Fill and Sign the Form for Sub Lease

Practical advice on finalizing your ‘Form For Sub Lease’ online

Are you worn out from the frustrations of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and businesses. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features offered by this user-friendly and economical platform and transform your document management strategy. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all efficiently, needing just a few clicks.

Adhere to this step-by-step guide:

- Access your account or sign up for a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our form library.

- Open your ‘Form For Sub Lease’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your coworkers on your Form For Sub Lease or send it for notarization—our solution provides everything necessary to complete such tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

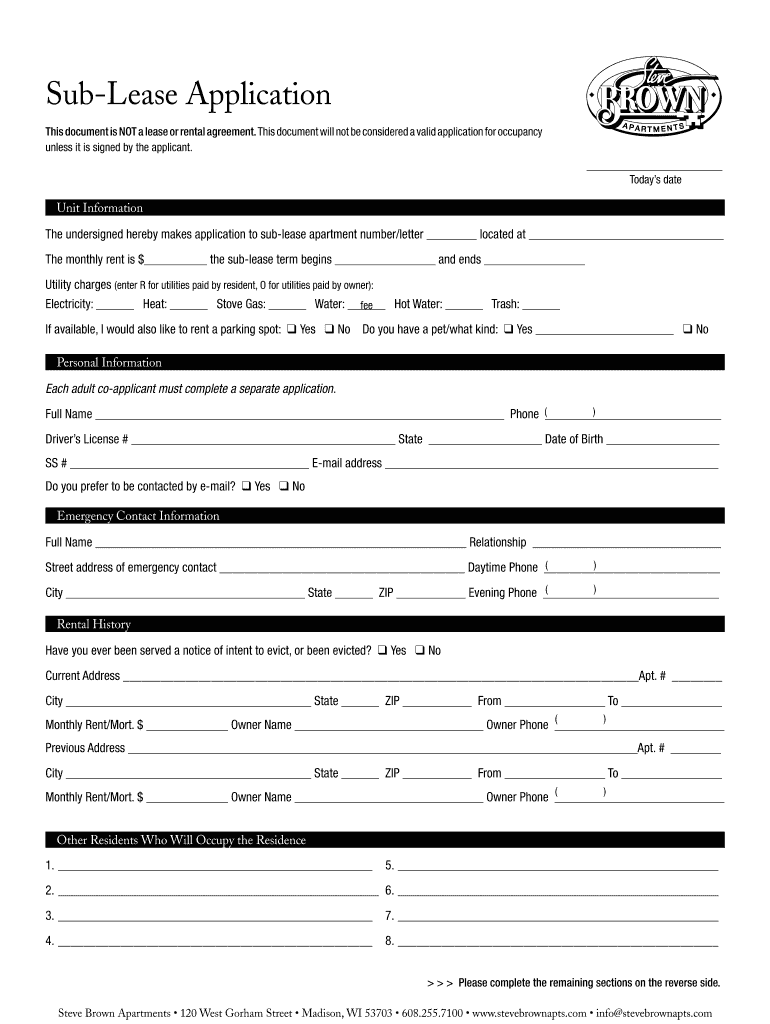

What is a Form For Sub Lease and how can it benefit me?

A Form For Sub Lease is a legal document that allows a tenant to rent out their leased property to another party. Using airSlate SignNow, you can easily create and eSign this form, ensuring that all parties are protected and conditions are clear. This streamlined process saves time and reduces the risk of errors.

-

How can I create a Form For Sub Lease using airSlate SignNow?

Creating a Form For Sub Lease with airSlate SignNow is simple. Just log in to your account, select the template for the sublease agreement, and customize it to fit your needs. Once you're done, you can send it for eSignature directly through our platform.

-

Is there a cost associated with using the Form For Sub Lease feature?

airSlate SignNow offers competitive pricing plans that include access to the Form For Sub Lease feature. You can choose from various subscription options based on your business needs, ensuring you get the best value for this essential legal document tool.

-

Can I integrate the Form For Sub Lease with other applications?

Yes, airSlate SignNow provides seamless integrations with various applications, including CRM and project management tools. This allows you to manage your Form For Sub Lease and other documents more efficiently, keeping everything organized in one place.

-

What security measures does airSlate SignNow have for the Form For Sub Lease?

Security is a top priority at airSlate SignNow. When you create or send a Form For Sub Lease, your documents are protected with advanced encryption and secure cloud storage. This ensures that your sensitive information remains confidential and safe from unauthorized access.

-

Can I track the status of my Form For Sub Lease once it's sent out?

Absolutely! With airSlate SignNow, you can easily track the status of your Form For Sub Lease in real-time. You'll receive notifications when the document is viewed, signed, or completed, allowing you to stay updated on the progress.

-

Is it possible to customize the Form For Sub Lease template?

Yes, airSlate SignNow allows you to customize your Form For Sub Lease template according to your specific requirements. You can add fields, clauses, and branding elements to ensure that the document meets your needs and reflects your identity.

Find out other form for sub lease

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles