NHJB-2117-P (03/25/2013) Page 1 of 4

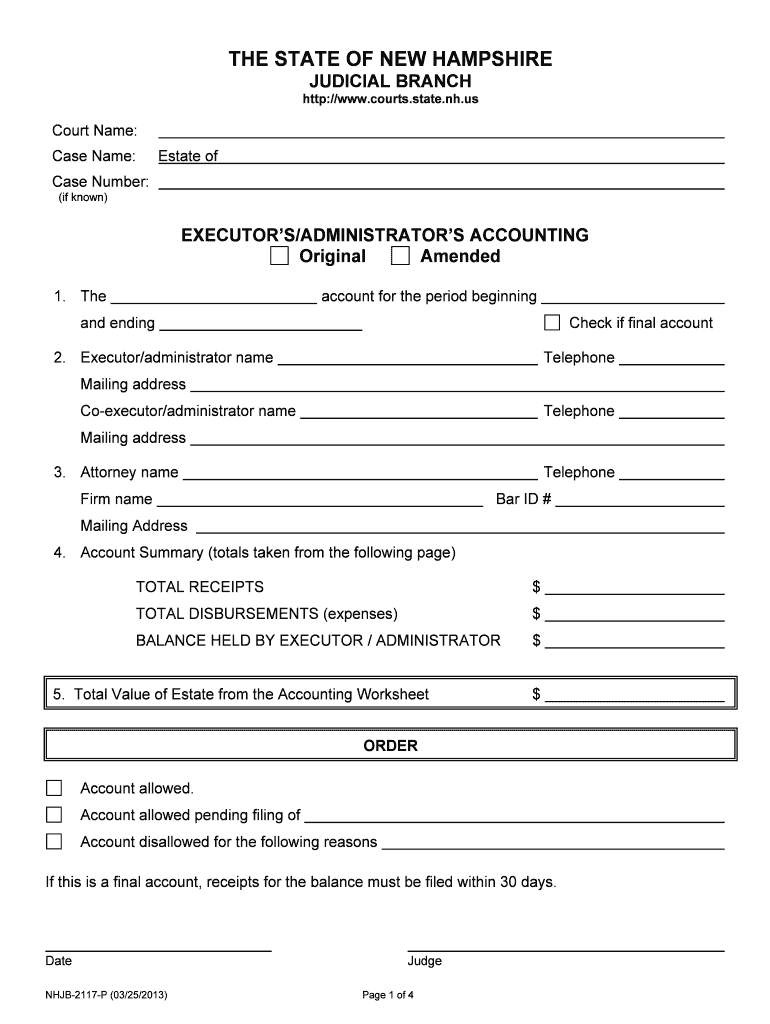

THE STATE OF NEW HAMPSHIRE

JUDICIAL BRANCH

http://www.courts.state.nh.us

Court Name:

Case Name:

Case Number:

(if known)

Estate of

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

Original Amended

1. The account for the period beginning

and ending Check if final account

2. Executor/administrator name Telephone

Mailing address

Co-executor/administrator name Telephone

Mailing address

3. Attorney name Telephone

Firm name Bar ID #

Mailing Address

4. Account Summary (totals taken from the following page)

TOTAL RECEIPTS $

TOTAL DISBURSEMENTS (expenses) $

BALANCE HELD BY EXECUTOR / ADMINISTRATOR $

5. Total Value of Estate from the Accounting Worksheet $

ORDER

Account allowed.

Account allowed pending filing of

Account disallowed for the follo wing reasons

If this is a final account, receipts for the balance must be filed within 30 days.

Date Judge

0.00

0.00

0.00

0.00

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

NHJB-2117-P (03/25/2013) Page 2 of 4

6. RECEIPTS

Schedule A – Inventory Total of Personal Estate or

Balance held at Prior Accounting ................................. $

On a separate sheet of paper, list all the personal estate (but not

real estate) that was listed on the Inventory form. For accounts

other than the first account, list each item included in Schedule 9

of the prior accounting. Schedule B – Net Gains (or losses) on Sales/Other Dispositions $

On a separate sheet of paper, list the Inventory value and sale

price for any asset sold (other than real estate), and show the difference

between the two amounts. Also list the date of the sale.

Schedule C – Income on all personal property, including dividends,

during accounting period ...................................... $

On a separate sheet of paper, list all income including dividends

and interest received during this accounting period. List the

individual amounts and date each was received. Schedule D – Cash received from sale of real estate ................. $

If real estate was listed on the Inventory, and has been sold during

this accounting period, on a separate sheet of paper list the address

of the real estate, sale price, amounts deducted from sale price,

amount received by the estate, and the date of sale. (May also attach

a copy of the HUD settlement statement.) Schedule E – Cash collected on rent s of real estate ................... $

If real estate was listed on the Inventory, and was not sold but rent

was collected during this account period, on a separate sheet of paper,

list the amount collected and the months for which the rent was collected.

Schedule F – Personal estate not listed on the Inventory ........... $

On a separate sheet of paper, list each asset that was not listed on the

Inventory with an explanation as to why it was not listed. Also list

the description and value for each asset.

Schedule G – Money advanced or contribut ed to estate ............. $

On a separate sheet of paper, list the name of the person who

gave money to the estate, the amount and date given.

TOTAL RECEIPTS (Schedules A - G) $

Add the amounts in Schedules A through G. Also enter this amount on Page 1, #4.

0.00

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

NHJB-2117-P (03/25/2013) Page 3 of 4

7. DISBURSEMENTS (expenses)

Schedule 1 – Administrative expenses including taxes ................ $

Administrative expenses are all expenses incurred in administering the

estate, such as filing fees, publication fees, bond premiums, etc. On a

separate sheet of paper, list the date paid, each expense and the amount.

Schedule 2 – Attorney and Fiduciary Fees

Total Fees (show breakdow n below) ........................................... $

Attorney fees $ Exec / Admin fees $

Prior fees allowed to date:

Attorney fees $ Exec / Admin fees $

Probate rules require fees to be shown in summary form.

This summary is sufficient unless the Court requires further detail.

Schedule 3 – Funeral and burial ex penses ................................... $

List all funeral and burial expenses, the amount and the date paid.

Schedule 4 – Paid spouse's allowance out of personal estate ..... $

If a Motion for Spousal Allowance has been filed and granted by the court,

on a separate sheet of paper, list the name of the spouse, amount

disbursed and the date Motion was granted by the court. If Receipt

(Form NHJB-2139-P) was not filed, you must file it at this time.

Schedule 5 – Debts, including expenses of last sickness ............. $

On a separate sheet of paper, list all debts and/or claims paid during this

accounting period that existed prior to death. List the last sickness

expenses individually. List the amount paid, the date of payment and to

whom the payment was made.

Schedule 6 – Distribution to legatees, not residuary legatees .... $

On a separate sheet of paper, list each person who received specific

bequests under the will. List name, amount received or item received and

its value. If Receipts (Form NHJB-2139-P) were not filed for each person,

you must file them at this time.

Schedule 7 – Interim distributions made with prior court approval $

If a Motion for Distribution was filed and granted by the court during this

accounting period, you must list the names that were on the Motion, the

amounts distributed, and date the Motion was granted by the court. If Receipts

(Form NHJB-2139-P) were not filed for each person, you must file them at this time.

Schedule 8 – Other Disbursem ents ............................................ $

On a separate sheet of paper, list any other disbursements not listed in

Schedules 1 through 7 above. List the amount disbursed, date it was

disbursed and the name of the person receiving the disbursement.

TOTAL DISBURSEMENTS (Schedules 1 - 8) $

Add the amounts in Schedules 1 through 8. Also enter this amount on Page 1, #4.

0.00

0.00

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

NHJB-2117-P (03/25/2013) Page 4 of 4

8.

Schedule 9– BALANCE HELD BY EXECUTOR / ADMINISTRATOR

(Total Receipts minus Total Disbursements) $

On a separate sheet of paper, list all the assets, except real estate,

Remaining in the estate and the value of each asset. If there is no will,

a Motion for Order of Distribution (2131-P) must be filed at the same

time as this account, if this is a final account. After the Motion is granted

by the court, the assets may be distributed and a Receipt (2139-P) must

be filed for each person. Also enter this amount on Page 1, #4.

9. Is an information schedule pursuant to Pro bate Rule 108(E) attached to this accounting?

Yes No

10. Have all Federal and State Income Tax Retu rns of the deceased for the period ending with

his/her death been filed and the related taxes paid?

Yes No

11. Have all Federal and State Income Tax Returns of the Estate, which are due at the time of filing

this account, been filed and the related taxes paid?

Yes No

12. Have there been any changes to the beneficiaries of the estate or have any of the beneficiaries’

addresses changed?

Yes No If yes, on a separate sheet of paper, list those

changes. If any beneficiary has died, atta ch a death certificate for that person.

13. The undersigned hereby represent(s ) that the above accounting is true and accurate to the best

of his/her/their knowledge and belief, and certifies that the following has been sent to all persons

beneficially interested in this account and all parties appearing of record: a copy of the account

which includes a notice to beneficially interest ed parties stating that the account may be

approved unless a written objection is filed within 30 days after the date the account is filed in

the probate court.

I certify that on this date I provided this document (s) to the parties who have filed an appearance for

this case or who are otherwise interested parties by:

Hand-delivery OR US Mail OR

Email (E-mail only by prior agreement of the parties based on Circuit Court Administrative Order).

Date Executor/Adminis. Signature

(must be signed in the presence of a Notarial Officer)

Date Executor/Adminis. Signature

(must be signed in the presence of a Notarial Officer)

State of , County of

This instrument was acknowledged bef ore me on by

Date Executor/Administrator

My Commission Expires

Affix Seal, if any Signature of Notarial Officer / Title

IMPORTANT NOTICE

To Beneficially Interested Parties

This Account may be approved by the probate court unle ss a written objection, containing the specific

factual or legal basis for the objection, is filed wit hin 30 days after the date the Account is filed in the

probate division. Failure to file an objection may forfeit your right to a hearing concerning the Account

or your objection, and the probate di vision may then act without a hearing or any further notice to you.

ASSENT and WAIVER OF NOTICE

If all the parties interested in the a ccount want to certify that they have examined the account, find it

correct and request that it be allowed without furt her notice to them, please complete an “Assent”

form (NHJB-2121-P) and file it with this account.

0.00

Case Name: Estate of

Case Number:

EXECUTOR’S/ADMINISTRATOR’S ACCOUNTING

NHJB-2117-P (11/02/2015)

(Accounting Worksheet) ACCOUNTING WORKSHEET

To Calculate Total Value of Estate (Page 1, Item #5) and use for determining any court fees.

1. Total Value of Entire Estate $

For this amount, see Inventory or Amended Inventory, page 1, section 5C.

2. Personal estate not inventoried and other receipts (current) $

For this amount, see this Accounting form, Section 6, schedules B, C, E and F.

3. Personal estate not inventoried and other receipts (previous) $

To calculate this amount, see prior Accounting form. 4. TOTAL Value of Estate $

Add 1+2+3. Enter total on the line to the right and also enter this amount

on Page 1, #5 of the Accounting form. If total is over $25,000, filing fee applies.

PROBATE DIVISION RULE 108(E).

The account shall show significant transactions that do not affect the amount for which the

executor/administrator is accountable.

1. The schedule listing such transactions shall cons ist of an information schedule, which shall be set

forth at the end of the other schedules required in an account, setting forth each transaction by a

separate number.

2. All changes in investments not reflected as gains or losses reported on other schedules of receipts shall be listed. These would inclu de, but not be limited to, stock dividends; stock splits; changes in

name; exchanges; or reorganizations.

3. All new investments made within the accounting period, and in hand at the close thereof, shall be

noted on the schedules of assets on hand at the close of the accounting period. Totally new

investments, and increased or additional investments in the same investment as shown on the

schedules of assets on hand at the beginning of the account period of the account, shall be

separately designated or annotated.

4. With regard to book accounts, notes or installment obligations (whether secured or not), detail regarding collections or payments shall be provi ded to permit reconciliation of the balances shown

on schedules of assets on hand at the beginn ing and the close of the accounting period.

5. The executor/administrator shall also report on the information schedule the details of any events

causing or resulting in a change in the manner, method or course of the executor/administrator's

administration. Such events would include, but not be limited to, death of an interim income

beneficiary; shifting enjoyment of the income to another beneficiary; death of a remainderman during

the course of administering an estate; or a beneficiary reaching a designated age, after which time

the beneficiary has a right to mandate partial withdrawals of principal.

Do not file this page with the court.

0.00

0.00

Helpful suggestions for finalizing your ‘Executorsadministrators Accounting New Hampshire ’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the ultimate eSignature solution for individuals and organizations. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and authorize paperwork online. Utilize the robust tools included in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all seamlessly, requiring only a few clicks.

Follow these comprehensive instructions:

- Log into your account or register for a free trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Executorsadministrators Accounting New Hampshire ’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and assign fillable fields for other parties (if required).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your copy, or convert it into a multi-use template.

No need to worry if you need to collaborate with your colleagues on your Executorsadministrators Accounting New Hampshire or send it for notarization—our platform provides everything you require to achieve such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!