this decision are (check all that apply):

detailed in the Worksheets, Part VIII, lines 20 through 26. the parent asking for a deviation:has a new spouse or domestic partner with income of $ .lives in a household where other adults have income of $ .has income from overtime or a 2nd

job that was excluded in section 5

above. other (specify): Yes – The monthly child support amount ordered in section 10 is different from the

standard calculation listed in section 8 because (check all that apply): A parent or parents in this case has:children from other relationships.p aid or received child support for children from other relationships.gifts, prizes or other assets.income that is not regular (non-recurring income) such as bonuses, overtime,

etc.

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 6 of 16 unusual unplanned debt (extraordinary debt not voluntarily incurred).ta x p la nnin g c o nsid era tio ns t h at w ill n ot r e duce t h e e co nom ic b enefit t o t h e

child re n.very different living costs, which are beyond their control.The children in this case:spend significant time with the parent who owes support. The non-standard

amount still gives the other parent’s household enough money for the children’s

basic needs. The children do not get public assistance (TANF).have extraordinary income. have special needs because of a disability.have special medical, educational, or psychological needs. There a re ( o r w ill b e) c o sts for court-ordered reunification or a voluntary placement

agreement.The parent who owes support has shown it is not fair to have to pay the $50 per

child presumptive minimum payment.The parent who is owed support has shown it is not fair to apply the self-support

reserve (calculated on lines 8.a. – c. of the Worksheets).Other reasons: The facts that support the reasons checked above are (check all that apply): detailed in the Worksheets, Part VIII, lines 20 through 26.the parent asking for a deviation:has a new spouse or domestic partner with income of $ .lives in a household where other adults have income of $ .has income from overtime or a 2nd

job that was excluded in section 5 above. as follows: 10. Monthly child support amount (transfer payment) After considering the standard calculation in section 8, and whether or not to apply a

deviation in section 9 , the court orders the following monthly child support amount

(transfer payment). (Name): must pay child

support to (name): each month as follows for the children

listed below (add lines for additional children if needed):

Child’s Name AgeAmount 1. $2. $3. $

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 7 of 16 4. $5. $ Total monthly child support amount: $ Child turning twelve years old – The monthly amount for

(child’s name) will change to $

starting with the month this child turns twelve (month, year): .

Residential Split – Each parent has at least one of the children from this relationship

living with him/her most of the time. (Name): must pay

child support to (name): each month as follows:

Total monthly child support amount: $11.Starting date and payment schedule The monthly child support amount must be paid starting (month, year):

on the following payment schedule:

in one payment each month by the day of the month.in two payments each month: ½ by the and ½ by the day of the month.other (specify): 12. Step Increase (for modifications or adjustments only) Does not apply. Approved – The court is changing a final child support order. The monthly child

support amount is increasing by more than 30% from the last final child support order.

This causes significant financial hardship to the parent who owes support, so the

increase will be applied in two equal steps: �For six months from the Starting Date in section 11 above, the monthly child

support amount will be the old monthly amount plus ½ of the increase, for a total of

$ each month. �On (date): , six months after the Starting Date in section 11,

the monthly child support amount will be the full amount listed in section 10.

Denied – The court is changing a final child support order (check one): but the monthly payment increased by less than 30%.and the monthly payment increased by more than 30%, but this does not cause a

significant hardship to the parent who owes support. 13.Periodic Adjustment Child support may be changed according to state law. The Court is not ordering a

specific periodic adjustment schedule below. Any party may ask the court to adjust child support periodically on the following

schedule without showing a substantial change of circumstances: The Motion to Adjust Child Support Order may be filed: every months.

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 8 of 16 on (date/s): other (describe condition or event): Important! A party must file a Motion to Adjust Child Support Order (form FL

Modify 521), and the court must approve a new Child Support Order for any

adjustment to take effect. Deadlines, if any (for example, deadline to exchange financial information, deadline to

file the motion): 14.Payment Method (check either Registry or Direct Pay) Registry – Send payment to the Washington State Support Registry. The Division of

Child Support (DCS) will forward the payments to the person owed support and keep

records of all payments. Address for payment: Washington State Support Registry

PO Box 45868, Olympia, WA 98504Phone number/s: 1 (800) 922-4306 or 1 (800) 442-5437Important! If you are ordered to send your support payments to the Washington

State Support Registry, and you pay some other person or organization, you will

not get credit for your payment. DCS Enforcement (if Registry is checked above): DCS will enforce this order because (check all that apply): this is a public assistance case.one of the parties has already asked DCS for services.one of the parties has asked for DCS services by signing the application

statement at the end of this order (above the Warnings).DCS will not enforce this order unless one of the parties applies for DCS services

or the children go on public assistance.Direct Pay – Send payment to the other parent or non-parent custodian by:mail to: street address or PO box city statezipor any new address the person owed support provides to the parent who owes

support. (This does not have to be his/her home address.) other method: 15.Enforcement through income withholding (garnishment) DCS or the person owed support can collect the support owed from the wages, earnings,

assets or benefits of the parent who owes support, and can enforce liens against real or

personal property as allowed by any state’s child support laws without notice to the parent

who owes the support.

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 9 of 16 If this order is not being enforced by DCS and the person owed support wants to have

support paid directly from the employer, the person owed support must ask the court to

sign a separate wage assignment order requiring the employer to withhold wages and

make payments. (Chapter 26.18 RCW.) Income withholding may be delayed until a payment becomes past due if the court finds

good reason to delay. Does not apply. There is no good reason to delay income withholding.Income withholding will be delayed until a payment becomes past due because (check

one): the child support payments are enforced by DCS and there are good reasons in the

children’s best interest not to withhold income at this time. If this is a case about

changing child support, previously ordered child support has been paid on time. List the good reasons here: the child support payments are not enforced by DCS and there are good reasons

not to withhold income at this time. List the good reasons here: the court has approved the parents’ written agreement for a different payment

arrangement. 16. End date for supportSupport must be paid for each child until (check one): the court signs a different order, if this is a temporary order.the child turns 18 or is no longer enrolled in high school, whichever happens last,

unless the court makes a different order in section 17.the child turns 18 or is otherwise emancipated, unless the court makes a different

order in section 17.after (child’s name): turns 18. Based on

information available to the court, it is expected that this child will be unable to support

him/herself and will remain dependent past the age of 18. Support must be paid until

(check one):

this child is able to support him/herself and is no longer dependent on the parents. other: other (specify): 17.Post-secondary educational support (for college or vocational school) Reserved – A parent or non-parent custodian may ask the court for post-secondary

educational support at a later date without showing a substantial change of

circumstances by filing a Petition to Modify Child Support Order (form FL Modify 501).

The Petition must be filed before child support ends as listed in section 16.Granted – The parents must pay for the children’s post-secondary educational

support. Post-secondary educational support may include support for the period after

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 10 of 16 high school and before college or vocational school begins. The amount or

percentage each person must pay (check one): will be decided later. The parties may make a written agreement or ask the

court to set the amount or percentage by filing a Petition to Modify Child

Support Order (form FL Modify 501).is as follows (specify): Denied – The request for post-secondary educational support is denied.Other (specify): 18.Claiming children as dependents on tax forms Does not apply.The parties have the right to claim the children as their dependents on their tax forms

as follows (check one):Every year – (name):

has the right to claim (children’s names): ;

and (name):

has the right to claim (children’s names): .

Alternating – (name):

has the right to claim the children for (c h eck o ne): e ve n o dd y e ars . T he

oth er p are nt h as t h e r ig ht t o c la im t h e c h ild re n f o r t h e o pposit e y e ars .

Other (specify): For tax years when a non-custodial parent has the right to claim the children, the

parents must cooperate to fill out and submit IRS Form 8332 in a timely manner. Warning! Under federal law, the parent who claims a child as a dependent may owe a

tax penalty if the child is not covered by health insurance.19. Health Insurance Important! Read the Health Insurance Warnings at the end of this order. The court is not ordering how health insurance must be provided for the children

because the court does not have enough information to determine the availability of

accessible health insurance for the children (insurance that could be used for the

children’s primary care). The law requires every parent to provide or pay for health

insurance. The Division of Child Support (DCS) or any parent can enforce this

requirement. (Skip to

20 .)

OR (Name): must pay the premium to provide health

insurance coverage for the children. The court has considered the needs of the

children, the cost and extent of coverage, and the accessibility of coverage.

The other parent must pay his/her proportional share* of the premium paid. Health

insurance premiums (check one):

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 11 of 16 are included on the Worksheets (line 14). No separate payment is needed. are not included on the Worksheets . Separate payment is needed. A parent

or non-parent custodian may ask DCS or the court to enforce payment for the

proportional share. *Proportional share is each parent’s percentage share of the combined net

income from line 6 of the Child Support Schedule Worksheets. The other parent is not ordered to pay for any part of the children’s insurance

because (explain): A parent has been ordered to pay an amount that is more than 25% of his/her

basic support obligation ( Worksheets, line 19). The court finds this is in the

children’s best interest because: Neither parent can be ordered to pay an amount towards health insurance premiums

that is more than 25% of his/her basic support obligation (Worksheets, line 19)

unless the court finds it is in the best interest of the children. Other (specify): 20.Health insurance if circumstances change or court has not orderedIf the parties’ circumstances change, or if the court is not ordering how health insurance

must be provided for the children in section 19: �A parent, non-parent custodian, or DCS can enforce the medical support requirement. �If a parent does not provide proof of accessible private insurance (insurance that can

be used for the children’s primary care), that parent must:�Get (or keep) insurance through his/her work or union, unless the insurance costs

more than 25% of his/her basic support obligation (line 19 of the Worksheets), � Pay his/her share of the other parent’s monthly premium up to 25% of his/her basic

support obligation (line 19 of the Worksheets), or �Pay his/her share of the monthly cost of any public health care coverage, such as

Healthy Kids, BHP, or Medicaid, for which there is an assignment. 21. Children’s expenses not included in the monthly child support amountUninsured medical expenses – Each parent is responsible for a share of uninsured

medical expenses as ordered below. Uninsured medical expenses include premiums, co-

pays, deductibles, and other health care costs not covered by insurance.

Children’s Expenses for: Parent (name):

Parent (name): Make payments to:

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 12 of 16 pays monthly pays monthlyPerson

who pays

the

expense

Service

ProviderUninsured

medical expenses Proportional

Share* %** Proportional

Share* %** * Proportional Share is each parent’s percentage share of the combined net income

from line 6 of the Child Support Schedule Worksheets.**If the percentages ordered are different from the Proportional Share, explain why: Other shared expenses (check one): Doe s n ot a pply . T he m onth ly a m ount c o ve rs a ll e xp ense s, e xce pt h ealt h c a re e xp ense s.The parents will share the cost for the expenses listed below (check all that apply):Make payments to:

Children’s Expenses for:

Parent (name):

pays monthly

Parent (name):

pays monthly

Person

who pays

the

expense

Service

Provider Day care: Proportional

Share* $ %** Proportional

Share* $ %**

Education: Proportional

Share* $ %** Proportional

Share* $ %** Long-

distance transportatio n:

Proportional

Share* $ %** Proportional

Share* $ %**

Other

(specify): Proportional

Share* $ %** Proportional

Share* $ %**

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 13 of 16 *Proportional Share is each parent’s percentage share of the combined net income

from line 6 of the Child Support Schedule Worksheets.**If any percentages ordered are different from the Proportional Share, explain why: Other (give more detail about covered expenses here, if needed) : A person receiving support can ask DCS to collect:� expenses owed directly to him/her. � reimbursement for expenses the person providing support was ordered to pay. � an order for a money judgment that s/he got from the court.

22.Past due child support, medical support and other expenses This order does not address any past due amounts or interest owed. As of (date): , neither parent owes (check all that apply): past due child support interest on past due child supportpast due medical support interest on past due medical supportpast due other expenses interest on past due other expenses to (check all that apply): the other parent or non-parent custodian. the state. The court orders the following money judgments (summarized in section 1 above): Judgment forDebtor’s name

(person who

must pay

money) Creditor’s name (person

who must be

paid)AmountInterest Past due ch ild s u pport

fr o m t o $$ Past due medical

sup port ( health ins. &

health care costs not

covered by ins.)

fro m t o $$ Past due expenses

for: day care education long-distance

transp. fr o m t o $$ Other (describe) : $$The interest rate for child support judgments is 12%.

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 14 of 16 Other (specify):

23.Overpayment caused by change Does not apply.The Order signed by the court today or on date:

caused an overpayment of $ .

(Name): shall repay this amount

to (Name): by (date): .

The overpayment shall be credited against the monthly support amount owed each

month at the rate of $ each month until paid off.Other (specify): 24.Other Orders All t h e W arn in gs b elo w a re r e quir e d b y la w a nd a re in co rp ora te d a nd m ade p art o f t h is o rd er. Other (specify): Ord ere d .Date Judge or Commissioner

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 15 of 16 Petitioner and Respondent or their lawyers fill out below:This document (check any that apply): This document (check any that apply): is an agreement of the parties is an agreement of the parties is presented by me is presented by me may be signed by the court without notice to me may be signed by the court without notice to me Petitioner signs here or lawyer signs here + WSBA # Respondent signs here or lawyer signs here + WSBA #Print Name DatePrint Name Date

If any parent or child received public assistance: The state Department of Social and Health Services (DSHS) was notified about this order

through the Prosecuting Attorney’s office, a nd has reviewed and approved the following: child s u pport medic a l s u pport p ast d ue c h ild s u pport oth er ( s p ecif y ): Deputy Prosecutor signs here Print name and WSBA # Date

Parent or Non-Parent Custodian applies for DCS enforcement services: I ask the Division of Child Support (DCS) to enforce this order. I understand that DCS will

keep $25 each year as a fee if DCS collects more than $500, unless I ask to be excused

from paying this fee in advance. (You may call DCS at 1-800-442-5437. DCS will not

charge a fee if you have ever received TANF, tribal TANF, or AFDC.) Parent or Non-Parent Custodian signs here Print name Date

(lawyer cannot sign for party)All the warnings below are required by law and are part of the

order. Do not remove.Warnings! If you don’t follow this child support

order…�DO L o r o th e r lic e nsin g a gencie s m ay d eny,

su sp en d, o r r e fu se t o r e new y o ur lic e nse s,

in clu d in g y o ur d riv e r’s lic e nse a nd b usin ess

or p ro fe ssio n al lic e nse s, a nd�D ept. o f F is h a nd W ild lif e m ay s u sp end o r

re fu se t o is s u e y o ur f is h in g a nd h untin g

lic e nse s a nd y o u m ay n ot b e a ble t o g et

pe rm it s . ( R CW 7 4.2 0A .3 20) If you receive child support…You may have to:�Document how that support and any cash

received for the children’s health care was

spent.�Repay the other parent for any day care or

special expenses included in the support if

you didn’t actually have those expenses.

(RCW 26.19.080)

RCW 26.09.135; 26.26.132; 26.10.050Mandatory Form (07/2017) FL All Family 130 Child Support Order p. 16 of 16 Health Insurance Warnings! Both parents must keep the Support Registry informed whether or not they have access to health

insurance for the children at a reasonable cost, and provide the policy information for any such

insurance. * * * If you are ordered to provide children’s health insurance…You have 20 days from the date of this order to send: �proof that the children are covered by insurance, or � proof that insurance is not available as ordered.Send your proof to the other parent or to the Support Registry (if your payments go there).If you do not provide proof of insurance: �The other parent or the support agency may contact your employer or union, without notifying you,

to ask for direct enforcement of this order (RCW 26.18.170), and �The other parent may:� Ask the Division of Child Support (DCS) for help,�Ask the court for a contempt order, or �File a Petition in court.Don’t cancel your children’s health insurance without the court’s approval, unless your job ends and

you can no longer get or continue coverage as ordered in section 19 through your job or union. If your

insurance coverage for the children ends, you must notify the other parent and the Support Registry.If an insurer sends you payment for a medical provider’s service: �you must send it to the medical provider if the provider has not been paid; or �you must send the payment to whoever paid the provider if someone else paid the provider; or�you may keep the payment if you paid the provider.If the children have public health care coverage, the state can make you pay for the cost of the monthly

premium.Always inform the Support Registry and other parent if your access to health insurance changes or

ends.

Convenient tips for preparing your ‘Births Marriages Deaths Fi Papers Past’ online

Are you weary of the inconvenience of managing paperwork? Look no further than airSlate SignNow, the top electronic signature service for individuals and businesses. Bid farewell to the tedious procedure of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Take advantage of the robust features included in this user-friendly and budget-friendly platform and transform your approach to document management. Whether you need to sign forms or collect signatures, airSlate SignNow manages everything efficiently, needing just a few clicks.

Adhere to this step-by-step guideline:

- Log into your account or start a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Access your ‘Births Marriages Deaths Fi Papers Past’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for additional parties (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Births Marriages Deaths Fi Papers Past or send it for notarization—our solution provides everything you need to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!