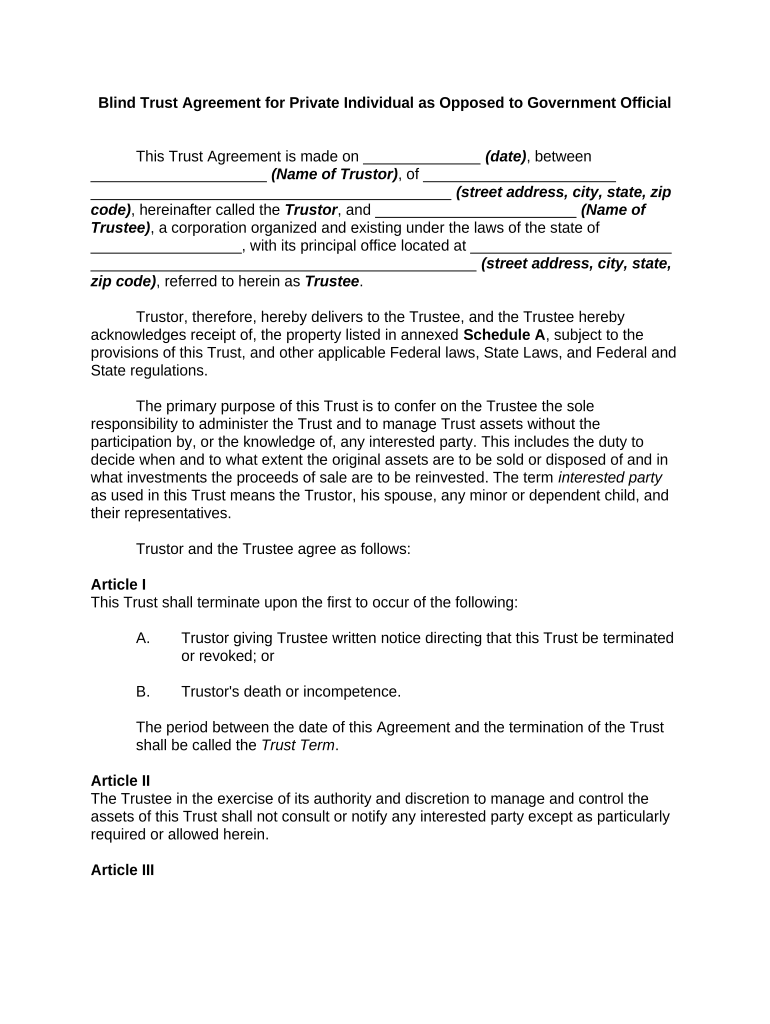

Blind Trust Agreement for Private Individual as Opposed to Government Official

This Trust Agreement is made on ______________ (date) , between

_____________________ (Name of Trustor) , of _______________________

___________________________________________ (street address, city, state, zip

code) , hereinafter called the Trustor , and ________________________ (Name of

Trustee) , a corporation organized and existing under the laws of the state of

__________________, with its principal office located at ________________________

______________________________________________ (street address, city, state,

zip code) , referred to herein as Trustee .

Trustor, therefore, hereby delivers to the Trustee, and the Trustee hereby

acknowledges receipt of, the property listed in annexed Schedule A , subject to the

provisions of this Trust, and other applicable Federal laws, State Laws, and Federal and

State regulations.

The primary purpose of this Trust is to confer on the Trustee the sole

responsibility to administer the Trust and to manage Trust assets without the

participation by, or the knowledge of, any interested party. This includes the duty to

decide when and to what extent the original assets are to be sold or disposed of and in

what investments the proceeds of sale are to be reinvested. The term interested party

as used in this Trust means the Trustor, his spouse, any minor or dependent child, and

their representatives.

Trustor and the Trustee agree as follows:

Article I

This Trust shall terminate upon the first to occur of the following:

A. Trustor giving Trustee written notice directing that this Trust be terminated

or revoked; or

B. Trustor's death or incompetence.

The period between the date of this Agreement and the termination of the Trust

shall be called the Trust Term .

Article II

The Trustee in the exercise of its authority and discretion to manage and control the

assets of this Trust shall not consult or notify any interested party except as particularly

required or allowed herein.

Article III

A. None of the assets initially placed in Trust hereunder, as listed in annexed

Schedule A , is prohibited as a holding by any interested party and/or applicable

Federal laws, State Laws, and Federal and State regulations.

B. Each asset listed in annexed Schedule A is free of any restriction with respect to

its transfer or sale, except as fully described in such Schedule A .

C. During the Trust Term, the interested parties shall not pledge, mortgage, or

otherwise encumber their interests in the property held in Trust hereunder.

D. The Trustee shall not knowingly or negligently disclose to the public or to any

interested party any information as to the acquisition, retention, or disposition of any

particular securities or other Trust property; except that, the Trustee shall promptly

notify the Trustor when the holdings of any particular asset transferred to the Trust by

any interested party have been completely disposed of or when the value of that asset

becomes less than $1,000.

E. The income tax return of the Trust shall be prepared by the Trustee, and such

return and any information relating thereto (other than the Trust income summarized in

appropriate categories necessary to complete an interested party's tax return), shall not

be disclosed publicly or to any interested party. To effectuate the provisions of this

Article, the Trustee shall use its best efforts to provide the interested party, promptly

after the close of each taxable year of the Trust during the Trust Term, with that

information concerning the Trust, including information on income, expenses, capital

gains and capital losses, which is necessary for the interested party to prepare and file

tax returns required by the laws of the United States and the laws of any State, district

or political subdivision; provided however, that in no event shall the Trustee disclose

publicly or to any interested party any information whatsoever which might identify the

securities or other property which comprise the assets of the Trust or identify the

securities or other property which have been sold from the assets of the Trust.

F. An interested party shall not receive any report on the holdings and sources of

income of the Trust; except that the Trustee shall:

1. Make quarterly reports of the aggregate market value of the assets

representing such interested party's interest in the Trust,

2. Report the net income or loss of the Trust and make other reports

necessary to enable the interested party to complete an individual tax return

required by law and this Trust, and

3. Provide an annual report to Trustor of the aggregate amount of the Trust's

income attributable to the Trust.

Article IV

With the exception of the provisions of Article III above, there shall be no direct or

indirect communication between Trustor or any other interested party and the Trustee

with respect to the Trust unless it relates only:

A. To a request for a distribution in cash or other unspecified assets of the

Trust,

B. To the general financial interest and needs of the interested party

(including, but not limited to, a preference for current income or long-term

appreciation),

C. To the notification of the Trustee of a law or regulation subsequently

applicable to the reporting individual which prohibits the interested party from

holding an asset, which notification directs that the asset not be held by the

Trust, or

D. To directions to the Trustee to sell all of an asset initially placed in the

Trust by an interested party which in the determination of the Trustor creates a

conflict of interest or the appearance thereof due to the subsequent assumption

of duties by the Trustor (but any such direction is not required).

Article V

The interested parties shall not take any action to obtain, and shall take appropriate

action to avoid receiving, information with respect to the holdings of, and the sources of

income of, the Trust, including obtaining a copy of any Trust tax return filed by the

Trustee or any information relating thereto, except for the reports and information

specified in this Trust.

Article VI

The Trustee shall not knowingly or negligently:

A. Disclose any information to any interested party with respect to this Trust

that may not be disclosed pursuant to any provision or requirement of this Trust,

B. Acquire any holding the ownership of which is prohibited by, or not in

accordance with the terms of, this Trust,

C. Solicit advice from any interested party with respect to this Trust, which

solicitation is prohibited by law or any provision of this Trust, or

D. Fail to file any document required by law.

Article VII

The Trustor shall not knowingly or negligently solicit or receive any information with

respect to this Trust that may not be disclosed pursuant to any provision of this Trust.

Article VIII

Subject to such amounts as the Trustee may from time to time reserve for the payment

of such income taxes as may be due and payable by the Trust, and for payment of

expenses and compensation as provided for in this Trust, during the Trust Term the

Trustee shall pay to the Trustor $___________ at the beginning of each month.

Article IX

In addition to the rights, duties, and powers conferred upon the Trustee by law, the

Trustee shall have the following powers, rights, and discretion with respect to any

Trust property held by it:

A. To sell, exchange, or otherwise dispose of the property in such manner

and upon such terms as the Trustee in its sole discretion shall deem appropriate;

B. Except as limited by specific enumeration in this Trust agreement, to

invest and reinvest the principal and any undistributed income, in property of any

kind;

C. Except as limited by specific enumeration in this Trust agreement, to

participate in any reorganization, consolidation, merger, or dissolution of any

corporation having stocks, bonds or other securities which may be held at any

time, to receive and hold any property which may be allocated or distributed to it

by reason of participation in any such reorganization, consolidation, merger, or

dissolution;

D. To exercise all conversion, subscription, voting, and other rights of

whatsoever nature pertaining to any such property and to grant proxies,

discretionary, or otherwise, with respect thereto;

E. To elect, appoint, and remove directors of any corporation, the stock of

which shall constitute Trust property, and to act through its nominee as a director

or officer of any such corporation;

F. Except as limited by specific enumeration in this Trust agreement, to

manage, control, operate, convert, reconvert, invest, reinvest, sell, exchange,

lease, mortgage, grant a security interest in, pledge, pool, or otherwise encumber

and deal with the property of this Trust, for Trust purposes and in behalf of the

Trust to the same extent and with the same powers that any individual would

have with respect to his own property and funds;

G. Except as limited by specific enumeration in this Trust agreement, to

borrow money from any person or corporation (including the Trustee hereunder)

and for the purpose of securing the payment thereof, to pledge, mortgage, or

otherwise encumber any and all such property for Trust purposes upon such

terms, covenants, and conditions as it may deem proper and also to extend the

time of payment of any loans or encumbrances which at any time may be

encumbrances on any such property irrespective of by whom the same were

made or where the obligations may or should ultimately be borne on such terms,

covenants, and conditions as it may deem proper;

H. To register any property belonging to the Trust in the name of its nominee,

or to hold the same unregistered, or in such form that title shall pass by delivery;

I. To abandon, settle, compromise, extend, renew, modify, adjust, or submit

to arbitration in whole or in part and without the order or decree of any court any

and all claims whether such claims shall increase or decrease the assets held

under this Trust agreement;

J. To determine whether or to what extent receipts should be deemed

income or principal, whether or to what extent expenditures should be charged

against principal or income, and what other adjustments should be made

between principal and income, provided that such adjustments shall not conflict

with well-settled rules for the determination of principal and income adjustments,

or the Uniform Principal and Income Act, if in effect in the State of ____________

(name of state) ;

K. To determine whether or not to amortize bonds purchased at a premium;

L. Except to the extent otherwise expressly provided in this Trust agreement,

to make distributions in kind or in cash or partly in each and for such purposes to

fix, insofar as legally permissible, the value of any property;

M. To pay such persons employed by the Trustee to assist it in the

administration of the Trust, including investment counsel, accountants, and those

engaged for assistance in preparation of tax returns, such sums as the Trustee

deems to be reasonable compensation for the services rendered by such

persons. Such persons may rely upon and execute the written instructions of the

Trustee, and shall not be obliged to inquire into the propriety thereof;

N. No person may be employed or consulted by the Trustee to assist it in any

capacity in the administration of the Trust or the management and control of

Trust assets, including investment counsel, investment advisers, accountants,

and those engaged for assistance in preparation of tax returns, unless the

following four conditions are met:

1. When an interested party learns about such employment or

consultation, the person must sign the Trust instrument as a party;

2. Under all the facts and circumstances, the person is determined

pursuant to the requirements for eligible entities to be independent of any

interested party with respect to the Trust arrangement,

3. The person is instructed by the Trustee to make no disclosure

publicly or to any interested party which might specifically identify current

Trust assets or those assets which have been sold or disposed of from

Trust holdings, and

4. The person is instructed by the Trustee to have no direct

communication with any interested party, and that any indirect

communication with an interested party shall be made only through the

Trustee pursuant to the terms of this Trust;

O. Except as specifically limited in this Trust agreement, to do all such acts,

take all such proceedings, and exercise all such rights and privileges, although

not otherwise specifically mentioned in this Article, with relation to any such

property, as if the Trustee were the absolute owner thereof, and in connection

therewith to make, execute, and deliver any instruments and to enter into any

covenants or agreements binding the Trust.

Article X

The Trustee shall not at any time be held liable for any action taken or not taken or for

any loss or depreciation of the value of any property held in the Trust whether due to an

error of judgment or otherwise where the Trustee has exercised good faith and ordinary

diligence in the exercise of its duties such as would have been exercised by a prudent

man.

Article XI

No Trustee hereunder shall be required, in any jurisdiction, to furnish any bond or other

security, or to obtain the approval of any court before applying, distributing, selling,

or otherwise dealing with property.

Article XII

Except as provided in this Trust, the Trustee shall make no accounting to the Trustor

until the date of termination of this Trust, and, at such time, it shall be required to make

full and proper accounting and turn over to the Trustor all assets of the Trust then held

by it the said Trustee.

Article XIII

The Trustee shall be compensated in accordance with the table in the annexed

Schedule B , or as provided for by the laws of the State of ________________ (name

of state) .

Article XIV

The Trustee (and any substitute or successor) shall have the right, by a duly

acknowledged instrument delivered to the Trustor, to resign as Trustee in which event

the Trustor shall designate and appoint a substitute or successor Trustee in its place

and stead, which shall have all of the rights, powers, discretions, and duties conferred

or imposed hereunder upon the original Trustee.

Article XV

The validity, construction, and administration of this Trust shall be governed by the laws

of the State of _______________ (name of state) .

WITNESS our signatures as of the day and date first above stated.

_______________________________

Name of Trustee

________________________ By_________________________________

(Printed Name of Trustor) ______________________________

______________________ (P rinted Name & Office in Corporation

(Signature of Trustor) __________________________________

(Name & Office in Corporation)

Attach Schedules

Acknowledgements (may vary by state)