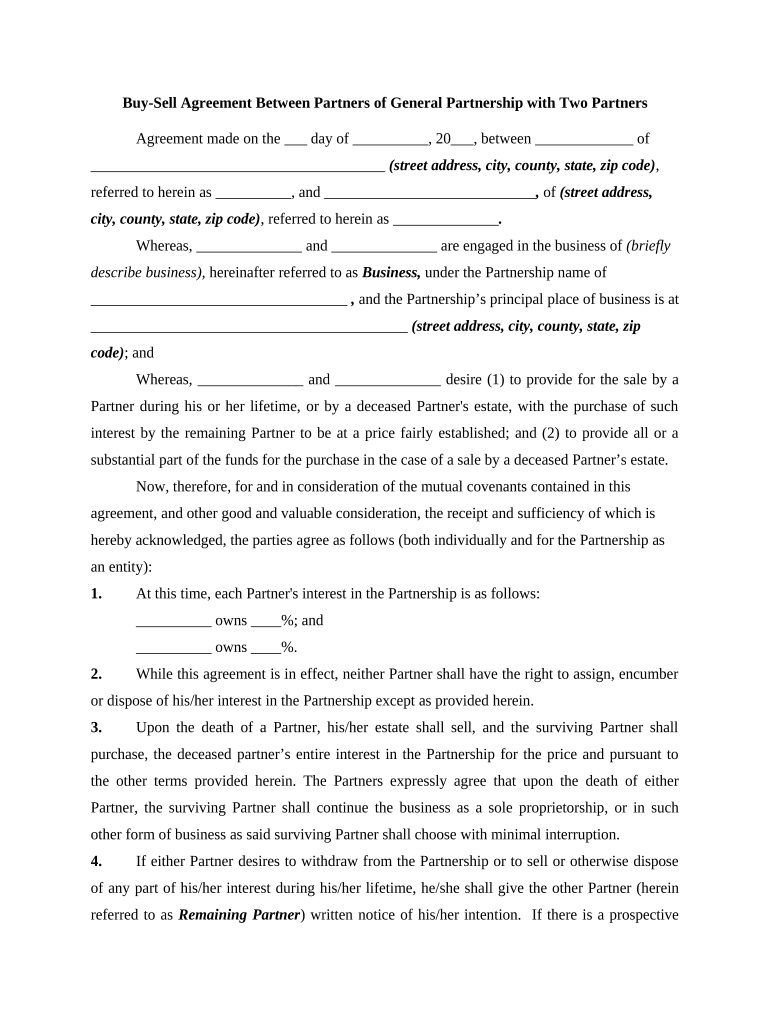

Buy-Sell Agreement Between Partners of General Partnership with Two Partners

Agreement made on the ___ day of __________, 20___, between _____________ of

_______________________________________ (street address, city, county, state, zip code) ,

referred to herein as __________ , and ____________________________ , of (street address,

city, county, state, zip code) , referred to herein as ______________ .

Whereas, ______________ and ______________ are engaged in the business of (briefly

describe business), hereinafter referred to as Business, under the Partnership name of

__________________________________ , and the Partnership’s principal place of business is at

__________________________________________ (street address, city, county, state, zip

code) ; and

Whereas, ______________ and ______________ desire (1) to provide for the sale by a

Partner during his or her lifetime, or by a deceased Partner's estate, with the purchase of such

interest by the remaining Partner to be at a price fairly established; and (2) to provide all or a

substantial part of the funds for the purchase in the case of a sale by a deceased Partner’s estate.

Now, therefore, for and in consideration of the mutual covenants contained in this

agreement, and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the parties agree as follows (both individually and for the Partnership as

an entity):

1. At this time, each Partner's interest in the Partnership is as follows:

__________ owns ____%; and

__________ owns ____%.

2. While this agreement is in effect, neither Partner shall have the right to assign, encumber

or dispose of his/her interest in the Partnership except as provided herein.

3. Upon the death of a Partner, his/her estate shall sell, and the surviving Partner shall

purchase, the deceased partner’s entire interest in the Partnership for the price and pursuant to

the other terms provided herein. The Partners expressly agree that upon the death of either

Partner, the surviving Partner shall continue the business as a sole proprietorship, or in such

other form of business as said surviving Partner shall choose with minimal interruption.

4. If either Partner desires to withdraw from the Partnership or to sell or otherwise dispose

of any part of his/her interest during his/her lifetime, he/she shall give the other Partner (herein

referred to as Remaining Partner ) written notice of his/her intention. If there is a prospective

transferee other than the Remaining Partner, such notice shall state the name and address of such

transferee and the terms and conditions of the proposed transfer.

5. Upon receipt of such written notice referred to in Paragraph 4, the Remaining Partner

shall have the right to purchase all of the interest offered for sale or transfer. The purchase price

shall be the amount established in Paragraphs 8 and 9 below; provided, however, that if a lower

price was stated in the notice to the Partnership, the Remaining Partner shall have the right to

purchase said partnership interest at such lower price.

6. The Remaining Partner shall pay for the interest of the selling Partner in cash (or by cash

and a Promissory Note as described in Paragraph 7 ) on the date of sale, and thereafter the

selling Partner shall not participate in the profits of the Business.

7. The Remaining Partner shall have the right to pay for the interest he/she purchases upon

the following terms: ____ % of the purchase price in cash upon the date of exercise of the option

to purchase with the balance to be evidenced by a Promissory Note containing the following

provisions:

A . The unpaid balance of said Note shall bear interest at the rate of ___% per annum.

B. Principal and interest shall be due and payable at the address of selling partner in

____consecutive equal monthly install ments on the first day of each month beginning on

the first day of the month following the exercise of this option by Remaining Partner.

Each subsequent monthly installment shall be due and payable on the first day of each

succeeding month thereafter until the entire indebtedness evidenced by this Note is fully

paid.

C. In the event default is made in the payment of this Note at maturity, or of any

installment thereof, whether maturing by expiration of time, by default as herein

provided, and same is placed in the hands of an attorney for collection, then an additional

amount of Fifteen Percent (15%) on the principal and interest of this Note shall be added

to the same as a collection fee, and the failure to pay any installment when due shall

mature the entire indebtedness at the option of the holder of this Note.

D. The Remaining Partner may prepay the principal amount outstanding in whole or

in part without penalty. The holder of this Note may require that any partial prepayments

(i) be on the date monthly installments are due, and (ii) be in the amount of that part of

one or more monthly installments which would be applicable to principal. Any partial

prepayment shall be applied against the principal amount outstanding and shall not

postpone the due date of any subsequent monthly installments or change the amount of

such installments, unless the holder of this Note shall otherwise agree in writing.

E. The Remaining Partner shall waive presentation for payment, demand, protest,

diligence in collecting, and notice of dishonor, notice of extension of time, notice of

protest, and notice of nonpayment of this Note.

8. ________________ and ______________ agree that at this time the fair market value of

the Partnership’s assets, including goodwill is $_________________, and the purchase price to

be paid by the Remaining Partner pursuant to this Agreement shall be ____% of that amount.

This values shall remain effective for the purposes herein until there is a redetermination of the

value as provided in Paragraph 9.

9. At the end of each fiscal year of the Partnership, the Partners shall redetermine this value

and shall indicate the new values by entries in Schedule A attached hereto. Each new set of

values entered in Schedule A shall be signed by both Partners, and the last value entered

opposite in Schedule A shall be controlling for the purposes of this Agreement. In determining

the value of a deceased Partner's interest in the Partnership after his/her death, the excess of the

death claim proceeds over the cash values of the insurance policies on his/her life which are

subject to this Agreement at the time of his/her death shall not be taken into account.

10. To assure that all or a substantial part of the purchase price of a deceased Partner's

interest will be available in cash upon his/her death, the Partnership has purchased key man life

insurance on the lives of each Partner from the ___________Insurance Company in the amount

of $_______________ with the Partnership as the beneficiary.

11. The Procedure upon the death of a Partner shall be as follows:

A. The surviving Partner, on behalf of the Partnership as beneficiary, shall promptly

file a claim to collect in cash the one-sum death proceeds of the policies on the deceased

Partner's life. Upon the collection of such proceeds and the qualification of a personal

representative for the deceased Partner, the surviving Partner shall pay over to the

personal representative an amount equal to the full proceeds collected, in part or in full

payment for the deceased Partner's interest in the Partnership.

B. If the one-sum death proceeds of the policy on the deceased Partner's life is

less than the total purchase price for his/her interest as provided herein, the surviving

partner, on behalf of the Partnership, shall either pay the balance forthwith in cash, or in

lieu of such cash payment shall execute and deliver to the personal representative of the

deceased partner’s estate a Promissory Note containing the following provisions:

i . The unpaid balance of said Note shall bear interest at the rate of ___% per

annum.

ii. Principal and interest shall be due and payable, at such address as the personal

representative of the deceased partner shall designate to the surviving Partner in writing,

in ____consecutive equal monthly install ments on the first day of each month beginning

on the first day of the month following the payment of the insurance proceeds to the

personal representative of the deceased partner’s estate. Each subsequent monthly

installment shall be due and payable on the first day of each succeeding month thereafter

until the entire indebtedness evidenced by this Note is fully paid.

iii. In the event default is made in the payment of this Note at maturity, or of any

installment thereof, whether maturing by expiration of time, by default as herein

provided, and same is placed in the hands of an attorney for collection, then an additional

amount of Fifteen Percent (15%) on the principal and interest of this Note shall be added

to the same as a collection fee, and the failure to pay any installment when due shall

mature the entire indebtedness at the option of the holder of this Note.

iv. The surviving Partner may prepay the principal amount outstanding in whole

or in part without penalty. The holder of this Note may require that any partial

prepayments (i) be on the date monthly installments are due, and (ii) be in the amount

of that part of one or more monthly installments which would be applicable to principal.

Any partial prepayment shall be applied against the principal amount outstanding and

shall not postpone the due date of any subsequent monthly installments or change the

amount of such installments, unless the holder of this Note shall otherwise agree in

writing.

v. The surviving Partner shall waive presentation for payment, demand, protest,

diligence in collecting, and notice of dishonor, notice of extension of time, notice of

protest, and notice of nonpayment of this Note.

D. The personal representative of the deceased Partner shall promptly execute (and

shall cause any other party or parties whose signatures may be necessary to transfer a

complete title to the deceased Partner's interest to execute) and, concurrently with receipt of

the full purchase price for the deceased Partner's interest (either in cash, or in cash and note,

as provided above), shall deliver all instruments necessary to effectuate the transfer of the

deceased Partner's interest in and to the Partnership, as of the date of the deceased Partner's

death. Transfer of such interest shall be made free and clear of all taxes, debts, claims, or

other encumbrances whatsoever, except for any promissory note given pursuant to

Subparagraph C.

E. Concurrently with the transfer to the Partnership of the deceased Partner's interest,

the surviving Partner shall execute and deliver to the personal representative of the deceased

Partner, an instrument or instruments by which the surviving Partner assures that all the debts

and obligations of the Partnership shall be timely paid and shall indemnify the deceased Partner's

estate against all Partnership liabilities and any and all claims by the surviving Partner or by

Partnership creditors.

12. Each Partner shall have the right to purchase from the Partnership any policy or policies

on his/her life which are subject to this agreement upon withdrawing from the Partnership during

his/her lifetime as provided above; or upon the termination of this Agreement during his/her

lifetime, under any of the circumstances enumerated in below. This right of purchase shall be

exercised as to each policy by paying to the Partnership, in cash, an amount equal to the cash

surrender value as defined in the policy, adjusted to the date of transfer of ownership of the

policy to the purchaser. The right of purchase shall lapse if it is not exercised within ____days

after occurrence of the event giving rise to the right of purchase.

13. This Agreement shall terminate upon:

A . The written agreement of the Partnership and the Partners;

B. The dissolution of the Partnership other than by the death of a Partner; or

C. The death of both Smith and Doe simultaneously, or within a period of ____ days.

14. This Agreement shall be binding upon the Partners, their heirs, legal representatives,

successors and assignees; and upon the Partnership, its successors and assigns.

15. The Partnership, the Partners, the personal representative of any deceased Partner, and all

other parties bound by this agreement shall promptly execute and deliver any and all papers or

instruments necessary or desirable to carry out the provisions of this Agreement.

16. Any notice provided for under this Agreement shall be deemed duly given if delivered

or mailed by certified or registered mail to the party entitled to receive such notice at the address

of the office of the Partnership.

17. Notwithstanding the foregoing, and anything herein to the contrary notwithstanding,

any dispute under this agreement shall be required to be resolved by binding arbitration of the

parties hereto. If the parties cannot agree on an arbitrator, each party shall select one arbitrator

and both arbitrators shall then select a third. The third arbitrator so selected shall arbitrate said

dispute. The arbitration shall be governed by the rules of the American Arbitration Association

then in force and effect.

18. This Agreement shall be construed according to the law of the State of ___________.

WITNESS our signatures as of the day and date first above stated.

____________________________ _____________________________

______________, individually and _______________, individually and

as a General Partner as a General Partner