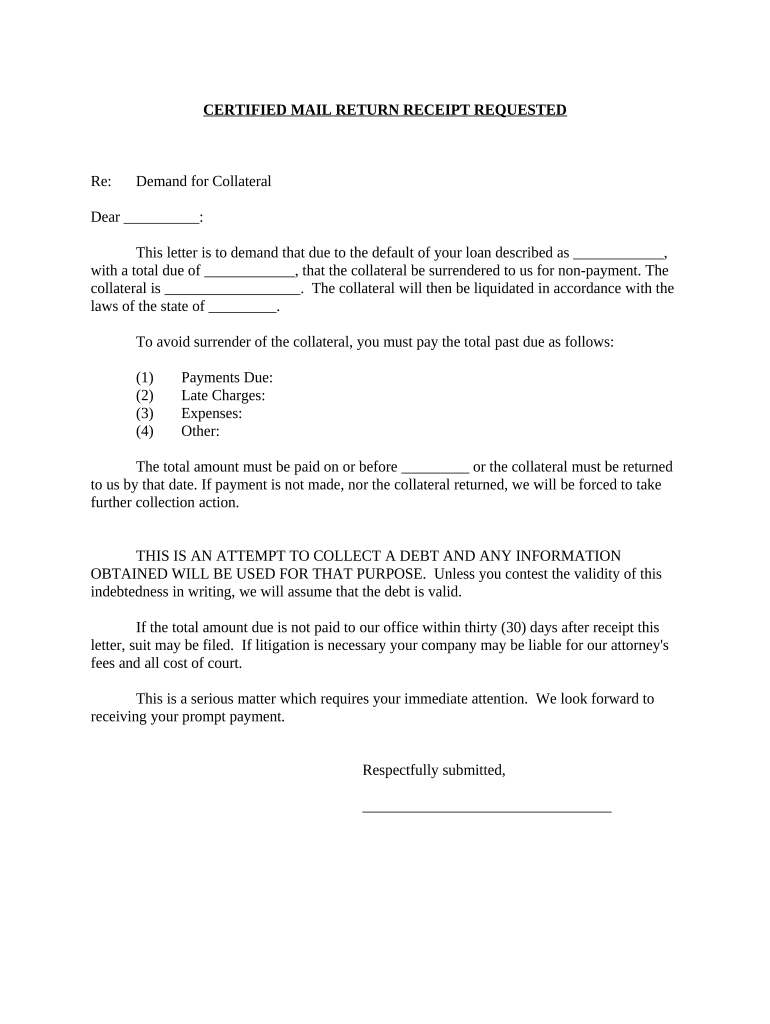

Fill and Sign the Demand Creditor Form

Valuable advice on completing your ‘Demand Creditor’ online

Are you fed up with the inconvenience of handling paperwork? Search no more than airSlate SignNow, the leading eSignature solution for both individuals and businesses. Bid farewell to the laborious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign forms online. Utilize the robust features integrated into this user-friendly and cost-effective platform and transform your method of managing paperwork. Whether you need to approve forms or collect electronic signatures, airSlate SignNow takes care of everything efficiently, with only a few clicks.

Follow this comprehensive guide:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Access your ‘Demand Creditor’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Demand Creditor or send it for notarization—our solution provides everything you need to achieve such tasks. Sign up with airSlate SignNow today and enhance your document management to a new dimension!

FAQs

-

What is a Demand Creditor in the context of airSlate SignNow?

A Demand Creditor refers to an individual or entity that has the right to demand payment from a debtor. With airSlate SignNow, businesses can efficiently manage documents related to demand creditors, ensuring that all agreements are securely signed and stored electronically.

-

How does airSlate SignNow benefit demand creditors?

AirSlate SignNow provides demand creditors with a streamlined process for sending and signing essential documents, such as loan agreements and contracts. This functionality not only saves time but also enhances security and compliance, allowing demand creditors to focus on their core business activities.

-

What features does airSlate SignNow offer for managing demand creditor documents?

AirSlate SignNow includes features like customizable templates, automated reminders, and secure electronic signatures that are crucial for managing demand creditor documents. These features help ensure that important agreements are executed promptly and tracked efficiently.

-

Is airSlate SignNow cost-effective for demand creditors?

Yes, airSlate SignNow is designed to be a cost-effective solution for demand creditors, offering various pricing plans to suit different business needs. By reducing the time and resources spent on document management, demand creditors can achieve signNow savings.

-

Can I integrate airSlate SignNow with other tools for my demand creditor processes?

Absolutely! AirSlate SignNow integrates seamlessly with popular business tools such as CRM systems, project management software, and cloud storage solutions. This integration allows demand creditors to streamline their workflows and enhance productivity.

-

What security measures does airSlate SignNow have for demand creditor documents?

AirSlate SignNow employs industry-standard security measures, including encryption and secure cloud storage, to protect documents related to demand creditors. This ensures that sensitive information remains confidential and safe from unauthorized access.

-

How can airSlate SignNow help improve compliance for demand creditors?

AirSlate SignNow helps demand creditors maintain compliance by providing a clear audit trail for all signed documents. This feature is essential for meeting regulatory requirements and can protect demand creditors in case of disputes.

The best way to complete and sign your demand creditor form

Find out other demand creditor form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles