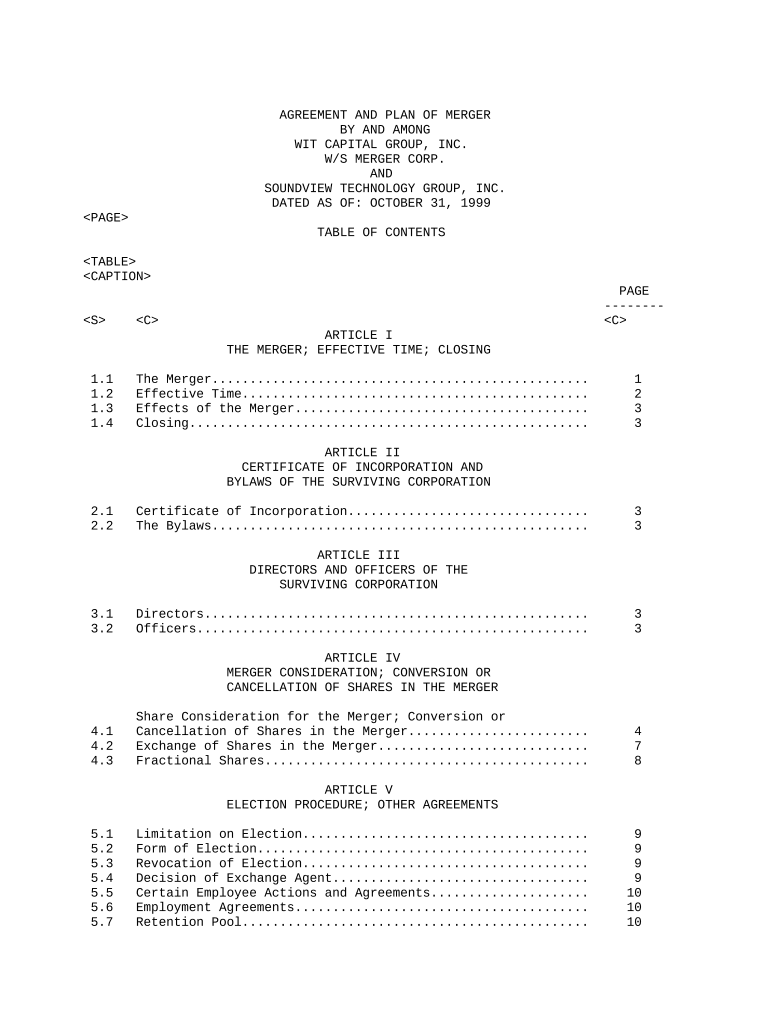

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

WIT CAPITAL GROUP, INC.

W/S MERGER CORP.

AND

SOUNDVIEW TECHNOLOGY GROUP, INC.

DATED AS OF: OCTOBER 31, 1999

TABLE OF CONTENTS

PAGE

--------

ARTICLE I

THE MERGER; EFFECTIVE TIME; CLOSING

1.1 The Merger.................................................. 1

1.2 Effective Time.............................................. 2

1.3 Effects of the Merger....................................... 3

1.4 Closing..................................................... 3

ARTICLE II

CERTIFICATE OF INCORPORATION AND

BYLAWS OF THE SURVIVING CORPORATION

2.1 Certificate of Incorporation................................ 3

2.2 The Bylaws.................................................. 3

ARTICLE III

DIRECTORS AND OFFICERS OF THE

SURVIVING CORPORATION

3.1 Directors................................................... 3

3.2 Officers.................................................... 3

ARTICLE IV

MERGER CONSIDERATION; CONVERSION OR

CANCELLATION OF SHARES IN THE MERGER

Share Consideration for the Merger; Conversion or

4.1 Cancellation of Shares in the Merger........................ 4

4.2 Exchange of Shares in the Merger............................ 7

4.3 Fractional Shares........................................... 8

ARTICLE V

ELECTION PROCEDURE; OTHER AGREEMENTS

5.1 Limitation on Election...................................... 9

5.2 Form of Election............................................ 9

5.3 Revocation of Election...................................... 9

5.4 Decision of Exchange Agent.................................. 9

5.5 Certain Employee Actions and Agreements..................... 10

5.6 Employment Agreements....................................... 10

5.7 Retention Pool.............................................. 10

5.8 Soundview Stock and Option Arrangements..................... 10

ARTICLE VI

REPRESENTATIONS AND WARRANTIES OF SOUNDVIEW

6.1 Organization; Qualification................................. 11

6.2 Subsidiaries and Affiliates................................. 12

6.3 Capitalization.............................................. 12

6.4 Authorization; Validity of Agreement; SoundView Action...... 13

6.5 Board Approvals Regarding Transactions...................... 13

6.6 Vote Required............................................... 13

6.7 Consents and Approvals; No Violations....................... 14

6.8 Governmental Documents and Financial Statements............. 14

6.9 Compliance with Applicable Law.............................. 15

I-i

PAGE

--------

6.10 Books and Records........................................... 16

6.11 Ineligible Persons.......................................... 16

6.12 No Undisclosed Liabilities.................................. 16

6.13 Interim Operations.......................................... 17

6.14 Absence of Certain Changes.................................. 17

6.15 Technology and Intellectual Property........................ 18

6.16 Legal Proceedings........................................... 19

6.17 Employee Benefit Plans...................................... 19

6.18 Tax Matters; Government Benefits............................ 21

6.19 Labor and Employment Matters................................ 22

6.20 Contracts and Commitments................................... 23

6.21 Insurance................................................... 23

6.22 Personnel................................................... 23

6.23 Insider Interests........................................... 23

6.24 Brokers or Finders.......................................... 24

ARTICLE VII

REPRESENTATIONS AND WARRANTIES OF PARENT

7.1 Organization; Qualification................................. 24

7.2 Subsidiaries and Affiliates................................. 24

7.3 Capitalization.............................................. 25

7.4 Authorization; Validity of Agreement; Parent Action......... 26

7.5 Board Approvals Regarding Transactions...................... 26

7.6 Vote Required............................................... 26

7.7 Consents and Approvals; No Violations....................... 26

7.8 Governmental Documents and Financial Statements............. 27

7.9 Compliance with Applicable Law.............................. 27

7.10 Books and Records........................................... 29

7.11 Ineligible Persons.......................................... 29

7.12 No Undisclosed Liabilities.................................. 29

7.13 Interim Operations.......................................... 30

7.14 Absence of Certain Changes.................................. 30

7.15 Technology and Intellectual Property........................ 31

7.16 Legal Proceedings........................................... 32

7.17 Employee Benefit Plans...................................... 32

7.18 Tax Matters; Government Benefits............................ 35

7.19 Labor and Employment Matters................................ 36

7.20 Contracts and Commitments................................... 37

7.21 Insurance................................................... 37

7.22 Insider Interests........................................... 37

7.23 Brokers or Finders.......................................... 37

ARTICLE VIII

COVENANTS

8.1 Interim Operations of SoundView............................. 37

8.2 Interim Operations of Parent................................ 40

8.3 Access; Confidentiality..................................... 42

8.4 Reasonable Best Efforts..................................... 42

Shareholders Meetings; Proxy Statement/Registration

8.5 Statement................................................... 43

8.6 No Solicitation of Competing Transaction.................... 44

I-ii

PAGE

--------

8.7 Publicity................................................... 44

8.8 Notification of Certain Matters............................. 45

8.9 State Takeover Laws......................................... 45

8.10 Merger Sub Compliance....................................... 45

8.11 Expenses.................................................... 45

8.12 Appointment of Director..................................... 45

8.13 Tax-Free Reorganization..................................... 45

ARTICLE IX

CONDITIONS

9.1 Conditions to the Obligations of Parent and Merger Sub...... 46

9.2 Conditions to the Obligations of SoundView.................. 48

ARTICLE X

TERMINATION/SURVIVAL

10.1 Termination................................................. 50

10.2 Effect of Termination....................................... 52

No Survival of Representations and Warranties and

10.3 Covenants................................................... 52

ARTICLE XI

DEFINITIONS

11.1 Definitions................................................. 52

ARTICLE XII

MISCELLANEOUS

12.1 Disputes.................................................... 60

12.2 Amendments; Extension; Waiver............................... 60

12.3 Entire Agreement............................................ 60

12.4 Specific Performance; Injunctive Relief..................... 61

12.5 Interpretation.............................................. 61

12.6 Severability................................................ 61

12.7 Notices..................................................... 61

12.8 Binding Effect; Persons Benefitting; No Assignment.......... 63

12.9 Counterparts................................................ 63

12.10 Governing Law............................................... 63

12.11 Jurisdiction; Waiver of Jury Trial and Certain Damages...... 63

I-iii

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER (hereinafter called this "Agreement"), dated as

of October 31, 1999, among Wit Capital Group, Inc., a Delaware corporation

("Parent"), W/S Merger Corp., a Delaware corporation and a direct wholly owned

subsidiary of Parent ("Merger Sub"), and SoundView Technology Group, Inc., a

Delaware corporation ("SoundView").

RECITALS

WHEREAS, the Boards of Directors of Parent, Merger Sub and SoundView each

have determined that it is in the best interests of their respective

stockholders for Merger Sub to merge with and into SoundView upon the terms and

subject to the conditions of this Agreement;

WHEREAS, for federal income tax purposes, it is intended that the Merger (as

hereinafter defined in Section 1.1) shall qualify as a reorganization within the

meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the

"Code"); and

WHEREAS, Parent, Merger Sub and SoundView desire to make certain

representations, warranties, covenants and agreements in connection with the

Merger.

NOW, THEREFORE, in consideration of the foregoing and the mutual

representations, warranties, covenants and agreements set forth herein, Parent,

Merger Sub and SoundView hereby agree as follows:

ARTICLE I

THE MERGER; EFFECTIVE TIME; CLOSING

1.1 THE MERGER. Subject to the terms and conditions of this Agreement and

the Delaware General Corporation Law (the "DGCL"), at the Effective Time (as

hereinafter defined), SoundView and Merger Sub shall consummate a merger (the

"Merger") in which (a) Merger Sub shall be merged with and into SoundView and

the separate corporate existence of Merger Sub shall thereupon cease, (b)

SoundView shall be the successor or surviving corporation in the Merger and

shall continue to be governed by the laws of the State of Delaware, and (c) the

separate corporate existence of SoundView with all its rights, privileges,

immunities, powers and franchises shall continue unaffected by the Merger. The

corporation surviving the Merger is sometimes hereinafter referred to as the

"Surviving Corporation." At the election of Parent, with prior notice and

consultation with SoundView, any direct wholly owned subsidiary of Parent may be

substituted for Merger Sub as a constituent corporation in the Merger. In such

event, the parties agree to execute an appropriate amendment to this Agreement

in order to reflect the foregoing. If at any time after December 15, 1999,

Parent is unable to satisfy the condition set forth in Section 9.1(i), Parent

shall be entitled to restructure the Merger so that at the Effective Time,

SoundView shall be merged with and into Merger Sub and the separate corporate

existence of SoundView shall thereupon cease, Merger Sub shall be the successor

or surviving corporation in the Merger and shall continue to be governed by the

laws of the State of Delaware, and the separate corporate existence of Merger

Sub with all its rights, privileges, immunities, powers and franchises shall

continue unaffected by the Merger, except that the name of Merger Sub shall be

changed to SoundView Technology Group, Inc.; provided, however, that no such

election shall be effective if such restructuring would be materially adverse to

the stockholders of SoundView or if within 5 business days after the date such

election is communicated in writing to SoundView, Parent shall have received an

opinion of Morrison & Foerster LLP or other counsel reasonably acceptable to

Parent addressed to Parent to the effect set forth in Section 9.1(i) and such

Section 9.1(i) shall thereafter be amended so as to replace references to

"Skadden Arps Slate Meagher & Flom LLP" with "Morrison & Foerster LLP" or such

other counsel in all places where it appears therein. In the event the foregoing

election is effective, the parties hereto agree to execute an appropriate

amendment to this Agreement in order to reflect the foregoing. If at any time

after December 15, 1999, SoundView is unable to satisfy the condition set forth

in Section 9.2(h), SoundView shall be entitled to

I-1

restructure the Merger so that at the Effective Time, SoundView shall be merged

with and into Merger Sub and the separate corporate existence of SoundView shall

thereupon cease, Merger Sub shall be the successor or surviving corporation in

the Merger and shall continue to be governed by the laws of the State of

Delaware, and the separate corporate existence of Merger Sub with all its

rights, privileges, immunities, powers and franchises shall continue unaffected

by the Merger, except that the name of Merger Sub shall be changed to "SoundView

Technology Group, Inc."; provided, however, that no such election shall be

effective if such restructuring would be materially adverse to the business,

operations or financial condition of SoundView or if within 5 business days

after the date such election is communicated in writing to Parent, SoundView

shall have received, an opinion of Skadden Arps Slate Meagher & Flom LLP or

other counsel reasonably acceptable to SoundView addressed to SoundView to the

effect set forth in Section 9.2(h) and such Section 9.2(h) shall thereafter be

amended so as to replace references to "Morrison & Foerster LLP" with "Skadden

Arps Slate Meagher & Flom LLP" or such other counsel in all places where it

appears therein. In the event the foregoing election is effective, the parties

hereto agree to execute an appropriate amendment to this Agreement in order to

reflect the foregoing.

1.2 EFFECTIVE TIME. Subject to the terms and conditions of this Agreement,

as soon as practicable after the satisfaction of the conditions set forth in

Article IX, Parent, Merger Sub and SoundView will cause an appropriate

Certificate of Merger (the "Certificate of Merger") to be executed and filed on

the date of the Closing (as hereinafter defined in Section 1.4) (or on such

other date as Parent and SoundView may agree) with the Secretary of State of the

State of Delaware in the manner provided in the DGCL. The Merger shall become

effective on the close of business on the date on which the Certificate of

Merger has been duly filed with the Secretary of State of the State of Delaware

or such other time as is agreed upon by the parties and specified in the

Certificate of Merger, and such time is hereinafter referred to as the

"Effective Time."

1.3 EFFECTS OF THE MERGER. The Merger shall have the effects set forth in

Delaware law. Without limiting the generality of the foregoing, at the Effective

Time, all the properties, rights, privileges, powers and franchises of SoundView

and Merger Sub shall vest in the Surviving Corporation, and all debts,

liabilities and duties of SoundView and Merger Sub shall become the debts,

liabilities and duties of the Surviving Corporation.

1.4 CLOSING. The closing of the Merger (the "Closing") shall take place

(a) at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, 919 Third

Avenue, New York, New York 10022, at 10:00 a.m. on the first business day

following the later of (i) the date on which the last of the conditions set

forth in Article IX hereof shall be fulfilled or waived in accordance with this

Agreement and (ii) January 7, 2000 or (b) at such other place, time and date as

Parent and SoundView may agree.

ARTICLE II

CERTIFICATE OF INCORPORATION AND BYLAWS

OF THE SURVIVING CORPORATION

2.1 CERTIFICATE OF INCORPORATION. At the Effective Time and in accordance

with the DGCL, the Restated Certificate of Incorporation of Merger Sub shall be

the Certificate of Incorporation of the Surviving Corporation except that the

name of the corporation shall be "SoundView Technology Group, Inc., until

thereafter amended in accordance with applicable law.

2.2 THE BYLAWS. At the Effective Time and without any further action on

the part of SoundView, Merger Sub or the Surviving Corporation, the Bylaws of

Merger Sub shall be the Bylaws of the Surviving Corporation.

I-2

ARTICLE III

DIRECTORS AND OFFICERS

OF THE SURVIVING CORPORATION

3.1 DIRECTORS. Ronald Readmond, Mark Loehr and Russell Crabs shall, from

and after the Effective Time, be the directors of the Surviving Corporation

until their successors have been duly elected or appointed and qualified.

3.2 OFFICERS. The officers of SoundView at the Effective Time shall, from

and after the Effective Time, be the officers of the Surviving Corporation until

their successors have been duly elected or appointed and qualified.

ARTICLE IV

MERGER CONSIDERATION; CONVERSION OR CANCELLATION OF SHARES IN THE MERGER

4.1 SHARE CONSIDERATION FOR THE MERGER; CONVERSION OR CANCELLATION OF SHARES

IN THE MERGER. The manner of converting or canceling shares of SoundView and

Merger Sub in the Merger shall be as follows:

(a) NON-ELECTING SHARES. At the Effective Time, each share of common

stock, par value $0.01 per share, of SoundView ("SoundView Common Stock") issued

and outstanding immediately prior to the Effective Time (such shares of

SoundView Common Stock being referred to hereinafter as the "Shares"), other

than (i) Shares as to which an election to receive cash has been properly made

pursuant to Article V hereof and not revoked, relinquished or lost (such Shares

being referred to hereinafter as "Electing Shares"), (ii) Shares as to which

dissenters' rights have been properly asserted and not withdrawn or lost under

Section 262 of the DGCL (such Shares being referred to hereinafter as

"Dissenting Shares") and (iii) Shares owned by Parent, Merger Sub or any direct

or indirect wholly owned subsidiary of Parent (collectively, "Parent Companies")

or SoundView, shall, by virtue of the Merger and without any action on the part

of the holder thereof, cease to be outstanding, be canceled and retired and be

converted into (x) that number of shares of common stock, par value $.01 per

share, of Parent ("Parent Common Stock") together with the associated rights

(the "Parent Rights") to purchase shares of Series A Junior Participating

Preferred Stock of Parent issued pursuant to the Rights Agreement dated June 7,

1999 between Parent and American Stock Transfer Company as Rights Agent (the

"Parent Rights Agreement") (the shares of Parent Common Stock together with the

Parent Rights being referred to herein as the "Parent Shares"), rounded to the

nearest thousandth of a share (with "5" being rounded downward), equal to the

quotient (the "Exchange Ratio") derived by dividing $81.2387 by the average of

the mean between the closing bid and ask prices (as reported for the primary

trading session (currently ending at 4:00 p.m.) on the Nasdaq National Market

("NNM")) of Parent Shares during the period (the "Exchange Rate Period")

comprised of the seven consecutive trading days ending on the fifth trading day

prior to such date not more than twenty and not less than ten days prior to the

date then scheduled for the Closing as is determined in advance by resolution of

Parent's Board of Directors (the "Average Stock Price"); PROVIDED, HOWEVER, that

the Exchange Ratio shall not be greater than 5.220 or less than 4.376 and (y)

cash in lieu of fractional Parent Shares as contemplated by Section 4.3. Shares

other than Electing Shares, Dissenting Shares and Parent Companies Shares are

sometimes referred to herein as "Non-electing Shares").

(b) ELECTING SHARES. At the Effective Time, on the terms and subject to

the conditions hereinafter set forth in Article IX, each Electing Share shall,

by virtue of the Merger and the election made with respect thereto, cease to be

outstanding, be canceled and retired and be converted into cash in an amount

equal to $81.2387 without interest thereon at any time (the "Cash Value per

Share").

(c) DISSENTING SHARES. Dissenting Shares shall not be converted into or

represent a right to receive the consideration set forth in Section 4.1 but the

holder of such Shares shall be entitled only to such rights as are provided by

the DGCL, and Parent shall be solely responsible for the payment of any amounts

due

I-3

in respect of such Dissenting Shares pursuant to the DGCL. If any holder of

Shares which theretofore were Dissenting Shares effectively withdraws or loses

(through failure to perfect or otherwise) such holder's right to appraisal under

Section 262 of the DGCL, then as of the occurrence of such withdrawal or loss

such holder's Share shall automatically be restored to the status of

Non-electing Shares.

(d) PARENT HOLDINGS. At the Effective Time, each Share issued and

outstanding and owned by Parent or any Parent Subsidiary immediately prior to

the Effective Time shall, by virtue of the Merger and without any action on the

part of the holder thereof, cease to be outstanding and be canceled and retired

without payment of any consideration therefor.

(e) MERGER SUB SHARES. At the Effective Time, each share of common stock

of Merger Sub issued and outstanding immediately prior to the Effective Time

shall, by virtue of the Merger and without any action on the part of Merger Sub

or the holder thereof, cease to be outstanding, be canceled and retired and be

converted into and become one fully paid and nonassessable share of common stock

of the Surviving Corporation.

(f) SOUNDVIEW STOCK OPTIONS. Except as set forth below, the terms and

provisions of the SoundView Stock Option Plan (as defined below) shall continue

in full force and effect and shall govern each option (or portion thereof, as

the case may be) outstanding immediately prior to the Effective Time under any

SoundView Stock Option Plan, whether vested, unvested, exercisable or

unexercisable (a "SoundView Stock Option"). At the Effective Time, each

SoundView Stock Option then outstanding shall be automatically converted,

without any further action, into an option to purchase Parent Shares. The number

of shares of SoundView Common Stock to be substituted for shall be equal to the

number of shares of Parent Common Stock together with the Parent Rights, rounded

down to the nearest whole number, which is equal to the number of shares of

SoundView Common Stock that were subject to such SoundView Stock Option

immediately prior to the Effective Time multiplied by the Exchange Ratio, at an

exercise price equal to the per share exercise price of each such SoundView

Stock Option immediately prior to the Effective Time divided by the Exchange

Ratio. Notwithstanding any vesting schedule set forth in or pursuant to any

SoundView Stock Option Plan or SoundView Stock Option, any SoundView Stock

Options of any SoundView employee outstanding and not yet vested at the

Effective Time shall, except to the extent forfeited pursuant to the terms of

the applicable SoundView Stock Option Plan or SoundView Stock Option, vest on

each March 31, June 30, September 30 and December 31 commencing March 31, 2000

and ending December 31, 2002 at the rate as nearly as practical equal to

one-twelfth of such unvested SoundView Stock Options of such SoundView employee.

Such options for Parent Common Stock shall for purposes of this Agreement be

called "Parent Common Stock Options." All of the Parent Common Stock Options

held by an employee shall vest immediately upon the occurrence of (i) the

termination by Parent of such employee's employment by Parent and its

Subsidiaries without Cause; (ii) the acquisition or creation by Parent of an

additional business as a result of which SoundView's institutional brokerage

business, as developed and expanded within Parent, is no longer Parent's primary

institutional brokerage business; (iii) the acquisition or creation by Parent of

an additional business as a result of which SoundView's investment banking

technology group or research technology group, as developed and expanded within

Parent, is no longer Parent's primary investment banking technology group or

research technology group, respectively; or (iv) the completion by Parent of a

merger or consolidation or the completion by another Person of a tender offer or

exchange offer for, or purchase of, shares of capital stock of Parent as a

result of which both (A) the Persons who were the holders of all of the shares

of common stock of Parent immediately prior to completion of such merger,

consolidation, tender offer, purchase or exchange offer hold shares of capital

stock of Parent or a company of which Parent is then a Subsidiary representing

less than 50% of the voting power of all classes of capital stock of Parent or

such other company, as the case may be, and (B) the individuals constituting the

Board of Directors of Parent immediately prior to completion of such merger,

consolidation, tender offer, purchase or exchange offer constitute less than 50%

of the Board of Directors of Parent or such other company, as the case may be.

Notwithstanding any other provisions of the SoundView Stock Options and

SoundView Stock Option

I-4

Plans to the contrary, with respect to any Parent Common Stock Option that was

vested prior to the Effective Time (x) upon exercise thereof after the Effective

Time and prior to the first anniversary of the Effective Time, Parent shall

issue to the Person exercising such option three certificates for the Parent

Shares issuable upon such exercise, each of which shall be for a number of

Parent Shares as nearly equal as practicable to one-third of such Parent Shares,

(A) the first of which shall contain no restrictive legend other than as may be

required by the Securities Act, (B) the second of which shall be subject to a

restrictive legend substantially in the form set forth in Exhibit A hereto

providing for a one-year restriction from the Effective Time on transfer and (C)

the third of which shall be subject to a restrictive legend substantially in the

form set forth in Exhibit B hereto providing for a two-year restriction from the

Effective Time on transfer or (y) upon exercise thereof on or after the first

anniversary of the Effective Time and prior to the second anniversary of the

Effective Time, Parent shall issue to the Person exercising such option two

certificates for the Parent Shares issuable upon such exercise, (A) one of which

shall be for a number of Parent Shares as nearly equal as practicable to

two-thirds of such Parent Shares and which shall contain no restrictive legend

other than as may be required by the Securities Act and (B) the other of which

shall be for the balance of such Parent Shares and which shall contain a

restrictive legend substantially in the form set forth in Exhibit A hereto

providing for a restriction on transfer through the second anniversary of the

Effective Time. Parent and SoundView shall take such actions as may be necessary

to amend their stock option plans and stock option agreements to reflect the

foregoing agreements for all periods on and after the Effective Time. For

purposes of this Agreement, the term "SoundView Stock Option Plan" means

SoundView's 1995 Stock Option Plan (the "SoundView Stock Option Plan"). Parent

shall use all reasonable efforts to cause to be reserved for issuance the number

of Parent Shares issuable upon exercise of the Parent Common Stock Options

referred to in this Section 4.1(f) and, as soon as reasonably practicable after

the Effective Time, Parent shall use all reasonable efforts to cause to be filed

a registration statement on Form S-8 (or any successor or other appropriate

form) under the Securities Act, or an amendment to an existing registration

statement of Form S-8, to register the Parent Shares issuable upon exercise of

the Parent Common Stock Options.

(g) CHANGES IN CAPITALIZATION. If between the date of this Agreement and

the Effective Time, the outstanding Parent Shares shall be changed into a

different number of shares or a different class by reason of any

reclassification, reorganization, consolidation, merger, recapitalization,

split-up, combination or exchange of shares or if a stock dividend thereon shall

be declared with a record date within said period, the number of Parent Shares

to be issued in the Merger shall be appropriately adjusted. Nothing in this

Section 4.1(g) shall be deemed to constitute a waiver by SoundView of the

provisions of Section 8.2 hereof.

4.2 EXCHANGE OF SHARES IN THE MERGER. The manner of making exchange of

Shares in the Merger shall be as follows:

(a) At the Effective Time, Parent shall make available to American Stock

Transfer Company or such other exchange agent as may be selected by Parent (the

"Exchange Agent") for the benefit of the holders of Shares, a sufficient number

of certificates representing the aggregate number of Parent Shares issuable

pursuant to Section 4.1 (the certificates representing such aggregate number of

Parent Shares being hereinafter referred to as the "Stock Merger Exchange

Fund"). The Exchange Agent shall, pursuant to irrevocable written instructions,

deliver the Parent Shares contemplated to be issued pursuant to Section 4.1 out

of the Stock Merger Exchange Fund. The Stock Merger Exchange Fund shall not be

used for any other purpose.

(b) Promptly after the Effective Time, the Exchange Agent shall mail to each

holder of record of a certificate or certificates which immediately prior to the

Effective Time represented outstanding Shares (the "Certificates") (i) a form of

letter of transmittal (which shall specify that delivery shall be effected, and

risk of loss and title to the Certificates shall pass, only upon proper delivery

of the Certificates to the Exchange Agent) and (ii) instructions for use in

effecting the surrender of the Certificates for payment therefor. Upon surrender

of Certificates for cancellation to the Exchange Agent, together with such

letter of transmittal duly executed and any other required documents, the holder

of such Certificates shall be

I-5

entitled to receive for the Shares represented by such Certificates the

consideration applicable to such Shares and the Certificates so surrendered

shall forthwith be canceled. Upon such surrender, the Exchange Agent shall issue

to each holder three certificates for the Parent Shares included in such

consideration, (A) the first of which shall be for a number of Parent Shares as

nearly equal as practicable to 34.84% of such Parent Shares and shall contain no

restrictive legend other than as may be required by the Securities Act, (B) the

second of which shall be for a number of Parent Shares as nearly equal as

practicable to 32.58% of such Parent Shares and shall be subject to a

restrictive legend substantially in the form set forth in Exhibit A hereto

providing for a one-year restriction on transfer and (C) the third of which

shall be for a number of Parent Shares as nearly equal as practicable to 32.58%

of such Parent Shares and shall be subject to a restrictive legend substantially

in the form set forth in Exhibit B hereto providing for a two-year restriction

on transfer. Until so surrendered, such Certificates shall represent solely the

right to receive the consideration applicable to such Share. No dividends or

other distributions that are declared after the Effective Time on Parent Shares

and payable to the holders of record thereof after the Effective Time will be

paid to Persons entitled by reason of the Merger to receive Parent Shares until

Certificates representing the right to receive such Parent Shares are

surrendered in appropriate form. Upon such surrender, there shall be paid to the

Person in whose name the Parent Shares are issued any dividends or other

distributions having a record date after the Effective Time and a payment date

prior to the time of such surrender. After such surrender there shall be paid to

the Person in whose name the Parent Shares are issued any dividends or other

distributions on such Parent Shares which shall have a record date after the

Effective Time and prior to such surrender and a payment date after such

surrender. In no event shall the Persons entitled to receive such dividends or

other distributions be entitled to receive interest on such dividends or other

distributions. If any certificate representing Parent Shares is to be issued or

cash payment in lieu of fractional share interests is to be made to a Person

other than the one in whose name the Certificate surrendered in exchange

therefor is registered, it shall be a condition of such exchange that the

Certificate so surrendered shall be properly endorsed and otherwise in proper

form for transfer and that the Person requesting such exchange shall pay to the

Exchange Agent any applicable transfer or other similar taxes, or shall

establish to the satisfaction of the Exchange Agent that any such tax has been

paid or is not applicable. Notwithstanding the foregoing, neither the Exchange

Agent nor any party hereto shall be liable to a holder of Shares for any Parent

Shares or dividends thereon, or, in accordance with Section 4.3, cash in lieu of

fractional Parent Shares, delivered to a public official when and if required by

applicable escheat law. The Exchange Agent shall not be entitled to vote or

exercise any rights of ownership with respect to the Parent Shares held by it

from time to time hereunder, except that it shall receive and hold all dividends

or other distributions paid or distributed with respect to such Parent Shares

for the account of the Persons entitled thereto.

(c) Any portion of the Stock Merger Exchange Fund and the Fractional

Securities Fund (as hereinafter defined in Section 4.3) which remains unclaimed

by the former stockholders of SoundView for six months after the Effective Time

shall be delivered to Parent, upon demand of Parent, and any former stockholders

of SoundView shall thereafter look only to Parent for payment of their claim for

the consideration for the Shares, including any cash in lieu of fractional

Parent Shares.

4.3 FRACTIONAL SHARES. No fractional Parent Shares shall be issued in the

Merger. In lieu of any such fractional securities, each holder of Shares who

would otherwise be entitled to a fraction of a Parent Share upon surrender of

Certificates for exchange pursuant to this Article IV will be paid an amount in

cash (without interest) determined by multiplying (i) the Average Stock Price

(but not more than $18.5625 or less than $15.5625) by (ii) the fraction of a

Parent Share to which such holder would otherwise be entitled. Parent shall make

available to the Exchange Agent sufficient funds (herein referred to as the

"Fractional Securities Fund") as and when necessary to enable the Exchange Agent

to make the cash payments contemplated hereby. In no event shall interest be

paid or accrued on any such cash payments.

I-6

ARTICLE V

ELECTION PROCEDURE; OTHER AGREEMENTS

5.1 LIMITATION ON ELECTION. No holder of Shares may elect to receive cash

with respect to a number of Shares in excess of the product of (a) the number of

Shares of which such holder is the holder of record at the Effective Time times

(b) a fraction the numerator of which is the excess of (i) the lesser of the

shareholders' equity of SoundView as of December 31, 1999 or $30 million, in

each case less any distributions in respect of the Shares declared or made after

December 31, 1999 and not reflected in such shareholders' equity over (ii) the

product of the sum of (A) the number of Dissenting Shares that are not Electing

Shares times the Cash Value per Share plus (B) the number of Old Agreement

Securities that are not Dissenting Shares or Electing Shares and the denominator

of which is the product of the number of Shares issued and outstanding plus the

number of Shares subject to unexercised SoundView Stock Options immediately

prior to the Effective Time times the Cash Value per Share.

5.2 FORM OF ELECTION. A form of election (the "Form of Election") shall be

mailed to holders of Shares of record as of ten days prior to the then-scheduled

Effective Date. Any such holder's election to receive cash pursuant to this

Article V shall have been properly made only if the Exchange Agent shall have

received at its designated office, by 5:00 p.m. New York time on the business

day preceding the fifth day prior to the Effective Date, a Form of Election

properly completed and accompanied by certificates for the shares to which such

Form of Election relates (or an appropriate guarantee of delivery guaranteeing

that the certificates for such shares will be delivered prior to the Effective

Time), as set forth in such Form of Election, duly endorsed in blank or

otherwise in form acceptable for transfer on the books of SoundView.

5.3 REVOCATION OF ELECTION. Any Form of Election may be revoked by the

person submitting such Form to the Exchange Agent only by written notice

received by the Exchange Agent prior to 5:00 p.m. New York time on the business

day before the third day prior to the Effective Date. At such time any cash

election by a holder of Dissenting Shares shall be deemed revoked. If a Form of

Election is so revoked, the certificate or certificates (or guarantee of

delivery, as appropriate) for the Shares to which such Form of Election relates

shall be promptly returned to the person submitting the same to the Exchange

Agent.

5.4 DECISION OF EXCHANGE AGENT. The Exchange Agent shall have discretion

to determine (a) whether or not elections to receive cash have been properly

made or revoked pursuant to this Article V with respect to any Shares and (b)

when elections and revocations were received by it. If the Exchange Agent

determines that any election to receive cash was not properly made with respect

to any Shares, such Shares shall be treated by the Exchange Agent as Shares

which were not Electing Shares at the Effective Time of the Merger, and such

Shares shall be exchanged in the Merger for Parent Shares pursuant to Section

4.1(a) hereof. The Exchange Agent may, with the mutual agreement of Parent and

SoundView, make such equitable changes in the procedures set forth in this

Article V for the implementation of the cash election provided for in this

Article V as shall be necessary or desirable to fully effect such elections.

5.5 CERTAIN EMPLOYEE ACTIONS AND AGREEMENTS. On the date hereof, each of

the holders of Shares named on Schedule 5.5 (a) has executed and delivered to

SoundView and Parent a written consent with respect to all of his or her Shares

approving the Merger and this Agreement in the form set forth as Exhibit C

hereto; (b) has executed and delivered to Parent a Voting Agreement (including

an irrevocable proxy) in the form set forth as Exhibit D hereto; and (c) has

executed and delivered to SoundView (and SoundView has executed and delivered to

Parent) an agreement implementing the provisions of Section 5.8 (each, a "Put

Termination Agreement") in the form set forth as Exhibit E. SoundView hereby

consents and agrees to the giving of each such consent and the entering into of

each such Voting Agreement and granting of each such irrevocable proxy.

I-7

5.6 EMPLOYMENT AGREEMENTS. On or about the date hereof, each of the

individuals named on Schedule 5.6 has entered into an Employment Agreement with

Parent, the term of which shall commence at the Effective Time.

5.7 RETENTION POOL. At the Effective Time, Parent shall issue to the

employees of SoundView and the SoundView Subsidiaries named on a Schedule (the

"Retention Schedule") to be agreed upon by Parent and SoundView in writing prior

to the Effective Time an aggregate number of Parent Shares (the "Retention

Shares") equal to the product of (a) the quotient resulting from dividing $25

million by $81.2387 times (b) the Exchange Ratio. The Retention Shares shall be

allocated among the employees listed on the Retention Schedule in the amounts

set forth in the Retention Schedule for each such employee. Subject to

applicable income tax withholding requirements, 50% of the Retention Shares

allocated to an employee who is continuously employed by Parent and its

Subsidiaries (including SoundView and its Subsidiaries) from the Effective Time

through the end of the thirtieth month after and including the month in which

the Effective Time occurs shall, on the last day of such thirtieth month, be

vested in and released to such employee, and 50% of the Retention Shares

allocated to an employee who is continuously employed by Parent and its

Subsidiaries (including SoundView and its Subsidiaries) from the Effective Time

through the end of the forty-second month after and including the month in which

the Effective Time occurs shall, on the last day of such forty-second month, be

vested in and released to such employee. If the employment by Parent or any of

its Subsidiaries of an employee to whom any Retention Shares have been allocated

is terminated for any reason other than by Parent without Cause, all of the

Retention Shares allocated to such employee shall be forfeited by such employee

and shall become treasury stock. All of the Retention Shares allocated to an

employee shall vest in and be released to such employee immediately upon the

occurrence of any of Section 4.1(f)(i)-(iv) hereof.

5.8 SOUNDVIEW STOCK AND OPTION ARRANGEMENTS. SoundView will use its

reasonable best efforts to complete each of the following actions at the

earliest practicable date: (a) to amend, effective immediately prior to the

Effective Time, the bylaws of SoundView to delete Sections 7 and 8 of

Article VI thereof; (b) to amend, effective immediately prior to the Effective

Time, the SoundView Stock Option Plan to delete Article XVI thereof and to

implement the matters set forth in Section 4.1(f) hereof; (c) to amend,

effective immediately prior to the Effective Time, each SoundView Stock Option

outstanding at such time and each associated stock appreciation right to

implement the matters set forth in Section 4.1(f) hereof and to eliminate the

right of the holder of such option or right to invoke the rights, under

Article XVI of the SoundView Stock Option Plan or any similar rights under such

holder's SoundView Stock Option, of a holder of a SoundView Stock Option or

Parent Common Stock Option or associated stock appreciation right or of any

Shares or Parent Shares acquired upon exercise of such option; and (d) to

terminate, effective immediately prior to the Effective Time, each Stock

Purchase and Transfer Restriction Agreement with each stockholder of SoundView

who is a party to such an agreement. Any Shares and SoundView Stock Options as

to which the foregoing deletions, amendments and terminations are not effective

immediately prior to the Effective Time are hereinafter referred to as the "Old

Agreement Securities."

ARTICLE VI

REPRESENTATIONS AND

WARRANTIES OF SOUNDVIEW

Except as set forth in the Disclosure Schedule prepared and signed by

SoundView and delivered to Parent prior to the execution hereof (provided that

the listing of an item in one section of the Disclosure Schedule shall be deemed

to be a listing in another section of such Disclosure Schedule and apply to any

other representation and warranty of such party in this Agreement but only to

the extent that it is reasonably apparent from a reading of such disclosure

item), SoundView represents and warrants to Parent and Merger Sub that all of

the statements contained in this Article VI are true and correct as of the date

of this Agreement (or, if made as of a specified date, as of such date).

I-8

6.1 ORGANIZATION; QUALIFICATION. SoundView (i) is a corporation duly

organized, validly existing and in good standing under the laws of the State of

Delaware; (ii) has full corporate power and authority to carry on its business

as it is now being conducted and to own, lease or operate the properties and

assets it now owns, leases or operates; and (iii) is duly qualified or licensed

to do business as a foreign corporation in good standing in every jurisdiction

in which ownership of property or the conduct of its business requires such

licensing or qualification or, if SoundView is not so licensed or qualified in

any such jurisdiction, it can become so qualified in such jurisdiction without

any material adverse effect (including assessment of state taxes for prior

years) upon its business and properties. SoundView has heretofore delivered to

Parent complete and correct copies of the certificate of incorporation and

by-laws of SoundView, as presently in effect.

6.2 SUBSIDIARIES AND AFFILIATES. The Disclosure Schedule sets forth the

name, jurisdiction of incorporation and authorized and outstanding capital stock

of each SoundView Subsidiary and the jurisdictions in which each SoundView

Subsidiary is licensed or qualified to do business. SoundView does not own,

directly or indirectly, any capital stock or other equity securities of any

corporation or have any direct or indirect equity or ownership interest in any

business other than publicly traded securities constituting less than five

percent of the outstanding equity of the issuing entity. All the outstanding

capital stock of each SoundView Subsidiary is owned directly or indirectly by

SoundView free and clear of all liens, options or encumbrances of any kind and

all material claims or charges of any kind, and is validly issued, fully paid

and nonassessable, and there are no outstanding options, rights or agreements of

any kind relating to the issuance, sale or transfer of any capital stock or

other equity securities of any such SoundView Subsidiary to any person except

SoundView or another SoundView Subsidiary. Each SoundView Subsidiary (i) is a

corporation duly organized, validly existing and in good standing under the laws

of its state of incorporation; (ii) has full corporate power and authority to

carry on its business as it is now being conducted and to own, lease or operate

the properties and assets it now owns, leases or operates; and (iii) is duly

qualified or licensed to do business as a foreign corporation in good standing

in every jurisdiction in which ownership of property or the conduct of its

business requires such licensing or qualification or, if a SoundView Subsidiary

is not so licensed or qualified in any such jurisdiction, it can become so

licensed or qualified in such jurisdiction without any material adverse effect

(including assessment of state taxes for prior years) upon its business and

properties. SoundView has heretofore delivered to Parent complete and correct

copies of the certificate of incorporation and by-laws of each SoundView

Subsidiary, as presently in effect.

6.3 CAPITALIZATION. (a) The authorized capital stock of SoundView consists

of 6,000,000 Shares. As of the date hereof, (i) 2,515,562 Shares are issued and

outstanding, (ii) no Shares are issued and held in the treasury of SoundView and

(iii) 1,577,962 Shares are reserved for issuance upon exercise of SoundView

Stock Options. All the outstanding shares of SoundView's capital stock are, and

all Shares which may be issued pursuant to the exercise of outstanding SoundView

Stock Options will be, when issued in accordance with the respective terms

thereof, duly authorized, validly issued, fully paid and nonassessable. There is

no Voting Debt of SoundView or any SoundView Subsidiary issued and outstanding.

Except as set forth above and except for the Transactions, as of the date

hereof, (i) there are no shares of capital stock of SoundView authorized, issued

or outstanding; (ii) there are no existing options, warrants, calls, pre-

emptive rights, subscriptions or other rights, agreements, arrangements or

commitments of any character, relating to the issued or unissued capital stock

of SoundView or any SoundView Subsidiary, obligating SoundView or any SoundView

Subsidiary to issue, transfer or sell or cause to be issued, transferred or sold

any shares of capital stock or Voting Debt of, or other equity interest in,

SoundView or any SoundView Subsidiary or securities convertible into or

exchangeable for such shares or equity interests, or obligating SoundView or any

SoundView Subsidiary to grant, extend or enter into any such option, warrant,

call, subscription or other right, agreement, arrangement or commitment and

(iii) there are no outstanding contractual obligations of SoundView or any

SoundView Subsidiary to repurchase, redeem or otherwise acquire any Shares or

any of the capital stock of SoundView or any SoundView Subsidiary or to provide

funds to make any investment (in the form of a loan, capital contribution or

otherwise) in any SoundView Subsidiary or any other entity. The Disclosure

Schedule sets forth a complete schedule of each SoundView

I-9

Stock Option outstanding as of the date hereof, including the name of the

optionee, number of shares, exercise price, date of grant and vesting schedule.

(b) There are no voting trusts or other agreements or understandings to

which SoundView or any SoundView Subsidiary is a party with respect to the

voting of the capital stock of SoundView or any of the SoundView Subsidiaries.

(c) No Indebtedness of SoundView or any SoundView Subsidiary contains any

restriction upon (i) the prepayment of any Indebtedness of SoundView or any

SoundView Subsidiary, (ii) the incurrence of Indebtedness by SoundView or any

SoundView Subsidiary or (iii) the ability of SoundView or any SoundView

Subsidiary to grant any lien on the properties or assets of SoundView or any

SoundView Subsidiary.

6.4 AUTHORIZATION; VALIDITY OF AGREEMENT; SOUNDVIEW ACTION. SoundView has

full corporate power and authority to execute and deliver this Agreement, and to

consummate the Transactions. The execution, delivery and performance by

SoundView of this Agreement and the consummation by it of the Transactions have

been duly authorized by the SoundView Board of Directors and by written consent

of holders of SoundView Common Stock representing a majority of the Shares and

no other corporate action on the part of SoundView is necessary to authorize the

execution and delivery by SoundView of this Agreement or the consummation by it

of the Transactions. This Agreement has been duly executed and delivered by

SoundView and, assuming due and valid authorization, execution and delivery

thereof by Parent and Merger Sub, this Agreement is a valid and binding

obligation of SoundView enforceable against SoundView in accordance with its

terms.

6.5 BOARD APPROVALS REGARDING TRANSACTIONS. SoundView's Board of

Directors, at a meeting duly called and held, has (i) unanimously determined

that each of this Agreement and the Merger are fair to and in the best interests

of the shareholders of SoundView and (ii) approved the Transactions, and none of

the aforesaid actions by SoundView's Board of Directors has been amended,

rescinded or modified. The action taken by SoundView's Board of Directors

constitutes approval of the Merger and the other Transactions by SoundView's

Board of Directors under the provisions of Section 203 of the DGCL such that

Section 203 of the DGCL does not apply to this Agreement or the other

Transactions. No other state takeover statute is applicable to the Merger or the

other Transactions.

6.6 VOTE REQUIRED. The affirmative written consent of the holders of a

majority of the outstanding Shares, which is the only vote or consent of the

holders of any class or series of SoundView's capital stock necessary to approve

the Merger, has been obtained and copies of such consents have been provided to

Parent. No action of the holders of any class or series of SoundView's capital

stock, acting in their capacity as stockholders, is necessary to approve any of

the Transactions other than the Merger.

6.7 CONSENTS AND APPROVALS; NO VIOLATIONS. Except for the filings,

permits, authorizations, consents and approvals as may be required under, and

other applicable requirements of, the Advisers Act, the Exchange Act, the

Securities Act, the rules and regulations of the NASD, the HSR Act, state

securities or blue sky laws, and the DGCL, none of the execution, delivery or

performance of this Agreement by SoundView, the consummation by SoundView of the

Transactions or compliance by SoundView with any of the provisions hereof will

(i) conflict with or result in any breach of any provision of the certificate of

incorporation, the by-laws or similar organizational documents of SoundView or

any SoundView Subsidiary, (ii) require any filing with, or permit,

authorization, consent or approval of, any Governmental Entity, (iii) result in

a violation or breach of, or constitute (with or without due notice or the

passage of time or both) a default (or give rise to any right of termination,

amendment, cancellation or acceleration) under, any of the terms, conditions or

provisions of any SoundView Agreement, or (iv) violate any order, writ,

injunction, decree, statute, rule or regulation applicable to SoundView, any to

which SoundView or any SoundView Subsidiary is a party or by which any of the

assets of any of them is bound, any SoundView Subsidiary or any of their

properties or assets, excluding from the foregoing clauses (ii), (iii) and (iv)

such violations, breaches or defaults which would not, individually or in the

aggregate, have a material adverse

I-10

effect on SoundView and the SoundView Subsidiaries, taken as a whole. There are

no third party consents or approvals required to be obtained under any SoundView

Agreement prior to the consummation of the Transactions, except for such

consents and approvals the failure of which to be obtained would not,

individually or in the aggregate, have a material adverse effect on SoundView

and the SoundView Subsidiaries, taken as a whole.

6.8 GOVERNMENTAL DOCUMENTS AND FINANCIAL STATEMENTS. SoundView and each

SoundView Subsidiary has filed with the appropriate Governmental Entity, and has

heretofore made available to Parent, true and complete copies of, the

Governmental Documents of SoundView and each SoundView Subsidiary. As of their

respective dates or, if amended, as of the date of the last such amendment filed

prior to the date hereof, the Governmental Documents of SoundView and each

SoundView Subsidiary, including, without limitation, any financial statements or

schedules included therein (a) did not contain any untrue statement of a

material fact or omit to state a material fact required to be stated therein or

necessary in order to make the statements made therein, in the light of the

circumstances under which they were made, not misleading and (b) complied in all

material respects with the applicable requirements of Applicable Law. SoundView

has previously delivered to Parent copies of the audited balance sheets of

SoundView and the SoundView Subsidiaries as of December 31 for the fiscal years

1996, 1997 and 1998 and the related audited statements of income, changes in

shareholders' equity and cash flows for the fiscal years 1996, 1997 and 1998,

inclusive, together with the related notes thereto, accompanied by the audit

report of Ernst & Young LLP, independent public accountants with respect

thereto, and the unaudited balance sheets of each of them as of June 30, 1999

and the related unaudited statements of income, changes in shareholders' equity

and cash flows for the period then ended (collectively, the balance sheets and

the statements above being referred to as the "SoundView Financial Statements"

and the June 30, 1999 balance sheet as the "SoundView Balance Sheet"). The

audited balance sheets previously delivered to Parent (including the related

notes) fairly present in accordance with GAAP the financial position of

SoundView and the SoundView Subsidiaries as of the dates thereof, and the other

SoundView Financial Statements fairly present in accordance with GAAP (subject,

in the case of the unaudited statements, to recurring adjustments normal in

nature and amount and the addition of footnotes) the results of the operations,

cash flows and changes in shareholders' equity of SoundView and the SoundView

Subsidiaries for the respective fiscal periods therein set forth; and such

balance sheets and statements (including the related notes, where applicable)

have been prepared in accordance with GAAP consistently applied throughout the

periods involved except as noted therein.

6.9 COMPLIANCE WITH APPLICABLE LAW. (a) SoundView and each SoundView

Subsidiary is, if so required by the nature of its business or assets, duly

registered with the SEC as a broker-dealer or an investment adviser and the

Commodity Futures Trading Commission as a commodity pool operator or commodity

trading adviser.

(b) SoundView, each SoundView Subsidiary, each SoundView Pooled Product and

each employee of each of them holds, and has at all pertinent times held, all

material licenses, franchises, permits, qualifications and authorizations

(collectively, "SoundView Permits") necessary for the lawful ownership and use

of the respective properties and assets of SoundView, the SoundView Subsidiaries

and the SoundView Pooled Products and the conduct of their respective businesses

under and pursuant to every, and have complied with each, and are not in default

in any material respect under any, Applicable Law relating to any of them or any

of their respective assets, properties or operations, and SoundView does not

know of any violations of any of the above and has not received notice asserting

any such violation. To SoundView's knowledge, all such SoundView Permits are

valid and in good standing and are not subject to any proceeding for the

suspension, modification or revocation thereof.

(c) Except for normal examinations conducted by any Governmental Entity in

the regular course of the business of SoundView, the SoundView Subsidiaries and

the SoundView Pooled Products, no Governmental Entity has at any time initiated

or, to SoundView's knowledge, threatened any proceeding or investigation into

the business or operations of any of them or any of their officers, directors or

employees

I-11

or (other than SoundView Pooled Products) equityholders in their capacity as

such. There is no unresolved violation, criticism, or exception by any

Governmental Entity with respect to any examination of SoundView, the SoundView

Subsidiaries or the SoundView Pooled Products.

(d) SoundView and each of the SoundView Subsidiaries has at all times since

December 31, 1994 or its date of formation, whichever is later, rendered

investment advisory services to investment advisory clients, including SoundView

Pooled Products, with whom such entity is or was a party to an investment

advisory agreement or similar arrangement in material compliance with all

applicable requirements as to portfolio composition and portfolio management

including, but not limited to, the terms of such investment advisory agreements,

written instructions from such investment advisory clients, the organizational

documents of such investment advisory clients that are SoundView Pooled

Products, prospectuses or other offering materials, board of director or trustee

directives and Applicable Law.

(e) Each of SoundView, the SoundView Subsidiaries and the SoundView Pooled

Products has timely filed all reports, registration statements and other

documents, together with any amendments required to be made with respect

thereto, that it was required to file with any Governmental Entity, in a form

which was accurate in all material respects and has paid all fees and

assessments due and payable in connection therewith.

(f) As of their respective dates, the Governmental Documents of SoundView,

the SoundView Subsidiaries and the SoundView Pooled Products complied in all

material respects with the requirements of the Securities Laws applicable to

such Governmental Documents. SoundView has previously delivered or made

available to the Parent a complete copy of each Governmental Document filed by

any of the foregoing entities or any of their employees since December 31, 1994

and prior to the date hereof and will deliver or by notice make available to the

Parent at the same time as the filing thereof a complete copy of each

Governmental Document filed after the date hereof and prior to the Closing Date

by or on behalf of any of them.

(g) Since inception, each SoundView Pooled Product has been excluded from

the definition of an investment company under the Investment Company Act by

virtue of Section 3(c)(1) or Section 3(c)(7) thereof.

6.10 BOOKS AND RECORDS. Each of SoundView, the SoundView Subsidiaries and

SoundView Pooled Products has at all times since formation maintained Records

which accurately reflect its transactions in reasonable detail, and have at all

times maintained accounting controls, policies and procedures reasonably

designed to provide that such transactions are executed in accordance with its

management's general or specific authorization, as applicable, and recorded in a

manner which permits the preparation of financial statements in accordance with

GAAP and applicable regulatory accounting requirements and other account and

financial data, and the documentation pertaining thereto is retained, protected

and duplicated in accordance with applicable regulatory requirements.

6.11 INELIGIBLE PERSONS. None of SoundView or any SoundView Subsidiary, or

any "associated person" (as defined in the Advisers Act or the Exchange Act) of

any thereof, is ineligible pursuant to Section 203 of the Advisers Act or

Section 15(b) of the Exchange Act to serve as a registered investment adviser or

broker-dealer or as an associated person of a registered investment adviser or

broker-dealer.

6.12 NO UNDISCLOSED LIABILITIES. Except for liabilities and obligations

(a) disclosed in the Financial Statements, (b) incurred in the ordinary course

of business and consistent with past practice since the Balance Sheet Date or

(c) incurred in accordance with the terms of this Agreement or with the prior

written consent of Parent, neither SoundView nor any SoundView Subsidiary has,

to the best of SoundView's knowledge, any liabilities or obligations of any

nature, whether or not accrued, contingent or otherwise, that have, or would be

reasonably likely to have, material adverse effect on SoundView and the

SoundView Subsidiaries, taken as a whole. The reserves reflected in the

Financial Statements are adequate, appropriate and reasonable and have been

calculated in a consistent manner.

I-12