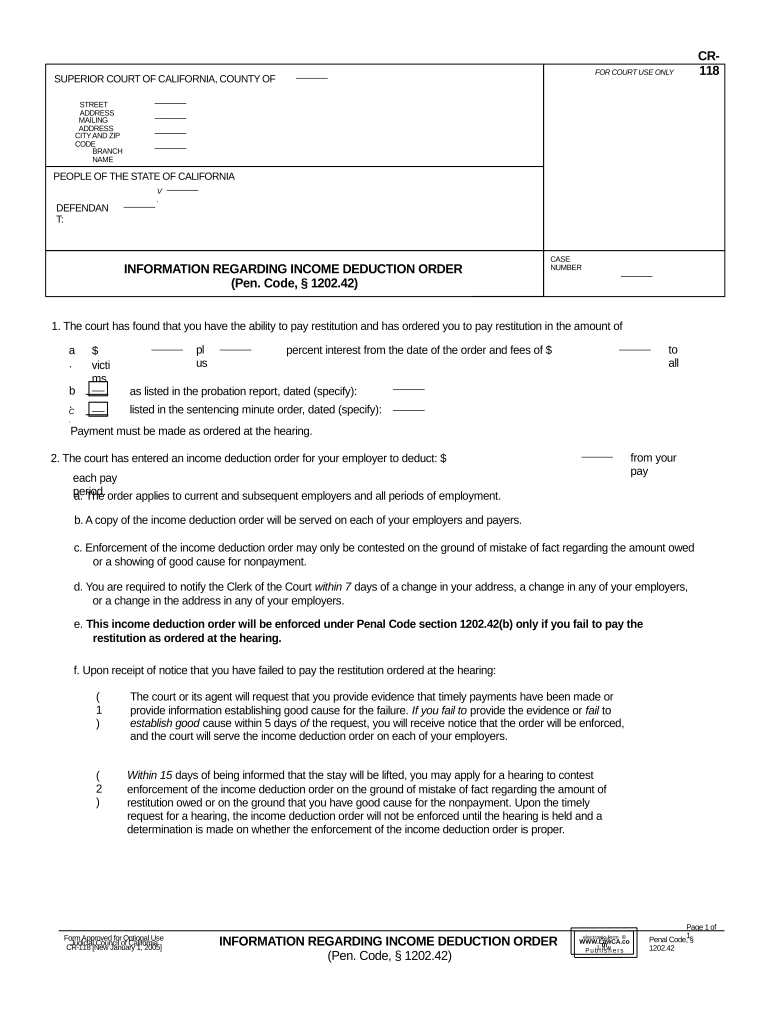

Fill and Sign the Ca Income Deduction Form

Useful tips for finishing your ‘Ca Income Deduction’ online

Are you fed up with the complications of managing documents? Search no more than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning papers. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to sign forms or collect eSignatures, airSlate SignNow manages everything seamlessly, needing just a few clicks.

Adhere to this comprehensive manual:

- Log into your account or register for a complimentary trial with our platform.

- Click +Create to upload a file from your device, cloud storage, or our forms catalog.

- Access your ‘Ca Income Deduction’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and allocate fillable areas for other participants (if needed).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work collaboratively with your teammates on your Ca Income Deduction or send it for notarization—our platform offers everything necessary to complete such tasks. Register with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

What is CA Income Deduction and how does it affect my business?

CA Income Deduction refers to the deductions allowed for California income tax purposes. Understanding CA Income Deduction can help businesses optimize their tax liabilities and improve financial planning. By leveraging deductions properly, you can enhance your overall cash flow, which is essential for business growth.

-

How can airSlate SignNow help with CA Income Deduction documentation?

airSlate SignNow streamlines the process of preparing and sending documents related to CA Income Deduction. With our easy-to-use platform, you can quickly eSign tax forms and other necessary documentation, ensuring compliance and accuracy. This efficiency allows businesses to focus more on strategic planning rather than paperwork.

-

Is airSlate SignNow cost-effective for managing CA Income Deduction related documents?

Yes, airSlate SignNow offers a cost-effective solution for managing CA Income Deduction related documents. Our pricing plans are designed to accommodate businesses of all sizes, providing features that help reduce administrative costs associated with document management. You can save both time and money while ensuring your documents are securely signed and stored.

-

What features does airSlate SignNow offer for handling CA Income Deduction forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all tailored to facilitate CA Income Deduction documentation. These features allow users to quickly create, send, and track important tax forms, making the entire process more efficient and organized. Additionally, real-time notifications keep you updated on the status of your documents.

-

Can I integrate airSlate SignNow with other accounting software for CA Income Deduction?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to enhance your CA Income Deduction processes. By connecting your tools, you can easily manage your documents and financial records in one place, ensuring that all information is synchronized and accurate. This integration maximizes efficiency and reduces the risk of errors.

-

What benefits can I expect from using airSlate SignNow for CA Income Deduction?

Using airSlate SignNow for CA Income Deduction offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for faster document turnaround times, which is critical during tax season. Moreover, with our secure eSigning capabilities, you can ensure compliance and protect sensitive financial information.

-

Is there customer support available for CA Income Deduction related inquiries?

Yes, airSlate SignNow provides dedicated customer support for all inquiries, including those related to CA Income Deduction. Our team is ready to assist you with any questions or challenges you might encounter while using our platform. We aim to ensure that you have a smooth experience and can effectively manage your documentation needs.

The best way to complete and sign your ca income deduction form

Find out other ca income deduction form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles