Office of Inspector General

U.S. Small Business Administration

April 2010 Update

Business Loan Programs

Review of SBA’s Job Creation Data Under the

Recovery Act. On April 30, 2010, the OIG issued a

report on the reliability of job creation and retention

data reported by SBA under the American Recovery

and Reinvestment Act of 2009 (Recovery Act). While

SBA’s two major loan programs, known as the 7(a)

and 504 loan programs, are not subject to recipient

reporting requirements under the Recovery Act, SBA

has reported job creation and retention statistics in its

monthly Recovery Act Program Performance Report

on the Agency’s website.

The OIG reviewed of a sample of Recovery Act loans

and found that Certified Development Companies

reported job creation and retention statistics for the

504 program consistent with program guidance. For

the 7(a) program, however, SBA did not define or

provide lenders with guidance on how jobs retained

were to be measured, and lenders generally reported

all existing jobs at a borrower’s business as “jobs

retained.” As a result, SBA’s reporting of 7(a) job

retention was unclear and misleading. The risk of

confusion was compounded by the fact that “jobs

created/retained” for the 7(a) and 504 loan programs

were reported side by side, even though they are not

comparable.

The OIG recommended that SBA define “jobs

retained” for the 7(a) program, provide justification for

the approach, and issue guidance to lenders on this

change. In addition, the OIG recommended that SBA

disclose any differences in metrics between programs

in subsequent monthly Recovery Act Program

Performance Reports and revise the cumulative “jobs

created/retained” metric to reflect any change.

Guilty Pleas for Conspiracy. On April 1, 2010, in the

Southern District of Texas, a loan broker, an SBA

borrower and undisclosed owner of an investment

Monthly Update on Activities of the SBA Office of Inspector General

company, the owner of an insurance agency, and

another SBA borrower pled guilty to conspiracy to

commit wire fraud. These four individuals and others

participated in a complex loan fraud scheme that

involved making false statements and submitting

fraudulent documents to SBA-approved lending

institutions in order to fraudulently obtain numerous

loans. The OIG is conducting this investigation jointly

with the Federal Bureau of Investigation (FBI) and the

Internal Revenue Service, Criminal Investigation

Division (IRS-CID).

Guilty Pleas for Conspiracy and False Statements. On

April 5, 2010, in the Southern District of Texas, four

individuals entered guilty pleas, as follows.

•

•

•

•

An SBA borrower and purchaser of a convenience

store pled guilty to conspiracy.

The president of a company that owns and

operates convenience stores pled guilty to making

false statements.

The vice president of the same company pled

guilty to conspiracy.

The president of a title company pled guilty, on

behalf of the company, to one count of false

statements to a financial institution. The company

was also sentenced to a fine of $25,000 and a

special assessment of $400.

The guilty pleas related to the purchase of a Texas

convenience store. The first individual obtained a

$1million SBA-guaranteed loan through an SBA

lender and a $300,000 conventional loan through a

bank to finance the purchase of the store from the

company operated by the second two individuals. The

bank used the title company to close the loans. The

defendants represented to the bank that money had

been received at closing from the purchaser when, in

fact, no funds changed hands. The OIG is conducting

this investigation jointly with the FBI.

April 2010

�Government Contracting and

Business Development

Report on Irregularities Involving a Tribally-owned

8(a) Company. On April 29, 2010, the OIG issued a

report on the results of a limited review of a Triballyowned 8(a) company. The review was initiated in

response to a referral from the Defense Contract Audit

Agency (DCAA) about billing irregularities and

company’s apparent concealment of the extent of the

non-disadvantaged owner’s involvement with the firm.

The OIG identified a number of irregularities

involving the formation of the 8(a) company that

indicated the non-disadvantaged owner may have been

controlling and operating the company for the benefit

of his defense contract business. Most significantly,

an agreement signed by the non-disadvantaged owner

and the President of the Tribal Council caused the

tribe that owned the company to effectively retain only

25 percent of the net profits from 8(a) contract awards.

In addition, the non-disadvantaged owner and his other

companies earned significant fees from the 8(a)

company for rent and other services. As a result, it

appeared that the company’s primary purpose was to

benefit the non-disadvantaged owner, which is

contrary to what Congress intended when it allowed

firms owned by Indian tribes to participate in the 8(a)

program.

The OIG recommended that SBA determine whether

the company still met eligibility requirements for the

8(a) program and, if not, initiate termination from the

program. The Agency stated that it would conduct a

thorough review of the company to determine the

firm’s compliance with 8(a) Business Development

Program rules and regulations.

Disaster Loans

Louisiana Resident Sentenced. On April 8, 2010, a

Louisiana resident was sentenced to 12 months and

1 day in prison, 36 months supervised release,

restitution to the SBA in the amount of $122,641, and

a special assessment of $100. She previously pled

guilty to one count of theft of Government funds. The

investigation disclosed that she forged the signature of

a building inspector and submitted forged and/or

fraudulent building permits, receipts, and construction

contracts to induce SBA to disburse disaster loan

funds to which she was not entitled and which she

later converted to personal use. The SBA OIG

Monthly Update on the Activities of the SBA Office of Inspector General

conducted this investigation jointly with the U.S.

Housing and Urban Development (HUD) OIG.

Louisiana Resident Indicted. On April 8, 2010, a

Louisiana resident was indicted on one count of wire

fraud for allegedly filing a fraudulent application with

the SBA for $108,000 in Hurricane Katrina disaster

assistance relating to her home in Baton Rouge. The

investigation revealed that she also received assistance

from the Federal Emergency Management Agency and

the Louisiana Road Home Program. She executed a

written “Loan Authorization and Agreement” in which

she agreed to use the proceeds of the SBA loan to

replace property at her residence that had been

damaged by Hurricane Katrina, to obtain written

receipts and contracts for all repairs, and to provide

them to SBA. It is alleged that she created fraudulent

documentation to reflect repair expenses incurred as a

result of the storm and transmitted these false

documents by means of a facsimile machine in Baton

Rouge to SBA’s offices in Fort Worth, Texas. The

SBA OIG is conducting this investigation jointly with

the HUD OIG, the Department of Homeland Security

OIG, and the U.S. Postal Service OIG.

SBA Employee Indicted. On April 14, 2010, an SBA

employee was indicted on charges of fraud in

connection with a major disaster, theft of public

money or property, and aggravated identity theft. The

investigation revealed that in December 2008, a Texas

resident applied for a $33,600 SBA disaster loan in

order to replace personal property damaged as a result

of Hurricane Ike. The individual later decided not to

take the loan and asked the SBA via telephone to

cancel his loan application. A few months later,

however, he received a letter from the SBA requesting

payment on the loan. An investigation revealed that

the SBA employee forged the applicant’s signature on

loan documents, altered one of her own personal

checks by placing the applicants name on it, and made

false entries into SBA’s Disaster Credit Management

System to support loan disbursement to her own

personal checking account.

Agency Management

Report on Adequacy of Procurement Staffing and

Oversight of Contractors Supporting the Procurement

Function. On April 9, 2010, the OIG issued a report

concerning the ability of SBA’s Office of Business

Operations’ (OBO) to effectively plan, execute, and

support the Agency’s procurement activities, including

2

April 2010

�Recovery Act contracts. Between July 2009 and

February 2010, SBA awarded 29 Recovery Act

contracts and processed 740 non-Recovery Act

contract actions. During this same period, OBO’s

workforce decreased from 13 contracting personnel

to 7. As a result, the OIG determined that the

workforce was insufficient to effectively award,

administer, and oversee Recovery Act contracts, as

well as other contracts managed by OBO. Without

adequate staff to perform contract execution,

administration functions, and to oversee contractors

supporting OBO, the Agency was exposed to

increased risk for mismanagement, improper

payments, fraud, waste, abuse.

The OIG recommended that SBA identify and

implement an interim solution to augment its

acquisition workforce until permanent staff could be

hired to ensure that the Agency has adequate oversight

of the procurement function and the contracting

personnel to support it.

Report on the Accuracy of Recovery Act Contract

Award Obligations Reported to the Federal

Procurement Database System – Next Generation and

Recovery.gov. On April 15, 2010, the OIG issued a

report concerning the accuracy of Recovery Act

contract award obligations reported by SBA to

Recovery.gov. The Recovery Act requires that, to the

maximum extent possible, contracts funded under the

Act be awarded as fixed-price contracts through the

use of competitive procedures. Agencies are required

to report to Recovery.gov contract actions that are not

competed or are not fixed price.

The OIG recommended that SBA reconcile Recovery

Act contract awards reported to FPDS-NG and

Recovery.gov, and report to Recovery.gov all noncompetitive contract awards not previously reported.

This monthly update is produced by the SBA OIG,

Peggy E. Gustafson, Inspector General.

The OIG has established an e-mail address

(oig@sba.gov) that we encourage the public to use to

communicate with our office. We welcome your

comments concerning this update or other OIG

publications. To obtain copies of these documents

please contact:

SBA OIG

409 Third Street SW., 7th Floor

Washington, DC 20416

E-mail: oig@sba.gov

Telephone number (202) 205-6586

FAX number (202) 205-7382

Many OIG reports can be found

on the OIG’s website at:

www.sba.gov/ig

If you are aware of suspected waste, fraud, or

abuse in any SBA program, please report it online at:

www.sba.gov/ig/aboutus/overview/rsw/index.html

Or call the OIG Hotline toll-free at (800) 767-0385

The OIG compared data posted on Recovery.gov as of

March 19, 2010, with data from the Federal

Procurement Data System-Next Generation

(FPDS-NG) for the same period. The OIG determined

that the Agency inaccurately reported eight Recovery

Act contract actions, valued at about $1.83 million.

Six of the eight contract actions reported to FPDS-NG

as "not competed under SAP [Simplified Acquisition

Procedures]" were not listed on Recovery.gov. In

addition, two of the eight contract actions were

inappropriately categorized by the Agency in

FPDS-NG because the contract values exceeded the

simplified acquisition threshold.

Monthly Update on the Activities of the SBA Office of Inspector General

3

April 2010

�

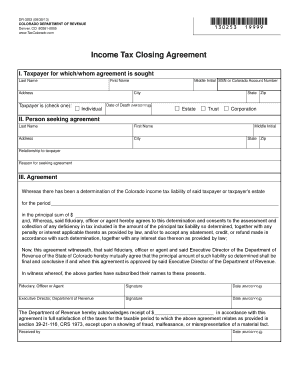

Valuable advice for completing your ‘Income Tax Closing Agreement’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading digital signature solution for both individuals and businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the comprehensive features included in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow takes care of everything seamlessly, with just a few clicks.

Follow this detailed guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘Income Tax Closing Agreement’ in the editor.

- Click Me (Fill Out Now) to complete the form on your behalf.

- Include and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with others on your Income Tax Closing Agreement or send it for notarization—our solution provides everything required to achieve such tasks. Register with airSlate SignNow today and elevate your document management to new heights!