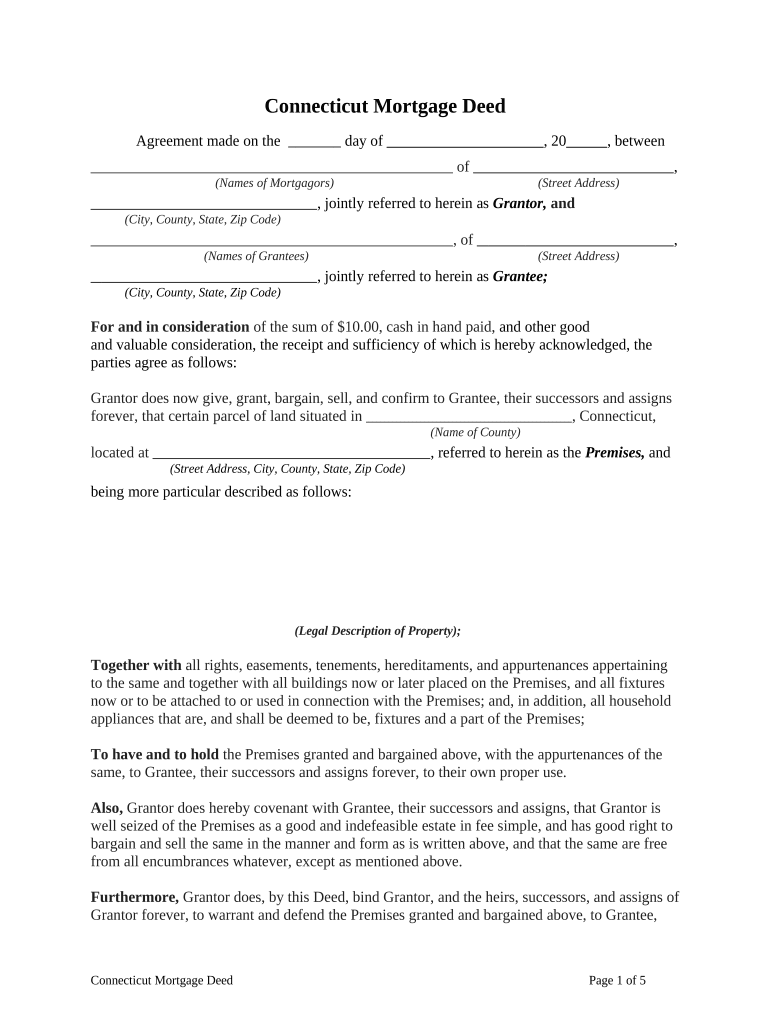

Fill and Sign the Ct Mortgage Deed Form

Valuable advice on finalizing your ‘Ct Mortgage Deed’ digitally

Are you fed up with the troubles of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and enterprises. Bid farewell to the monotonous routine of printing and scanning files. With airSlate SignNow, you can seamlessly finalize and endorse documents online. Utilize the extensive features included in this user-friendly and economical platform and transform your method of document management. Whether you require to sign forms or collect signatures, airSlate SignNow makes it all simple, requiring merely a few clicks.

Adhere to this comprehensive guide:

- Log into your account or initiate a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud, or our template collection.

- Access your ‘Ct Mortgage Deed’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your coworkers on your Ct Mortgage Deed or send it for notarization—our platform offers everything necessary to achieve such goals. Sign up with airSlate SignNow today and enhance your document management to a higher level!

FAQs

-

What is a quit claim deed CT and when should I use it?

A quit claim deed CT is a legal document that allows an individual to transfer their interest in a property to another person without making any guarantees about the title. This type of deed is often used in situations such as divorce settlements or transferring property between family members. It's important to understand the implications, as it does not ensure that the property is free of liens or other claims.

-

How can airSlate SignNow help me with a quit claim deed CT?

airSlate SignNow provides a user-friendly platform to create, sign, and send your quit claim deed CT quickly and efficiently. With our eSignature capabilities, you can ensure that all parties involved have access to the document and can sign it securely online. This streamlines the process, saving you time and reducing the need for physical paperwork.

-

Is there a cost associated with using airSlate SignNow for a quit claim deed CT?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost-effective solution allows you to handle multiple documents, like a quit claim deed CT, without breaking the bank. Visit our pricing page to find the plan that best suits your requirements.

-

What features does airSlate SignNow offer for managing quit claim deeds CT?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and the ability to track document status in real-time. These features make it easy to manage your quit claim deed CT and ensure that all necessary signatures are obtained promptly. Plus, our platform is compliant with legal standards, so you can trust the integrity of your documents.

-

Can I integrate airSlate SignNow with other tools for handling quit claim deeds CT?

Absolutely! airSlate SignNow integrates seamlessly with various applications including Google Drive, Dropbox, and CRM systems. This integration allows you to manage your quit claim deed CT and other important documents all in one place, enhancing your workflow and efficiency.

-

How secure is airSlate SignNow when handling quit claim deeds CT?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect your quit claim deeds CT and ensure that your data remains confidential. Additionally, our platform complies with industry regulations, so you can have peace of mind knowing that your documents are safe.

-

What are the benefits of using airSlate SignNow for a quit claim deed CT?

Using airSlate SignNow for your quit claim deed CT offers numerous benefits including speed, convenience, and cost savings. The ability to eSign documents online eliminates the challenges of in-person signing and reduces delays. Furthermore, our platform is easy to use, making it accessible for everyone involved in the transaction.

The best way to complete and sign your ct mortgage deed form

Find out other ct mortgage deed form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles