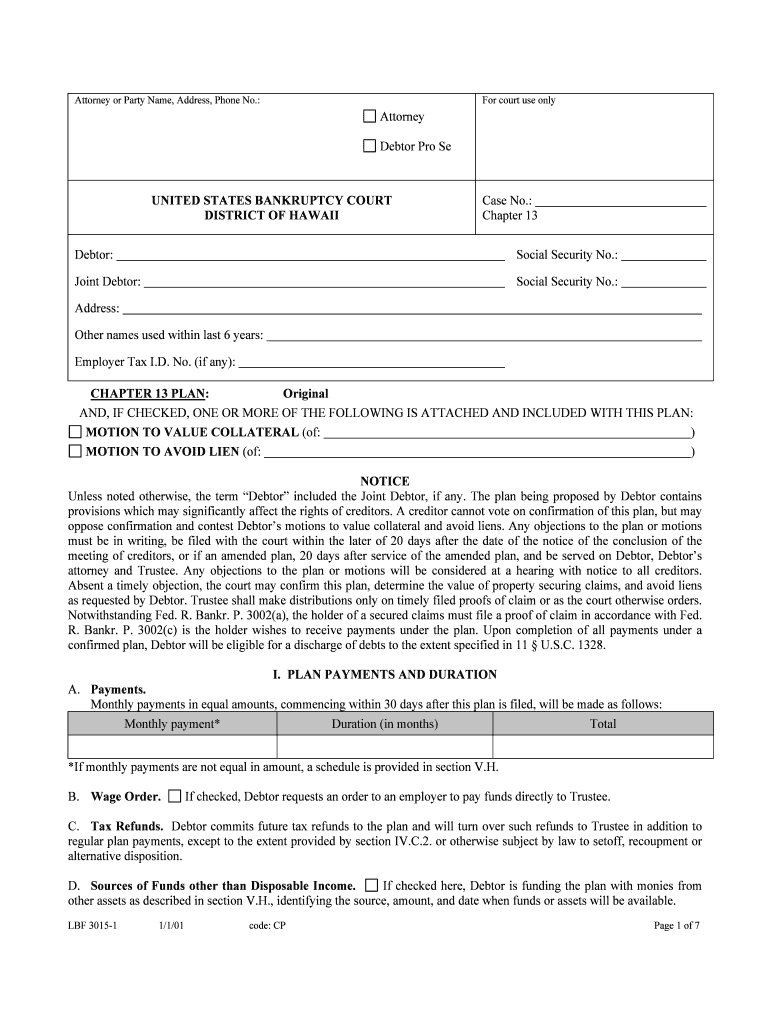

LBF 3015-11/1/01code: CP Page 1 of 7Attorney or Party Name, Address, Phone No.: Attorney Debtor Pro Se For court use only UNITED STATES BANKRUPTCY COURT DISTRICT OF HAWAII Case No.: Chapter 13Debtor: Social Security No.: Joint Debtor: Social Security No.: Address: Other names used within last 6 years: Employer Tax I.D. No. (if any): CHAPTER 13 PLAN: OriginalAND, IF CHECKED, ONE OR MORE OF THE FOLLOWING IS ATTACHED AND INCLUDED WITH THIS PLAN: MOTION TO VALUE COLLATERAL (of: ) MOTION TO AVOID LIEN (of: ) NOTICE Unless noted otherwise, the term “Debtor” included the Joint Debtor, if any. The plan being proposed by Debtor contains

provisions which may significantly affect the rights of creditors. A creditor cannot vote on confirmation of this plan, but may

oppose confirmation and contest Debtor’s motions to value collateral and avoid liens. Any objections to the plan or motions

must be in writing, be filed with the court within the later of 20 days after the date of the notice of the conclusion of the

meeting of creditors, or if an amended plan, 20 days after service of the amended plan, and be served on Debtor, Debtor’s

attorney and Trustee. Any objections to the plan or motions will be considered at a hearing with notice to all creditors.

Absent a timely objection, the court may confirm this plan, determine the value of property securing claims, and avoid liens

as requested by Debtor. Trustee shall make distributions only on timely filed proofs of claim or as the court otherwise orders.

Notwithstanding Fed. R. Bankr. P. 3002(a), the holder of a secured claims must file a proof of claim in accordance with Fed.

R. Bankr. P. 3002(c) is the holder wishes to receive payments under the plan. Upon completion of all payments under a

confirmed plan, Debtor will be eligible for a discharge of debts to the extent specified in 11 § U.S.C. 1328. I. PLAN PAYMENTS AND DURATION A.Payments. Monthly payments in equal amounts, commencing within 30 days after this plan is filed, will be made as follows: Monthly payment*Duration (in months) Total *If monthly payments are not equal in amount, a schedule is provided in section V.H.B.Wage Order. If checked, Debtor requests an order to an employer to pay funds directly to Trustee. C.Tax Refunds. Debtor commits future tax refunds to the plan and will turn over such refunds to Trustee in addition to

regular plan payments, except to the extent provided by section IV.C.2. or otherwise subject by law to setoff, recoupment or

alternative disposition.D.Sources of Funds other than Disposable Income. If checked here, Debtor is funding the plan with monies from

other assets as described in section V.H., identifying the source, amount, and date when funds or assets will be available.

LBF 3015-11/1/01code: CP Page 2 of 7 II. DISTRIBUTION OF PLAN PAYMENTS A.Administrative Expenses. Trustee’s fee of 10% or the percentage fee set by 28 U.S.C. § 586(e) will be paid in advance of all other claims. Unpaid

Debtor’s attorney fees approved by the court will be paid before or at the same time as each payment to other creditors. Debtor’s attorney opts for allowance and payment under the Chapter 13 Attorney Fee Guidelines as follows: Attorney fees for Chapter 13 case Amount paid prepetition Balance Due Debtor’s attorney opts out of the Chapter 13 Attorney Fee Guidelines and will seek allowance of fees under

applicable authority, including 11 U.S.C. §§ 329 & 330, Fed. R. Bankr. P. 2002, 2016 & 2017, and the court’s general

Guidelines for Compensation and Expense Reimbursement of Professionals and Trustees.Administrative expenses Est. monthly amountNo. months Total Trustee10% = Debtor’s attorney Other (explain in section V.H.) B. Secured Claims. Class 1. Long-term secured claims that were delinquent when the petition was filed and that mature after the last

payment under the plan. Except for the curing of an arrearage, these claims are not modified by the plan and creditors

holding these claims will retain their liens. Distributions to cure prepetition arrearages, with interest (10% unless specified

otherwise), will be paid pro rata with other secured claims through the plan. All payments due postpetition will be made

directly by Debtor unless listed in section II.F. “Arrearage” includes principal owed, accrued and unpaid interest and other

charges, such as attorney fees and foreclosure costs, through the date the petition was filed. Debtor’s statement of arrearage

and monthly payment is a good faith estimate only and distributions will be determined by the arrearage stated in a proof of

claim timely filed and allowed. Treatment of a prepetition arrearage under an unexpired lease or executory contract is

provided for in section II.D. below.

Creditor/Collateral Est. arrearage Interest Est. mo. pmt. [Continue in section V.H. or on continuation sheet as necessary.] Class 2. Secured claims which are modified by this plan or that will not extend beyond the plan’s duration. This class

includes any secured claim that has matured or will mature prior to the completion of the plan. It also includes any secured

claim, regardless of its maturity date, that is modified as permitted by 11 U.S.C. § 1322(b)(2) or (c)(2). Holders of Class 2

secured claims will retain any lien or security interest. They will be paid the full amount of the secured claims as stated on

the creditor’s timely filed proof of claim, or the market value of their collateral, whichever is less, together with interest (10%

unless specified otherwise). If Debtor believes that the market value of a creditor’s collateral is less than the amount of the

claim, Debtor must include a Motion to Value Collateral with this plan. Any deficiency, i.e. the difference between the

amount of the claim and the value of the collateral, will be treated as a Class 7 general unsecured claim unless the deficiency

is a priority claim under Class 5. “Claim amount” includes principal owed, accrued and unpaid interest and other charges,

such as attorney fees and foreclosure costs, through the date the petition was filed. Debtor’s statement of claim amount,

market value and monthly payment is a good faith estimate only.

LBF 3015-11/1/01code: CP Page 3 of 7(Class 2 – cont’d) Creditor/Collateral Claim amountMarket

valueInterestEst. mo. pmt. [Continue in section V.H. or on continuation sheet as necessary.] Motion(s) to Value Collateral attached (LBF 3015-506 for personal property; not for use with real property). Creditor(s): Class 3. Secured claims satisfied by the surrender of collateral. As to personal property, Debtor will offer to

surrender the property not later than 5 days after entry of the order confirming this plan. As to real property, Debtor consents

to termination of the stays under 11 U.S.C. §§ 362(a) & 1301(a) to permit the secured creditor whose collateral is being

surrendered to receive or foreclose upon that collateral and to exercise its rights and remedies as to its collateral. Entry of the

order confirming this plan will constitute an order terminating the stays under 11 U.S.C. §§ 362(a) & 1301(a). Debtor will

surrender possession not later than after entry of an order confirming sale or, in a nonjudicial foreclosure, after recordation of

the mortgagee’s affidavit after sale. A secured creditor listed in Class 3 wishing to refuse Debtor’s surrender of collateral in

full or partial satisfaction of its claim must file a written objection to this plan. The filing of a declaration by Debtor that the

personal or real property has been surrendered, with proof of service on the creditor, will result in no distribution, as a

secured claim, to a creditor listed below filing a proof of claim.

Creditor/Collateral Claim amountEst. deficiency [Continue in section V.H. or on continuation sheet as necessary.] Class 4. Claims to be paid directly by Debtor or third party. This class is limited to (i) secured claims which extend

beyond the length of the plan, were not delinquent when the bankruptcy was filed, and are not modified by this plan; and (ii)

claims which will be paid with money or property not belonging to Debtor or to the bankruptcy estate. Holders of Class 4

claims will retain their liens and security interests. These claims are not modified in any respect, are not provided for under

the plan, and will receive no distributions. Any proof of claim concerning the creditor and collateral listed below will be

disregarded by Trustee for distribution purposes, unless the collateral later is surrendered, resulting in a deficiency claim. Creditor/Collateral Regular paymentMaturity date [Continue in section V.H. or on continuation sheet as necessary.]

LBF 3015-11/1/01code: CP Page 4 of 7C.Unsecured Claims. Class 5. Priority unsecured claims. Claims, such as claims for delinquent child and spousal support and certain types

of taxes, entitled to priority under 11 U.S.C. § 507, will be paid in full by deferred payments in installments after satisfaction

of claims included in Classes 1 and 2, and before payment on other unsecured claims. Notwithstanding the amounts listed

below, payments on priority unsecured claims will be made in accordance with timely filed proofs of claim unless the court

otherwise orders. A holder of a particular claim entitled to priority but agreeing to other than full payment shall amend the

proof of claim. Class 5 includes the under collateralized portion of a secured claim entitled to priority treatment. Creditor Type of priority Est. claim amount [Continue in section V.H. or on continuation sheet as necessary.] Class 6. Special unsecured claims. The following unsecured claims, such as co-signed unsecured claims, will be paid

in full and ahead of general unsecured claims for the reasons stated. Creditor Reason for special treatment Claim amount [Continue in section V.H. or on continuation sheet as necessary.] Class 7. General unsecured claims. Unsecured claims, not entitled to priority under 11 U.S.C. § 507 nor special

treatment under Class 6, will be paid after all other claims. Notwithstanding Debtor’s good faith estimate of percentage

distribution on general unsecured claims in the section III liquidation analysis, for the purposes of 11 U.S.C. § 1328(a),

completion of the plan will occur upon the earlier of 100% payment to all creditors filing a timely proof of claim or full

payment of the amount stated in section I of the plan.

D.Executory Contracts and Unexpired Leases Being Assumed. Debtor assumes the unexpired leases and executory

contracts noted below. Debtor will pay directly to the other party to the contract or lease all postpetition obligations. Any

executory contract or unexpired lease not assumed is rejected. A prepetition arrearage under an expired lease or executory

contract being assumed will be treated as a claim in Class 1, Class 6, or as stated in section V.H. Party to lease or contract being assumed Prepetition arrearage (if any) If arrearage, treatment:(Class 1, Class 6, or other) [Continue in section V.H. or on continuation sheet as necessary.]

LBF 3015-11/1/01code: CP Page 5 of 7E.Avoidable Liens and Security Interests. Debtor is moving to avoid a judicial lien or nonpossessory, non-purchase

money security interest under 11 U.S.C. § 522(f) as noted below. Avoidance of a lien or security interest requires a separate

motion for each lien and must be attached to this plan. Motion(s) to Avoid Lien attached (LBF 3015-522). Creditor(s):F.Postpetition Obligations. Debtor will pay directly to creditors all obligations coming due postpetition except:G.Order of Distribution. After confirmation of this plan, funds available for distribution will be paid monthly by Trustee

in the following order; (i) Trustee’s monthly administrative fees; then (ii) administrative expenses as allowed under

applicable rules and guidelines; then (iii) pro rata payments on Class 1 and Class 2 secured claims, including prepetition

arrearages under unexpired leases and executory contracts being assumed and designated as Class 1 claims; then (iv) Class 5

priority unsecured claims; then (v) Class 6 special unsecured claims, and then (vi) Class 7 general unsecured claims. Within

each such category, claims shall be paid on a pro rata basis. Unless a claim objection is sustained or a motion to value

collateral or to avoid a lien is granted, or the court otherwise orders, distributions on account of claims in Classes 1, 2, 5, 6,

and 7 will be based upon the classification and amount stated in each claim holder’s proof of claim rather than any

classification or amount stated in this plan. III. LIQUIDATION ANALYSIS The value, as of the date the petition was filed, of property to be distributed under the plan on account of each allowed

unsecured claim is not less than the amount that would be paid on such claim if the estate of the Debtor were liquidated on

such date under chapter 7 of the Bankruptcy Code. Debtor estimates, in good faith, that liquidation under Chapter 7 would be

as follows:1. Real property – Schedule A$ 5. Exemptions – Schedule C$ 2. Personal property – Schedule B$ 3. Property recoverable by avoiding powers$ 6. Secured claims (less unsecured portions if any) – Schedule D$ 4. Total assets – Add boxes 1 – 3$ $ 7. Priority claims – Schedule E8. Est. Ch. 7 administrative expenses$ 9. Total adjustments – Add Boxes 5 - 8$ 10. Amount available to pay general unsecured claims in liquidation – Subtract Box 9 from Box 4$ 11. Total amount of general unsecured debt from Schedule F + unsecured portions from Schedule D, if any$ 12. Estimated distribution on general unsecured claims in liquidation – Divide Box 10 by Box 11 % 13. Estimated distribution on general unsecured claims through this plan % IV. TAXES A. Tax Returns Due Prepetition. All federal and state tax returns due prepetition have been filed All federal and state tax returns due prepetition have not been filed but will be filed prior to confirmation. B.Postpetition Taxes. Debtor will file all postpetition federal, state and local tax returns and pay all postpetition taxes as

they come due. Returns will be filed and payments made at the location specified by the taxing authority. Debtor will

provide Trustee with a copy of each federal tax return, W-2 form, and 1099 form received or filed while the case is pending.

LBF 3015-11/1/01code: CP Page 6 of 7C.Additional Provisions 1.This plan shall not affect the rights of any federal, state or local taxing authority to examine or audit Debtor’s tax

returns. a.If there are any additional taxes due and owing as a result of such examination, such additional taxes shall

be paid under this plan, through an amended plan, or directly by Debtor.b.Confirmation of this plan does not discharge any additional taxes. 2.Notwithstanding section 1.B., any refunds or overpayments due from any federal, state or local taxing authority

may be applied to any outstanding tax liability owed to the respective taxing authority. V. OTHER PROVISIONS A. Guidelines for Chapter 13 Procedures. The court has established Guidelines for Chapter 13 Procedures which are

applicable to all Chapter 13 cases filed on or after January 1, 2001, and to the extent practicable, all pending Chapter 13

cases. The Guidelines mandate use of this form plan and other documents, and contain a number of important provisions

regarding the administration of Chapter 13 cases. Its terms are incorporated into this plan. A copy of the Guidelines may be

obtained from the Clerk of the bankruptcy court and also is available and may be downloaded from the court’s website:

www.hib.uscourts.gov.B.Vesting and Possession of Property. Property of the estate shall revest in Debtor upon plan confirmation. If the case is

converted to a case under chapter 7, 11, or 12, or is dismissed, the property of the estate shall vest in accordance with

applicable law.C.Debtor’s Duties. In addition to the duties and obligations imposed upon Debtor by the Bankruptcy Code and Rules,

Local Bankruptcy Rules, and the Guidelines for Chapter 13 Procedures, this plan imposes certain additional requirements on

Debtor, including: (i) Transfers of property. Debtor is prohibited from encumbering, selling, or otherwise disposing of any

personal or real property other than in the regular course of Debtor’s business without first obtaining court authorization. (ii)

New Debt. Except as provided in 11 U.S.C. § 364, Debtor shall not incur any new debt exceeding $1,000 without the prior

written approval of Trustee or order of the court. (iii) Insurance. Debtor shall maintain insurance as required by any law,

contract, or security agreement on all vehicles and property subject to a security interest in the amount of the outstanding

claim of the creditor or value of the collateral, whichever is less, unless otherwise ordered by the court. (iv) Support

payments. Debtor shall maintain ongoing child or spousal support payments directly to the court-ordered recipient. (v)

Periodic reports. Debtor shall provide to Trustee any requested financial information regarding Debtor’s business in the

manner and for the periods set by Trustee.DDismissal – Lack of Feasibility Based on Claims Actually Filed. Debtor understands that this case may be dismissed

without a hearing if Debtor fails to respond adequately to Trustee’s Motion to Dismiss Case for Lack of Feasibility. Trustee

may file a motion to dismiss if Trustee determines that the timely filed proofs of claim will make impossible the full

payment, within 60 months from confirmation, administrative expenses, secured claims, priority unsecured claims and any

claims placed in a special class for full payment. To respond adequately to Trustee’s Motion to Dismiss Case for Lack of

Feasibility, Debtor shall file within 30 days after the date of such notice, an objection to claim which, if sustained, would

ensure feasibility, or a motion to modify the confirmed plan. Failure to file an objection to a claim making the plan not

feasible, or to file a motion to modify the plan within the 30-day period, or an overruling of the objection to claim, or denial

of the motion to modify the plan, may result in dismissal of the case without further notice.E.Relief from Stay. If the order unconditionally permits the secured creditor to foreclose on or repossess it collateral,

Trustee, as soon as practicable, shall cease making payments to all creditors whose claims are based entirely on a secured

interest in the collateral being foreclosed on or repossessed, unless the order provides otherwise. Such action by Trustee will

not affect the number or amount of periodic payments due from Debtor under the plan.F.Duration of Plan. The plan will run a minimum of 36 months, unless all timely filed claims are sooner paid in full. To

ensure full payment of administrative expenses, secured claims, priority unsecured claims and any claims placed in a special

class for full payment, Trustee may seek to provide for feasibility by filing a motion to extend plan up to 60 months.

LBF 3015-11/1/01code: CP Page 7 of 7G.Certification. Debtor certifies that this plan has been proposed in good faith, that the foregoing information provided in

the plan is true and correct, and that Debtor will be able to make all plan payments and otherwise comply with the plan. This

plan will be served on the Chapter 13 Trustee, the federal, state and local taxing authorities, and all creditors and parties in

interest.H.Other. Included below is any information concerning additional creditors or claims, irregular plan payments, funding of

plan from other sources, special treatment of prepetition arrearages under an unexpired lease or executory contract being

assumed, and any other special provisions. (Note: Additional provisions may not conflict with the substantive provisions of

the court-approved form plan unless approved by the court upon separate motion.)Dated: DebtorJoint Debtor (if any) Dated: Debtor’s Attorney