GENERAL APPLICATION FOR REBATE OF GST/HST

Use this form to apply for a rebate of the GST/HST for any of the reasons listed in Part B below. For more information and instructions, see page 3.

This form contains information based on proposed amendments to the Excise Tax Act and Regulations. At the time of publication, these proposed amendments

were not law. The publication of this form should not be taken as a statement by the CRA that such amendments will in fact become law in their current form.

Please type or print

Part A – Identification

Claimant's last name (individuals only) or name of business/organization (include trading name if applicable)

Claimant's first name and initials (individuals only)

Business Number (if applicable)

R T

Mailing address (Apt No – Street No, Street name, PO Box, RR)

City

Province/State

Country

Postal/Zip Code

Telephone number

–

–

Business address (if different from mailing address) (Apt No – Street No, Street name, PO Box, RR)

City

Province/State

Country

Postal/Zip Code

If you filed this form before, has your address

changed since your last application?

Yes

No

If yes, do you wish to have your file updated to reflect

the address change(s)?

Does this application amend a previous

application?

Yes

No

Language of correspondence

This claim is

being filed by

Head office

Branch/Division

(Code 1 only)

Period

covered

Year

English

Month

Day

From

Yes

No

French

Year

Month

Day

to

Part B – Reason for rebate request

Tick the appropriate box to indicate the reason for this claim. Tick only one box.

For details and documents that you have to file with this application, see Guide RC4033.

Reason

Code

Code

Reason

1

Amounts paid in error

11

Non-resident recipient of a taxable supply of an installation

service – rebate not paid or credited by supplier

4

Commercial goods and artistic works exported by a non-resident

12

Goods imported at a place in a non-participating province,

or imported at a place in a participating province with a

lower HST rate

5

Legal aid plan

13

Intangible personal property or services supplied in a participating

province

7

Taxable sale of real property by a non-registrant or taxable sale

of capital personal property of a municipality or designated

municipality who is a non-registrant

14

Segregated fund receives taxable specified services from

insurer – rebate paid or credited by insurer

8

Indian band, tribal council, or band-empowered entity

15

Specified services supplied to an investment plan or a segregated

fund

9

Lease of land for residential purposes

16

Provincial point-of-sale rebate on designated items

10

Non-resident recipient of a taxable supply of an installation

service – rebate paid or credited by registered supplier

23

Ontario First Nations point-of-sale relief (credited by a supplier)

Remission order (for details on when this applies,

see Guide RC4033)

FOR INTERNAL USE ONLY

IC

GST189 E (10/09)

NC

Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou au 1-800-959-3376.

�Part C – Rebate claimed

Section I – Rebate calculation (Do not complete this section for reason code 23.)

Complete Part F on the next page (if applicable) before completing this section.

Amounts claimed

(Totals from Part F or Supplements)

Calculation method

Method (b) Actual GST/HST paid (for code 1 in certain cases, and for codes 4, 5, 8, 10, and 11, see Guide RC4033)

$

+

Method (c) Other (for code 1 in certain cases, and for codes 7, 9, 12, 13, 14, 15, and 16, see Guide RC4033)

Total rebate claimed

=

Year

Month

Day

From

$

ț

$

ț

Yes

Have you used your rebate to reduce the amount owing on a GST/HST return by claiming it on line 111 on the return?

If yes, enter the reporting period of that GST/HST return.

ț

Year

No

Month

Day

to

Section II – Ontario First Nations point-of-sale relief (Complete this section for reason code 23 only.)

If you ticked reason code 23 in Part B, you cannot claim a rebate for any other reason codes on this application. Instead, file a separate application for each

reason code.

Total amount claimed for Ontario First Nations point-of-sale relief credited on your

off-reserve supplies of qualifying property or services

Enter the reporting period of the GST/HST return in which

you included this amount and ensure that it is included on

line 111 of the return.

Year

$

Month

From

Day

Year

ț

Month

Day

to

Part D – Third party address (Do not complete this part for reason code 23.)

Complete this part only if a third party is filing this rebate application on behalf of the claimant and the claimant previously signed and sent us Form GST507,

Third Party Authorization and Cancellation of Authorization for GST/HST Rebates, or is attaching completed Form GST507 to this application. This allows the

third party to either:

ț sign and file the rebate application on the claimant's behalf and receive the rebate cheque (made payable to the claimant); or

ț file the rebate application, signed by the claimant, and receive the rebate cheque (made payable to the claimant).

Completing Part D does not authorize the third party to represent the claimant. The third party information in this part must match the information

indicated by the claimant on Form GST507.

Form GST507, Third Party Authorization and Cancellation

of Authorization for GST/HST Rebates

is attached to this rebate application

was previously provided

c/o Name of third party

Mailing address (Apt No – Street No., Street name, PO Box, RR)

City

Province/State

Country

Postal/Zip code

Telephone number

–

–

Part E – Certification

I certify that:

1. The information in this application, including any accompanying document(s) and supplement(s), is correct and complete to the best of my knowledge.

2. The amounts claimed for rebate have not been included in previous rebate applications, nor have they been claimed, or will they be claimed, as

input tax credits on a GST/HST return of the claimant identified in Part A.

3. I understand that this rebate claim is subject to verification.

4. In addition to any documents submitted with this application, books, records, and invoices are available for inspection.

Signature of claimant or authorized representative of claimant

Name (print)

Year

Month

Day

Page 2

�Part F – Details of rebate application

To support your claim, attach all required documents and information, as indicated in Guide RC4033. If the space below is not sufficient to list all details, use

Form GST288, Supplement to Forms GST189 and GST498. Do not complete this part for reason code 23.

Method (b) Actual GST/HST paid (for code 1 in certain cases, and for codes 4, 5, 8, 10, and 11, see Guide RC4033); or

Method (c) Other (for code 1 in certain cases, and for codes 7, 9, 12, 13, 14, 15, and 16, see Guide RC4033).

Purchases

Date

Invoice No. or

import entry No.

Actual GST/HST

paid

Brief description of purchases

Supplier's name

Other

1

2

+

+

3

+

+

4

+

+

5

+

+

(b)

=

(c)

=

Total (forward to Part C – Rebate claimed)

Part G – Registered supplier identification OR insurer election

To be completed by the registered supplier if reason code 10 is entered in Part B, or by the insurer if reason code 14 is entered in Part B.

Name

Business Number

R T

Mailing address (Apt No – Street No., Street name, PO Box, RR)

City

Province/State

Country

Postal/Zip Code

Telephone number

–

Did you pay or credit the rebate amount to the claimant?

Yes

If yes, enter the reporting period of the GST/HST return in which you

took the adjustment (line 107). Attach this application to that return.

If you have to file your GST/HST return electronically, this application

has to be sent by mail to the Summerside Tax Centre.

From

Signature of authorized official

–

No

Year

Month

Day

Year

Month

Day

to

Name (print)

Year

Month

Day

Privacy Act, Personal Information Bank number CRA PPU 091

General information

Who should complete this form?

Use this form to apply for a rebate of the GST/HST for any of the reasons

listed in Part B. For detailed instructions on when to use this form and how to

complete it, see Guide RC4033, General Application for GST/HST Rebates.

Completing the rebate application

You have to complete Parts A, B and E of this form. Also, complete the

applicable section of Part C. In some cases, you also have to complete

Part F. Complete Part D only if you are sending, or have already sent,

Form GST507, Third Party Authorization and Cancellation of Authorization

for GST/HST Rebates.

Note

You cannot complete Part D if your application is for a reason code 23

rebate.

To determine the appropriate reason code for your rebate application and for

instructions on how to calculate your rebate, see Guide R4033, General

Application for GST/HST Rebates.

Where do I send my rebate application?

Reason code 10 and 14

Do not send your rebate application to us if you are claiming a rebate under

reason code 10 or 14. Instead, you have to give this completed form to the

GST/HST registered supplier or insurer who paid or credited you with your

rebate.

Reason code 23

If you are claiming an amount under reason code 23 and you are filing a

paper GST/HST return, send this completed form with your return.

If you are claiming an amount under reason code 23 and you are filing your

GST/HST return electronically, send this completed form to:

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C1

If you are claiming an amount under reason code 23 and you are filing your

GST/HSTreturn electronically with Revenu Québec, send this completed form

to:

Summerside Tax Centre

275 Pope Road

Summerside PE C1N 6A2

All other reason codes

If you are claiming a rebate for any other reason code and you are filing a

paper GST/HST return and claiming the rebate on line 111, send this

completed form with your return.

If you are filing your GST/HST return electronically or you are not claiming

the rebate on line 111 of your return, send this completed form to:

Summerside Tax Centre

275 Pope Road

Summerside PE C1N 6A2

For more information

For more information, see Guide RC4033, General Application for GST/HST

Rebates, go to www.cra.gc.ca/gsthst, or call 1-800-959-5525.

Page 3

�

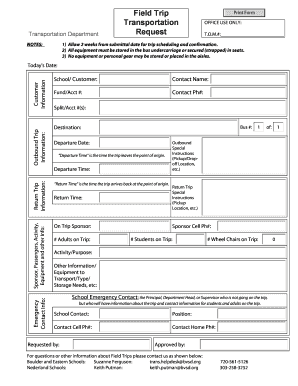

Useful Advice for Finalizing Your ‘Field Trip Curriculum’ Online

Are you fed up with the inconvenience of handling paper documents? Discover airSlate SignNow, the premier e-signature solution for both individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can easily complete and endorse documents online. Take advantage of the comprehensive features integrated into this user-friendly and cost-effective platform to transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow simplifies the entire process with just a few clicks.

Follow these comprehensive steps:

- Access your account or sign up for a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Field Trip Curriculum’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your side.

- Incorporate and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request electronic signatures from others.

- Download, print your version, or convert it into a multi-use template.

Don’t fret if you need to collaborate with your colleagues on your Field Trip Curriculum or send it for notarization—our platform provides everything you need to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to a new standard!