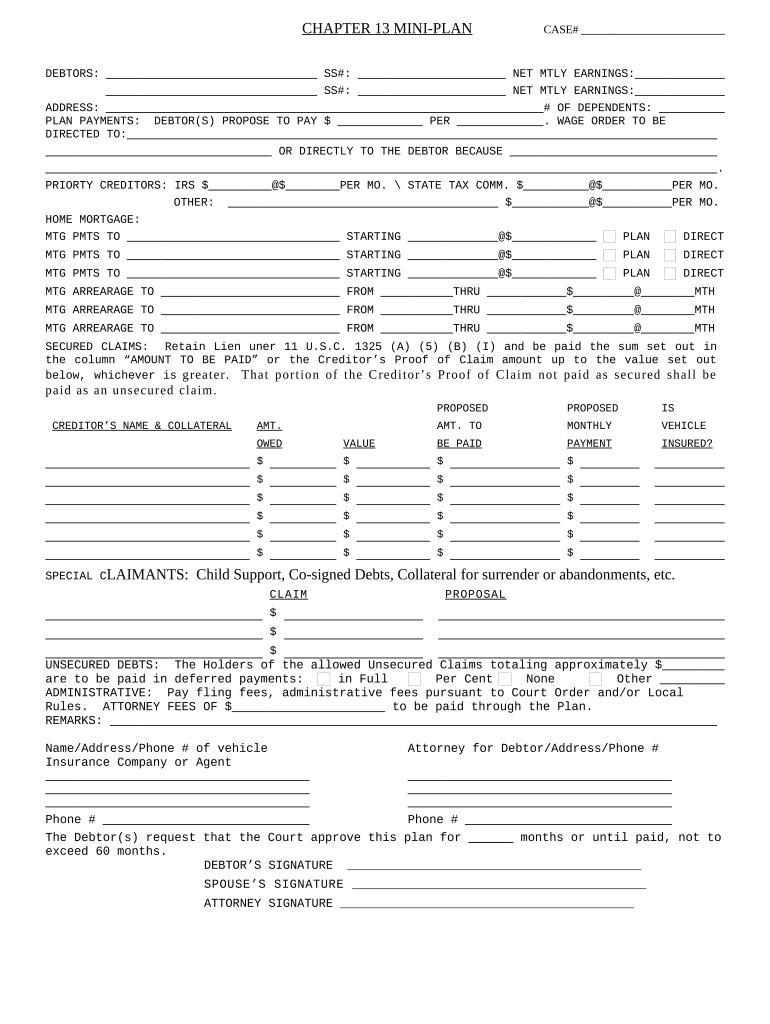

Fill and Sign the Chapter 13 Plan Mississippi Form

Valuable advice on finalizing your ‘Chapter 13 Plan Mississippi’ online

Are you weary of the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and enterprises. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Make use of the robust tools integrated within this user-friendly and cost-effective platform and transform your method of paperwork management. Whether you need to endorse forms or collect eSignatures, airSlate SignNow takes care of it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud, or our template repository.

- Open your ‘Chapter 13 Plan Mississippi’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for other parties (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your Chapter 13 Plan Mississippi or send it for notarization—our platform has everything you require to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is a Chapter 13 Plan in Mississippi?

A Chapter 13 Plan in Mississippi is a legal process that allows individuals with a regular income to reorganize their debts and create a repayment plan over three to five years. This plan is designed to help you catch up on missed payments and keep your assets, making it a valuable option for those facing financial difficulties.

-

How do I create a Chapter 13 Plan in Mississippi?

To create a Chapter 13 Plan in Mississippi, you must file a petition with the bankruptcy court, detailing your income, expenses, and debts. Working with a qualified attorney can simplify this process, ensuring that your plan meets the requirements of Mississippi law and is approved by the court.

-

What are the benefits of a Chapter 13 Plan in Mississippi?

The benefits of a Chapter 13 Plan in Mississippi include the ability to keep your home and car while addressing your debts in a structured way. It also allows you to manage your finances more effectively and potentially discharge certain debts, providing a fresh start without losing assets.

-

How much does it cost to file a Chapter 13 Plan in Mississippi?

The cost to file a Chapter 13 Plan in Mississippi typically ranges from $3,000 to $5,000, including attorney fees and court costs. However, this investment can lead to signNow long-term savings by helping you avoid foreclosure and manage your debts more effectively.

-

Can I modify my Chapter 13 Plan in Mississippi?

Yes, you can modify your Chapter 13 Plan in Mississippi if your financial situation changes. Whether you experience a change in income or unexpected expenses, the court allows modifications to ensure your repayment plan remains manageable.

-

What happens if I miss a payment on my Chapter 13 Plan in Mississippi?

If you miss a payment on your Chapter 13 Plan in Mississippi, you may risk dismissal of your case. It's crucial to communicate with your attorney and the bankruptcy trustee to address any missed payments and explore options for modifying your plan.

-

How does a Chapter 13 Plan affect my credit score in Mississippi?

Filing a Chapter 13 Plan in Mississippi will impact your credit score, but it can also lead to improvement over time as you make consistent payments. Successfully completing the repayment plan demonstrates financial responsibility, which can help rebuild your credit.

The best way to complete and sign your chapter 13 plan mississippi form

Find out other chapter 13 plan mississippi form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles