Fill and Sign the Download Tankless Dhw Service Agreement Foley Mechanical Form

Useful Advice on Preparing Your ‘Download Tankless Dhw Service Agreement Foley Mechanical’ Online

Are you fed up with the inconveniences of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the powerful features included in this user-friendly and cost-effective platform and transform your strategy for document management. Whether you need to sign forms or gather eSignatures, airSlate SignNow simplifies it all with just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Download Tankless Dhw Service Agreement Foley Mechanical’ in the editor.

- Click Me (Fill Out Now) to prepare the form on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Download Tankless Dhw Service Agreement Foley Mechanical or send it for notarization—our solution offers everything you require to achieve such tasks. Register with airSlate SignNow today and enhance your document management to a new level!

FAQs

-

What is the Tankless DHW Service Agreement by Foley Mechanical?

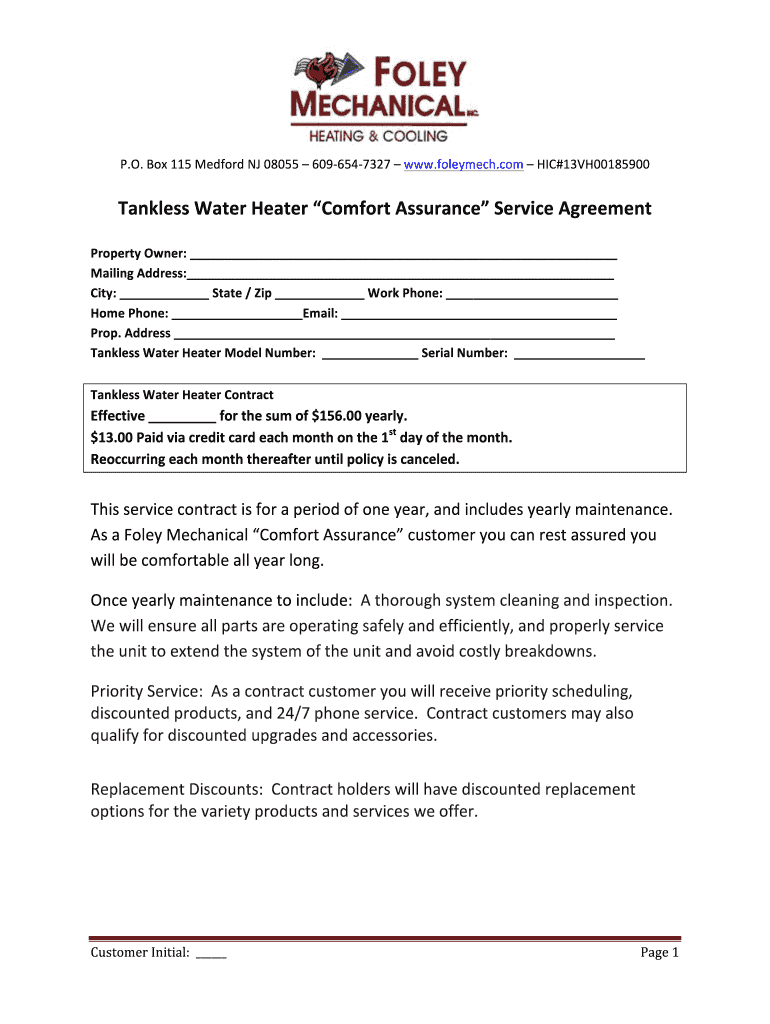

The Tankless DHW Service Agreement by Foley Mechanical is a comprehensive document that outlines the terms and conditions for servicing tankless water heaters. With this agreement, customers can ensure their systems are maintained effectively and efficiently. To get started, simply Download Tankless DHW Service Agreement Foley Mechanical from our platform.

-

How do I Download Tankless DHW Service Agreement Foley Mechanical?

To Download Tankless DHW Service Agreement Foley Mechanical, visit our website and navigate to the service agreements section. You will find a straightforward link that allows you to download the document in a few easy steps. Make sure you fill out any necessary information to complete the process.

-

What are the benefits of signing the Tankless DHW Service Agreement?

Signing the Tankless DHW Service Agreement provides numerous advantages, such as priority service, discounted rates on repairs, and peace of mind knowing your tankless water heater is covered. This proactive approach helps extend the life of your system. Be sure to Download Tankless DHW Service Agreement Foley Mechanical to enjoy these benefits.

-

Is there a fee associated with the Tankless DHW Service Agreement?

Yes, there is a nominal fee associated with the Tankless DHW Service Agreement, which varies based on the level of service you choose. This fee covers the comprehensive benefits and services included in the agreement. For detailed pricing information, please refer to the section after you Download Tankless DHW Service Agreement Foley Mechanical.

-

Can I customize my Tankless DHW Service Agreement?

Absolutely! The Tankless DHW Service Agreement can be tailored to fit your specific needs. During the process, you can specify your preferences for service frequency and additional options. After customizing, remember to Download Tankless DHW Service Agreement Foley Mechanical to finalize your terms.

-

What happens if I need to cancel my Tankless DHW Service Agreement?

If you need to cancel your Tankless DHW Service Agreement, you can do so by contacting our customer service team. They will guide you through the cancellation process and inform you about any applicable terms. Ensure you have your agreement handy when you signNow out, especially if you want to Download Tankless DHW Service Agreement Foley Mechanical again in the future.

-

Are there any integrations available with the Tankless DHW Service Agreement?

Yes, the Tankless DHW Service Agreement can be integrated with various management systems to streamline your service process. This feature allows for easy tracking and management of service appointments and records. To explore these integrations, make sure to Download Tankless DHW Service Agreement Foley Mechanical for complete details.

Find out other download tankless dhw service agreement foley mechanical form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles