Fill and Sign the Business Credit Application Connecticut Form

Useful tips for finishing your ‘Business Credit Application Connecticut’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Say farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the powerful features contained within this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect eSignatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Follow this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Business Credit Application Connecticut’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or transform it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Business Credit Application Connecticut or send it for notarization—our platform has you supported with everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

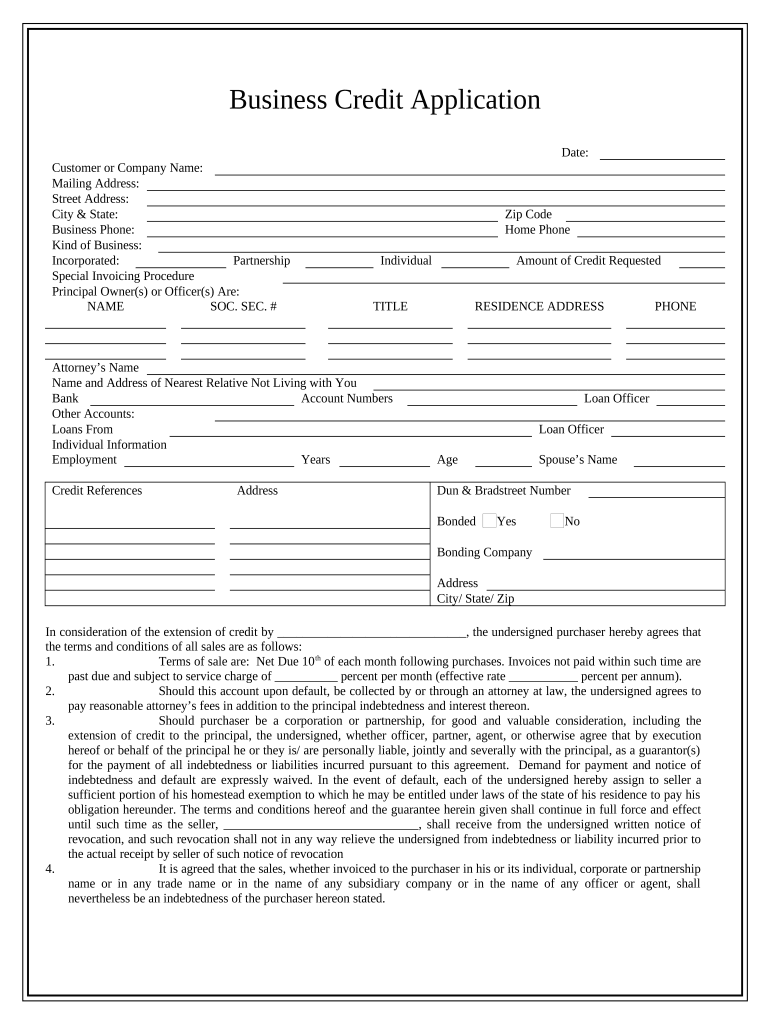

What is a Business Credit Application in Connecticut?

A Business Credit Application in Connecticut is a formal document that allows businesses to apply for credit from suppliers or financial institutions. This application typically requires details about the business's financial history, ownership, and creditworthiness. By utilizing tools like airSlate SignNow, businesses can easily create, send, and eSign their applications securely and efficiently.

-

How does airSlate SignNow streamline the Business Credit Application process in Connecticut?

airSlate SignNow simplifies the Business Credit Application process in Connecticut by providing an intuitive platform for document creation and electronic signatures. Users can quickly fill out application forms, gather necessary signatures, and track the progress of their submissions all in one place. This efficiency helps businesses save time and reduce paperwork.

-

What are the pricing options for using airSlate SignNow for Business Credit Applications in Connecticut?

airSlate SignNow offers competitive pricing plans tailored to different business needs, making it affordable for any size of business in Connecticut. Each plan includes features like unlimited document signing, integrations with popular software, and secure cloud storage. You can choose a plan that best fits your requirements for handling Business Credit Applications.

-

Is airSlate SignNow compliant with Connecticut business regulations for credit applications?

Yes, airSlate SignNow is designed to comply with relevant business regulations in Connecticut, ensuring that your Business Credit Application meets legal requirements. Our platform adheres to industry standards for electronic signatures and data protection, giving you peace of mind while managing sensitive financial information.

-

Can I integrate airSlate SignNow with other software for my Business Credit Application in Connecticut?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, including CRM systems and accounting software. This integration allows businesses in Connecticut to streamline their workflows when processing Business Credit Applications, making it easier to manage customer data and financial records.

-

What features does airSlate SignNow offer for processing Business Credit Applications in Connecticut?

airSlate SignNow provides a range of features to enhance the processing of Business Credit Applications in Connecticut. These include customizable templates, real-time tracking, automated reminders, and secure cloud storage. These features ensure that your application process is efficient, organized, and secure.

-

How can electronic signatures benefit my Business Credit Application in Connecticut?

Using electronic signatures for your Business Credit Application in Connecticut can signNowly speed up the approval process. Electronic signatures are legally recognized and can be executed from anywhere, allowing for quicker turnaround times. This convenience helps businesses secure credit approvals faster and enhances overall efficiency.

The best way to complete and sign your business credit application connecticut form

Find out other business credit application connecticut form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles