Fill and Sign the Disclosure of Distribution Agreement Services Agreement and Tax Sharing Form

Useful suggestions for getting your ‘Disclosure Of Distribution Agreement Services Agreement And Tax Sharing’ online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and authorize paperwork online. Take advantage of the robust tools included in this user-friendly and cost-effective platform to transform your method of document handling. Whether you need to authorize forms or collect signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow these comprehensive instructions:

- Log into your account or register for a free trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our form library.

- Edit your ‘Disclosure Of Distribution Agreement Services Agreement And Tax Sharing’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Disclosure Of Distribution Agreement Services Agreement And Tax Sharing or send it for notarization—our service provides you with everything you need to achieve these objectives. Sign up with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

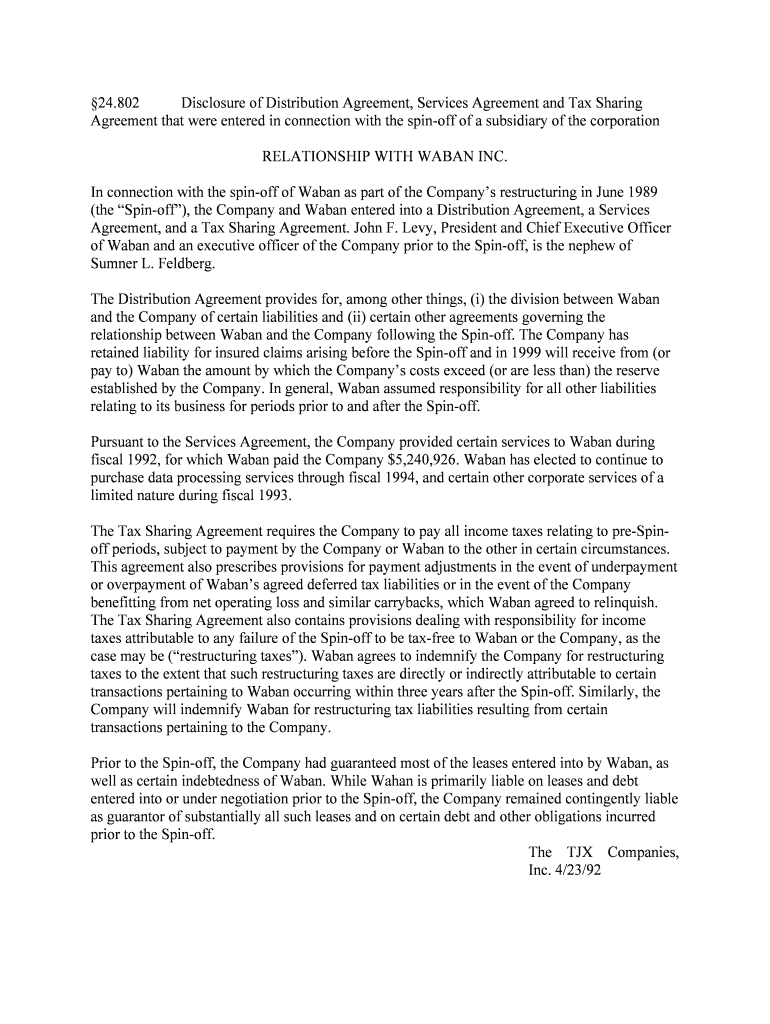

What is the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing?

The Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing refers to the essential documentation that outlines the terms and conditions between parties involved in distribution and service agreements, including tax sharing responsibilities. Understanding this disclosure is crucial for businesses to ensure compliance and transparency in their contractual relationships.

-

How can airSlate SignNow assist with the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing?

airSlate SignNow provides an efficient platform to create, send, and eSign documents related to the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing. With our user-friendly interface, businesses can streamline their document management process, ensuring that agreements are executed swiftly and securely.

-

What are the pricing options for using airSlate SignNow for managing agreements?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small startup or a large enterprise, you can choose a plan that aligns with your requirements for managing the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing efficiently.

-

Is it easy to integrate airSlate SignNow with other software for managing agreements?

Yes, airSlate SignNow offers seamless integrations with popular platforms such as Salesforce, Google Drive, and Microsoft Office. This allows businesses to manage the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing alongside other essential tools, enhancing collaboration and productivity.

-

What features does airSlate SignNow offer for document security?

airSlate SignNow prioritizes document security with features like advanced encryption, two-factor authentication, and secure cloud storage. These measures ensure that your Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing are protected against unauthorized access and data bsignNowes.

-

How does eSigning work for the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing?

eSigning through airSlate SignNow is a straightforward process that allows signers to electronically sign documents securely. Once the Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing are prepared, you can send them for eSignature, and recipients can sign from anywhere, ensuring a fast and efficient workflow.

-

Can I track the status of my agreements with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your documents. You can easily see when your Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing have been viewed, signed, or require further action, helping you stay organized and informed.

The best way to complete and sign your disclosure of distribution agreement services agreement and tax sharing form

Find out other disclosure of distribution agreement services agreement and tax sharing form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles