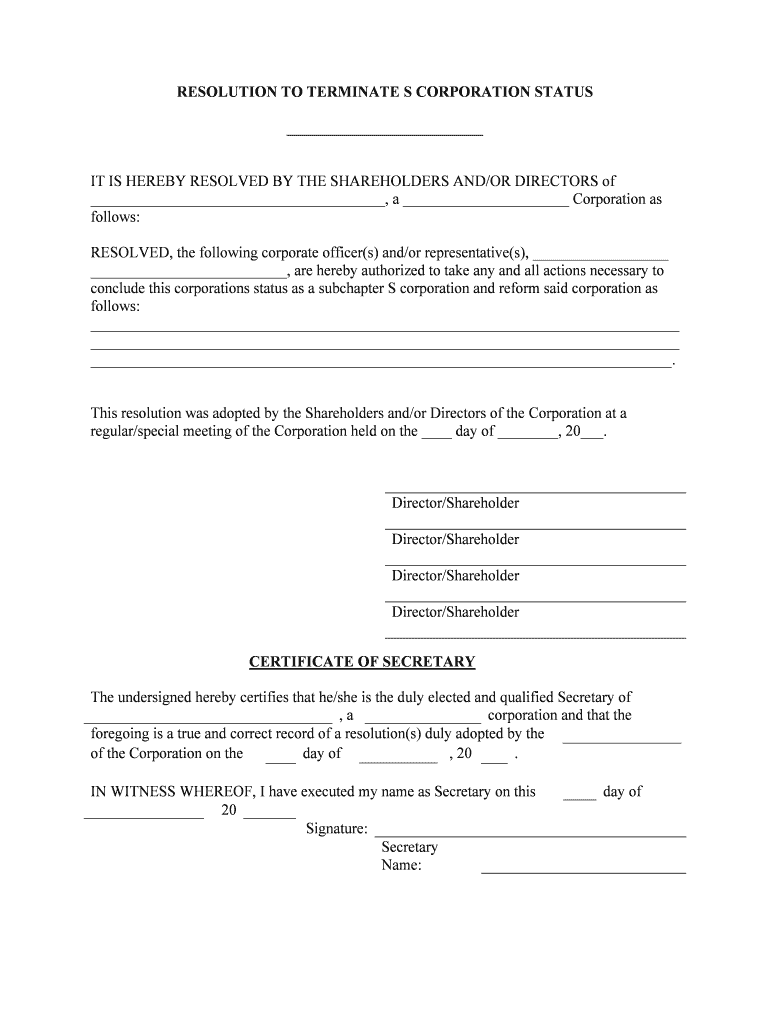

Fill and Sign the Form of S Corporation Revocation Tax Allocation and

Useful suggestions for finalizing your ‘Form Of S Corporation Revocation Tax Allocation And ’ online

Fed up with the burden of handling documents? Discover airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious tasks of printing and scanning files. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the powerful features available in this user-friendly and cost-effective platform to transform your document handling experience. Whether you need to endorse forms or collect eSignatures, airSlate SignNow takes care of everything swiftly, requiring just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Form Of S Corporation Revocation Tax Allocation And ’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and designate fillable fields for other participants (if needed).

- Continue with the Send Invite setup to request eSignatures from others.

- Download or print your copy, or convert it into a reusable template.

No need to worry if you have to collaborate with your colleagues on your Form Of S Corporation Revocation Tax Allocation And or send it for notarization—our platform offers everything you require to complete such tasks. Enroll with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the Form Of S Corporation Revocation, Tax Allocation And process?

The Form Of S Corporation Revocation, Tax Allocation And process involves formally revoking an S Corporation status and reallocating tax responsibilities to ensure compliance with IRS regulations. This form is crucial for businesses considering a change in their tax structure. Using airSlate SignNow, you can easily prepare and eSign your revocation documents, streamlining the entire process.

-

How does airSlate SignNow simplify the Form Of S Corporation Revocation, Tax Allocation And?

airSlate SignNow simplifies the Form Of S Corporation Revocation, Tax Allocation And by providing an intuitive platform for document creation, sending, and signing. With our user-friendly interface, you can quickly draft the necessary forms, obtain eSignatures from stakeholders, and manage documents securely. This saves you time and reduces the complexity of tax-related changes.

-

Can I integrate airSlate SignNow with other accounting software for the Form Of S Corporation Revocation, Tax Allocation And?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easy to manage your Form Of S Corporation Revocation, Tax Allocation And alongside your financial records. By linking these tools, you can ensure that all tax documentation is synchronized with your accounting data, enhancing efficiency and accuracy.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow provides flexible pricing plans tailored to businesses of all sizes, ensuring accessibility for managing the Form Of S Corporation Revocation, Tax Allocation And. Pricing typically includes various features such as unlimited document sends, templates, and integrations. Check our website for specific pricing tiers that best fit your business needs.

-

What features does airSlate SignNow offer to assist with S Corporation tax documents?

airSlate SignNow offers several features to assist with S Corporation tax documents, including customizable templates, bulk send options, and robust security measures. These features ensure that your Form Of S Corporation Revocation, Tax Allocation And is prepared efficiently and securely. Additionally, real-time tracking allows you to monitor the signing process.

-

Is airSlate SignNow compliant with tax regulations for Form Of S Corporation Revocation, Tax Allocation And?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, including those pertaining to the Form Of S Corporation Revocation, Tax Allocation And. Our platform adheres to industry standards for electronic signatures and document management, ensuring that your tax documents meet legal requirements.

-

How can I get support for using airSlate SignNow for my tax documents?

airSlate SignNow provides comprehensive customer support to assist you with any questions regarding your tax documents, including the Form Of S Corporation Revocation, Tax Allocation And. You can access our help center, tutorials, or contact our support team directly for personalized assistance, ensuring you can navigate the platform with ease.

The best way to complete and sign your form of s corporation revocation tax allocation and

Find out other form of s corporation revocation tax allocation and

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles