DENTAL

ENROLLMENT/CHANGE FORM

The Prudential Insurance Company of America

2101 Welsh Road, Dresher PA 19025

Group.Insurance.Eligibility@Prudential.com

Fax: 1-866-764-0547

A. EMPLOYEE INFORMATION

Employee’s Last Name ______________________________________________________

First Name __________________________________________

Name of Employer _____________________________________________________________________________

MI ________

Group Contract No. ____________________________

Employee’s Address __________________________________________________________________________________________________________________________

Married

Widowed

Male

–

–

/

/

/

/

Social Security No. ___________________________ Date of Birth __________________ Date Employed __________________

Single

Divorced

Female

/

/

Effective Date of Coverage or Change __________________

Email Address______________________________________

–

–

Daytime Phone __________________________

Reason for Enrollment or Change

Enroll:

Annual Enrollment

New Hire

Terminate:

Employee Coverage

Qualifying Event Reason:

_____________________________ Date

/

/

Change:

Name

Dependent Coverage

Termination Reason: _________________________

Address/Phone Number

Other

(Please Specify): _________________________

B. DENTAL COVERAGE ELECTION

I ELECT THE FOLLOWING FOR ME AND MY DEPENDENT(S): Dental Plan Selection ___________________________________

Type of Coverage:

Employee

Employee/Spouse/Domestic Partner

Employee/Child

Employee/Children

Employee/Spouse/Domestic Partner/Child(ren)

C. DEPENDENTS TO BE COVERED OR DELETED

Full Name (First, MI, Last)

Relationship

Sex

Date of Birth

Full-Time

Student?

When coverage begins, will family

member have any other dental coverage?

Enroll

Delete

M

F

/

/

Yes

No

Yes

No

Enroll

Delete

M

F

/

/

Yes

No

Yes

No

Enroll

Delete

M

F

/

/

Yes

No

Yes

No

Enroll

Delete

M

F

/

/

Yes

No

Yes

No

D. EMPLOYEE SIGNATURE

Please review the following before completing this step. After review, indicate your acceptance or waiver of coverage below, sign and date this form,

and return to your Benefits Administrator. You will receive complete plan information for the dental coverage you have elected.

Acceptance or Waiver of Coverage

Acceptance of Coverage. I am enrolling for coverage and I authorize my employer to deduct from my earnings (if employee contributions are

required) until further notice my contributions for coverage under my employer’s dental plan. I understand that I cannot make an elective change

in the coverage selected until the next annual enrollment period.

Waiver of Coverage. I acknowledge that I have been given the opportunity by my employer to enroll in the employer’s dental plan and have

elected not to enroll for that coverage at this time. I understand that if I decide to enroll in the dental coverage for me and/or any qualified

dependent(s) at a later date, neither my qualified dependent(s) nor I will be eligible to enroll in the dental plan until (1) my employer’s next

annual enrollment period, or (2) there is a qualifying life event as defined in the employer’s dental plan.

I am waiving coverage for:

Myself

Spouse/Domestic Partner

Qualified Dependent(s)

Please review and sign the reverse side.

GL.2010.057-NY

GL0932401

G

L

0

9

3

2

4

0

1

Ed. 04/2014

�IMPORTANT NOTICE:

For residents of all states except Alabama, the District of Columbia, Florida, Maryland, Kentucky, New Jersey, New York,

Pennsylvania, Puerto Rico, Rhode Island, Utah, Vermont, Virginia and Washington; WARNING: Any person who knowingly and with intent

to injure, defraud, or deceive any insurance company or other person, or knowing that he is facilitating commission of a fraud, submits incomplete,

false, fraudulent, deceptive or misleading facts or information when filing an insurance application or a statement of claim for payment of a loss or

benefit commits a fraudulent insurance act, is/may be guilty of a crime and may be prosecuted and punished under state law. Penalties may include

fines, civil damages and criminal penalties, including confinement in prison. In addition, an insurer may deny insurance benefits if false information

materially related to a claim was provided by the applicant or if the applicant conceals, for the purpose of misleading, information concerning any

fact material thereto.

ALABAMA RESIDENTS —Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly

presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or

any combination thereof.

DISTRICT OF COLUMBIA and RHODE ISLAND RESIDENTS —It is a crime to provide false or misleading information to an insurer for the

purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance

benefits, if false information materially related to a claim was provided by the applicant.

KENTUCKY RESIDENTS —Any person who knowingly and with intent to defraud any insurance company or other person files an application for

insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto

commits a fraudulent insurance act, which is a crime.

MARYLAND RESIDENTS—Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who

knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

NEW JERSEY RESIDENTS —Any person who includes any false or misleading information on an application for an insurance policy is subject

to criminal and civil penalties.

PENNSYLVANIA and UTAH RESIDENTS —Any person who knowingly and with intent to defraud any insurance company or other person files

an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information

concerning any material fact thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

PUERTO RICO RESIDENTS —Any person who knowingly and with the intention of defrauding presents false information in an insurance

application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more

than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less

than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or

both penalties. Should aggravating circumstances [be] present, the penalty thus established may be increased to a maximum of five (5) years, if

extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

VERMONT RESIDENTS —Any person who knowingly presents a false or fraudulent claim for payment of a loss or knowingly makes a false

statement in an application for insurance may be guilty of a criminal offense under state law.

VIRGINIA RESIDENTS —Any person who knowingly and with intent to injure, defraud, or deceive any insurance company or other person, or

knowing that he is facilitating commission of a fraud, submits incomplete, false, fraudulent, deceptive or misleading facts or information when filing

a statement of claim for payment of a loss or benefit may have violated state law, is guilty of a crime and may be prosecuted and punished under

state law. Penalties may include fines, civil damages and criminal penalties, including confinement in prison. In addition, an insurer may deny

insurance benefits if false information materially related to a claim was provided by the applicant or if the applicant conceals, for the purpose of

misleading, information concerning any fact material thereto.

WASHINGTON RESIDENTS —Any person who knowingly provides false, incomplete, or misleading information to an insurance company for

the purpose of defrauding the company commits a crime. Penalties include imprisonment, fines, and denial of insurance benefits.

FLORIDA RESIDENTS —Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an

application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

NEW YORK RESIDENTS —Any person who knowingly and with intent to defraud any insurance company or other person files an application for

insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any

fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand

dollars and the stated value of the claim for each such violation.

GL.2010.057-NY

GL0932402

G

L

0

9

3

2

4

0

2

Ed. 04/2014

�Ohio Disclosure — WARNING: IF YOU AND YOUR FAMILY MEMBERS ARE COVERED BY MORE THAN ONE HEALTH CARE PLAN, YOU

MAY NOT BE ABLE TO COLLECT BENEFITS FROM BOTH PLANS. EACH PLAN MAY REQUIRE YOU TO FOLLOW ITS RULES OR USE

SPECIFIC DOCTORS AND HOSPITALS, AND IT MAY BE IMPOSSIBLE TO COMPLY WITH BOTH PLANS AT THE SAME TIME. BEFORE YOU

ENROLL IN THIS PLAN, READ ALL OF THE RULES VERY CAREFULLY AND COMPARE THEM WITH THE RULES OF ANY OTHER PLAN

THAT COVERS YOU OR YOUR FAMILY.

I represent that all information supplied above is true and correct. I have thoroughly reviewed understand and accurately responded to all questions

and information on this form.

Employee Signature _____________________________________________________

Date (Month/Day/Year) _____ / _____ / _____

© 2014 Prudential Financial Inc. and its related entities.

Prudential, the Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

Dental Insurance coverage is issued by The Prudential Insurance Company of America, Newark NJ. Dental Support: 877-471-3368. Please refer to the Booklet-Certificate for all plan details,

including any exclusions, limitations and restrictions which may apply. Contract provisions may vary by state. California COA #1179, NAIC #68241. Contract Series: 83500.

GL.2010.057-NY

GL0932403

G

L

0

9

3

2

4

0

3

32505

Ed. 04/2014

�

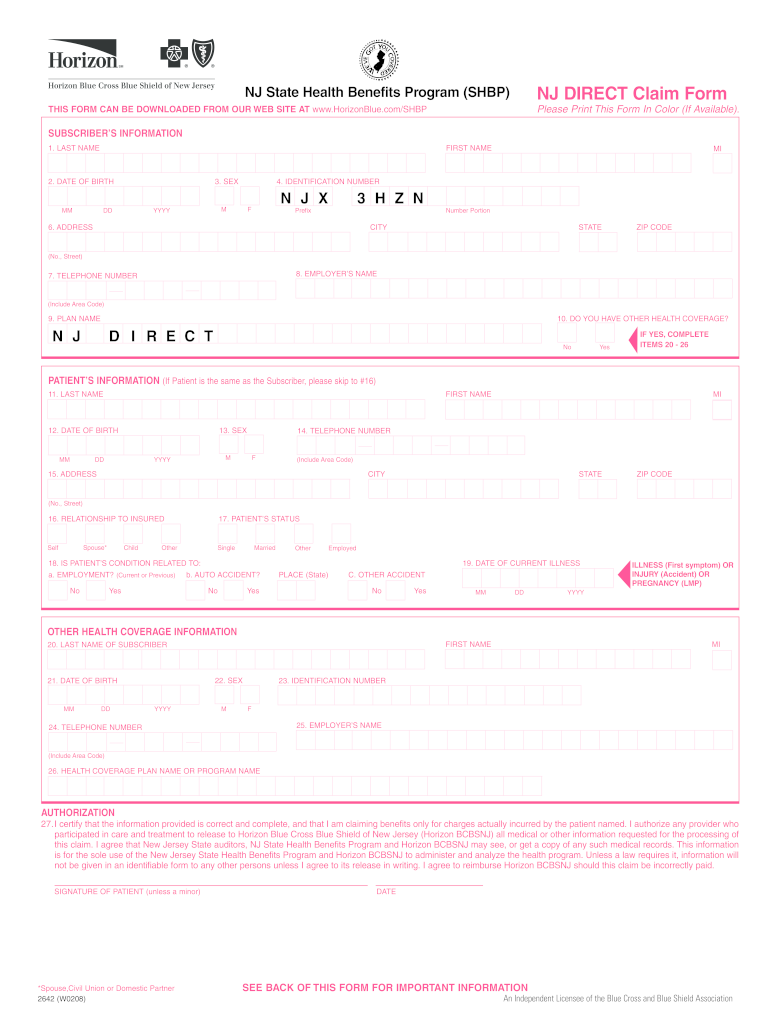

Useful Advice on Setting Up Your ‘Claim Form Nj’ Online

Are you fed up with the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the robust tools offered by this user-friendly and cost-effective platform to transform your document management strategy. Whether you need to authorize forms or gather digital signatures, airSlate SignNow simplifies the process, needing only a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Access your ‘Claim Form Nj’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite configuration to solicit eSignatures from others.

- Save, print your copy, or turn it into a reusable template.

No need to worry if you need to collaborate with others on your Claim Form Nj or send it for notarization—our platform provides everything you require to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to a new standard!