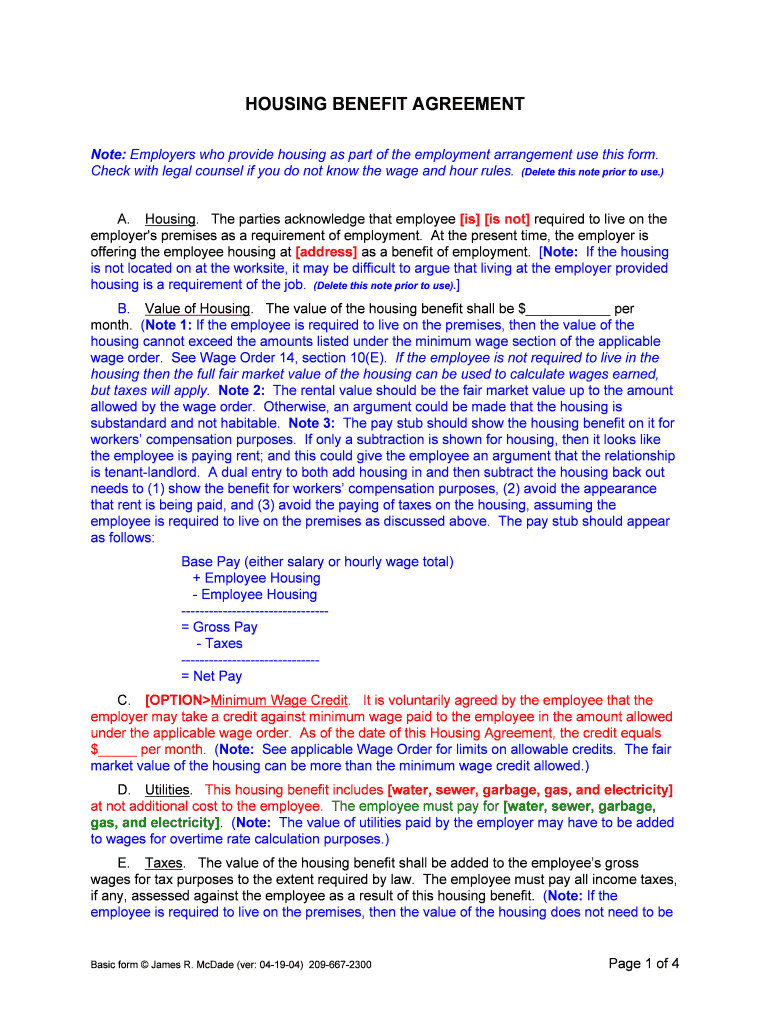

Basic form © James R. McDade (ver: 04-19-04) 209-667-2300 Page 1 of 4 HOUSING BENEFIT AGREEMENT Note: Employers who provide housing as part of the employment arrangement use this form.

Check with legal counsel if you do not know the wage and hour rules. (Delete this note prior to use.) A. Housing. The parties acknowledge that employee [is] [is not] required to live on the

employer's premises as a requirement of employment. At the present time, the employer is

offering the employee housing at [address] as a benefit of employment. [Note: If the housing

is not located on at the worksite, it may be difficult to argue that living at the employer provided

housing is a requirement of the job. (Delete this note prior to use).]

B. Value of Housing . The value of the housing benefit shall be $___________ per

month. (Note 1: If the employee is required to live on the premises, then the value of the

housing cannot exceed the amounts listed under the minimum wage section of the applicable

wage order. See Wage Order 14, section 10(E). If the employee is not required to live in the

housing then the full fair market value of the housing can be used to calculate wages earned,

but taxes will apply. Note 2: The rental value should be the fair market value up to the amount

allowed by the wage order. Otherwise, an argument could be made that the housing is

substandard and not habitable. Note 3: The pay stub should show the housing benefit on it for

workers’ compensation purposes. If only a subtraction is shown for housing, then it looks like

the employee is paying rent; and this could give the employee an argument that the relationship

is tenant-landlord. A dual entry to both add housing in and then subtract the housing back out

needs to (1) show the benefit for workers’ compensation purposes, (2) avoid the appearance

that rent is being paid, and (3) avoid the paying of taxes on the housing, assuming the

employee is required to live on the premises as discussed above. The pay stub should appear

as follows:

Base Pay (either salary or hourly wage total) + Employee Housing - Employee Housing--------------------------------= Gross Pay - Taxes------------------------------= Net Pay C. [OPTION>Minimum Wage Credit. It is voluntarily agreed by the employee that the

employer may take a credit against minimum wage paid to the employee in the amount allowed

under the applicable wage order. As of the date of this Housing Agreement, the credit equals

$_____ per month. (Note: See applicable Wage Order for limits on allowable credits. The fair

market value of the housing can be more than the minimum wage credit allowed.)

D. Utilities. This housing benefit includes [water, sewer, garbage, gas, and electricity]

at not additional cost to the employee. The employee must pay for [water, sewer, garbage,

gas, and electricity]. (Note: The value of utilities paid by the employer may have to be added

to wages for overtime rate calculation purposes.)

E.Taxes. The value of the housing benefit shall be added to the employee’s gross

wages for tax purposes to the extent required by law. The employee must pay all income taxes,

if any, assessed against the employee as a result of this housing benefit. (Note: If the

employee is required to live on the premises, then the value of the housing does not need to be

Basic form © James R. McDade (ver: 04-19-04) 209-667-2300 Page 2 of 4reported to the IRS. If the employee is either voluntarily or involuntarily living in employer

housing, then Workers’ compensation insurance may require that the employer report a value of

the housing to workers’ compensation for premium calculation purposes. Check with your

accountant for any other payroll tax issues.) F. Right to Change Benefit. The employer reserves the right to add, change, or eliminate

any housing benefit or any eligibility requirement for housing benefits at any time at the sole

discretion of the employer.

G. Deposit. The employee agrees to have $____ deducted from the employee’s wages

for purposes of a refundable cleaning deposit. If the employee returns the housing in good

order, then the deposit will be returned. (Note: Asking for a deposit will tend to show a

landlord-tenant relationship. Special rules apply to handing and returning deposits under Civil

Code §1950.5.)

H. No Lease Intended. The housing offered to the employee is not a lease or a rental.

The employer may revoke this housing benefit at any time, for any reason, without or without

prior notice. No relationship of landlord and tenant is intended or created. The employee shall

be eligible for the housing benefit only so long as employee is employed by and actively working

for the employer. If employee’s employment with the employer ceases for any reason, then the

employee’s housing benefits will cease immediately. If the employee is on a leave of absence,

then this housing benefit will cease [60] days after the employee first begins the leave of

absence. In all cases after this housing benefit ceases, the employee will be responsible for all

rent, utilities, and damages between the time this housing benefit ceases and the time that the

employee and those living with employee vacate the house.

I. Surrender of Housing . The employee must vacate the house and remove all the

employee’s property within [fifteen (15)] days from the date that the employee is given notice to

do so. If the employee remains in possession of the house after the time for vacating the house

expires, the employer shall have the right, in addition to any other remedy provided by law, to

bring an action to evict the employee without any further notice pursuant to Code of Civil

Procedure §1161(1), [Option>and the employee shall be responsible to the employer for all

rent, utilities, and damages for unlawful detention until the employee and those living with

employee vacate the house. (Note: The option to pay rent and damages may cause the

relationship to become a month-to-month tenancy; for which advance notice may need to be

given for an eviction. See, Karz v Mecham (1981) 120 Cal.App.3d Supp. 1) The employee will

be charged for the cost of cleaning the house and surrounding premises if the employee leaves

it dirty and damaged, except normal wear and tear. The employee will also be charged for

removal and storage of personal property if the employee does not remove all of the employee’s

belongings. By signing this Housing Agreement, the employee hereby waives any claim against

the employer for disposing of the employee’s personal property after reasonable attempts by the

employer to return the property to the employee. (Note: Pursuant to Code of Civil Procedure

§1161(1), no prior notice need be given before starting an eviction of the employee if the

employment relationship ends and the employee won’t voluntarily vacate. However, it is a good

idea to be reasonable in providing time for the employee to vacate.)

(Note: If the employee is not working due to a workers’ compensation injury, and the employer

wants the employee out of the housing, then in order to win a Labor Code §132a claim, the

employer needs to show that because of business necessity, the employer cannot afford to

allow the employee to remain in the house and/or that a replacement employee cannot be found

unless housing is offered. See, Dominguez (1998) 63 CC 1277; Mannetter (1976) 41 CCC

1060; Silberman, Labor Code §132a. If the employee refuses to leave the premises, the law is

unclear as to whether notice of eviction must be given prior to filing an unlawful detainer action

Basic form © James R. McDade (ver: 04-19-04) 209-667-2300 Page 3 of 4to force the employee out. Because the employee is still employed, Code of Civil Procedure

§1161(1) does not apply; so the safest thing to do is to provide 30 days notice (if the employee

has been in the house less than a year) or 60 days notice (if the employee has been in the

house more than a year) pursuant to Civil Code §1946.1 prior to starting an eviction action. See

an attorney prior to evicting or terminating an employee who is on a workers’ compensation

leave of absence.) J. Care of the Housing. While the employee lives in the housing, the employee must

maintain the housing in proper repair and protect the housing from damage. The employee

shall be responsible for all damage to the housing and surrounding grounds caused by the

employee or the employee’s family, except normal wear and tear. The employee must maintain

the yard in good condition--watering and cutting the grass when needed. The employee must

not allow garbage and debris, including non-operating vehicles, to accumulate in the yard,

street, or surrounding areas. The employee shall park or locate operating vehicles only in

designated areas. The employee is to keep his or her children and guests under control. No

parties are allowed in the housing or yard if the employee is not present or if it bothers the

neighbors. For safety reasons, no children or guests are allowed to either play or loiter on the

operations portion of the farm nor operate farm equipment. The employee must respect the

privacy and comfort of the neighbors.

K.Guests. The employee may only have the employee’s spouse and dependent children

live with employee in the housing, unless otherwise agreed to in advance by the employer. The

employee shall not have non-dependent guests and relatives stay in the house overnight for

more than fourteen (14) days annually.

L. Pets and Animals. The employee shall also not allow any pets or animals to remain

on the premises without the express written consent of the employer.

M. Right to Inspect. The employer shall have the right to enter the premises, including

the interior of the house, at any reasonable time to inspect or repair the premises by giving

twenty-four (24) hours advance notice to the employee, unless an emergency situation, as

determined at the sole discretion of the employer, mandates a shorter notice period.

N. Failure to Obey Rules. If the employee fails to comply with any of the rules in this

Housing Agreement, the employee may lose his or her housing benefit and possibly his or her

job with the employer. In addition, if the employee or the employer brings any lawsuit to enforce

or interpret this Housing Agreement, including any court action to remove the employee from

the housing, the prevailing party shall be entitled to reasonable attorneys' fees and costs of suit.

O. At-Will Employment Unaffected. This Housing Agreement does not change the at-will

relationship of the parties. Employment is not for a specified period and can be terminated

either by party at any time, with or without cause or notice.

P . No Right to Assign or Sublet. The employee may not assign his or her interest under

this Housing Agreement, and shall have no right to sublet any portion of the premises.

Q. No W aiv e r. T he w aiv e r b y t h e e m plo ye r o ne o r m ore t im es o f a b re ach o f a ny t e rm o f

th is A gre em ent is n ot a w aiv e r o f t h e b re ach o f a ny o th e r t e rm o f t h is A gre em ent n or o f a

subse qu ent b re ach o f t h e o ne w aiv e d.

R. Integration and Modification . This instrument constitutes the entire and complete

agreement of the parties relating to the subject matter contained herein. This instrument

supersedes in its entirety any and all prior oral and/or written agreements or memorandums of

understanding between the parties. No modification of this Agreement shall be made or entered

into except by means of a writing signed by the party to be charged.

Basic form © James R. McDade (ver: 04-19-04) 209-667-2300 Page 4 of 4Dated: __________________________________________________________ _________________________________Employee’s Signature Employer's SignatureThis agreement was verbally translated to the employee in Spanish by the undersigned:______________________________ Date: _________________________Translator

Valuable suggestions for finalizing your ‘Form Housing Agreement’ online

Fed up with the difficulties of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can swiftly complete and sign documents online. Take advantage of the robust features included in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow simplifies it all, with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our form library.

- Open your ‘Form Housing Agreement’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Rest assured, if you need to work with your colleagues on your Form Housing Agreement or send it for notarization—our platform offers everything you require to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!