- 1 -

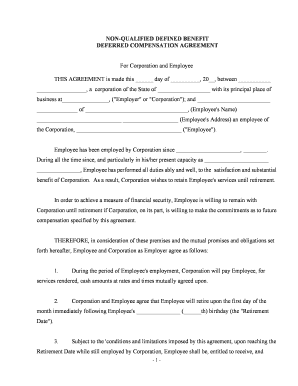

NON-QUALIFIED DEFINED BENEFIT

DEFERRED COMPENSATION AGREEMENT

For Corporation and Employee

THIS AGREEMENT is made this ______ day of __________, 20__, between ___________

_________________, a corporation of the State of __________________ with its principal place of

business at________________, ("Employer" or "Corporation"); and _________________________

______________ of ___________________________________, (Employee's Name)

_____________________________ ___________________ (Employee's Address) an employee of

the Corporation, ____________________________________ ("Employee").

Employee has been employed by Corporation since ______________________, ________.

During all the time since, and particularly in his/her present capacity as ______________________

_______________, Employee has performed all duties ably and well, to the satisfaction and substantia l

benefit of Corporation. As a result, Corporation wishes to retain Employee's services until retirement.

In order to achieve a measure of financial security, Employee is willing to remain with

Corporation until retirement if Corporation, on its part, is willing to make the commi tments as to future

compensation specified by this agreement.

THEREFORE, in consideration of these premises and the mutual promises and obligations set

forth hereafter, Employee and Corporation as Employer agree as follows:

1. During the period of Employee's employment, Corporation will pay Employee, for

services rendered, cash amounts at rates and times mutually agreed upon.

2. Corporation and Employee agree that Employee will retire upon the first day of the

month immediately following Employee's _______________ (______th) birthday (the "Retirement

Date").

3. Subject to the 'conditions and limitations imposed by this agreement, upon reaching the

Retirement Date while still employed by Corporation, Employee shall be, entitled to receive, and

- 2 -

Corporation agrees to pay Employee, a series of one hundred twenty (120) equal monthly payments

representing installments of Annual Retirement Benefit of $____________payable for a period of ten

(10) years commencing upon the Retirement Date.

4. If prior to the Retirement Date Employee should become disabled to such an extent that

as a result of accidental bodily injury or sickness Employee is wholly and continuously unable to

perform Employee's full-time service for Corporation, such disability shall be treated similarly to a

retirement on the Retirement Date. Corporation shall make payments to employee in the same manner it

would have done following normal retirement except that Employee shall only be entitled to receive

that percentage of the Annual Retirement Benefit which corresponds to Employee's total consecutive

full years of service with Corporation at found in the following table:

Percentage (%)* of Annual

Years of Service Retirement Benefit_____________ ______________________

0 - 2 0% (no benefit) 3 - 5 25%

6 - 9 50%

10 - 14 75%

Thereafter 100%

The decision of a majority of the Board of Directors of Corporation that Employee is di sabled to

the extent provided above shall be conclusive for the purposes of this agreement. The Board of

Directors shall communicate its decision to Employee in writing within ___ days afte r the decision has

been made. If Employee is continuously disabled as defined above for a 6-month period commencing

upon the date of the Board of Directors' communication, then Corporation shall make the payments

provided herein, commencing upon the first day of the month immediately following expiration of the

6-month period.

5. In the event of Employee's death while employed by Corporation and prior to the

Retirement Date (or any determination of disability under Paragraph 4) Corporation agrees that it will

- 3 -

pay to such beneficiary or beneficiaries as Employee may have designated pursuant to Paragraph 7, or

in the absence of any such designation, to Employee's surviving spouse, if any, a series of one hundred

twenty (120) equal monthly payments representing installments of an annual payment of

$___________ payable for a period of ten (10) years commencing upon the first day of the month

immediately following Employee's death.

6. In the event of Employee's death while entitled to payments under either of Paragra phs 3

or 4, any amount not yet paid at Employee's death, shall be payable instead to Employee's designated

beneficiary or beneficiaries, or in the absence of a designation, to Employee's surviving spouse, if any,

in the same manner as if payable to Employee. Any amounts not fully paid by reason of a payee's death

while receiving payments shall be immediately payable in a single sum to the payee's estate.

In the event of Employee's death leaving neither a spouse nor any designated

beneficiary surviving, any unpaid amount to which Employee was entitled shall be payable i n a single

sum to Employee's estate upon the first day of the month immediately following Employee's death.

7. To designate a beneficiary or beneficiaries to receive any amounts due under this

agreement, Employee shall file with Corporation a written notice specifying the name, address and

relationship to Employee of each beneficiary. Any such designation may be changed by Employee

with a new written notice.

8. If Corporation should terminate the employment of Employee prior to the Retirement

Date (or a determination of disability under Paragraph 4) by discharging Employee for malfeasance,

dishonest or such other cause as a majority of the Board of Directors of corporation in its sole

discretion deems sufficient, this agreement shall automatically terminate, and Corporation shall have

no obligation to make any payments whatsoever hereunder.

9. This agreement shall also terminate, and Corporation shall be immediately rel ieved of

all obligation to make payments hereunder if Employee's employment by Corporation should

terminate prior to the Retirement Date (or a determination of disability under Paragraph 4) for any

reason other than discharge as described in Paragraph 8. Nevertheless, in the sole discretion of a majority of the Board of Directors, any monies,

- 4 -

life insurance contracts, annuities or other assets Corporation may have set aside to meet its obligation

under this agreement may be transferred absolutely to any other person or firm by whom Employee

may be employed or with whom Employee may enter into a contract for service.

10. Employee agrees that he/she will not hereafter, either during full-time employment or

while receiving any benefits under this agreement, enter into competition with Corporation, directly

or indirectly, within the City of____________ or a _______ mile radius thereof, through employment

by or engaging in any business similar to that carried on by Corporation, or which in the exclusive

opinion of Corporation's Board of Directors is in competition with Corporation. The judgment of a

majority of the Board of Directors that such competition exists shall be conclusive for purposes of this

agreement.

11. If Employee should violate the provisions of Paragraph 10 and continue to do so for a

period of ___ days after Corporation shall have requested Employee in writing to refrain from an

action prohibited by said Paragraph 10, Employee agrees that no further payments shall be due

Employee, Employee's spouse, any other designated beneficiary, or their respective estates under this

agreement and that Corporation shall have no further obligation whatsoever hereunder.

12. Corporation agrees that it will not merge or consolidate with any other corporation or

organization, or permit its business activities to be taken over by any other organization, unless and

until the succeeding or continuing corporation or other organization shall expressly assume the ri ghts

and obligations of Corporation under this agreement. Corporation further agrees that it will not cease

its business activities or terminate its existence, other than as heretofore set forth in this paragraph,

without having made adequate provision for its obligations under this agreement to be fulfi lled. In the

event of any default by Corporation under this paragraph only, Employee (or other obligee or

obligees) shall have a continuing lien for the amount required to assure performance of thi s agreement

upon all corporate assets, including any transferred assets, until such default is corrected.

13. It is the intention of Corporation to maintain adequate reserves for the satisfaction of

its obligations under this agreement. Nothing in this agreement, however, shall create a n obligation on

Corporation's part to set aside or earmark any monies or other assets specifically for this purpose.

Should Corporation elect to purchase life insurance or annuity contracts as a means of satisfying its

- 5 -

obligations under this agreement, in whole or in part, it reserves the absolute right in its sole discretion

to terminate any such contracts, as well as any other funding program, at any time, in whole or in part.

14. At no time shall Employee, Employee's spouse, or any other beneficiary Employee

may have designated under this agreement be deemed to have any right, title or interest in or to any

specific fund or assets of Corporation, including, but not limited, to, any life insurance or annuity

contracts which the Corporation may at any time have purchased. As to any claim for unpaid benefits

under this agreement, Employee, Employee's spouse, or any other beneficiary designated hereunder,

shall be an unsecured creditor of Corporation in the same manner as any other creditor having a

general claim for unpaid compensation.

15. It is expressly agreed that neither Employee, Employee's spouse, nor any other

beneficiary shall have any right to commute, sell, pledge, assign, transfer or otherwise convey the

right to receive any payments under this agreement, which payments and the right thereto being

hereby expressly made non-assignable and non-transferable. Such payments shall not be subject to

legal process or levy of any kind.

16. The benefits under this agreement shall be independent of, and in addition to, benefits

payable under any other employment agreement that may exist from time to tim e between the parties

hereto, or any other compensation payable by Corporation to Employee whether as salary, or

otherwise. This agreement shall not be deemed to constitute a contract of employment between the

parties, nor shall any provision hereof restrict the right of Corporation to discharge Employee, or

restrict the right of Employee to terminate his/her employment.

17. During Employee's lifetime this agreement may be terminated or amended in any

particular by the mutual written agreement of Employee and Corporation.

18. This agreement shall be binding upon the parties hereto, their heirs, executors,

administrators, and successors in interest.

19. Unless otherwise provided in this agreement, any controversy or claim arising out of or

relating to this contract, or the breach thereof, shall be settled by arbitration in accordance with the

- 6 -

Rules of the American Arbitration Association, and judgment upon the award rendered by the

Arbitrator(s) may be entered in any Court having jurisdiction thereof. IN WITNESS WHEREOF the parties have executed this agreement the day and year first above

written.

_____________________Corporation

Attest: _____________________ By: _____________________ _____________________ ____________________

Title Title

_____________________ ____________________

Witness (Employee)

Helpful hints for preparing your ‘Deferralcom Election Form Sample’ online

Exhausted by the trouble of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the boring routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and authorize documents online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your method of document administration. Whether you need to sign forms or collect signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our collection of forms.

- Open your ‘Deferralcom Election Form Sample’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or turn it into a reusable template.

Don’t fret if you need to collaborate with others on your Deferralcom Election Form Sample or send it for notarization—our platform offers everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new heights!