Fill and Sign the General Information for Preparing an Application for Tax Certificate Atc Form City of Birmingham Alabama Finance Department Tax

Useful suggestions for creating your ‘General Information For Preparing An Application For Tax Certificate Atc Form City Of Birmingham Alabama Finance Department Tax’ online

Are you fed up with the inconvenience of managing paperwork? Search no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features included in this user-friendly and cost-efficient platform to transform your approach to document management. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages everything effectively, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘General Information For Preparing An Application For Tax Certificate Atc Form City Of Birmingham Alabama Finance Department Tax’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign editable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from additional parties.

- Save, print your version, or convert it into a reusable template.

Don’t be concerned if you need to work with others on your General Information For Preparing An Application For Tax Certificate Atc Form City Of Birmingham Alabama Finance Department Tax or send it for notarization—our platform provides everything necessary to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is the process for applying for a tax certificate in Birmingham, Alabama?

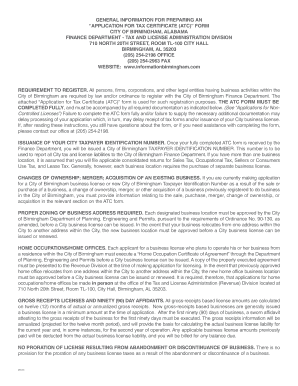

To apply for a tax certificate in Birmingham, Alabama, you will need to gather specific documents and fill out the ATC form. The GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205 provides detailed steps on how to complete the application correctly.

-

Where can I find the ATC form for the tax certificate application?

The ATC form can be downloaded directly from the City of Birmingham's Finance Department website. Refer to the GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205 for links and additional resources.

-

What documents do I need to submit with my tax certificate application?

When applying for the tax certificate, you must include several documents such as proof of business registration, identification, and any relevant tax documents. The GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205 outlines all required documents in detail.

-

Is there a fee associated with the tax certificate application?

Yes, there is typically a fee associated with the tax certificate application in Birmingham, Alabama. For the most accurate and updated fees, consult the GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205.

-

How long does it take to process the tax certificate application?

The processing time for the tax certificate application can vary, but it generally takes a few weeks. For specific timelines, refer to the GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205.

-

Can I submit my tax certificate application online?

Yes, the City of Birmingham allows online submissions for the tax certificate application. Check the GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205 for instructions on how to submit electronically.

-

What should I do if my tax certificate application is denied?

If your application for the tax certificate is denied, you can appeal the decision. The GENERAL INFORMATION FOR PREPARING AN APPLICATION FOR TAX CERTIFICATE ATC FORM CITY OF BIRMINGHAM, ALABAMA FINANCE DEPARTMENT TAX AND LICENSE ADMINISTRATION DIVISION 710 NORTH 20TH STREET, ROOM TL 100 CITY HALL BIRMINGHAM, AL 35203 205 outlines the steps needed to initiate an appeal process.

Find out other general information for preparing an application for tax certificate atc form city of birmingham alabama finance department tax

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles