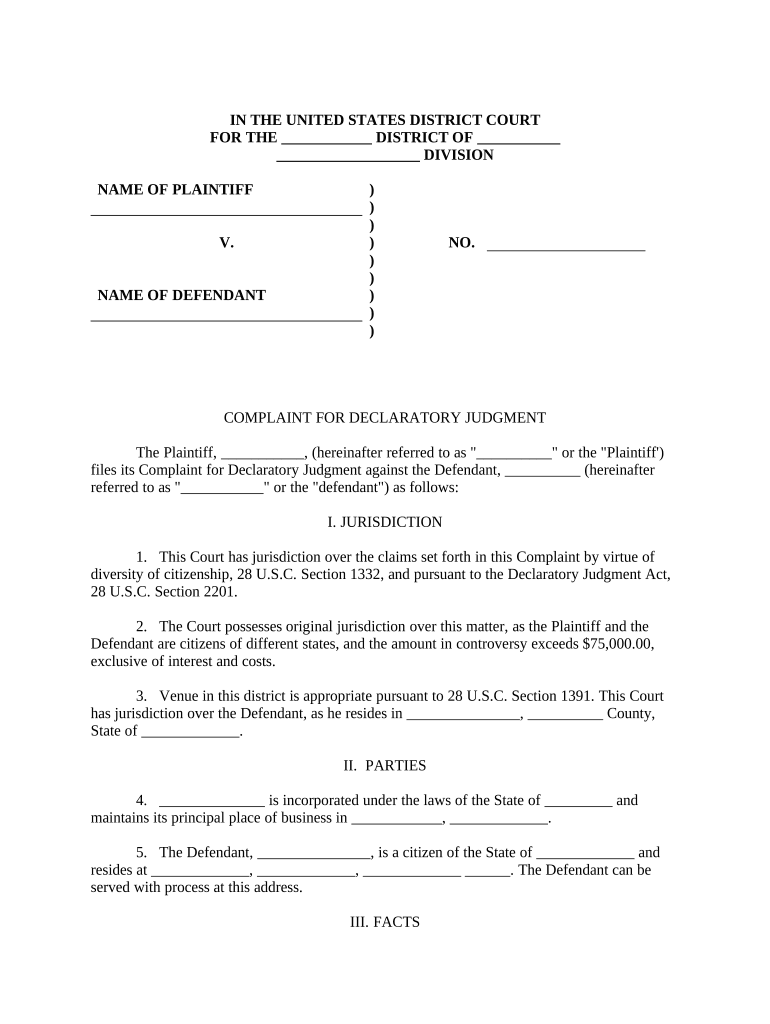

Fill and Sign the Declaratory Judgment Insurance Form

Practical advice on finalizing your ‘Declaratory Judgment Insurance’ online

Are you fed up with the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Wave goodbye to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the comprehensive features built into this intuitive and cost-effective platform and transform your document management approach. Whether you need to approve forms or collect eSignatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Declaratory Judgment Insurance’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and assign fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you want to collaborate with your colleagues on your Declaratory Judgment Insurance or send it for notarization—our solution provides all the necessary tools to manage such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is Declaratory Judgment Insurance and how does it work?

Declaratory Judgment Insurance is a specialized insurance product that provides coverage for legal disputes over the interpretation of contracts or laws. It helps businesses manage the risks associated with litigation by covering the costs of defending against declaratory judgment actions. By securing this type of insurance, companies can protect their financial interests while ensuring clarity in legal proceedings.

-

What are the benefits of purchasing Declaratory Judgment Insurance?

Purchasing Declaratory Judgment Insurance offers several benefits, including financial protection against unexpected legal costs and the assurance that your business can defend its rights effectively. This insurance can also help mitigate risks by providing clarity in contractual obligations, making it a valuable tool for businesses engaged in complex agreements. Additionally, it enhances your company's credibility when dealing with partners and clients.

-

How much does Declaratory Judgment Insurance typically cost?

The cost of Declaratory Judgment Insurance can vary widely based on factors such as the size of your business, the nature of your operations, and the coverage limits you choose. Generally, businesses can expect to pay a premium that reflects their particular risk profile. It’s advisable to consult with an insurance specialist to receive tailored quotes and understand the best options for your needs.

-

Can Declaratory Judgment Insurance be integrated with other business insurance products?

Yes, Declaratory Judgment Insurance can often be integrated with other business insurance products to create a comprehensive risk management strategy. Many insurers offer packages that include various types of coverage, allowing businesses to streamline their insurance needs. This integration can enhance protection and potentially lead to cost savings on premiums.

-

Who should consider getting Declaratory Judgment Insurance?

Businesses that engage in contracts or legal agreements with signNow financial implications should consider obtaining Declaratory Judgment Insurance. This includes companies in industries such as real estate, construction, and finance, where disputes over contract interpretations are common. Additionally, any organization looking to safeguard itself against potential legal challenges would benefit from this type of coverage.

-

What features should I look for in a Declaratory Judgment Insurance policy?

When evaluating Declaratory Judgment Insurance policies, look for features such as comprehensive coverage for legal fees, access to legal resources, and support for dispute resolution. It's also important to consider the insurer's reputation and their experience in handling similar claims. A policy that includes flexible terms and conditions can provide additional peace of mind.

-

How can airSlate SignNow help with the management of Declaratory Judgment Insurance documents?

airSlate SignNow provides an easy-to-use platform for managing all your Declaratory Judgment Insurance documents. With features like eSigning and document tracking, businesses can streamline the process of sending and signing insurance contracts, ensuring that all paperwork is completed efficiently and securely. This not only saves time but also enhances compliance and record-keeping.

The best way to complete and sign your declaratory judgment insurance form

Find out other declaratory judgment insurance form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles