§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-240© 1994 Jefren Publishing Company, Inc.

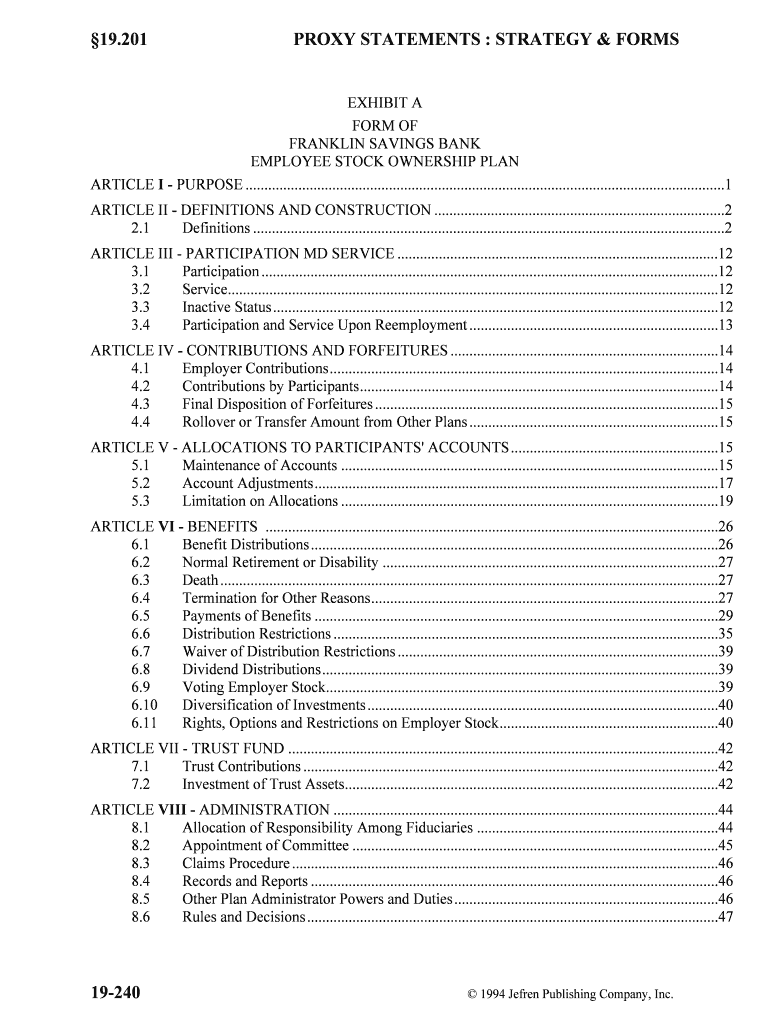

EXHIBIT A

FORM OF

FRANKLIN SAVINGS BANK

EMPLOYEE STOCK OWNERSHIP PLAN

ARTICLE I - PURPOSE ...............................................................................................................................1

ARTICLE II - DEFINITIONS AND CONSTRUCTION .............................................................................2

2.1 Definitions .............................................................................................................................2

ARTICLE III - PARTICIPATION MD SERVICE .....................................................................................12 3.1 Participation .........................................................................................................................12

3.2 Service..................................................................................................................................12

3.3 Inactive Status ......................................................................................................................12

3.4 Participation and Service Upon Reemployment ..................................................................13

ARTICLE IV - CONTRIBUTIONS AND FORFEITURES .......................................................................14

4.1 Employer Contributions .......................................................................................................14

4.2 Contributions by Participants...............................................................................................14

4.3 Final Disposition of Forfeitures ...........................................................................................15

4.4 Rollover or Transfer Amount from Other Plans ..................................................................15

ARTICLE V - ALLOCATIONS TO PARTICIPANTS' ACCOUNTS .......................................................15 5.1 Maintenance of Accounts ....................................................................................................15

5.2 Account Adjustments ...........................................................................................................17

5.3 Limitation on Allocations ....................................................................................................19

ARTICLE VI - BENEFITS ........................................................................................................................26

6.1 Benefit Distributions ............................................................................................................26

6.2 Normal Retirement or Disability .........................................................................................27

6.3 Death ....................................................................................................................................27

6.4 Termination for Other Reasons............................................................................................27

6.5 Payments of Benefits ...........................................................................................................29

6.6 Distribution Restrictions ......................................................................................................35

6.7 Waiver of Distribution Restrictions .....................................................................................39

6.8 Dividend Distributions .........................................................................................................39

6.9 Voting Employer Stock........................................................................................................39

6.10 Diversification of Investments .............................................................................................40

6.11 Rights, Options and Restrictions on Employer Stock..........................................................40

ARTICLE VII - TRUST FUND ..................................................................................................................42 7.1 Trust Contributions ..............................................................................................................42

7.2 Investment of Trust Assets...................................................................................................42

ARTICLE VIII - ADMINISTRATION ......................................................................................................44

8.1 Allocation of Responsibility Among Fiduciaries ................................................................44

8.2 Appointment of Committee .................................................................................................45

8.3 Claims Procedure .................................................................................................................46

8.4 Records and Reports ............................................................................................................46

8.5 Other Plan Administrator Powers and Duties ......................................................................46

8.6 Rules and Decisions .............................................................................................................47

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-241

8.7 Authorization of Benefit Payments......................................................................................47

8.8 Application and Forms for Benefits.....................................................................................47

8.9 Facility of Payment ..............................................................................................................48

8.10 Indemnification of the Committee .......................................................................................48

ARTICLE IX - MISCELLANEOUS .............................................................................................................48 9.1 Nonguarantee of Employment ...............................................................................................48

9.2 Rights to Trust Assets ............................................................................................................48

9.3 Nonalienation of Benefits ......................................................................................................48

9.4 Controlled Group of Corporations ........................................................................................49

9.5 Leased Employees ................................................................................................................49

9.6 Unclaimed Pension Checks ..................................................................................................49

9.7 Correction of Errors ..............................................................................................................49

9.8 Construction ..........................................................................................................................50

9.9 Discontinuance of Employer Contributions .........................................................................50

ARTICLE X - AMENDMENTS AND ACTION BY EMPLOYER ............................................................50

10.1 Amendments ..........................................................................................................................50

10.2 Action by Employer...............................................................................................................50

10.3 Amendment or Change of Vesting Schedule ........................................................................50

ARTICLE XI - SUCCESSOR EMPLOYER, MERGER OR CONSOLIDATION .....................................51

11.1 Successor Employer .............................................................................................................51

11.2 Plan Assets ............................................................................................................................51

ARTICLE XII - PLAN TERMINATION......................................................................................................52 12.1 Right to Terminate .................................................................................................................52

12.2 Partial Termination ................................................................................................................52

12.3 Liquidation of the Trust Fund................................................................................................52

12.4 Manner of Distribution ..........................................................................................................52

ARTICLE XIII - TOP-HEAVY PLAN RESTRICTIONS ............................................................................53

13.1 General Rule ..........................................................................................................................53

13.2 Top-Heavy Test .....................................................................................................................53

13.3 Superseding Rules .................................................................................................................55

13.4 Special Definitions ................................................................................................................56

ARTICLE XIV - PROVISIONS RELATING TO MULTIPLE EMPLOYERS ...........................................58

14.1 Special Definitions ................................................................................................................58

14.2 Provisions Relating to Employer Contributions ....................................................................58

14.3 Duties of Primary Employer ..................................................................................................59

14.4 Portability of Service Credit ..................................................................................................60

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-242© 1994 Jefren Publishing Company, Inc.

FRANKLIN SAVINGS BANK

EMPLOYEE STOCK OWNERSHIP PLAN ARTICLE I - PURPOSE

Effective July 1, 1990, the Employer has adopted the Franklin Savings Bank

Employee Stock Ownership Plan and a related Trust Agreement to enable present and future

employees to acquire stock ownership interests in the Employer. Therefore, funds accumulated

pursuant to this Plan and the Trust established hereunder will be invested primarily or totally in

qualifying employer securities, as defined in Section 409(1) of the Internal Revenue Code and

Section 407(d)(5) of ERISA, in the form of shares of common stock or preferred stock (meeting

certain requirements) of Franklin Savings Bank or an Affiliated Employer.

The Plan is a stock bonus plan and an employee stock ownership plan which is

intended to meet the applicable requirements of Sections 401(a), 501(a) and 4975(e)(7) of the

Internal Revenue Code of 1986, as amended from time to time.

The Plan may be used to accomplish the following objectives:

1. To transfer the ownership of stock in the Employer to its Employees; and

2. To provide Participants with beneficial ownership of Employer Stock, without

requiring any cash outlay or other personal investment on the part of Participants.

The Plan is also designed to be available as a technique of corporate finance for the

Employer. Accordingly, it may be used to accomplish the following objectives:

1. To meet general financing requirements of the Employer, including capital

growth and transfers in the ownership of Employer Stock; and

2. To receive loans (or other extensions of credit) to finance the acquisition of

Employer Stock ("Acquisition Loans"), with such loans to be repaid by contributions to the Trust

and dividends received on such Employer Stock.

The provisions of this Plan shall apply only to an Employee who terminates

employment on or after the Effective Date.

ARTICLE II - DEFINITIONS AND CONSTRUCTION

2.1 Definitions: The following words and phrases shall, when used herein, have the

following respective meanings unless the context clearly indicates otherwise:

(a) Acquisition Loan: A loan or other extension of credit used by the Trustee to

finance the acquisition of Employer Stock.(b) Adjustment Factor: The cost of living adjustment factor prescribed by the

Secretary of the Treasury under Code Section 415(d) for years beginning after December 31,

1987, as applied to such items and in such manner as the Secretary shall provide.

(c) Affiliated Employer: The Employer and any corporation which is a member of a

controlled group of corporations (as defined in Section 414(b) of the Code) which includes the

Employer; any trade or business (whether or not incorporated) which is under common control

(as defined in Section 414(c) of the Code) with the Employer; any organization (whether or not

incorporated) which is a member of an affiliated service group (as defined in Section 414(m) of

the Code) which includes the Employer; and any other entity required to be aggregated with the

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-243

Employer pursuant to regulations under Section 414(o) of the Code.

(d) Annual Additions: With respect to each Plan Year, the sum of the following

amounts allocated to a Participant's account during the Limitation Year: (1) Employer contributions,

(2) Forfeitures, and

(3) Amounts allocated, after March 31, 1984, to an individual medical

account, as defined in Code Section 415(1)(2), which is part of a pension or annuity plan

maintained by the Employer are treated as Annual Additions to a defined contribution plan. Also,

amounts derived from contributions paid or accrued after December 31, 1985, in taxable years

ending after such date, which are attributable to post-retirement medical benefits, allocated to the

separate account of a key employee, as defined in Code Section 419A(d)(3), under a welfare

benefit fund, as defined in Code Section 419(e), maintained by the Employer are treated as

Annual Additions to a defined contribution plan.

For this purpose, any excess amount applied under Sections 5.3(a)(1)-(4)

or Section 5.3(b) in the Limitation Year to reduce Employer contributions will be considered

Annual Additions for such Limitation Year.

Employee contributions shall not include Rollover or Transfer Amounts for

purposes of this definition of Annual Additions.

(e) Authorized Leave of Absence: Any absence authorized by the Employer under

the Employer's standard personnel practices provided that all persons under similar

circumstances must be treated alike in the granting of such Authorized Leaves of Absence and

provided further that the Participant returns within the period of authorized absence. An absence

due to service in the Armed Forces of the United States shall be considered an Authorized Leave

of Absence provided that the absence is caused by war or other emergency, or provided that the

Employee is required to serve under the laws of conscription in time of peace, and further

provided that the Employee returns to employment with the Employer within the period provided

by law.

(f) Beneficiary: A person or persons (natural or otherwise) designated by a

Participant in accordance with the provisions of Sections 6.3 and 6.5 to receive any death benefit

which shall be payable under this Plan.(g) Board of Directors: The Employer's governing body according to law and the

Employer's governing documents.(h) Break in Service: A Plan Year after the Effective Date during which an Employee

completes 500 or fewer Hours of Service shall constitute a one year Break in Service. Breaks in

Service will be measured on the same Eligibility Computation Period as are Years of Service.(i) Committee: The Administrative Committee appointed by the Board of Directors

in accordance with Article VIII.(j) Compensation: Compensation shall mean the total of all amounts paid to a

Participant by the Employer for personal services determined on the same basis as reported on

the Participant's Federal Income Tax Withholding Statement (Form W-2). The following rules shall apply for purposes of this definition:

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-244© 1994 Jefren Publishing Company, Inc.

(1) Any Employee pre-tax salary reduction contributions to a tax deferred

annuity under Code Section 403(b) or to a cafeteria plan under Code Section 125 or to a deferred

compensation plan under either of Code Sections 401(k) or 402(h)(1)(B) shall be included in

Compensation for purposes hereof.

