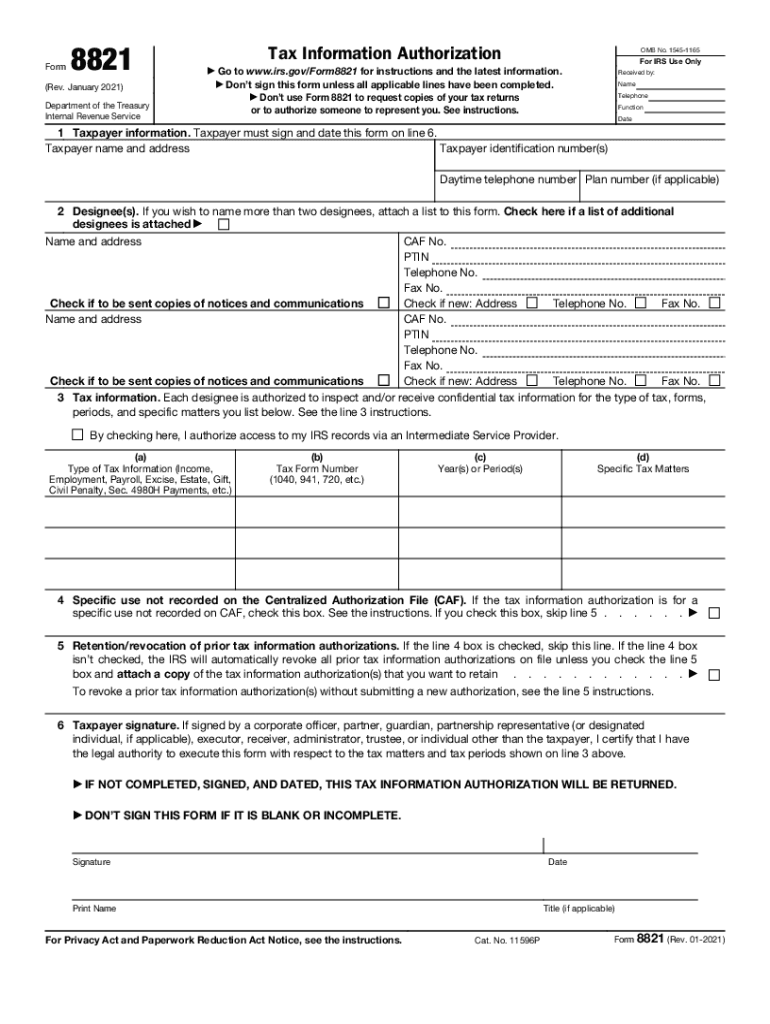

Fill and Sign the Form 8821 Rev January 2021 Tax Information Authorization

Convenient tips for preparing your ‘Form 8821 Rev January 2021 Tax Information Authorization’ online

Are you fed up with the burden of managing paperwork? Search no further than airSlate SignNow, the premier eSignature tool for both individuals and businesses. Wave farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features integrated into this intuitive and cost-effective platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow takes care of everything with ease, needing just a few clicks.

Adhere to this step-by-step guide:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Access your ‘Form 8821 Rev January 2021 Tax Information Authorization’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to fret if you need to work with others on your Form 8821 Rev January 2021 Tax Information Authorization or send it for notarization—our solution provides everything you need to accomplish these tasks. Enroll with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is Form 8821 Rev January Tax Information Authorization?

Form 8821 Rev January Tax Information Authorization is a document that allows individuals or businesses to authorize an appointee to receive confidential tax information from the IRS. This form is crucial for ensuring that your tax matters are handled by a trusted representative, making it easier to manage tax-related issues.

-

How can airSlate SignNow assist with Form 8821 Rev January Tax Information Authorization?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your Form 8821 Rev January Tax Information Authorization. Our solution streamlines the process, allowing you to complete and send this important tax form quickly and securely.

-

What are the benefits of using airSlate SignNow for Form 8821 Rev January Tax Information Authorization?

Using airSlate SignNow for your Form 8821 Rev January Tax Information Authorization ensures a fast, secure, and legally binding signing process. Our platform eliminates the need for printing and mailing, saving you time and resources while providing a compliant way to manage your tax authorization.

-

Is there a cost associated with using airSlate SignNow for Form 8821 Rev January Tax Information Authorization?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that best fits your requirements, ensuring you have access to all features needed to efficiently manage your Form 8821 Rev January Tax Information Authorization without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing Form 8821 Rev January Tax Information Authorization?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage your Form 8821 Rev January Tax Information Authorization alongside your existing workflows. This integration capability enhances efficiency and ensures that you can keep track of all your important documents in one place.

-

What features does airSlate SignNow offer for completing Form 8821 Rev January Tax Information Authorization?

airSlate SignNow includes features such as document templates, automated reminders, and secure cloud storage that make completing your Form 8821 Rev January Tax Information Authorization easier. These tools help you manage the signing process efficiently, ensuring that all parties can sign the document anytime, anywhere.

-

Is airSlate SignNow user-friendly for filing Form 8821 Rev January Tax Information Authorization?

Yes, airSlate SignNow is designed with user experience in mind. Even if you're not tech-savvy, you can easily navigate the platform to complete and send your Form 8821 Rev January Tax Information Authorization without any hassle.

Find out other form 8821 rev january 2021 tax information authorization

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles