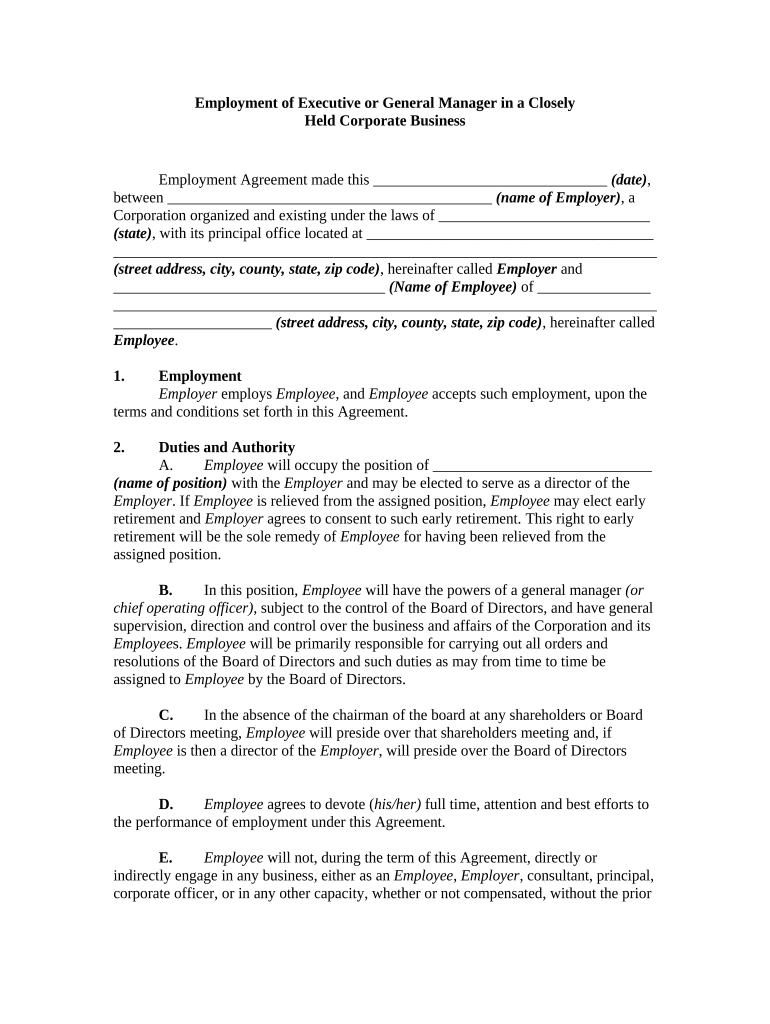

Employment of Executive or General Manager in a Closely

Held Corporate Business

Employment Agreement made this _______________________________ (date) ,

between ___________________________________________ (name of Employer) , a

Corporation organized and existing under the laws of ____________________________

(state) , with its principal office located at ______________________________________

________________________________________________________________________

(street address, city, county, state, zip code) , hereinafter called Employer and

____________________________________ (Name of Employee) of _______________

________________________________________________________________________

_____________________ (street address, city, county, state, zip code) , hereinafter called

Employee .

1. Employment

Employer employs Employee , and Employee accepts such employment, upon the

terms and conditions set forth in this Agreement.

2. Duties and Authority

A. Employee will occupy the position of _____________________________

(name of position) with the Employer and may be elected to serve as a director of the

Employer . If Employee is relieved from the assigned position, Employee may elect early

retirement and Employer agrees to consent to such early retirement. This right to early

retirement will be the sole remedy of Employee for having been relieved from the

assigned position.

B. In this position, Employee will have the powers of a general manager (or

chief operating officer) , subject to the control of the Board of Directors, and have general

supervision, direction and control over the business and affairs of the Corporation and its

Employee s. Employee will be primarily responsible for carrying out all orders and

resolutions of the Board of Directors and such duties as may from time to time be

assigned to Employee by the Board of Directors.

C. In the absence of the chairman of the board at any shareholders or Board

of Directors meeting, Employee will preside over that shareholders meeting and, if

Employee is then a director of the Employer , will preside over the Board of Directors

meeting.

D. Employee agrees to devote ( his/her) full time, attention and best efforts to

the performance of employment under this Agreement.

E. Employee will not, during the term of this Agreement, directly or

indirectly engage in any business, either as an Employee , Employer , consultant, principal,

corporate officer, or in any other capacity, whether or not compensated, without the prior

written consent of Employer , except for that time allocated for such purposes as

contained in the Shareholders Agreement.

3. Terms of Employment

The term of employment shall begin on the date of this Agreement, and shall

extend until terminated as provided for in this Agreement.

4. Compensation

Employee will receive compensation during the term of this Agreement as

follows:

A. A base annual salary of $_______________ payable either bi-monthly or

monthly at the discretion of the Employee . The base salary shall be adjusted at the end of

each year of employment to reflect any change in the cost of living by multiplying the

salary for the prior year by a fraction, the numerator of which is the National Consumer

Price Index (NCPI) for the month most recently released by the Bureau of Labor

Statistics of the United States Department of Labor and the denominator of which is the

NCPI for the identical month in the preceding year. If this index is discontinued, changed

or unavailable, Employer shall determine and use a similar criterion for reflecting any

increase in the cost of living.

B. A bonus as determined by the Board of Directors at its annual meeting in

the sole discretion of said Board.

5. Deferred Compensation

If Employee retires after performing services for the Employer up until Employee

reaches the age of ________ (retirement age) or retires at an earlier age with the approval

of the Employer , Employee will be entitled to deferred compensation payments after

retirement upon the following terms and conditions:

A. For a period of _______ (number) years (the retirement period) ,

Employee will receive the following:

1. Base payments equal to _______% of the average total salary ( i.e.,

base salary plus any bonuses) paid to Employee during the last ________

(number) full years of employment prior to the month of retirement

_______________ (the retirement salary base ).

2. Advisor payments equal to ________% of the retirement salary

base, provided that Employee serves as an advisor and consultant to the Employer

regarding its business. To earn the advisor payments, Employee will hold

(himself/herself) available to perform services at reasonable times at the request of

the Board of Directors of the Employer , consistent with any business activities

Employee may be engaged in at such time. The Board of Directors of the

Employer shall have the right to require the presence of Employee at any Board of

Directors meeting, not exceeding more than one meeting per month, to act and

serve in the advisory capacity. Attendance at these Board of Directors meetings

shall not be required should Employee 's health prevent attendance; however,

Employer shall have the right to demand a written statement from Employee

prepared by a licensed medical examiner evidencing inability of Employee to

attend the meeting or meetings. Employee will be reimbursed for all reasonable

and necessary travel and incidental expenses incurred by Employee in connection

with the performance of advisory services.

3. Noncompetition payments equal to _______% of the retirement

base salary, provided that Employee will not, directly or indirectly, perform any

business, commercial, or consulting services to any person, firm, or organization

or become associated as a manager, employee, director, or owner of any business

organization competing directly or indirectly with the Employer , whether or not

compensated, without the prior written consent of Employer . If Employer and

Employee are unable to agree on whether a particular business in which Employee

attempts to engage is directly or indirectly in competition with the Employer , the

matter will be submitted to arbitration under the provisions of Section 16 of this

Agreement.

B. The deferred compensation payments shall be made in equal monthly

installments starting in the month following the month of retirement.

C. In the event of the death of Employee prior to the expiration of the

retirement period, the Employer will pay all remaining base payments specified in

Subparagraph A-1 above, and no other deferred compensation payments, to any

beneficiary of Employee designated by Employee in a written document filed with the

Employer , or in the absence of such designation, the estate of Employee . The Employer

may elect to pay these remaining base payments in a lump sum or in the equal monthly

installments specified in Paragraph B .

D. Employee shall not sell, assign, transfer or pledge, or in any other way

dispose of or encumber, voluntarily or involuntarily, by gift, testamentary disposition,

inheritance, transfer to any inter-vivos trust, seizure and sale by legal process, operation

of law, bankruptcy, winding up of a corporation, or otherwise, the right to receive any

deferred compensation pursuant to this Agreement.

6. Relocation

If Employee is transferred and assigned to a new principal place of work located

more than _______ (number) miles from Employee 's present residence, Employer will

pay for all reasonable relocation expenses including:

A. Transportation fares, meals, and lodging for Employee , (his/her) spouse

and family from Employee 's present residence to any new residence located near the new

principal place of work;

B. Moving of Employee 's household goods and the personal effects of

Employee and Employee 's family from Employee 's present residence to the new

residence;

C. Lodging and meals for Employee and Employee 's family for a period of

not more than _______ (number) consecutive days while occupying temporary living

quarters located near the new principal place of work;

D. Round trip travel, meals, and lodging expenses for Employee 's family for

no more than _______ (number) house-hunting trips to locate a new residence, each trip

not to exceed _______ (number) days; and

E. Expenses in connection with the sale of the residence of Employee

including realtor fees, mortgage prepayment penalties, termite inspector fees, title

insurance policy and revenue stamps, escrow fees, fees for preparing documents, state or

local sales taxes, mortgage discount points (if in lieu of a prepayment penalty), and

seller's attorneys' fees (not to exceed _________ % of the sales price). At the option of

Employee and in lieu of reimbursement for these expenses, Employee may sell the

residence of Employee to the Employer at the fair market value of the residence

determined by an appraiser chosen by the Employer . The appraisal will be performed

within _______ (number) days after notice of transfer, and notice of appraised value will

be submitted by report to Employee . Employee will have the right to sell the residence to

the Employer at the appraised price by giving notice of intent to sell within ________

(number) days from the date of the appraisal report. The term residence shall mean the

property occupied by Employee as the principal residence at the time of transfer and does

not include summer homes, multiple-family dwellings, houseboats, boats, or airplanes,

but does include condominium or cooperative apartment units and duplexes (two-family)

occupied by Employee .

7. Medical and Group Insurance

Employer agrees to include Employee in the group medical and hospital plan of

Employer , when such plan is established, and will provide group life insurance for

Employee in the amount of not less than $_______________ of life insurance during the

term of employment.

8. Vacation

Employee shall be entitled to _______ (number) weeks of paid vacation during

each year of employment; the time for the vacation shall be mutually agreed upon by

Employee and Employer . If vacation is not taken, for the benefit of the Employer ,

Employee shall be reimbursed at (his/her) base salary rate for time not taken)

9. Automobile

Employer will provide to Employee , during the term of this Agreement, the use of

a new automobile of Employee 's choice, at a price not to exceed $_____________, and

will replace the automobile with a new one every ________ (number) years. Employer

will pay all automobile operating expenses incurred by Employee in the performance of

Employee 's business duties. The Employer will procure and maintain in force an

automobile liability policy for the automobile with coverage, including Employee , in the

minimum amount of $______________ of automobile liability insurance, combined

single limit on bodily injury and property damage.

10. Expense Reimbursement

Employee shall be entitled to reimbursement for all reasonable expenses,

including travel and entertainment, incurred by Employee in the performance of

Employee 's duties. Employee will maintain records and written receipts as required by

federal and state tax authorities to substantiate expenses as an income tax deduction for

Employer and shall submit vouchers for expenses for which reimbursement is made.

11. Permanent Disability

A. If Employee becomes permanently disabled (as defined below) during

employment with Employer , Employer may terminate this Agreement by giving _______

(number) days' notice to Employee of its intent to terminate, and, unless Employee

resumes performance of the duties set forth in Section Two within ______ (number)

days of the date of notice and continues performance for the remainder of the notice

period, this Agreement will terminate at the end of the ______ (number) -day period.

Permanently disabled for the purpose of this Agreement will mean the inability, due to

physical or mental ill health, or any reason beyond the control of Employee , to perform

Employee 's duties for _______ (number) consecutive days or for an aggregate of ______

(number) days during any one employment year irrespective of whether such days are

consecutive.

B. Upon termination of employment under the provisions of the above

Paragraph A , Employee may have any deferred compensation to which the Employee

may be entitled under the provisions of Section Five paid to (him/her) upon giving notice

to the Employer . For the purposes of Section Five , termination under Paragraph A of

this Section shall be considered retirement ; Employee will be excused from performing

advisory services as required under Section Five , Subparagraph A-2 , but shall

nevertheless be entitled to advisory payments except to the extent limited by death of

Employee as set forth in Section Five , Paragraph C .

C. Employer shall maintain, at its expense, a disability policy covering

Employee for a dollar amount specified by Employee . This amount may not exceed 100%

of Employee’s base salary.

12. Termination

A. This Agreement shall immediately be deemed terminated by death of

Employee.

B. This Agreement may be terminated by Employer by giving (number) days'

notice to Employee if Employee willfully breaches or habitually neglects the duties to be

performed under Section Two , or engages in any conduct which is dishonest or damages

the reputation of Employer .

C. . This Agreement may be terminated by Employee , without cause by

giving ______ (number) days' notice to Employer .

D. If employment is terminated pursuant to Paragraph B or C above,

Employee will be entitled to only base salary compensation earned prior to the date of

termination as provided for in Section Three of this Agreement computed pro rata up to

and including the date of termination. Employee shall not receive the deferred

compensation payments provided for in Section Four , Paragraph B , and Section Five ,

respectively.

E. If Employer is acquired, is a non-surviving party in a merger or transfers

substantially all of its assets, this Agreement shall not be terminated and Employer agrees

to take all actions necessary to ensure that the transferee or surviving company is bound

by the provisions of this Agreement.

13. No Waiver

The failure of either party to this Agreement to insist upon the performance of any

of the terms and conditions of this Agreement, or the waiver of any breach of any of the

terms and conditions of this Agreement, shall not be construed as subsequently waiving

any such terms and conditions, but the same shall continue and remain in full force and

effect as if no such forbearance or waiver had occurred.

14. Governing Law

This Agreement shall be governed by, construed, and enforced in accordance with

the laws of the State of __________________.

15. Notices

Any notice provided for or concerning this Agreement shall be in writing and

shall be deemed sufficiently given when sent by certified or registered mail if sent to the

respective address of each party as set forth at the beginning of this Agreement.

16 . Mandatory Arbitration

Any dispute under this Agreement shall be required to be resolved by binding

arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each party

shall select one arbitrator and both arbitrators shall then select a third. The third

arbitrator so selected shall arbitrate said dispute. The arbitration shall be governed by the

rules of the American Arbitration Association then in force and effect.

17 Entire Agreement

This Agreement shall constitute the entire agreement between the parties and any

prior understanding or representation of any kind preceding the date of this Agreement

shall not be binding upon either party except to the extent incorporated in this

Agreement.

18. Modification of Agreement

Any modification of this Agreement or additional obligation assumed by either

party in connection with this Agreement shall be binding only if placed in writing and

signed by each party or an authorized representative of each party.

19. Assignment of Rights

The rights of each party under this Agreement are personal to that party and may

not be assigned or transferred to any other person, firm, corporation, or other entity

without the prior, express, and written consent of the other party.

20. Counterparts

This Agreement may be executed in any number of counterparts, each of which

shall be deemed to be an original, but all of which together shall constitute but one and

the same instrument.

WITNESS our signatures as of the day and date first above stated.

___________________________

(Name of Employer)

By: _________________________ _____________________________

____________________________ _____________________________

(P rinted or typed name) Name and Signature of Employee

_____________________________

(Name and Office in Corporation)