(2) Any benefits paid under this and any other deferred compensation plan

and any qualified retirement plan shall be excluded from Compensation for purposes hereof.

(3) For purposes of Employer contributions under Section 4.1 and allocations

thereof under Section 5.2, Compensation shall not include any compensation paid to the

Participant prior to the date his participation in the Plan commenced.

(4) For any Plan Year beginning on or after January 1, 1989, the annual

Compensation of each Participant taken into account under the Plan for any year shall not exceed

$200,000, as adjusted by the Secretary at the same time and in the same manner as under Code

Section 415(d). In determining the Compensation of a Participant for purposes of this limitation,

the rules of Code Section 414(q)(6) shall apply, except in applying such rules, the term "family"

shall include only the spouse of the Participant and any lineal descendants of the Participant who

have not attained age 19 before the close of the year. If, as a result of the application of such

rules the adjusted $200,000 limitation is exceeded, then (except for purposes of determining the

portion of Compensation up to the integration level if this Plan provides for permitted disparity),

the limitation shall be prorated among the affected individuals in proportion to each such

individual's Compensation as determined under this section prior to the application of this

limitation.

(k) Disability: Disability means a physical or mental disorder resulting from a

bodily injury or disease or mental disorder which renders a Participant incapable of continuing in

the employment of the Employer within the meaning of the Social Security laws.(1) Effective Date: July 1, 1990, the date on which the provisions of this Plan

became effective.(m) Eligibility Computation Period: The 12 consecutive month period used to

determine whether an Employee has completed a Year of Service or incurred a Break in Service

for purposes of determining his or her eligibility to participate under Article III. The initial

Eligibility Computation Period shall commence on the employment commencement date (the

date on which the Employee first performs an Hour of Service). The Eligibility Computation

Period thereafter shall be the same as a Plan Year, commencing with the Plan Year which

includes the first anniversary of the Employee's employment commencement date and

succeeding Plan Years.

In the event that a reemployed Employee does not participate as of his

reemployment date, said Employee's Eligibility Computation Period shall commence on his

reemployment commencement date (the date on which the reemployed Employee first performs

an Hour of Service during his reemployment). The reemployment Eligibility Computation Period

thereafter shall be the same as the Plan Year commencing with the Plan Year which includes the

first anniversary of the Employee's reemployment commencement date and succeeding Plan

Years.

(n) Employee: Any person other than an independent contractor who, on or after the

Effective Date, is receiving remuneration for personal services rendered to the Employer (or who

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-245

would be receiving such remuneration except for an Authorized Leave of Absence) or for

personal services rendered to an Affiliated Employer or any other employer required to be

aggregated with such Employer under Code Sections 414(b), (c), (m) or (o). Employee shall also

include any Leased Employee deemed to be an Employee of any Employer described in the

previous sentence as provided in Code Sections 414(n) or (o).

(o) Employer: Franklin Savings Bank, a federally chartered savings bank, Franklin

Commercial Mortgage Group, Inc., a corporation organized and existing under the laws of the

State of Michigan and Franklin Home Lending Group, Inc., a corporation organized and existing

under the laws of the State of Michigan, or their respective successor or successors. Each of the

individual Employers named herein may be referred to as an Employer Member. For purposes of

Section 5.3, Employer also includes all members of a controlled group of corporations (as

defined in Code Section 414(b) as modified by Code Section 415(h)), all commonly controlled

trades or businesses (as defined in Code Section 414(c) as modified by Code Section 415(h)) or

affiliated service groups (as defined in Code Section 414(m)) of which the Employer is a part,

and any other entity required to be aggregated with the Employer pursuant to regulations under

Code Section 414(o).(p) Employer Stock: Common stock of the Employer or an Affiliated Employer

which is a qualifying employer security as defined in Section 4975(e)(8) of the Internal Revenue

Code and Section 407(d)(5) of ERISA and which, except as otherwise herein provided, is not

subject to a put, call, or other option or buy-sell or similar agreement while held by and when

distributed from the Plan, regardless of whether the Plan is then a leveraged employee stock

ownership plan. Employer Stock may also mean preferred stock of the Employer or an Affiliated

Employer as defined in Section 409(1) of the Internal Revenue Code.(q) Employer Stock Account: The account maintained for a Participant to record

his share of the contributions of Employer Stock and adjustments relating thereto.(r) ERISA: Public Law No. 93-406, the Employee Retirement Income Security

Act of 1974, as amended from time to time.(s) Fiduciaries: The Employer, the Plan Administrator, the Trustee, the Committee

and any designated Investment Manager, but only with respect to the specific responsibilities of

each for Plan and Trust administration, all as described in Section 8.1.(t) Financed Shares: Shares of Employer Stock acquired by the Trustee with the

proceeds of an Acquisition Loan.(u) Forfeitures: The non-vested portion of a Participant's Employer Contribution

Account which is forfeited in accordance with Section 4.3.(v) Highly Compensated Employee: The term Highly Compensated Employee

includes Highly Compensated Active Employees and Highly Compensated Former Employees. (1) Highly Compensated Active Employee includes any Employee who

performs service for the Employer during the determination year and who, during the look-back

year:

[a] received compensation from the Employer in excess of $75,000 (as

adjusted pursuant to Code Section 415(d));

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-246© 1994 Jefren Publishing Company, Inc.

[b] received compensation from the Employer in excess of $50,000 (as

adjusted pursuant to Code Section 415(d)) and was a member of the top-paid group for such

year; or

[c] was an officer of the Employer and received compensation during

such year that is greater than fifty percent (50%) of the dollar limitation in effect under Code

Section 415(b)(1)(A).

(2) The term Highly Compensated Employee also includes:

[a] Employees who are both described in the preceding sentence if the

term "determination year" is substituted for the term "look-back year" and the Employee is one

of the one hundred (100) Employees who received the most compensation from the Employer

during the determination year; and

[b] Employees who are five percent (5%) owners at any time during

the look-back year or determination year.

(3) If no officer has satisfied the compensation requirement of (1)[b] above

during either a determination year or look-back year, the highest paid officer for such year shall

be treated as a Highly Compensated Employee.

(4) For purposes of this Section, the determination year is the Plan Year. The

look-back year is the twelve-month period immediately preceding the determination year.

(5) A Highly Compensated Former Employee includes any Employee who

separated from service (or was deemed to have separated) prior to the determination year,

performs no service for the Employer during the determination year, and was a Highly

Compensated Active Employee for either the separation year or any determination year ending

on or after the Employee's 55th birthday.

(6) If an Employee is, during a determination year or look-back year, a family

member of either a five percent (5%) owner who is an active or former Employee or a Highly

Compensated Employee who is one of the ten (10) most highly compensated Employees ranked

on the basis of Compensation paid by the Employer during such year, then the family member

and the five percent (5%) owner or top-ten Highly Compensated Employee shall be aggregated.

In such case, the family member and five percent (5%) owner or top-ten Highly Compensated

Employee shall be treated as a single Employee receiving Compensation and Plan contributions

or benefits equal to the sum of such Compensation and contributions or benefits of the family

member and five percent (5%) owner or top-ten Highly Compensated Employee. For purposes of

this section, family member includes the spouse, lineal ascendants and descendants of the

Employee or former Employee and the spouses of such lineal ascendants and descendants.

(7) The determination of who is a Highly Compensated Employee, including

the determinations of the number and identity of Employees in the top-paid group, the top one

hundred (100) Employees, the number of Employees treated as officers and the Compensation

that is considered, will be made in accordance with Code Section 414(q) and the regulations

thereunder.

(w) Hour of Service:

(1) Each hour for which an Employee is paid, or entitled to payment, for the

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-247

performance of duties for the Employer. These hours shall be credited to the Employee for the

computation period in which the duties are performed.

(2) Each hour for which an Employee is paid, or entitled to payment, by the

Employer on account of a period of time during which no duties are performed (irrespective of

whether the employment relationship has terminated) due to vacation, holiday, illness, incapacity

(including disability), layoff, jury duty, military duty or leave of absence. No more than 501

Hours of Service will be credited under this paragraph for any single continuous period (whether

or not such period occurs in a single computation period). Hours under this paragraph will be

calculated and credited pursuant to Section 2530.200b-2 of the Department of Labor Regulations

which is incorporated herein by this reference.

(3) Each hour for which back pay, irrespective of mitigation of damages, is

either awarded or agreed to by the Employer. The same Hours of Service will not be credited

both under paragraph (1) or paragraph (2), as the case may be, and under this paragraph (3).

These hours shall be credited to the Employee for the computation period or periods to which the

award or agreement pertains rather than the computation period in which the award, agreement

or payment is made.

(4) Hours of Service shall be determined on the basis of actual hours for

which an Employee is paid or entitled to payment.

(5) Where the Employer maintains the plan of a predecessor employer,

service for such predecessor employer shall be treated as service for the Employer.

(6) Hours of Service will be credited for employment with other members of

an affiliated service group (under Code Section 414(m)), a controlled group of corporations

(under Code Section 414(b)), or a group of trades or businesses under common control (under

Code Section 414(c)), of which the Employer is a member and any other entity required to be

aggregated with the Employer pursuant to Code Section 414(o) and the regulations thereunder.

(7) Hours of Service Will also be credited for any individual considered an

Employee for purposes of this Plan under Code Section 414(n) or Code Section 414(o) and the

regulations thereunder.

(8) Solely for purposes of determining whether a Break in Service (as defined

in Section 2.1) has occurred in a computation period under the Plan, an individual who is absent

from work for maternity or paternity reasons shall receive credit for the Hours of Service which

would otherwise have been credited to such individual but for such absence, or, in any case in

which such hours cannot be determined, for 8 Hours of Service per day of such absence. For

purposes of this paragraph, an absence from work for maternity or paternity reasons means an

absence:

[a] by reason of the pregnancy of the individual;

[b] by reason of a birth of a child of the individual;

[c] by reason of the placement of a child with the individual in

connection with the adoption of such child by such individual; or

[d] for purposes of caring for such child for a period beginning

immediately following such birth or placement.

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-248© 1994 Jefren Publishing Company, Inc.

The Hours of Service credited under this paragraph (8) shall be credited in

the computation period in which the absence begins if the crediting is necessary to prevent a

Break in Service in that period. In all other cases, Hours of Service credited under this paragraph

shall be credited in the next following computation period.

(x) Income: The net gain or loss of the Trust Fund from investments, as reflected by

interest payments, dividends, realized and unrealized gains and losses on securities, other

investment transactions and expenses paid from the Trust Fund. In determining the income of the

Trust Fund for any period, assets shall be valued on the basis of their fair market value.(y) Internal Revenue Code or Code: The Internal Revenue Code of 1986, as amended.

(z) Joint and One-Half Survivor Annuity: Joint and One-Half Survivor Annuity is an

immediate annuity for the life of the Participant with a survivor annuity payable to the

Participant's Spouse or Beneficiary in periodic payments equal to one-half of the amount payable

during the life of the Participant. The combined value of both annuities shall be an amount equal

to the Participant's account balance at the date of determination.

Notwithstanding the foregoing, a Joint and One-Half Survivor Annuity for a

Participant who is not married is an immediate annuity for the life of the Participant.

(aa) Loan Suspense Account: The account to which Financed Shares are initially

allocated. Financed Shares shall be released from the Loan Suspense Account in accordance with

Section 5.1. (bb) Leased Employee: Any person (other than an employee of the recipient) who,

pursuant to an agreement between the recipient and any other person ("leasing organization") has

performed services for the recipient (or for the recipient and related persons determined in

accordance with Code Section 414(n)(6)) on a substantially full time basis for a period of at least

one year, and such services are of a type historically performed by employees in the business

field of the recipient Employer. Contributions or benefits provided to a Leased Employee by the

leasing organization which are attributable to services performed for the recipient Employer will

be treated as provided by the recipient Employer. A Leased Employee will not be considered an Employee of the recipient if the

requirements of (1) and (2) below are met:

(1) Such employee is covered by a money purchase pension plan providing:[a] a nonintegrated employer contribution rate of at least ten percent

(10%) of compensation (as defined in Code Section 415(c)(3), but including amounts contributed

by the Employer pursuant to a salary reduction agreement which are excludible from the

employee's gross income under any of Code Sections 125, 402(a)(8), 402(h) or 403(b));

[b] immediate participation; and

[c] full and immediate vesting.

(2) Leased Employees do not constitute more than twenty percent (20%) of

the recipient's nonhighly compensated workforce.

(cc) Normal Retirement Age: For all purposes under this Plan, the Normal Retirement

Age shall be 65.

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-249

(dd) Other Investments Account: The account maintained for a Participant to record

his share of contributions of Trust assets other than Employer Stock and adjustments relating

thereto.

(ee) Participant: An Employee participating in the Plan in accordance with the

provisions of Section 3.1. (ff) Plan: The Franklin Savings Bank Employee Stock Ownership Plan, the Plan set

forth herein, as amended from time to time.

(gg) Plan Administrator: The person or entity appointed under the provisions of

Article VIII to administer the Plan.(hh) Plan Year: The 12-month period commencing on July 1 and ending on June 30.

(ii) Qualified Election Period: For purposes of Section 6.10, "Qualified Election

Period" shall mean the five Plan Year period beginning with the later of (i) the Plan Year after

the Plan Year in which the Participant attains age 55; or, (ii) the Plan Year after the Plan Year in

which the Participant first becomes a Qualified Participant.(jj) Qualified Participant: For purposes of Section 6.10, "Qualified Participant"

shall mean a Participant who has attained age 55 and who has completed at least 10 years of

participation.(kk) Service: A Participant's period of employment with the Employer determined

in accordance with Section 3.2.(ll) Spouse or Surviving Spouses: The spouse or surviving spouse of the

Participant, provided that a former spouse will be treated as the spouse or surviving spouse to the

extent provided under a qualified domestic relations order as described in Code Section 414(p).

(mm) Trust (or Trust Fund): The fund known as the Franklin Savings Bank

Employee Stock Ownership Trust, maintained in accordance with the terms of the trust

agreement, as from time to time amended, which constitutes a part of this Plan.(nn) Trustee: The corporation or individual(s) appointed by the Board of Directors

of the Employer to administer the Trust.

(oo) Valuation Date: The last day of each Plan Year or the date on which a special

valuation is made pursuant to Section 5.2.(pp) Vesting Computation Periods: The 12 consecutive month period used to

determine whether an Employee has completed a Year of Service for purposes of vesting. The

initial Vesting Computation Period shall commence on the employment commencement date

(the date on which the Employee first performs an Hour of Service). The Vesting Computation

Period thereafter shall be the same as a Plan Year, commencing with the Plan Year which

includes the first anniversary of the Employee's employment commencement date and

succeeding Plan Years. In the event that a reemployed Employee does not participate as of his

reemployment date, said Employee's Vesting Computation Period shall commence on his

reemployment commencement date (the date on which the reemployed Employee first performs

an Hour of Service during his reemployment). The reemployment Vesting Computation Period

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-250© 1994 Jefren Publishing Company, Inc.

thereafter shall be the same as the Plan Year commencing with the Plan Year which includes the

first anniversary of the Employee's reemployment commencement date and succeeding Plan

Years.

(qq) Year of Service: A 12 consecutive month period during which an Employee

has not less than 1,000 Hours of Service. Employment at either the beginning or the end of the

applicable computation period shall not be determinative of whether a Year of Service has been

completed, a Year of Service having been completed if the Employee has 1,000 or more Hours

of Service at any time during the applicable computation period; provided, however, for

purposes of allocating contributions, income and forfeitures (if applicable), an Employee who

dies or is totally and permanently disabled during a given Plan Year shall always be deemed to

have completed 1,000 Hours during said year. If the Plan's service requirement for purposes of

eligibility to participate includes a fraction less than one (1), said fraction will be deemed to be

completed upon completion of one Hour of Service in the relevant computation period.

ARTICLE III - PARTICIPATION AND SERVICE

3.1 Participation: Any Employee meeting the eligibility requirements set forth below in

this Section 3.1 as of the date this Plan is adopted by the Board of Directors shall participate

from the Effective Date of the Plan. Any other Employee shall become a Participant as of July 1

or January 1 thereafter coinciding with, or next following, the expiration of the Eligibility

Computation Period during which the Employee satisfies the following:

(a) Completion of one (1) Year of Service within any Eligibility Computation Period.

(b) Attainment of twenty-one (21) years of age, provided such Employee is so

employed on such January 1 or July 1.

Notwithstanding the other provisions of this Section 3.1, any Employee who is

considered "part-time" pursuant to the Employer's employment policies shall be excluded from

participation under this Plan.

3.2 Service: A Participant's eligibility for benefits under the Plan shall be based on his

period of Service, determined in accordance with the following: (a) Service Prior to the Effective Date: Any Employee shall receive Years of Service

credit for purposes of eligibility and vesting for said Employee's last period of continuous

employment with the Employer which includes the Effective Date. The relevant 12 consecutive

month period for said purpose shall be the Plan Year. b) Service for Employees Participating From and After the Effective Date:

Subject to the reemployment provisions of Section 3.4, an Employee shall accrue a Year of

Service for each Eligibility Computation Period or Vesting Computation Period in which he has

1,000 or more Hours of Service.3.3 Inactive Status: In the event that any Participant shall fail, in any Plan Year of his

employment after the Effective Date, to accumulate 1,000 Hours of Service, such Plan Year shall

not be considered as a period of Service for the purpose of determining the Participant's vested

interest in accordance with Section 6.4, but he shall continue to receive Income allocations in

accordance with Section 5.2(a) and any applicable Employer Contribution and Forfeiture

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-251

allocations pursuant to Section 5.2.

3.4 Participation and Service Upon Reemployment: If an Employee has a one-year

Break in Service before satisfying the Plan's requirement for eligibility, service before such

Break will not be taken into account. Upon the reemployment of any person after the Effective

Date who had previously been employed by the Employer prior to the Effective Date, his rights

upon reemployment shall be determined in accordance with the Plan in effect on the date of his

employment termination. Upon the reemployment of any person after the Effective Date who

had previously been employed by the Employer on or after the Effective Date, the following

rules shall apply in determining his Participation in the Plan and his Service under Section 3.2:

(a) Participation: A former Participant shall become a Participant immediately

upon his return to the employ of the Employer if such former Participant had a nonforfeitable

right to all or a portion of his account balance derived from Employer contributions at the time of

his termination. A former Employee who did not have a nonforfeitable right to any portion of

his account balance derived from Employer contributions at the time of his termination shall be

considered a new Employee, for eligibility purposes, if the number of consecutive one year

Breaks in Service equals or exceeds the greater of 5 or the aggregate number of Years of Service

before such Break. If such former Employee's Years of Service before his termination may not

be disregarded under other provisions of this Plan in circumstances described in the preceding

sentence, such Employee shall participate immediately upon his reemployment.

In the event a Participant becomes ineligible to participate because he is no

longer a member of an eligible class of Employees, but has not incurred a Break in Service, such

Employee shall participate immediately upon his return to an eligible class of Employees. If such

Participant incurs a Break in Service his eligibility to participate shall be determined pursuant to

the two preceding paragraphs.

In the event an Employee who is not a member of an eligible class of

Employees becomes a member of the eligible class, such Employee shall participate immediate ly

if such Employee has satisfied any minimum

age and service requirements and would previously

have become a Participant had he been in the eligible class.

(b) Service: In the case of a Participant who has 5 or more consecutive one year

Breaks in Service, all service after such Breaks in Service will be disregarded for the purpose of

vesting the Employer-derived account balance that accrued before such Breaks in Service. Such

Participant's pre-Break service will count in vesting the post-Break Employer-derived account

balance only if either: (1) Such Participant had a nonforfeitable interest in the account balance

attributable to Employer contributions at the time of separation from service; or

(2) Upon returning to service the number of consecutive one year Breaks in

Service is less than the number of Years of Service.

Separate accounts will be maintained for the Participant's pre-Break and post-Break Employer-

derived account balance. Both accounts will share in the earnings and losses of the fund.

In the case of a Participant who has fewer than five consecutive one year Breaks

in Service, service shall be credited pursuant to Section 3.2 hereof.

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-252© 1994 Jefren Publishing Company, Inc.

Notwithstanding the foregoing, for purposes of computing vested benefits under

Section 6.4 in the case of any Employee who has any one year Break in Service, Years of

Service before such Break shall not be taken into account until the Employee has completed one

Year of Service after his reemployment.

ARTICLE IV - CONTRIBUTIONS AND FORFEITURES

4.1 Employer Contributions: The Employer shall, for each Plan Year, contribute to the

Trust Fund the amount determined by resolution of the Board of Directors adopted on or before

the last day of each Plan Year, to be held and administered in Trust by the Trustee according to

the terms of this Plan. In no case, however, shall the Employer make a contribution to the Plan

that will cause the Employer to violate any minimum capital requirement imposed on the

Employer pursuant to any state or federal law. The Employer's contribution shall not exceed the

maximum deductible amount permitted by the Internal Revenue Code of 1986, as amended. A

contribution may be made in either cash or shares of Employer Stock. The Employer may make

scheduled discretionary contributions to the Trust Fund to the extent necessary to provide the

Trustee with sufficient funds to pay any currently maturing obligations under any Acquisition

Loan, provided such contributions do not cause the Employer to fail to meet its minimum

regulatory capital requirement.

All contributions of the Employer shall be paid to the Trustee not later than the date

prescribed by law for filing the Employer's federal income tax return, including extensions which

have been granted for the filing of such tax return.

4.2 Contributions by Participants: No Employee contributions are permitted under this

Plan. 4.3 Final Disposition of Forfeitures: All forfeited, non-vested amounts shall be allocated

among the accounts of other Participants as of the last day of the Plan Year in which the

terminated Participant incurs a Break in Service.

If a Participant receives or is deemed to receive a distribution pursuant to Section 6.4,

and the Participant resumes employment covered under the Plan, the Participant's employer-

derived account balance will be restored to the amount of said account balance on the date of

distribution if the Participant repays to the Plan the full amount of the distribution attributable to

Employer contributions before the earlier of 5 years after the first date on which the Participant is

subsequently reemployed by the Employer, or the date the Participant incurs 5 consecutive one

year Breaks in Service following the date of the distribution. In all other cases, the Participant's

employer-derived account balance will not be restored.

Notwithstanding the foregoing provisions of Section 4.3, forfeitures shall first be

charged against a Participant's Other Investments Account, with any remaining amount charged

against his Employer Stock Account (at the current fair market value of Employer Stock on the

last day of the Plan Year in which the stock is forfeited). Financed Shares shall be forfeited only

after other shares of Employer Stock have been forfeited.

4.4 Rollover or Transfer Amount from Other Plans: No rollovers or transfers from other

Plans will be permitted under this Plan.

ARTICLE V - ALLOCATIONS TO PARTICIPANTS' ACCOUNTS

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-253

5.1 Maintenance of Accounts:

(a) Individual Accounts: The Committee shall create and maintain adequate records

to disclose the interest in the Trust of each Participant, former Participant and Beneficiary. Such

records shall be in the form of individual accounts, and credits and charges shall be made to such

accounts in the manner herein described. When appropriate, a Participant shall have two separate

accounts, an Employer Stock Account and an Other Investments Account. Each account shall be

maintained as described below.

(1) The Employer Stock Account maintained for each Participant will be

credited annually with the Participant's allocable share of Employer Stock (including fractional

shares) purchased and paid for or contributed in kind, together with any Forfeitures of Employer

Stock and With any stock dividends on Employer Stock allocated to his Employer Stock

Account.

(2) The Other Investments Account maintained for each Participant will be

credited annually with the Participant's allocable share of [a] Employer contributions in cash, [b]

any Forfeitures from a Participant's Other Investments Account, and [c] net income (or loss) of

the Trust attributable to Trust Assets, together with any cash dividends on Employer Stock

allocated to the Participant's Employer Stock Account (other than dividends distributed pursuant

to Section 6.8). Such Other Investments Account will be debited for the Participant's share of any

cash payments made by the Trustee for the acquisition of Employer Stock or for the payment of

any principal and/or interest on an Acquisition Loan.

The maintenance of individual accounts is only for accounting purposes, and a

segregation of the assets of the Trust Fund to each account shall not be required. Distributions

and withdrawals made from any account shall be charged to the account as of the date paid. In

addition, the Committee shall maintain adequate records of the aggregate cost basis of each class

of Employer Stock allocated to each Participant's Accounts. The Committee shall also keep

separate records of Financed Shares and of Employer Contributions (and any earnings thereon)

made for the purpose of enabling the Trustee to repay any Acquisition Loan. From time to time,

the Committee, in its discretion, may modify the accounting procedures for the purpose of

achieving equitable and nondiscriminatory allocations among the Accounts of Participants in

accordance with the general concepts of the Plan and applicable law.

(b) Loan Suspense Account: Any Financed Shares acquired by the Trust shall initially

be credited to a Loan Suspense Account and will be allocated to the Employer Stock Accounts of

Participants only as payments on the Acquisition Loan are made by the Trustee. The number of

Financed Shares to be released from the Loan Suspense Account for allocations to Participants'

Employer Stock Accounts for each Plan Year shall be determined by the Committee (as of each

Plan Year end) as described immediately below. (1) Principal and Interest Rule: The number of Financed Shares held in the Loan

Suspense Account immediately before the release (rounded upward to the nearest whole number

of shares) for the current Plan Year shall be multiplied by a fraction, the numerator of which

shall be the amount of principal and/or interest paid on the Acquisition Loan for that Plan Year,

and the denominator of which shall be the sum of the numerator plus the total payments of

principal and interest on that Acquisition Loan projected to be paid for all future Plan Years. For

this purpose, the interest to be paid in future years is to be computed using the interest rate in

effect as of the current Valuation Date.

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-254© 1994 Jefren Publishing Company, Inc.

(2) Principal Only Rule: The Committee may elect (at the time an Acquisition

Loan is incurred) or the provisions of the Acquisition Loan may provide for the release of

Financed Shares from the Loan Suspense Account based solely on the ratio that the payments of

principal for each Plan Year bear to the total principal amount of the Acquisition Loan. This

method may be used only to the extent that: [a] the Acquisition Loan provides for annual

payments of principal and interest at a cumulative rate that is not less rapid at any time than leve l

annual payments of such combined amounts for ten (10) years; [b] interest included in any

payment on the Acquisition Loan is disregarded only to the extent that it would be determined to

be interest under standard loan amortization tables; and [c] the entire duration of the Acquisition

Loan repayment period does not exceed ten (10) years, even in the event of a renewal, extension

or refinancing of the Acquisition Loan.

If subsection 5.1(b)(1) is applicable and if no amount of principal and interest is

paid for the Plan Year, or if subsection 5.1(b)(2) is applicable and no amount of principal is paid

for the Plan Year, there shall be no release of shares of Employer Stock from the Loan Suspense

Account for the Plan Year. Therefore, by establishing the terms of an Acquisition Loan or by

extending, renewing or renegotiating the terms of a loan, the Employer may, in its sole and

exclusive discretion, cause no shares of Employer Stock to be released from the Loan Suspense

Account for a Plan Year or reduce or eliminate the number of said shares which would have been

so released had the Employer not extended, renewed or renegotiated the terms of the Acquisition

Loan.

In each Plan Year in which Trust Assets are applied to make payments on an

Acquisition Loan, the Financed Shares released from the Loan Suspense Account in accordance

with the provisions of this Section shall be allocated among the Employer Stock Accounts of

Participants in the manner determined by the Committee based upon the source of funds

(Employer Contributions, earnings attributable to Employer Contributions and cash dividends on

Financed Shares allocated to Participants' Employer Stock Accounts or cash dividends on

Financed Shares credited to the Loan Suspense Account) used to make the payments on the

Acquisition Loan. Cash dividends on Financed Shares used for payment of an Acquisition Loan

shall be allocated pursuant to Section 5.2(b).

5.2 Account Adjustments: The accounts of Participants, former Participants and

Beneficiaries shall be adjusted in accordance with the rules described below. (a) Income: The Income or loss of the Trust Fund (other than dividends on

Employer Stock) for each relevant accounting period selected by the Committee shall be

allocated to the Other Investments Accounts of Participants, former Participants and

Beneficiaries who had unpaid balances in their Other Investments Accounts on the last day of the

accounting period in proportion to the balances in such accounts at the beginning of the

accounting period, but after first reducing each Other Investments Account balance by any

distributions from said Account during the accounting period. For purposes of the foregoing, net

income (or loss) includes the increase or decrease in the fair market value of Trust Assets,

interest income, dividends and other income and gains or losses attributable to Trust Assets

reduced by any expenses charged to said Trust Assets for that accounting period. The

determination of said net income (or loss) of the Trust shall not take into account any interest

paid by the Trust under an Acquisition Loan. Each valuation shall be based on the fair market

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-255

value of assets in the Trust Fund on the Valuation Date.

(b) Dividends on Employer Stock: Any cash dividend received on shares of

Employer Stock allocated to Participants' Employer Stock Accounts as of the record date relating

to the cash dividend will be allocated to the Other Investments Accounts of such Participants.

Any cash dividend received on unallocated shares of Employer Stock, including any Financed

Shares credited to the Loan Suspense Account, shall be allocated in accordance with Section

5.2(a). Any stock dividend received on Employer Stock shall be credited to the Accounts to

which such Employer Stock was allocated as of the record date relating to the stock dividend.

Notwithstanding the foregoing, any cash dividends which are currently distributed to Participants

pursuant to Section 6.8 shall not be credited to their respective Other Investments Accounts.If cash dividends on Financed Shares allocated to a Participant's Employer Stock

Account are used for payments on an Acquisition Loan, Financed Shares (representing that

portion of such payments and whose Fair Market Value is at least equal to the amount of such

dividends) released from the Loan Suspense Account shall be allocated to that Participant's

Employer Stock Account.

(c) Employer Contributions: As of the end of each Plan Year, the Employer's

contributions for the Plan Year shall be allocated to the Employer Stock Accounts and Other

Investments Accounts of Participants who were not placed on inactive status during the Plan

Year and who were employed by the Employer on the last day of the Plan Year in the same

proportion as such Participant's Compensation for the Plan Year bears to the total Compensation

of all Participants for such Plan Year.

If in any given Plan Year the requirement that Participants be active (complete

1,000 or more Hours of Service during the Plan Year) in order to receive an Employer

contribution would cause the Plan to fail the minimum participation rules of Code Section

401(a)(26) or the minimum coverage rules of Code Section 410(b), the number of Hours of

Service which constitutes active status under the Plan shall be reduced in a uniform manner to

the extent necessary to satisfy Code Sections 401(a)(26) and/or 410(b).

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-256© 1994 Jefren Publishing Company, Inc.

Notwithstanding the foregoing, in no event will the amount allocated to each

Participant's Employer Stock Account and/or Other Investments Account hereunder exceed the

maximum addition allowable for such year as provided in Section 5.3. In addition, if this Plan is

a Top-Heavy plan under Article XIII hereof, no allocations shall be made hereunder until the

minimum contribution allocations set forth in Section 13.3 have been made.

(d) Forfeitures: As of the end of each Plan Year, any Forfeitures which have

become available for allocation during such Plan Year pursuant to Section 4.3, shall be credited

to the Employer Stock Accounts and/or Other Investments Accounts (depending on whether the

forfeiture is in stock or cash) of the same Participants who are entitled to an Employer

Contribution for the Plan Year under Section 4.1. Such amounts shall be allocated according to

the ratio that each Participant's Compensation for the Plan Year bears to the total Compensation

of all such Participants for the Plan Year.(e) Limitation on Allocations to Selling Shareholder: If an eligible Employer

shareholder (pursuant to Code Section 1042) sells Employer Stock to the Trust and elects (with

the consent of the Employer) nonrecognition of gain under Section 1042 of the Code or takes the

estate tax deduction under Section 2057 of the Code, no portion of the Employer Stock

purchased in such transaction (or any dividends or other income attributable thereto) may be

allocated during the ten-year period following the purchase to the Accounts of: (1) the selling shareholder who makes an election under Section 1042 of the

Code or the decedent whose estate made the sale to which Section 2057 of the Code applies; or

(2) his spouse, brothers or sisters (whether by the whole or half blood),

ancestors or certain lineal descendants, or any other person who bears a relationship to him that

is described in Section 267(b) of the Code.

In addition, no portion of the Employer Stock purchased in such transaction (or any

dividends or other income attributable thereto) may thereafter be allocated to the Accounts of

any shareholder owning (as determined under Section 318(a) of the Code, without regard to

Section 318(a)(2)(B)(i) of the Code), during the entire one-year period preceding the purchase or

on an Allocation Date, more than 25% of the outstanding Employer Stock.

To the extent that a Participant is subject to the allocation limitation described in this

Section 5.3(e) for a Plan Year, he shall not share in the allocation of Employer Contributions and

Forfeitures.

5.3 Limitation on Allocations: This Section 5.3 applies notwithstanding any other

provision in this Plan to the contrary.

(a) If the Participant does not participate in, and has never participated in another

qualified plan or a welfare benefit fund, as defined in Section 419(e) of the Code, maintained by

the Employer, or an individual medical account, as defined in Code Section 415(1)(2),

maintained by the Employer, which provides an Annual Addition as defined in Section 2.1, the

amount of Annual Additions which may be credited to the Participant's account for any

Limitation Year will not exceed the lesser of the maximum permissible amount or any other

limitation contained in this Plan. If the Employer contribution that would otherwise be

contributed or allocated to the Participant's account would cause the Annual Additions for the

Limitation Year to exceed the maximum permissible amount, the amount contributed or

EMPLOYEE STOCK PURCHASE PLANS §19.201

July 199419-257

allocated will be reduced so that the Annual Additions for the Limitation Year will equal the

maximum permissible amount.

Prior to determining the Participant's actual compensation for the Limitation Year, the

Employer may determine the maximum permissible amount for a Participant on the basis of a

reasonable estimation of the Participant's compensation for the Limitation Year, uniformly

determined for all Participants similarly situated.

As soon as is administratively feasible after the end of the Limitation Year, the

maximum permissible amount for the Limitation Year will be determined on the basis of the

Participant's actual compensation for the Limitation Year.

If pursuant to the preceding paragraph or as a result of the allocation of Forfeitures,

there is an excess amount, the excess will be disposed of as follows:

(1) Any nondeductible voluntary Employee Contributions, to the extent they

would reduce the excess amount, will be returned to the Participant.

(2) If after the application of paragraph (1) an excess amount still exists, and

the Participant is covered by the Plan at the end of a Limitation Year, the excess amount in the

Participant's account will be used to reduce Employer Contributions (including any allocation of

Forfeitures) for such Participant in the next Limitation Year, and each succeeding Limitation

Year if necessary.

(3) If after the application of paragraph (1) an excess amount still exists, and

the Participant is not covered by the Plan at the end of the Limitation Year, the excess amount

will be held unallocated in a suspense account. The suspense account will be applied to reduce

future Employer Contributions (including any allocation of Forfeitures) for all remaining

Participants in the next Limitation Year, and each succeeding Limitation Year if necessary.

(4) If a suspense account is in existence at any time during the Limitation Year

pursuant to this section, it will not participate in the allocation of the trust's investment gains and

losses. If a suspense account is in existence at any time during a particular Limitation Year, all

amounts in the suspense account must be allocated and reallocated to Participants' accounts

before any Employer contributions may be made to the Plan for that Limitation Year. Excess

amounts may not be distributed to Participants or former Participants.

(b) This section applies if, in addition to this Plan, the Participant is covered under

another qualified defined contribution plan or welfare benefit fund, as defined in Section 419(e)

of the Code, maintained by the Employer or an individual medical account, as defined in Code

Section 415(1)(2) maintained by the Employer which provides an Annual Addition as defined in

Section 2.1, during any Limitation Year. The Annual Additions which may be credited to a

Participant's account under this Plan for any such Limitation Year will not exceed the maximum

permissible amount reduced by the Annual Additions credited to a Participant's account under

the other plans and welfare benefit funds for the same Limitation Year. If the Annual Additions

with respect to the Participant under other defined contribution plans and welfare benefit funds

maintained by the Employer are less than the maximum permissible amount and the Employer

contribution that would otherwise be contributed or allocated to the Participant's account under

this Plan would cause the Annual Additions for the Limitation Year to exceed this limitation, the

§19.201 PROXY STATEMENTS : STRATEGY & FORMS

19-258© 1994 Jefren Publishing Company, Inc.

amount contributed or allocated will be reduced so that the Annual Additions under all such

plans and funds for the Limitation Year will equal the maximum permissible amount. If the

Annual Additions with respect to the Participant under such other defined contribution plans and

welfare benefit funds in the aggregate are equal to or greater than the maximum permissible

amount, no amount will be contributed or allocated to the Participant's account under this Plan

for the Limitation Year.

Prior to determining the Participant's actual compensation for the Limitation Yea r, the

Employer may determine the maximum permissible amount for a Participant in the manner

described in Section 5.3(a).

As soon as is administratively feasible after the end of the Limitation Year, the

maximum permissible amount for the Limitation Year will be determined on the basis of the

Participant's actual compensation for the Limitation Year.

If, pursuant to the preceding paragraph, or as a result of the allocation of Forfeitures, a

Participant's Annual Additions under this Plan and such other plans would result in an excess

amount for a Limitation Year, the excess amount will be deemed to consist of the Annual

Additions last allocated, except that Annual Additions attributable to a welfare benefit fund or

individual medical account will be deemed to have been allocated first regardless of the actual

allocation date.

If an excess amount was allocated to a Participant on an allocation date of this Plan

which coincides with an allocation date of another plan, the excess amount attri buted to this Plan

will be the product of,

(1) the total excess amount allocated as of such date, times

(2) the ratio of (i) the Annual Additions allocated to the Participant for the

Limitation Year as of such date under this Plan to (ii) the total Annual Additions allocated to the

Participant for the Limitation Year as of such date under this and all the other qualified defined

contribution plans.

(c) If the Employer maintains, or at any time maintained, a qualified defined benefit

plan covering