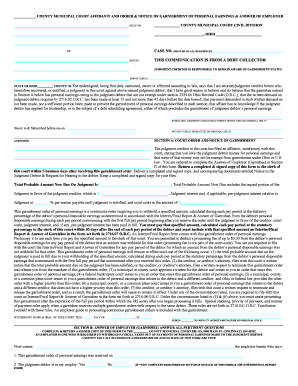

____________ COUNTY MUNICIPAL COURT AFFIDAVIT AND ORDER & NOTICE OF GARNISHMENT OF PERSONAL EARNINGS & ANSWER OF EMPLOYER___________________________________________________________CREDITOR ______________ COUNTY MUNICIPAL COURT CIVIL DIVISION___________________________________________________________ ___________________________, OHIO ____________________________________________________________________________________VS. CASE NO. (MUST BE ON ALL REFERENCES )_____________________________________________________________________________________________________________________DEBTOR THIS COMMUNICATION IS FROM A DEBT COLLECTOR___________________________________________________________ JUDGMENT CREDITOR IS RESPONSIBLE TO REMAIN AWARE OF GARNISHMENT STATUS___________________________________________________________ (SS# OPTIONAL) _________________-_________________-_________________STATE OF OHIO, __________ COUNTY: SS The undersigned, being first duly cautioned, sworn or affirmed according to law, says that I am attorney/judgment creditor herein who

heretofore recovered, or certified, a judgment in this court against above named judgment debtor; that I have good reason to believe and do believe that the garnishee named

in Section A below has personal earnings owing to the judgment debtor that are not exempt under section 2329.66 Ohio Revised Code (O.R.C.); that the written demand on

judgment debtor requires by 2716.02 O.R.C. has been made at least 15 and not more than 45 days before the date hereof; that payment demanded in such written demand as

not been made, nor a sufficient portion been made to prevent the garnishment of personal earnings described in such section; that affiant has no knowledge if the judgment

debtor has applied for trusteeship, or is the subject of a debt scheduling agreement, either of which precludes the garnishment of judgment debtor’s personal earnings._________________________________________________________SIGNATURE: JUDGMENT CREDITOR/ATTORNEY (SIGNATURE ON ORIGINAL ONLY)Sworn to & Subscribed before me on ________________________________________________ ____________________________________________________________________________NOTARY PUBLIC (SIGNATURE ON ORIGINAL ONLY)_____________________________________________________________________________________________________________________________________________________________________________________________________________________________GARNISHEE: SECTION A: COURT ORDER AND NOTICE OF GARNISHMENT________________________________________________________________________________ The judgment creditor in this case has filed an affidavit, satisfactory with this court, stating that you owe the judgment debtor money for personal earnings and ________________________________________________________________________________ that some of that money may not be exempt from garnishment under Ohio or U.S. law. You are ordered to complete the Answer of Employer (Garnishee) in Section ________________________________________________________________________________ B of this form. Return a completed & signed copy of this form to the clerk of

this court within 5 business days after receiving this garnishment order. Deliver a completed and signed copy, and accompanying documents entitled Notice to the

Judgment Debtor & Request for Hearing to the debtor. Keep a completed and signed copy for your files.Total Probable Amount Now Due On Judgment Is $_____________________________________________; Total Probable Amount Now Due includes the unpaid portion of theJudgment in favor of the judgment creditor, which is $____________________________________; Judgment interest and, if applicable, pre-judgment interest relative toJudgment at __________ % per annum payable until judgment is satisfied; and court costs in the amount of $________________________This garnishment order of personal earnings is a continuous order requiring you to withhold a specified amount, calculated during each pay period at the statutory

percentage of the debtor’s personal disposable earnings as determined in accordance with the Interim/Final Report & Answer of Garnishee, from the debtors personal

disposable earnings during each pay period commencing with the first full pay period beginning after you receive the order until the judgment in favor of the creditor, court

costs, judgment interest, and, if any, pre-judgment interest has been paid in full. You must pay that specified amount, calculated each pay period at the statutory

percentage to the clerk of this court within 30 days after the end of each pay period of the debtor and must include with that specified amount an Interim/Final

Report & Answer of Garnishee in the form set forth in 2716.07 O.R.C. An Interim/Final Report form comes with this garnishment order of personal earnings.

Photocopy it to use each time you pay the specified amount to the clerk of this court. You are permitted to deduct a processing fee of up to $3.00 from the debtor’s personal

disposable earnings for any pay period of the debtor that an amount was withheld for that order (processing fee is not part of the court costs). You are not required to file

with the court the Interim/Final Report and Answer of Garnishee for any pay period of the debtor for which an amount from the debtor’s personal disposable earnings was

not withheld for that order. This garnishment order of personal earnings will remain in effect until one of the following occur: (1) the total probable amount due on the

judgment is paid in full due to your withholding of the specified amount, calculated during each pay period at the statutory percentage from the debtor’s personal disposable

earnings that commenced with the first full pay period that commenced after you received this order; (2) the creditor, or creditor’s attorney, files with this court a written

notice that the total probable amount due on the judgment has been satisfied, or the creditor, or creditor’s attorney, files a written request to terminate this garnishment order

and release you from the mandate of this garnishment order; (3) a municipal or county court appoints a trustee for the debtor and issues to you an order that stays this

garnishment order of personal earnings; (4) a federal bankruptcy court issues to you an order that stays this garnishment order of personal earnings; (5) a municipal, county,

or a common pleas court issues to you a garnishment order of personal earnings that relates to the debtor and a different creditor, and Ohio or federal law provides the other

order with a higher priority than this order; (6) a municipal, county, or a common pleas court issues to you a garnishment order of personal earnings that relates to the debtor

and a different creditor that does not have a higher priority than this order; (7) the creditor, or creditor’s attorney, files with this court a written request to terminate and

release the garnishment order, and as a result, the garnishment order will cease to remain in effect. Under any of the circumstances listed, you are required to file with this

court an Interim/Final Report & Answer of Garnishee in the form set forth in 2716.08 O.R.C. Under the circumstances listed in (5) & (6) above, you must cease processing

this garnishment after the expiration of the full pay period within which the 182 nd day after you began processing it falls. Special stacking, priority of payment, and manner

of payment rules apply when a garnishee receives multiple garnishment orders with respect to the same debtor. These rules are set forth in 2716.041 O.R.C. Familiarize

yourself with these rules. An employer guide to processing continuous garnishment orders is included with this garnishment.WITNESS MY HAND & SEAL OF THIS COURT THIS ________DAY OF ____________________, 20_________ ____________________________________________________________________________JUDGE-__________ CO. MUN. CT. (JUDGE’S SIGNATURE ON ORIGINAL ONLY)______________________________________________________________________________________________________________________________________________________________ SECTION B: ANSWER OF EMPLOYER (GARNISHEE) ANSWER ALL PERTINENT QUESTIONS COMPLETE & RETURN A SIGNED COPY OF THIS FORM TO THE __________ COUNTY MUNICIPAL COURT RM 115, 1000 MAIN ST. CINCINNATI, OH 45202 AN EMPLOYER IS ONE WHO IS REQUIRED TO WITHHOLD PAYROLL TAXES OUT OF PAYMENTS OF PERSONAL EARNINGS MADE TO THE JUDGMENT DEBTOR I CERTIFY THAT ALL STATEMENTS ANSWERED BELOW AND ON BACK OF THIS FORM ARE TRUE. Now comes __________________________________________________________________________________________________________________________________________the employer herein who says:1. This garnishment order of personal earnings was received on__________________________________________________________________________________________2. The judgment debtor is in my employ: Yes _______________ No_______________ (IF “YES” COMPLETE REMAINDER OF SECTION B ON BACK OF THIS FORM & THE INTERIM/FINAL REPORT

FORM)

If the answer is “no” give date of last employment_________________________________________________ ___________________________________________________________ __________________________ __ _____________________________________________________________PRINT NAME AND TITLE OF PERSON WHO COMPLETED FORM DATE SIGNATURE OF PERSON COMPLETING FORM________________________________________________________________________________________________________________________________________________________________________________________HOLDING (CLERK USE ONLY)_________________________________________________________________________________________CREDITOR/ATTORNEY$______________________ CASH CHECK___________________________________________________________________ADDRESS___________________________________________PH# _____________________ FILE DATE_______________________________________________________________ CITY, STATE, ZIP CODE judge _____________________ REVISED 09/00

SECTION B: ANSWER OF EMPLOYER (GARNISHEE), CONTINUED 3. (A) Is the debt to which this garnishment order of personal earnings pertains the subject of an existing agreementfor debt scheduling between the judgment debtor and a budget and debt counseling service, and has the judgmentdebtor made every payment that was due under the agreement for debt scheduling no later than 45 days afterthe date on which the payment was due? YES_________NO__________If the answer to both parts of this question is “YES”, give all available details of the agreement, sign this form, and return it to the court.________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________(B) Were you, on the date that you received this garnishment order of personal earnings, withholding moneys from the judgment debtor’s

personal disposable earnings pursuant to another garnishment order of personal earnings that Ohio or federal law provides with a higher

priority than this garnishment order of personal earnings (such as a support order, or internal revenue service levy)?YES_________NO__________If the answer to this question is “YES” give the name of the court that issued the higher priority order, the associated case number, the

date upon which you received that order, and the balance due to the relevant judgment creditor under that order.____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ (C) Did you receive prior to the date that you received this garnishment order of personal earnings one or more other garnishment orders

of personal earnings that are not described in question 3(B), and are you currently processing one or more of those orders of the statutorily

required time period, or holding one or more of those orders for processing for a statutorily required period in the sequence of their receipt

by you? YES_________NO__________If the answer to this question is “YES” give the name of the court that issued each of those previously received orders, the associated case

numbers, the date upon which you received each of those orders, and the balance due to the relevant judgment creditor under each of

those orders. List first the previously received order(s) that you are currently processing, and list each of the other previously received

orders in the sequence that you are required to process them.______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ I CERTIFY THAT THE STATEMENTS ABOVE ARE TRUE, AND THAT A COMPLETED ANDSIGNED COPY OF THIS FORM, ALONG WITH TWO COPIES OF THE NOTICE TO THE JUDGMENT DEBTOR FORM, AND A REQUEST FOR HEARING FORM, HAVE BEEN DELIVEREDTO THE JUDGMENT DEBTOR. EACH DEDUCTION FROM THE EMPLOYEE’S PAY WILL BE THE RESULT OF A CONTINUOUS GARNISHMENT.

Useful advice on preparing your ‘Garnishment Employer’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive features embedded in this user-friendly and affordable platform to transform your method of document management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow simplifies the process, requiring just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Garnishment Employer’ in the editor.

- Click Me (Fill Out Now) to edit the document on your end.

- Add and assign fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your Garnishment Employer or send it for notarization—our platform offers all the resources you need to achieve such objectives. Sign up with airSlate SignNow today and elevate your document management to a new level!