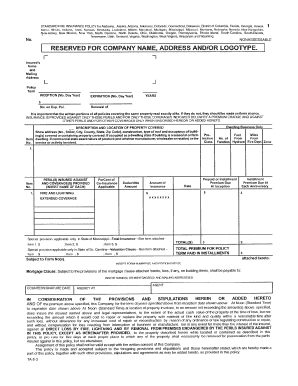

Fill and Sign the Fire Insurance Policy Sample Form

Useful suggestions for preparing your ‘Fire Insurance Policy Sample’ online

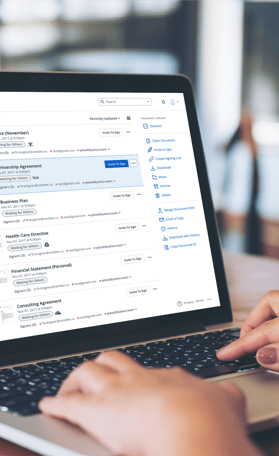

Are you fed up with the complications of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can easily complete and sign paperwork online. Take advantage of the powerful features included in this intuitive and affordable platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Adhere to this step-by-step guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form library.

- Access your ‘Fire Insurance Policy Sample’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

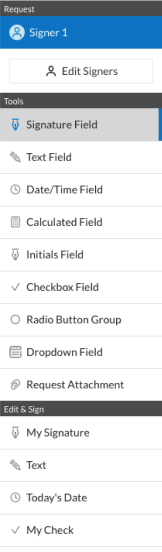

- Add and designate fillable fields for other individuals (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Fire Insurance Policy Sample or send it for notarization—our platform offers everything you require to execute such tasks. Create an account with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

What is a Fire Insurance Policy Sample?

A Fire Insurance Policy Sample is a template that outlines the coverage, terms, and conditions associated with fire insurance. This sample helps businesses understand what to expect from their insurance policy, including coverage limits, exclusions, and claims processes. By reviewing a Fire Insurance Policy Sample, you can better assess your insurance needs and ensure adequate protection against fire-related damages.

-

How can I obtain a Fire Insurance Policy Sample?

You can easily obtain a Fire Insurance Policy Sample from various online resources or through your insurance provider. Many insurers offer sample documents on their websites or by request. Additionally, reviewing multiple Fire Insurance Policy Samples can provide insights into the differences in coverage and help you choose the best policy for your needs.

-

What are the key features of a Fire Insurance Policy?

Key features of a Fire Insurance Policy include coverage for property damage caused by fire, smoke, and explosion. Policies often cover both the building and its contents, depending on the terms outlined in a Fire Insurance Policy Sample. It's essential to review these features carefully to ensure your policy meets your specific business needs.

-

How much does a Fire Insurance Policy typically cost?

The cost of a Fire Insurance Policy varies based on several factors, including the size of your property, its location, and the value of the assets covered. Reviewing a Fire Insurance Policy Sample can provide an estimate of potential premiums and help you understand the cost implications of different coverage options.

-

What are the benefits of having a Fire Insurance Policy?

Having a Fire Insurance Policy provides peace of mind by protecting your property against fire-related damages. It helps cover the cost of repairs or replacements, ensuring that your business can recover quickly from a loss. A Fire Insurance Policy Sample can illustrate how these benefits are structured and what you should expect from your coverage.

-

Can a Fire Insurance Policy be customized?

Yes, many insurers allow customization of Fire Insurance Policies to better fit individual business needs. This may include adding specific endorsements or adjusting coverage limits. By comparing different Fire Insurance Policy Samples, you can identify options that suit your unique requirements.

-

Are there any exclusions in a Fire Insurance Policy?

Yes, Fire Insurance Policies typically contain certain exclusions, such as damages from natural disasters or negligence. To understand these exclusions better, reviewing a Fire Insurance Policy Sample is crucial, as it will outline what is not covered and help you avoid potential gaps in your coverage.

Related searches to fire insurance policy sample form

Find out other fire insurance policy sample form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles