Beneficiary Deeds in

Montana

by Marsha Goetting, Ph.D., CFP®, CFCS, Professor and Extension Family

Economics Specialist, Montana State University-Bozeman; Kristen Juras,

Professor, School of Law, University of Montana-Missoula

MontGuide

Beneficiary deeds allow owners of real property in Montana to transfer at death

without probate their property to one or more beneficiaries.

MT200707HR Revised 8/16

THE 2007 MONTANA LEGISLATURE AUTHORIZED

beneficiary deeds as a way for people to transfer at death

their real property (located in Montana) to one or more

beneficiaries without probate. Real property is land,

including whatever is erected, growing on or affixed to it,

such as homes, garages, or other buildings, fences, water

systems (unless removable), mineral deposits and standing

uncut timber.

This MontGuide answers questions about the new law

(Montana Code Annotated Section §72-6-121) that applies

to owners who have signed and recorded a beneficiary

deed with the clerk and recorder in the Montana county

where the real property is located and who pass away after

October 1, 2007. Statutory language for a beneficiary

deed and a beneficiary deed revocation are also provided

in this MontGuide.

What is a beneficiary deed?

A beneficiary deed is one in which an owner conveys an

interest in Montana real property to a grantee beneficiary

effective upon the owner’s death. In other words, real

property is transferred from the deceased person to the

person(s) listed on the deed. The deed must specifically

state that it is effective only upon the death of the owner.

The deed must also have a complete legal description of

the Montana property that the owner wishes to convey at

death. An owner should use the legal description for the

real property from a previously recorded deed – not the

description appearing on the property tax bill that is sent

annually to the owner by the county treasurer.

A beneficiary deed must be recorded before the death

of the owner (or, for joint tenancy property, before the

death of the last surviving owner) with the clerk and

recorder in the Montana county where the property is

located. All beneficiary deeds must have the post office

address of the grantee listed on it before the clerk and

For More Online MontGuides, Visit www.msuextension.org

recorder's office can record it. The owner must also

prepare a Montana realty transfer certificate before the

clerk and recorder will record a beneficiary deed. A

Montana Realty Transfer Certificate is available at any

Montana county clerk and recorder’s office or online at

www.revenue.mt.gov, search "Realty Transfer Certificate".

The recording fee for a beneficiary deed is $7 per

page. If a document does not meet the requirements it is

referred to as “non-standard” and the cost is $7 per page

plus $10. Details about the standard format are provided

in the Montana Code Annotated, http://leg.mt.gov/

bills/mca/7/4/7-4-2636.htm. For example, the name and

mailing address of the person to whom the document is to

be returned is to be included in the margin in the upper

left-hand corner of the first page of each document. The

document is non-standard if no return address is included

in the upper left hand corner. There are many more

requirements regarding the margins, color of ink, and

size of paper. An example of a standard beneficiary deed

form is provided at www.montana.edu/estateplanning/

beneficiarydeedform.pdf.

Who can be a grantee beneficiary?

The term grantee beneficiary means the party to whom an

owner grants an interest in the Montana real property that

is described on the beneficiary deed. Grantee beneficiaries

may be a variety of parties, for example: spouse, children,

relatives, friends, charitable organizations, trustee of a

trust, or a corporation.

An owner is not required to have the signature, consent,

or agreement of the grantee beneficiary. Nor is the owner

required to give the grantee beneficiary notice that a

beneficiary deed has been recorded. The grantee beneficiary

also has no ownership rights in the Montana real property

described on the beneficiary deed until the owner dies.

�Can there be more than one grantee

beneficiary?

An owner may designate more than one grantee beneficiary

for his or her Montana real property. However, the owner

should specify in the beneficiary deed whether the grantee

beneficiaries will own the property (after the death of the

owner) as tenants in common or as joint tenants with right

of survivorship. For further information regarding these

two forms of property ownership, read MSU Extension

MontGuide, Property Ownership (MT198907HR).

Request a copy from your local Extension office.

Because the language for a beneficiary deed that is

provided by the Montana statute does not specify the

type of ownership when there is more than one grantee

beneficiary, an owner should consult an attorney for

advice about which form of ownership would be best to

accomplish his or her estate planning goals.

What happens if a grantee beneficiary dies

before the owner of the real property?

If an owner designates only one grantee beneficiary and

is concerned about what happens to the property if the

grantee beneficiary dies before the owner, he or she may

designate one of the several alternatives listed below for the

distribution of the property listed on the beneficiary deed.

1. The owner may specify that the beneficiary deed

becomes void upon the death of the grantee beneficiary.

2. The owner may specify that the Montana real property

becomes part of the estate of the deceased grantee

beneficiary. Under this condition, when the owner(s)

die, the real property is distributed according to the will

of the deceased grantee beneficiary or, if the deceased

grantee beneficiary had no will, to the heirs of the

deceased grantee beneficiary under Montana intestate

statutes. This alternative may present complications

if several years lapse between the death of the grantee

beneficiary and death of the owner(s). An attorney can

provide information about potential consequences of

using this alternative for your specific circumstances.

3. The owner may specify a successor grantee beneficiary, as

discussed in more detail in the next section.

Who can be a successor grantee

beneficiary?

An owner of Montana real property can also designate a

successor grantee beneficiary in case the grantee beneficiary

dies before the owner. If an owner designates a successor

grantee beneficiary, the beneficiary deed should state the

condition under which the successor inherits.

2

Example: Mark owns real property in Montana. Mark

recorded a beneficiary deed to be effective upon his

death, naming his son, Evan, as his grantee beneficiary.

Mark also designated his grandson, Luke, as the successor

grantee beneficiary in case Evan dies before Mark. Mark’s

attorney recommended the following language in the

beneficiary deed: “If Evan dies before me, I name Luke

as the successor grantee beneficiary effective upon my

death, should he survive Evan and me. If Luke does not

survive Evan and me, this deed shall be void.”

If an owner names more than one grantee beneficiary

and specifies that they are to become owners as joint

tenants with right of survivorship, the surviving joint

grantee beneficiaries inherit the real property if one of

the joint grantee beneficiaries dies before the owner. An

owner should specify what he or she wants to happen to

the property if all of the joint tenant grantee beneficiaries

die before the owner.

Example: Patricia recorded a beneficiary deed for her

Montana land to be effective upon her death, naming

her sisters, Fay and Ellen, as grantee beneficiaries

with the title to be held as joint tenants with right

of survivorship. If Fay dies before Patricia, Ellen

will become the sole grantee beneficiary. Patricia’s

beneficiary deed should specify what happens if neither

Fay nor Ellen survive Patricia. Therefore, Patricia’s

attorney recommended the following language in the

beneficiary deed: “If both Fay and Ellen predecease

me, the Montana 4-H Foundation will become the

successor grantee beneficiary effective upon my death.”

If an owner names more than one grantee beneficiary

and does not specify that they own the property as

joint tenants with right of survivorship, the grantee

beneficiaries inherit as tenants in common. The

beneficiary deed should specify what happens to the

interest of a deceased tenant in common grantee

beneficiary if he or she fails to survive the owner.

Example: Edna owns real property in Montana and has

recorded a beneficiary deed to be effective upon Edna’s

death. She named her two sisters, Wendy and Patsy,

grantee beneficiaries with the title to be held as tenants

in common. Edna’s beneficiary deed should specify

what happens to either Wendy or Patsy’s interests if

they do not survive Edna. Therefore Edna’s attorney

recommended the following language in the beneficiary

deed: “In the event that either Wendy or Patsy does not

survive me, her one-half interest in the real property

shall be distributed to the Montana State University

Foundation effective upon my death.”

�If Edna had named Wendy and Patsy grantee

beneficiaries as joint tenants with right of survivorship,

upon the death of either Wendy or Patsy, the survivor

would inherit the entire property. However, Edna could

name a successor grantee beneficiary if both Wendy and

Patsy predecease her. To accomplish this goal Edna’s

attorney suggested the following statement: “I convey

the property described below to the grantee beneficiaries,

Wendy and Patsy, as joint tenants with right of

survivorship, effective upon my death. If both Wendy and

Patsy fail to survive me, the property shall be distributed

to the University of Montana Foundation effective upon

my death.”

The advice of an attorney should be sought when

drafting a beneficiary deed that lists more than one

grantee beneficiary to assure that the owner has

considered the forms of property ownership and decided

what he or she wants to happen to the property if one of

the beneficiaries dies before the owner.

What happens if more than one person

owns the real property?

Whether a grantee beneficiary receives the property as the

result of a beneficiary deed depends upon how the owners

hold title to the real property. Do the owners have the

property titled as joint tenants with right of survivorship

or as tenants in common?

When the Montana real property is titled by the

owners as joint tenants with right of survivorship, the right

of the surviving joint tenant takes priority over the right

of the grantee beneficiary.

Example: Doug and his wife, Laura, own real property

in Montana as joint tenants with right of survivorship.

Doug signed and recorded a beneficiary deed naming

their two daughters as grantee beneficiaries to be

effective upon his death. If Doug dies before Laura,

their daughters will not inherit the property upon

his death because the existing joint tenancy contract

with his wife, Laura, takes priority. However, if Laura

dies before Doug, and Doug dies six days later, the

beneficiary deed signed by Doug naming their two

daughters as grantee beneficiaries will be effective, and

their two daughters will inherit the property upon

Doug’s death.

Ownership of Montana real property that is held as

joint tenancy with right of survivorship is not affected by

the recording of a beneficiary deed unless the deed is

signed by all of the owners or signed by one owner, who is

the last one to die.

Example: Donna, Debbie and Kristi own real property

in Montana as joint tenants with right of survivorship.

Donna signed and recorded a beneficiary deed without

obtaining the signatures of the other two joint owners,

Debbie and Kristi. If Donna dies before Debbie and

Kristi, the grantee beneficiary that Donna designated

would not receive the Montana real property because

all joint owners did not sign the beneficiary deed.

However, if Donna was the last survivor, the grantee

beneficiary she named would inherit the Montana real

property upon Donna’s death.

If all of the owners of real property titled as joint

tenants with right of survivorship sign a beneficiary

deed designating a grantee beneficiary, the transfer to

the grantee beneficiary does not become effective until

the death of the last surviving owner. However, the deed

should specifically state that the transfer to the grantee

beneficiary becomes effective upon the death of the last

surviving owner.

Example: Phyllis and Bob own real property in

Montana as joint tenants with right of survivorship.

They both signed and recorded a beneficiary deed

naming their son as the grantee beneficiary to be

effective on the death of the last surviving owner. This

means their son will not receive the Montana real

property until after both Phyllis and Bob die.

If the last surviving joint owner of real property held as

joint tenancy with right of survivorship had not signed the

beneficiary deed, the deed becomes void.

Example: Lynn and Eric own real property in Montana

as joint tenants with right of survivorship. Lynn signed

and recorded a beneficiary deed naming her daughter

from a prior marriage as the grantee beneficiary. Because

Eric did not sign the beneficiary deed, it becomes void

if Lynn dies before Eric. Lynn’s daughter, the grantee

beneficiary, would not receive the property upon Lynn’s

death. If Lynn and Eric want to assure that Lynn’s

daughter receives their Montana real property as a

result of the beneficiary deed, Eric should also sign the

beneficiary deed before it is recorded with the clerk and

recorder in the county where the land is located.

If the owners have their real property titled as tenants

in common rather than as joint tenants with right of

survivorship, each owner may execute a beneficiary deed

to distribute his or her interest in the property upon

death. The beneficiary deed does not affect the interest

that is held by the other tenant in common co-owner(s).

3

�Example: Carol and Amy own real property in

Montana as tenants in common. Carol recorded a

beneficiary deed for her one-half interest in the real

property, naming her daughter as the grantee beneficiary

to be effective upon Carol’s death. Amy did not execute

a beneficiary deed for her one-half interest in the real

property. Upon Carol’s death, her one-half interest in

the property as a tenant in common becomes owned by

her daughter, her grantee beneficiary. Amy will continue

to own the other one-half interest in the property. Upon

Amy’s death her one-half interest in the property will be

distributed according to her will or Montana intestate

statutes if she doesn’t have a will.

What wording on a beneficiary deed makes

it legal?

The wording that was included in the Montana statute

for a beneficiary deed is provided in Figure 1. An

online version of this form is at www.montana.edu/

estateplanning/beneficiarydeedform.pdf.

How is a beneficiary deed revoked?

A beneficiary deed may be revoked at any time by the

owner, or if there is more than one owner, by the owners

who have signed the beneficiary deed. To be effective, the

revocation must be signed and recorded before the death

of the owner(s) in the office of the Montana clerk and

recorder of the county in which the real property is located.

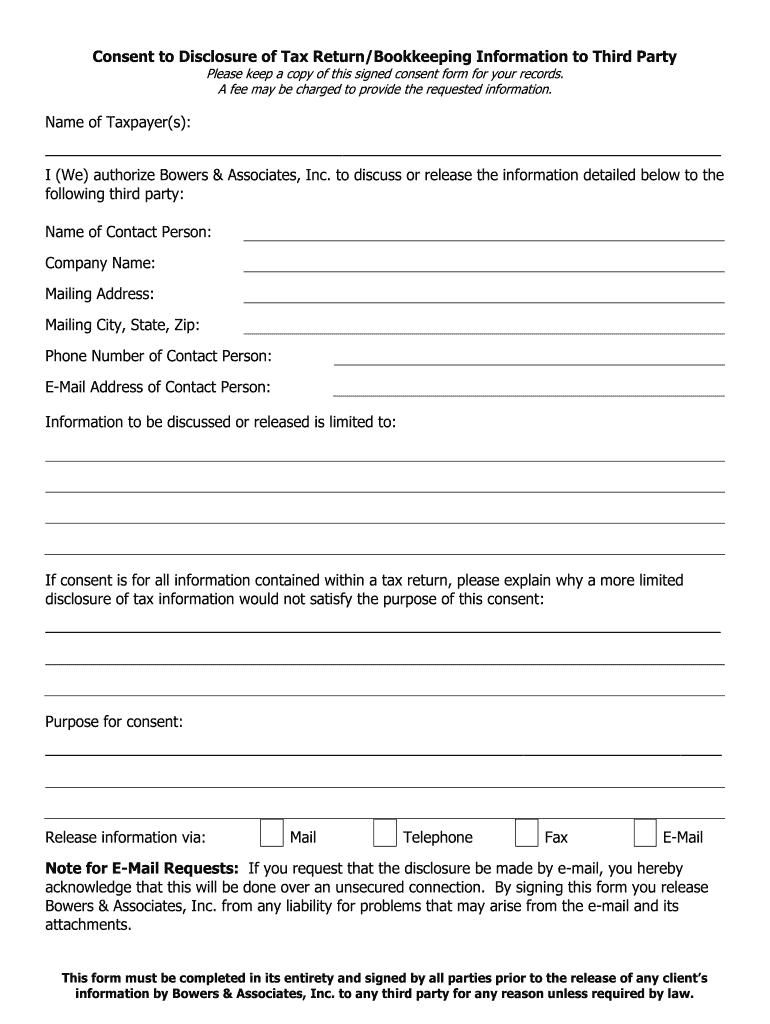

FIGURE 1: Statutory Language for a Beneficiary Deed (sample, non-standard form)

I (We) _________________________ (Owner) hereby convey to ___________________________ (Grantee Beneficiary)

effective on my (our) death the following described real property:_______________________________________

(Legal description from previously recorded deed)

_______________________________________

If a grantee beneficiary predeceases the owner, the conveyance to that grantee beneficiary must either (choose one):

[ ] Become void.

E

L

P

M

A

S

[ ] Become part of the estate of the grantee beneficiary.

_______________________________________

(Date)

_______________________________________________________________________________________________

[Signature of Grantor(s)]

State of Montana, County of _____________________

This instrument was acknowledged before me on _____ day of ____________________, 201__

(Date)

(Month)

by _______________________________________________________________.

(Name of Owner)

________________________________________________________

(Signature of Notarial Officer)

________________________________________________________

(Printed or Typed Name of Notary)

Notary Public for the State of Montana

Residing at______________________________________

My commission expires____________________________

(Notary Seal)

4

�If the real property is owned as joint tenants with right

of survivorship and the beneficiary deed was signed by

all joint owners, a revocation is not effective unless it is

signed by all of the joint owners, or signed by one owner,

when that owner is last to die.

The filing and recording of a new beneficiary deed by

the same owner for the same property will also revoke

a previously filed and recorded beneficiary deed. The

wording that was included in the Montana statute for the

revocation of a beneficiary deed is provided in Figure 2.

An online version of this form is at www.montana.edu/

estateplanning/revocationofbeneficiarydeedsampleform.pdf.

Example: Michael and Kris owned real property in

Montana as joint tenants with right of survivorship.

Both signed and recorded a beneficiary deed naming

Michael’s sister as the grantee beneficiary to be effective

upon the death of both Michael and Kris. Several

years later Michael signed and recorded a revocation.

Michael died before Kris as a result of an automobile

accident. The revocation was not effective because Kris

had not signed the revocation. However, after Michael’s

death Kris, as the surviving joint owner, could record a

revocation or record a new beneficiary deed naming the

grantee beneficiary she prefers.

What is required to retitle the property into

the name of the grantee beneficiary upon

the owner’s death?

To retitle the real property in the name of the grantee

beneficiary upon the owner’s death, proof must be

provided that the owner has died. A notarized affidavit

certifying the death of the owner signed by the grantee

beneficiary or beneficiaries is an acceptable document.

Sample wording for an affidavit of death is provided

FIGURE 2: Statutory Language for a Revocation of Beneficiary Deed (sample, non-standard form)

The undersigned hereby revokes the beneficiary deed recorded on ________ ____, _______ in docket or book ___________,

(Month)

(Date)

(Year)

at page ______, or instrument number ____________, records of ________________ County, Montana, concerning the

E

L

P

M

A

S

following described real property:______________________________________________________________________

(Legal description from previously recorded deed)

________________________________________________________________________________________________

___________ _______, _______

(Month)

(Date)

(Year)

________________________________________________________________________________________________

[Signature of Grantor(s)]

State of Montana, County of _____________________

This instrument was acknowledged before me on _____ day of ____________________, 201__

(Date)

(Month)

by _______________________________________________________________.

(Name of Owner)

_______________________________________________________________

(Signature of Notarial Officer)

_______________________________________________________________

(Printed or Typed Name of Notary)

Notary Public for the State of Montana

Residing at______________________________________

My commission expires____________________________

(Notary Seal)

5

�in Figure 3. An online version of this form is available

at www.montana.edu/estateplanning/documents/

affidavitofdeathdampleform.pdf. A grantee beneficiary

should consult an attorney if he or she has any questions

about verifying the death of the owner(s) of Montana real

property.

The grantee beneficiaries can take title to the real

property with a beneficiary deed without going through

the probate process by recording the affidavit with the

county clerk and recorder where the real property is

located. If there is more than one grantee beneficiary, they

will take title as tenants in common, unless the beneficiary

deed has specified that the grantee beneficiaries are to

become owners as joint tenants with right of survivorship.

FIGURE 3: Affidavit of Death (sample)

I, _________________________________, being first duly sworn, upon oath, depose and say the following:

(Name of Beneficiary)

1.

________________________________ signed and recorded a beneficiary deed with the intent to convey the following

(Name of Grantor)

property located in ________________________, Montana described as follows:

(Name of County)

______________________________________________________________________________________________

2.

The beneficiary deed was recorded in_________________County on _____________ _______, _______

(Month)

(Day)

(Year)

Book__________, Page________, Instrument Number_________.

3.

E

L

P

M

A

S

The grantor died on _____________ _______, _______. At the time of death, the grantor had not revoked the above

(Month)

(Day)

(Year)

described beneficiary deed.

4.

The following person(s) is/are the person(s) named as the grantee beneficiary(ies) under the beneficiary deed described above,

and are entitled to succeed to the grantor’s interest in the real property described above as a result of the grantor’s death:

(Grantee Beneficiary Name):_________________________________________________

Mailing address:__________________________________________________________

Dated this _____ day of __________________, 201__.

(Date)

(Month)

____________________________________________

(Signature of Affiant)

State of Montana County of _____________________________________________________

This instrument was acknowledged before me on _____ day of ____________________, 201__

(Date)

(Month)

by _______________________________________________________________.

(Name of affiant)

_______________________________________________________________

(Signature of Notarial Officer)

_______________________________________________________________

(Printed or Typed Name of Notary)

Notary Public for the State of Montana

Residing at______________________________________

My commission expires____________________________

(Notary Seal)

6

�What if the real property listed on the

beneficiary deed has an encumbrance

against it?

Montana real property that is conveyed in a beneficiary

deed to a grantee beneficiary is subject to any

encumbrances arising against the property during the

owner’s lifetime. Encumbrances against real property

include for example: mortgages; deeds of trust; liens

for unpaid taxes or failure to pay for labor, materials,

equipment or services on the property; contracts;

assignments; and any other legal conveyance document

recognized by the state of Montana. This would include a

marriage dissolution settlement or order.

Any Medicaid payments to an owner may also become

an encumbrance against the Montana real property

in certain situations. If the owner was a recipient of

Medicaid and had conveyed an interest in Montana real

property by means of a beneficiary deed, the Montana

Department of Public Health and Human Services

may assert a claim against the real property. The claim

typically would be for the dollar amount of Medicaid

payments that were provided to the owner before his or

her death, up to the value of the Montana real property.

For further information about Medicaid read MSU

Extension MontGuide, Medicaid and Long-Term Care

Costs (MT199511HR). Request a copy from your local

Extension office.

If there are insufficient assets in the owner’s estate to pay

valid creditors’ claims, the creditors may seek payment from

the value of the Montana real property that was conveyed

by a beneficiary deed. The personal representative is in

charge of making sure that all valid creditors’ claims are

paid, if necessary, from the beneficiary deed real property.

What is the effect of a will on a beneficiary

deed?

After a beneficiary deed has been signed and recorded

with the Montana clerk and recorder in the county where

the real property is located, the deed cannot be revoked

by a provision in the owner’s will. A beneficiary deed may

only be revoked by recording a revocation in the manner

described previously or by recording a new beneficiary deed.

Example: Gary signed and recorded a beneficiary deed

naming his daughter as grantee beneficiary of real

property he owned in Montana to be effective upon

his death. Gary later wrote a will leaving the same

Montana real property to his son. Upon Gary’s death,

the provision in the will leaving the real property to his

son is not valid. The real property would pass to Gary’s

daughter under the terms of the beneficiary deed.

What is the effect of a trust on a

beneficiary deed?

If an owner’s real property has not been re-titled in the

name of the owner’s revocable living trust, a beneficiary

deed may be executed naming the trustee of the revocable

trust as the grantee beneficiary. The terms of the trust

document control how the property will be distributed

upon the death of the person who established the trust.

What rights do the surviving spouse and

minor children have in the real property

if they were not named as grantee

beneficiaries on a beneficiary deed?

Montana law provides certain allowances for the surviving

spouse and minor or dependent children of a deceased

property owner. If assets of the estate are insufficient to

provide for the Montana statutory allowances for the

spouse’s elective share (which increases in percentage from

three to 50 percent based on the length of the marriage);

exempt property ($10,000); family allowance ($18,000);

homestead allowance ($20,000); the Montana real

property listed in a beneficiary deed can be claimed for

the statutory amounts. The personal representative for the

estate is in charge of making sure the statutory allowance

claims are paid to the spouse and minor or dependent

children.

For further information about rights of the surviving

spouse and minor or dependent children read MSU

Extension MontGuide, Probate (MT199006HR). Request

a copy from your local Extension office.

The $20,000 homestead allowance is different from

the Montana homestead declaration that protects up to

$250,000 in the value of the home while the owner is

living against most creditors’ claims.

What if there are water rights on the real

property?

If there are water rights associated with the Montana real

property that is being transferred by an owner at his or her

death with a beneficiary deed, the owner does not need to

file Form 608 (DNRC Water Right Ownership Update)

or Form 640 (Certification of Water Right Ownership

Update) that appears on pages five and six of the Realty

Transfer Certificate. The water rights information is

provided on page 3, Part 7, Water Right Disclosure in

the Realty Transfer Certificate Form 488 (RTC) revised

01/13. http://revenue.mt.gov/Portals/9/property/

forms/488RTC.pdf.

7

�What if more than one beneficiary deed is

recorded?

Beneficiary deeds can be revoked at any time by the

owner, so the latest recorded beneficiary deed is the

controlling document. In other words, if owners change

their minds about who they want to receive the real

property after they die, one recorded beneficiary deed

can be replaced with a later recorded document naming

different beneficiaries. The recording of a new beneficiary

deed revokes any beneficiary deed dated earlier.

Can a beneficiary deed be used to transfer

personal property after death?

No. A beneficiary deed is designed to transfer real

property not personal property. However, certain personal

properties of a Montana resident can also be transferred at

death by other methods without probate by designating

beneficiaries on contracts. For example, a person can list

one or more beneficiaries on a life insurance policy; make

a payable on death (POD) beneficiary designation on

accounts at financial institutions, or sign a transfer on

death (TOD) beneficiary registration for stocks, bonds,

and mutual funds. For further information about PODs

and TODs read MSU Extension MontGuide, NonProbate Transfers (MT199509HR). Request a copy from

your local Extension office.

Summary

D

After October 1, 2007 a person can transfer his or her

Montana real property at death to one or more parties by

signing and recording a beneficiary deed with the clerk

and recorder in the county where the real property is

located. The beneficiary deed must contain a complete

legal description of the Montana real property. All

beneficiary deeds must have the post office address of the

grantee listed on it before the clerk and recorder's office

can record it. The owner also must prepare a Montana

Realty Transfer Certificate. After recording, the beneficiary

deed should be stored in a safe place such as a safe deposit

box or a secure place in the grantor’s home.

References

2013 Montana Codes Annotated Section §72 - 6 - 121;

http://leg.mt.gov/bills/mca/72/6/72-6-121.htm

2007 Montana Estate Planning Legislative Update;

Kristen Juras, University of Montana School of Law,

September 1, 2007.

Disclaimer

This MontGuide is not a substitute for legal advice.

Rather it is designed to inform persons about the

provisions of the Montana beneficiary deed statute. Future

changes this law cannot be predicted and statements in

the MontGuide are based solely on the statutes in force on

the date of publication.

Acknowledgement

Representatives from the following reviewed this

MontGuide and recommend its reading by all Montanans

who are in the process of estate planning:

- Business, Estates, Trusts, Tax and Real Property Section

– State Bar of Montana

- Montana Credit Union Network

- Clerk and Recorders and Supervisory Staff in Gallatin,

Hill, Lewis and Clark, and Park Counties.

NLOAD

OW

FREE

E

E W

To order additional publications, please contact your county or reservation MSU Extension office, visit our online

catalog at www.msuextension.org/store or e-mail orderpubs@montana.edu

Copyright © 2016 MSU Extension

We encourage the use of this document for nonprofit educational purposes. This document may be reprinted for nonprofit educational purposes if no endorsement of a commercial

product, service or company is stated or implied, and if appropriate credit is given to the author and MSU Extension. To use these documents in electronic formats, permission must be

sought from the Extension Communications Coordinator, 135 Culbertson Hall, Montana State University, Bozeman MT 59717; E-mail: publications@montana.edu

The U.S. Department of Agriculture (USDA), Montana State University and Montana State University Extension prohibit discrimination in all of their programs and activities on the

basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital and family status. Issued in furtherance of cooperative extension

work in agriculture and home economics, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture, Jeff Bader, Director of Extension, Montana State

University, Bozeman, MT 59717.

File under: Family Financial Management (Estate Planning)

Revised August 2016 816SA

