Fill and Sign the Hobby Vs Business and Losses for Tax Purposes Form

Useful tips for preparing your ‘Hobby Vs Business And Losses For Tax Purposes’ online

Are you exhausted from dealing with paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and endorse paperwork online. Take advantage of the robust features included in this user-friendly and affordable platform and transform your document management process. Whether you need to sign forms or gather electronic signatures, airSlate SignNow makes it all straightforward, needing just a few clicks.

Follow this guided tutorial:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Edit your ‘Hobby Vs Business And Losses For Tax Purposes’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Hobby Vs Business And Losses For Tax Purposes or send it for notarization—our platform offers all the tools required to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to the next level!

FAQs

-

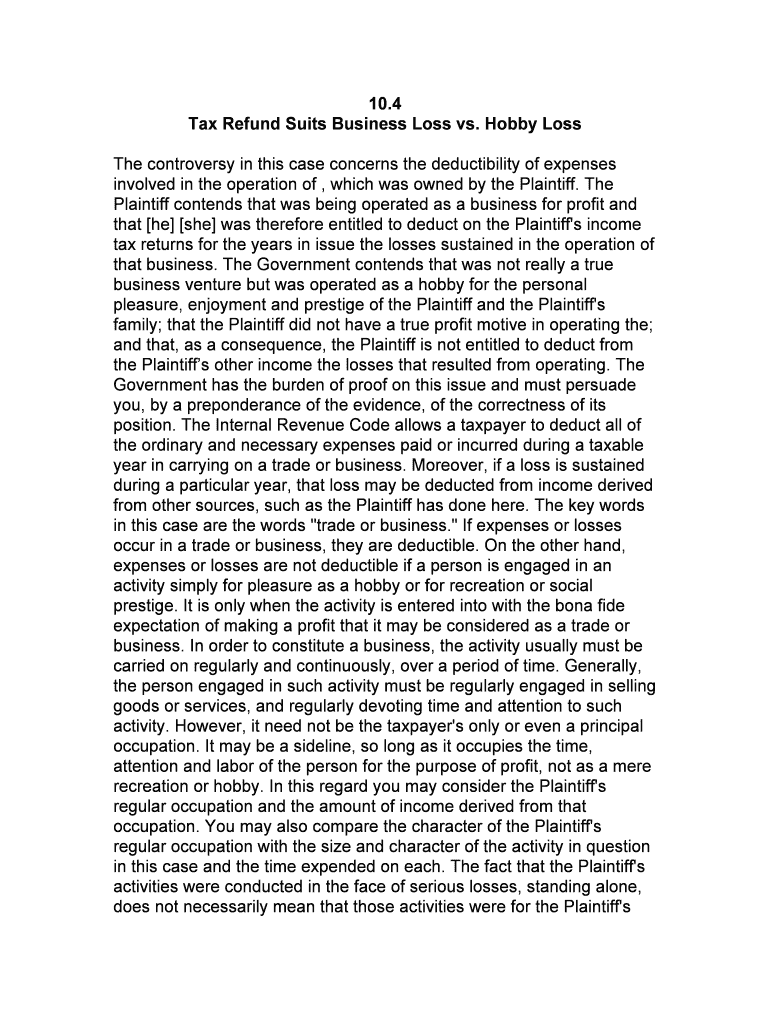

What is the difference between a hobby and a business for tax purposes?

The distinction between a hobby and a business for tax purposes is crucial. Generally, if you engage in an activity with the intent to make a profit, it's considered a business. Conversely, if your activity is primarily for personal enjoyment without the intent to profit, it's classified as a hobby, which can affect how losses are treated for tax purposes.

-

How do losses from a hobby impact my taxes?

When it comes to losses from a hobby, the IRS allows you to deduct certain expenses, but only up to the amount of income generated from that hobby. Understanding the implications of hobby vs business and losses for tax purposes is essential, as business losses can be fully deductible, while hobby losses are limited. Therefore, keeping accurate records is important to support your claims.

-

Can I convert my hobby into a business for tax purposes?

Yes, you can convert your hobby into a business for tax purposes, but you must demonstrate a profit motive. This means you should show a consistent effort to make a profit and treat your activities with a business-like approach. Understanding hobby vs business and losses for tax purposes can help you maximize your deductions and minimize your tax liability.

-

What features does airSlate SignNow offer for business document management?

airSlate SignNow offers a range of features designed for effective document management, including eSigning, templates, and automated workflows. These tools are especially beneficial for businesses looking to streamline operations and ensure compliance. Knowing how to utilize these features can help clarify the differences in tax treatment of hobby vs business and losses for tax purposes.

-

How can airSlate SignNow help me track expenses related to my business?

With airSlate SignNow, you can easily manage and track your business expenses through its document management features. By keeping organized records of your transactions, you can better differentiate between hobby and business expenses. This clarity is vital when considering hobby vs business and losses for tax purposes.

-

Is airSlate SignNow cost-effective for small businesses?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for small businesses. Its pricing plans are flexible, allowing you to choose options that fit your budget while providing essential features that help you manage documents effectively, especially when navigating hobby vs business and losses for tax purposes.

-

What integrations does airSlate SignNow offer?

airSlate SignNow offers seamless integrations with popular tools such as Google Workspace, Salesforce, and Microsoft Office. These integrations enhance your workflow, making it easier to manage documents and communications, which is particularly useful when dealing with hobby vs business and losses for tax purposes.

The best way to complete and sign your hobby vs business and losses for tax purposes form

Find out other hobby vs business and losses for tax purposes form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles